Global Honey Wine Market

Market Size in USD Million

CAGR :

%

USD

751.60 Million

USD

1,695.13 Million

2024

2032

USD

751.60 Million

USD

1,695.13 Million

2024

2032

| 2025 –2032 | |

| USD 751.60 Million | |

| USD 1,695.13 Million | |

|

|

|

|

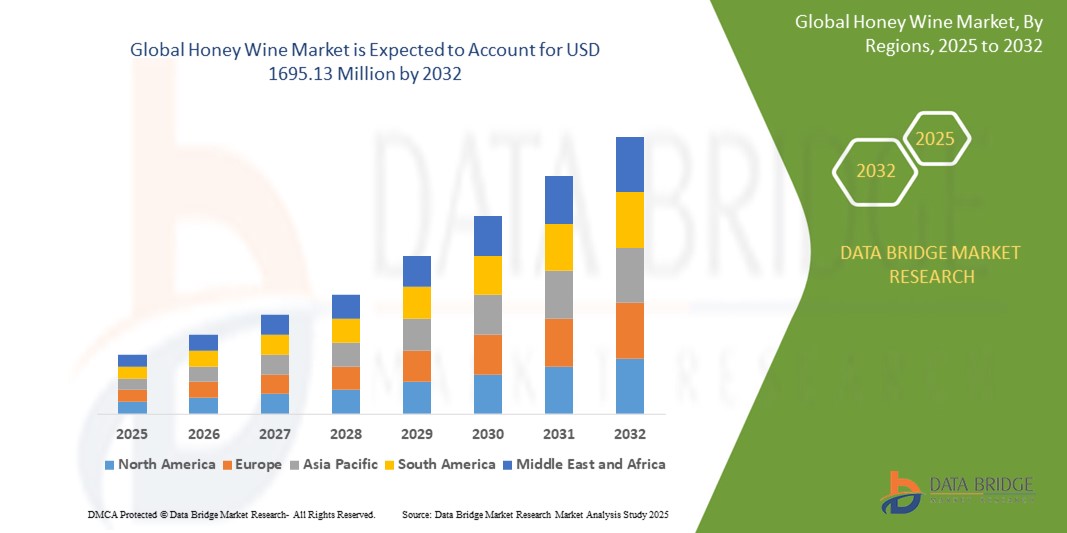

What is the Global Honey Wine Market Size and Growth Rate?

- The global honey wine market size was valued at USD 751.66 Million in 2024 and is expected to reach USD 1695.13 Million by 2032, at a CAGR of10.70% during the forecast period

- The honey wine market is experiencing growth due to rising interest in traditional and handmade beverages. Demand for honey wine is further propelled by its versatility as a pairing option, notably wine with honey baked ham

- This synergy capitalizes on complementary flavors, enhancing dining experiences. Increased consumer appreciation for unique culinary combinations drives the honey wine market's expansion alongside growing food trends

What are the Major Takeaways of Honey Wine Market?

- Honey wine, also known as mead, is an alcoholic beverage made by fermenting honey with water and sometimes additional fruits, spices, or grains. It is one of the oldest known fermented beverages, appreciated for its sweet, floral flavors. Often varying in sweetness and complexity, honey wine offers a unique and historical drinking experience

- North America dominated the honey wine market with the largest revenue share of 38.12% in 2024, driven by rising consumer interest in craft alcoholic beverages and growing awareness of traditional mead across diverse demographics

- Asia-Pacific honey wine market is projected to grow at the fastest CAGR of 14.21% from 2025 to 2032, fueled by rising disposable incomes, expanding urban populations, and increasing exposure to global beverage trends

- The conventional segment dominated the honey wine market with the largest market revenue share of 68.4% in 2024, owing to its widespread availability, lower price point, and broader consumer base

Report Scope and Honey Wine Market Segmentation

|

Attributes |

Honey Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Honey Wine Market?

