Global Homeware Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.51 Billion

2024

2032

USD

1.70 Billion

USD

2.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.51 Billion | |

|

|

|

|

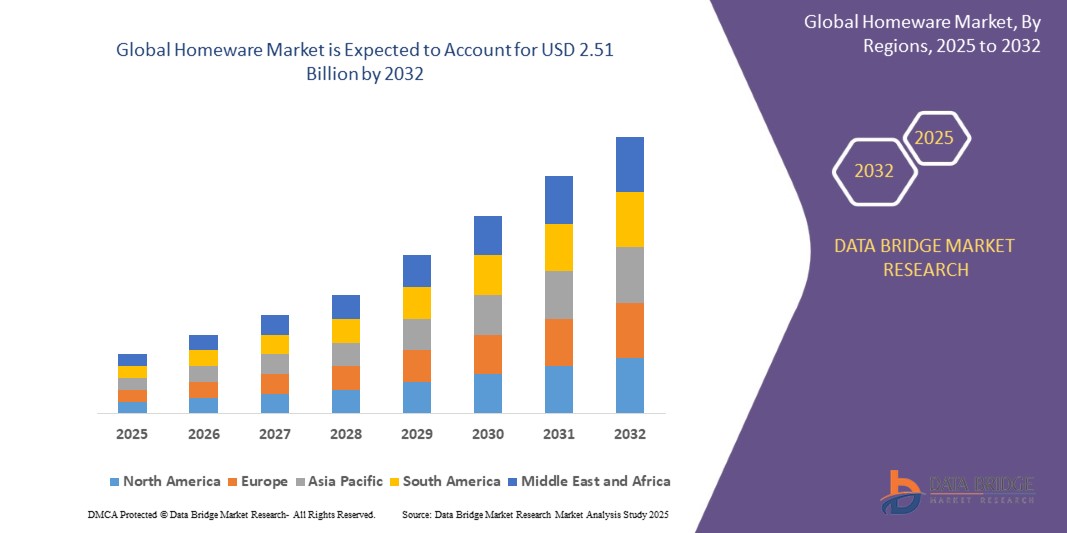

What is the Global Homeware Market Size and Growth Rate?

- The global homeware market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.51 billion by 2032, at a CAGR of 5.00% during the forecast period

- The homeware market is witnessing significant growth driven by technological advancements and innovative methods. Smart home technology, which includes interconnected devices such as smart speakers, lighting, and appliances, is becoming increasingly popular among consumers. This integration enhances convenience and efficiency, leading to a surge in demand for smart home products

What are the Major Takeaways of Homeware Market?

- Advancements in materials, such as sustainable and biodegradable options, are reshaping the homeware landscape. Companies are now focusing on eco-friendly products that resonate with environmentally conscious consumers. For instance, bamboo and recycled materials are being used for kitchenware, offering both style and sustainability

- E-commerce platforms are also transforming the homeware market. Online shopping offers consumers convenience and a broader selection of products. Virtual reality (VR) and augmented reality (AR) technologies enable customers to visualize homeware items in their spaces before making a purchase, enhancing the online shopping experience

- North America dominated the homeware market with the largest revenue share of 36.58% in 2024, driven by rising smart home adoption, technological advancements, and strong consumer demand for convenience-driven, connected living solutions

- Asia-Pacific homeware market is projected to grow at the fastest CAGR of 8.96% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and strong technological advancements in emerging economies such as China, India, Japan, and Southeast Asian countries

- The Furniture segment dominated the homeware market with the largest market revenue share of 28.4% in 2024, driven by the growing demand for functional, aesthetically appealing, and space-saving furniture solutions across urban households and commercial spaces

Report Scope and Homeware Market Segmentation

|

Attributes |

Homeware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Homeware Market?

“Smart Homeware Evolution through AI and Sustainable Materials”

- A major emerging trend in the global homeware market is the integration of artificial intelligence (AI) and eco-friendly materials to create smarter, sustainable, and more convenient household products. AI-powered homewares are reshaping consumer expectations by enhancing functionality, efficiency, and user interaction

- For instance, brands such as IKEA are launching AI-integrated lighting and energy-efficient homeware solutions that automatically adjust based on room conditions, enhancing comfort and reducing energy consumption

- AI integration enables homewares such as smart kitchen appliances, climate control systems, and lighting to learn user preferences, automate daily tasks, and provide voice-enabled control through platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit

- The rising use of sustainable materials, including recycled plastics, bamboo, and biodegradable composites, reflects growing consumer demand for eco-conscious products without compromising design or durability

- Companies such as Philips and Lock & Lock are leading the trend with AI-enabled smart cooking appliances and homewares developed using environmentally responsible materials, appealing to tech-savvy, eco-conscious consumers

- As the smart home ecosystem expands, AI-enabled, sustainable homewares are becoming central to modern living, offering convenience, efficiency, and environmental benefits across residential and commercial spaces

What are the Key Drivers of Homeware Market?