“Premiumization and Experimentation in Flavor Profiles”

- A significant and growing trend in the global Honey Wine market is the premiumization of products and the increasing consumer interest in unique, artisanal flavors. Consumers are moving beyond traditional mead and exploring diverse flavor profiles through infusions with fruits, spices, herbs, and botanicals

- For instance, brands such as Charm City Meadworks and Superstition Meadery have introduced a range of meads flavored with blackberries, ginger, cinnamon, and coffee, appealing to adventurous palates and craft beverage enthusiasts

- The trend is also driven by the craft alcohol movement, where consumers seek authenticity, small-batch production, and high-quality ingredients. Limited-edition releases, collaborations with brewers or distillers, and aging in wine or whiskey barrels are becoming more common

- In addition, the use of locally sourced honey and organic ingredients enhances product appeal among environmentally conscious consumers

- This focus on innovation is helping honey wine shed its niche image and gain traction in mainstream markets, especially in North America and Europe. Producers are leveraging creative labeling and storytelling to attract millennials and Gen Z buyers

- As consumers become more open to novel alcoholic beverages, the flavor-driven experimentation and premium positioning of honey wine are expected to fuel its global market growth across retail, specialty stores, and online platforms

What are the Key Drivers of Honey Wine Market?

- The rising consumer interest in natural, gluten-free, and low-sulfite alcoholic beverages is a major factor propelling demand for honey wine. With its ancient heritage and all-natural ingredients, honey wine fits the health-conscious trend gaining popularity worldwide

- For instance, in March 2024, Enlightenment Wines Meadery expanded its distribution network across the U.S., capitalizing on the growing demand for fermented drinks with clean labels and functional ingredients

- The resurgence of interest in heritage alcohol among younger consumers, especially those seeking alternatives to wine and beer, is also fueling market expansion. Honey wine offers a historical connection and cultural richness that appeals to niche segments such as medieval fairs, paleo diets, and historical reenactments

- Moreover, the growth of e-commerce platforms and DTC (direct-to-consumer) sales channels is enabling small and mid-sized meaderies to reach broader audiences without needing large-scale retail distribution. Online subscription boxes and virtual tastings have further amplified honey wine’s reach during and after the pandemic

- The shift toward low-ABV (alcohol by volume) craft beverages and increased participation in artisanal alcohol tastings and experiences are expected to boost the market significantly over the forecast period

Which Factor is challenging the Growth of the Honey Wine Market?

- Despite growing interest, limited consumer awareness and lack of mainstream visibility remain key challenges for the honey wine market. Many consumers are still unfamiliar with mead or perceive it as overly sweet or historical rather than modern and versatile

- For instance, according to a 2023 survey by the American Mead Makers Association, over 60% of consumers in the U.S. had never tried mead, and among those who had, many associated it with Renaissance fairs or folklore, not as a contemporary alcoholic option

- In addition, high production costs due to the use of quality honey and small-batch fermentation processes make honey wine more expensive than mass-produced beers or wines. This can be a deterrent for price-sensitive consumers

- Regulatory hurdles, especially in markets where alcohol distribution laws are strict, also limit meaderies from expanding rapidly. Smaller producers may lack the scale to negotiate placement in major retail chains or compete with well-established wine and spirits brands

- To overcome these barriers, industry players must focus on consumer education, sampling events, and creative marketing strategies. Increasing visibility through collaborations, influencer marketing, and experiential retailing can help honey wine gain wider acceptance and drive long-term market growth

How is the Honey Wine Market Segmented?

The market is segmented on the basis of nature, variety, sales channel, and product type.

• By Nature

On the basis of nature, the honey wine market is segmented into organic and conventional. The conventional segment dominated the Honey Wine market with the largest market revenue share of 68.4% in 2024, owing to its widespread availability, lower price point, and broader consumer base. Conventional honey wines are often produced in higher volumes and are more accessible in both mainstream retail and online channels, contributing to their dominant position in the market.

The organic segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising consumer preference for natural, clean-label alcoholic beverages. Growing awareness around pesticide-free ingredients and sustainable beekeeping practices is encouraging producers to launch certified organic variants that appeal to health-conscious and eco-aware consumers.

• By Variety

On the basis of variety, the honey wine market is segmented into traditional, cyser, melomel, pyment, and metheglin. The traditional variety held the largest market revenue share of 35.9% in 2024, benefiting from its historical appeal, simplicity of formulation (honey, water, and yeast), and its positioning as a classic mead type. Traditional honey wine is commonly preferred by new entrants to the mead market and is often used in tastings and heritage-themed events.

The melomel segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its fruit-infused flavors that align with evolving consumer taste preferences. Melomel allows for creative flavor innovation and seasonal offerings, attracting adventurous drinkers and younger demographics seeking unique beverage experiences.

• By Sales Channel

On the basis of sales channel, the Honey Wine market is segmented into modern trade, specialty stores, convenience stores, commercial, hotels/restaurants/bars, and online retailers. The online retailers segment dominated the market with the largest revenue share of 32.7% in 2024, fueled by the rapid growth of e-commerce platforms and direct-to-consumer (DTC) strategies adopted by many meaderies. Online sales benefit from broader product reach, convenience, and the ability to engage customers through digital marketing, subscription boxes, and virtual tastings.

The hotels/restaurants/bars (HoReCa) segment is expected to experience the fastest CAGR from 2025 to 2032. This growth is driven by rising interest in curated alcohol menus, food pairings, and experiential dining, where mead is increasingly offered as a craft or specialty option. Collaborations between meaderies and hospitality businesses are expanding honey wine’s presence in premium consumption spaces.

• By Product Type

On the basis of product type, the honey wine market is segmented into carbonated, dry, semi-dry, sweet, and semi-sweet. The sweet honey wine segment led the market with the largest revenue share of 40.1% in 2024, due to its broad palatability, especially among first-time drinkers and consumers in markets with a preference for dessert-style beverages. Sweet meads often serve as gateway products for new consumers and are prominently featured in tastings and samplers.

The dry segment is projected to register the fastest CAGR from 2025 to 2032, supported by the shifting consumer preference toward lower-sugar and more refined alcoholic beverages. Dry honey wines appeal to seasoned wine enthusiasts and are increasingly favored for their versatility in food pairings and premium positioning in the alcoholic beverages market.

Which Region Holds the Largest Share of the Honey Wine Market?

- North America dominated the honey wine market with the largest revenue share of 38.12% in 2024, driven by rising consumer interest in craft alcoholic beverages and growing awareness of traditional mead across diverse demographics

- The region benefits from a strong network of local meaderies, increasing participation in renaissance fairs and artisanal alcohol festivals, and an evolving palate favoring unique, honey-based drinks

- In addition, the increasing popularity of organic and locally sourced products supports the rising consumption of honey wine as a premium, niche beverage

U.S. Honey Wine Market Insight

U.S. market dominated North America’s honey wine revenue in 2024, fueled by a booming craft alcohol movement and the growth of small-batch wineries across states such as California, Oregon, and Michigan. Rising consumer interest in historical alcoholic beverages, combined with the availability of various mead varieties (sweet, dry, melomel, etc.), has made honey wine more mainstream. Direct-to-consumer channels and tasting room experiences are also helping local producers expand reach, increase consumer education, and boost brand loyalty.

Europe Honey Wine Market Insight

The Europe Honey Wine market is projected to grow at a substantial CAGR through 2032, driven by deep-rooted cultural associations with mead in Nordic and Eastern European countries. Countries such as Poland, the U.K., and Lithuania are experiencing renewed interest in mead, boosted by the craft alcohol trend and tourism. Moreover, traditional production methods, GI-protected regional varieties, and the demand for natural, preservative-free alcoholic drinks are shaping consumption patterns.

U.K. Honey Wine Market Insight

The U.K. Honey Wine market is anticipated to expand at a notable CAGR during the forecast period, propelled by the country’s thriving craft beverage sector and growing popularity of Viking and medieval-themed festivals. Mead producers are benefiting from increasing shelf space in specialty wine shops, online platforms, and pubs offering local brews. Rising interest in heritage drinks among millennials and sustainability-conscious consumers is further accelerating market penetration.