- The rapid growth of smart home technology adoption, coupled with rising demand for sustainable, multifunctional products, is significantly propelling the homeware market

- For instance, in March 2024, LG Electronics launched its AI-powered homeware line with energy-efficient features and smart connectivity, enabling users to control appliances through mobile apps and voice assistants. Such developments reflect increasing industry focus on convenience and sustainability

- The growing need for energy conservation, improved home functionality, and enhanced aesthetic appeal is driving demand for intelligent, adaptable homeware solutions across furniture, kitchenware, and decorative segments

- Rising disposable incomes, urbanization, and consumer preference for modern, connected living environments continue to boost market growth, particularly in emerging economies

- In addition, the global emphasis on reducing plastic waste and carbon footprints is encouraging the adoption of recyclable and biodegradable homeware products, with both established and new brands introducing eco-friendly alternatives

Which Factor is challenging the Growth of the Homeware Market?

- The homeware market faces challenges related to high initial costs of smart homewares, concerns over data privacy, and limited access to eco-friendly products in some regions

- For instance, while AI-integrated smart kitchenware or lighting offers convenience, high price points and cybersecurity concerns deter some consumers from adopting these technologies. Data privacy issues, especially regarding voice-controlled devices, remain a key hesitation factor

- The production of sustainable homewares using recycled or biodegradable materials often involves higher manufacturing costs, impacting affordability for price-sensitive markets, particularly in developing economies

- In addition, the lack of robust recycling infrastructure in certain regions limits the circular use of materials, hindering the market's environmental goals

- To overcome these barriers, companies must focus on affordability, transparency in data privacy, and investing in accessible, eco-conscious production methods to support long-term market expansion and align with evolving consumer expectations

How is the Homeware Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Product Type

On the basis of product type, the homeware market is segmented into Home Decoration, Furniture, Soft Furnishings, Kitchenware, Home Appliances, Lighting, Storage and Flooring, Bathroom Accessories and Cleaning, Tableware, and Hardware Tools. The Furniture segment dominated the homeware market with the largest market revenue share of 28.4% in 2024, driven by the growing demand for functional, aesthetically appealing, and space-saving furniture solutions across urban households and commercial spaces. Increasing consumer preference for modular and multifunctional furniture, combined with rising investments in home interiors, continues to boost this segment’s growth.

The Home Appliances segment is projected to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by technological advancements, energy-efficient products, and growing consumer inclination towards smart, connected appliances. Rapid urbanization, coupled with the rising adoption of AI-enabled devices, supports demand for innovative kitchen, cleaning, and home comfort appliances.

• By Distribution Channel

On the basis of distribution channel, the homeware market is segmented into Homeware Stores, Franchised Stores, Departmental Stores, Online, and Specialty Stores. The Online segment held the largest market revenue share of 36.7% in 2024, driven by the convenience of e-commerce platforms, a wide product assortment, competitive pricing, and doorstep delivery. The growing influence of digital marketing, virtual showrooms, and personalized shopping experiences has significantly contributed to the expansion of online Homeware sales.

The Specialty Stores segment is expected to witness the fastest CAGR from 2025 to 2032, supported by consumer preference for curated, high-quality products and personalized in-store experiences. Specialty stores are gaining popularity for offering niche, designer, and eco-friendly Homeware solutions tailored to premium and lifestyle-focused consumers.

• By Application

On the basis of application, the homeware market is segmented into Residential and Commercial. The Residential segment dominated the Homeware market with the largest market revenue share of 72.3% in 2024, fueled by increasing homeownership rates, rising disposable incomes, and the global trend towards home improvement and interior personalization. The surge in smart home technology, along with evolving consumer lifestyles, is further driving demand for residential Homeware products.

The Commercial segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the expansion of hospitality, retail, and office spaces. Demand for stylish, durable, and functional Homeware products that enhance commercial environments, improve aesthetics, and align with corporate branding is fueling market growth in this segment.

Which Region Holds the Largest Share of the Homeware Market?

- North America dominated the homeware market with the largest revenue share of 36.58% in 2024, driven by rising smart home adoption, technological advancements, and strong consumer demand for convenience-driven, connected living solutions

- High disposable incomes, a tech-savvy population, and the growing need for advanced home security solutions have accelerated the integration of Homeware products with smart home ecosystems across the region

- North American consumers particularly value seamless device interoperability, voice assistant compatibility, and mobile control features, positioning homeware solutions as essential components of modern households and commercial spaces

U.S. Homeware Market Insight

The U.S. homeware market accounted for the largest revenue share in North America in 2024, fueled by rapid smart home adoption, high levels of consumer awareness, and robust demand for intelligent security solutions. The proliferation of DIY home automation systems, voice-controlled technologies such as Alexa and Google Assistant, and mobile-enabled access management continues to drive growth. The expanding real estate sector and consumer preference for integrated security and convenience features further bolster the U.S. homeware market.

Canada Homeware Market Insight

The Canada homeware market is witnessing steady growth, supported by increasing urbanization, growing consumer awareness about smart security solutions, and the expanding smart home market. Rising concerns about residential safety, coupled with favorable regulatory frameworks and smart city initiatives, are driving the demand for connected homeware products. The country's high internet penetration and emphasis on technology adoption are expected to further fuel market growth across both residential and commercial segments.

Which Region is the Fastest Growing Region in the Homeware Market?

Asia-Pacific homeware market is projected to grow at the fastest CAGR of 8.96% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and strong technological advancements in emerging economies such as China, India, Japan, and Southeast Asian countries. Government initiatives promoting smart city development, digitalization, and home automation adoption are accelerating the penetration of homeware products across the region. In addition, APAC's position as a manufacturing hub for smart home components is improving product affordability and accessibility, expanding market reach to a broader consumer base.

China Homeware Market Insight

China homeware market captured the largest revenue share within Asia-Pacific in 2024, driven by rapid urban development, growing middle-class purchasing power, and the country's status as a global leader in smart home manufacturing. Rising demand for smart security solutions in residential, commercial, and rental properties, coupled with the widespread availability of affordable Homeware products from domestic manufacturers, continues to fuel growth.

India Homeware Market Insight

The India homeware market is experiencing robust growth, supported by increasing urbanization, growing security concerns, and rising adoption of smart home technologies. The government's Digital India initiatives, coupled with improving internet connectivity and smartphone penetration, are driving demand for connected, intelligent homeware solutions. The affordability of entry-level smart security devices is further expanding market reach among India's rapidly growing middle-class population.

Japan Homeware Market Insight

The Japan homeware market is expanding steadily due to the country's tech-forward culture, aging population, and rising demand for accessible, secure living environments. The integration of Homeware products with IoT ecosystems, smart home platforms, and health-focused automation systems is gaining traction. Increasing focus on convenience, safety, and energy-efficient living solutions supports continued homeware market growth in Japan across both residential and commercial applications.

Which are the Top Companies in Homeware Market?

The homeware industry is primarily led by well-established companies, including:

- ARC International (France)

- Conair Corporation (U.S.)

- International Cookware (U.S.)

- Libbey (U.S.)

- Lock & Lock (South Korea)

- Century Furniture LLC (U.S.)

- Heritage Home Group LLC (U.S.)

- Masco Corporation Designs (U.S.)

- HNI Corporation (U.S.)

- IKEA (Sweden)

What are the Recent Developments in Global Homeware Market?

- In November 2023, Flannels Home officially launched, representing Flannels' strategic expansion into the home goods market. This new retail venture showcases an exclusive collection of designer houseware pieces from prestigious brands, including Versace and Dolce & Gabbana. By curating high-end products, Flannels Home aims to attract discerning customers seeking luxury and style in their home decor and furnishings

- In March 2023, IKEA announced the closure of all its locations in Russia due to the ongoing conflict in Ukraine, which has disrupted supply chains and created significant operational challenges. The decision reflects IKEA's commitment to corporate responsibility and ethical practices in response to geopolitical issues. As a result, the retailer has shifted its focus to strengthening its presence in other global markets

- In January 2023, Wayfair announced its plans to acquire Joss & Main, a strategic move aimed at enhancing its footprint in the competitive home goods industry. This acquisition is expected to bolster Wayfair’s product offerings and market reach, allowing the company to tap into Joss & Main's unique customer base. The integration of the two brands will such asly streamline operations and enhance the overall shopping experience for consumers

- In June 2022, In June 2022, actress Priyanka Chopra launched Sona Home, a new homeware brand developed in collaboration with designer Manish Goyal. The brand features a range of kitchenware and barware that draws inspiration from Indian traditions and aesthetics. With a focus on cultural heritage, Sona Home aims to offer stylish, functional products that celebrate the richness of Indian craftsmanship while appealing to a global audience

- In September 2020, GHETTO GASTRO, a renowned kitchenware manufacturer based in New York, partnered with CRUX and Williams Sonoma Inc. to introduce an innovative smart kitchenware collection in the U.S. This collaboration includes a diverse range of modern kitchen appliances, such as air fryers, blenders, and waffle makers. By blending cutting-edge technology with stylish design, this collection aims to enhance the cooking experience for consumers looking for convenience and efficiency in their kitchens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.