Germany Honey Wine Market Insight

Germany Honey Wine market is expected to grow at a considerable CAGR through 2032, supported by a strong preference for natural and organic alcohol products. German consumers are increasingly exploring alternative drinks beyond beer and wine, including premium meads with fruit and spice infusions. The growing number of independent meaderies and expanding presence of honey wine at Christmas markets and local fairs are boosting domestic consumption.

Which Region is the Fastest Growing in the Honey Wine Market?

Asia-Pacific honey wine market is projected to grow at the fastest CAGR of 14.21% from 2025 to 2032, fueled by rising disposable incomes, expanding urban populations, and increasing exposure to global beverage trends. Interest in natural, health-oriented alcoholic beverages is rising, particularly among younger consumers in countries such as China, Japan, South Korea, and India. The regional growth is also supported by rising honey production and government initiatives promoting local food and beverage entrepreneurship.

Japan Honey Wine Market Insight

Japan Honey Wine market is gaining momentum due to the country’s appreciation for niche and artisanal products, along with its reputation for high-quality alcohol craftsmanship. Honey wine is increasingly featured in gourmet food pairings and luxury dining venues. The rise of fusion cuisine and craft cocktail culture also supports the growth of flavored meads and low-alcohol variants tailored to local tastes.

China Honey Wine Market Insight

China Honey Wine market held the largest market share in Asia-Pacific in 2024, driven by the rapid growth of e-commerce, rising middle-class affluence, and the increasing trend of health-conscious consumption. Chinese producers are innovating with traditional ingredients such as goji berries, longan, and lotus to develop localized mead varieties that appeal to cultural preferences. Government support for domestic agriculture and apiculture also provides a solid foundation for expanding honey wine production and consumption.

Which are the Top Companies in Honey Wine Market?

The honey wine industry is primarily led by well-established companies, including:

- moonshinemeadery (India)

- The Honey Wine Company (U.S.)

- Etowah Meadery (U.S.)

- Schramm's Mead (U.S.)

- B. Nektar Meadery (U.S.)

- Wicked Warren's (U.S.)

- BENT RUN BREWING CO (U.S.)

- Modern Methods Brewing Company (U.S.)

- Humble Bee Wines (U.S.)

- Real Beer Media, Inc. (U.K.)

- ROSEWOOD ESTATES WINERY & MEADERY.(Canada)

- Brothers Drake Meadery. (U.S.)

- Redstone Meadery (U.S.)

- Medovina (U.S.)

What are the Recent Developments in Global Honey Wine Market?

- In March 2022, Hill Zill Wines Pvt. Ltd., the manufacturer of Fruzzanté, a sparkling alcoholic beverage, launched its premium honey mead brand called Arkä. Arkä is made from honey extracted from beehives that are fermented and presented as mead, a drink that has been mentioned in ancient scriptures dating back to 100 BC. After its success in Maharashtra & Goa, the brand is now available in Karnataka. This expansion diversifies the company's offerings and contributes to the honey wine market's growth by introducing a unique and historically significant beverage to new regions

- In May 2022, Moonshine Meadery brings ‘Hopped Mead’ and their brand-new, pure and superior quality honey ‘Sidr Honey’ to Goa. Moonshine Meadery brings ‘Hopped Mead’ and their brand-new, pure, and superior quality honey ‘Sidr Honey’ to Goa. Moonshine Meadery contributes to the growth of the honey wine market by attracting new consumers and catering to evolving tastes and preferences

- In June 2021, Antelope Ridge Mead introduced their latest offerings, sweet and dry meads featuring an array of flavors such as black currant, orange blossom honey, crush berry, blackberry, and raspberry. This diverse product line caters to varied consumer preferences and expands the market by attracting new customers seeking unique and flavorful honey wine options, thus stimulating overall market growth

- In 2020, 2 Towns Ciderhouse, known for its alcoholic cider, recently acquired Nectar Creek Meadery. This acquisition will see some of Nectar Creek's mead production moving to 2 Towns' facility. The move will such asly increase the availability and accessibility of Nectar Creek's mead products by leveraging 2 Towns' established infrastructure and distribution networks, ultimately contributing to market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Honey Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Honey Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Honey Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.