Global Implant Grade Ceramic Surface Texturing Services Market

Market Size in USD Million

CAGR :

%

USD

45.00 Million

USD

127.64 Million

2024

2032

USD

45.00 Million

USD

127.64 Million

2024

2032

| 2025 –2032 | |

| USD 45.00 Million | |

| USD 127.64 Million | |

|

|

|

|

Implant-Grade Ceramic Surface Texturing Services Market Size

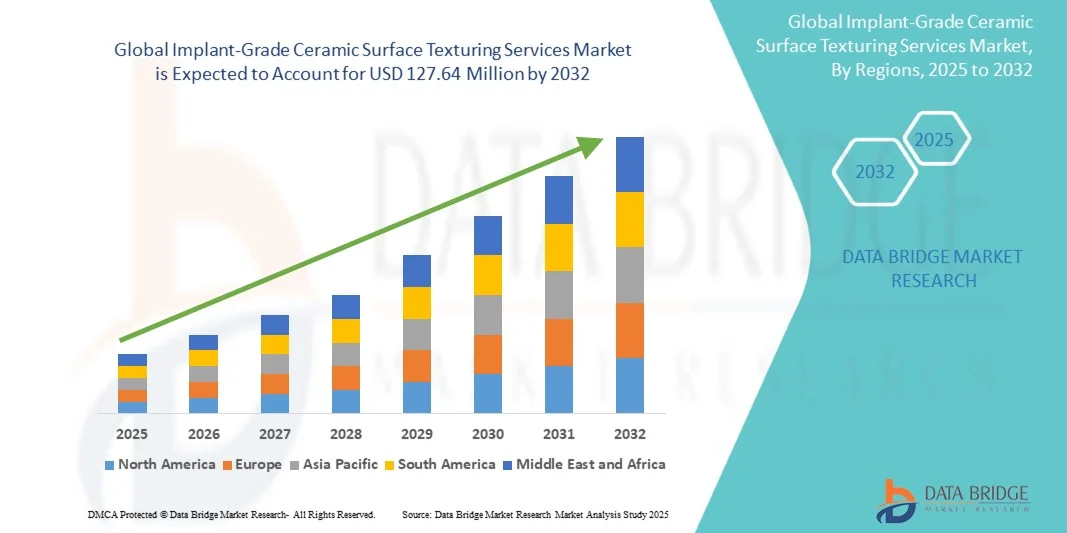

- The global implant-grade ceramic surface texturing services market size was valued at USD 45.00 million in 2024 and is expected to reach USD 127.64 million by 2032, at a CAGR of 13.92% during the forecast period

- The arket expansion is primarily driven by the rising demand for advanced biocompatible implant materials and the growing emphasis on enhanced osseointegration and biofunctionality in dental and orthopedic implants

- In addition, the increasing utilization of precision technologies such as laser texturing, plasma treatment, and nano-surface engineering is enabling superior mechanical adhesion and biological performance, propelling the market’s growth. These trends collectively underscore the accelerating adoption of specialized surface texturing services across global medical implant manufacturing

Implant-Grade Ceramic Surface Texturing Services Market Analysis

- Implant-grade ceramic surface texturing services play a crucial role in enhancing the biocompatibility, osseointegration, and mechanical performance of dental and orthopedic implants, making them indispensable in the production of advanced medical-grade ceramics such as zirconia and alumina

- The rising demand for minimally invasive and durable implant solutions, coupled with advancements in laser texturing, plasma treatment, and nano-surface engineering, is driving the market’s rapid growth across healthcare manufacturing sectors

- North America dominated the implant-grade ceramic surface texturing services market with the largest revenue share of 40.3% in 2024, supported by a strong base of medical device OEMs, stringent regulatory standards (FDA, ISO 13485), and early adoption of precision texturing technologies, particularly in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by expanding implant production in China, Japan, and South Korea, growing dental tourism, and rising investments in advanced biomedical manufacturing infrastructure

- The laser texturing segment accounted for the largest market share of 43% in 2024, attributed to its superior accuracy, repeatability, and ability to produce controlled micro- and nano-scale topographies that significantly improve cell adhesion and implant integration outcomes

Report Scope and Implant-Grade Ceramic Surface Texturing Services Market Segmentation

|

Attributes |

Implant-Grade Ceramic Surface Texturing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Implant-Grade Ceramic Surface Texturing Services Market Trends

“Advancements in Laser and Nano-Texturing Technologies”

- A major and accelerating trend in the global implant-grade ceramic surface texturing services market is the increasing adoption of laser-based micro- and nano-texturing techniques that enhance surface roughness, cell adhesion, and osseointegration for dental and orthopedic implants

- For instance, laser-ablated zirconia implants are gaining popularity for producing precise microgrooves that improve mechanical interlocking with bone tissue while maintaining material strength

- The integration of nano-patterned surfaces enables implants to modulate protein adsorption and cellular responses, significantly improving biological performance

- Advanced texturing technologies also facilitate customized surface patterns tailored to patient-specific implant geometries, improving long-term clinical outcomes and implant stability

- This trend towards precision and biofunctional surface engineering is reshaping manufacturer expectations and driving R&D investments in more efficient, reproducible, and high-throughput texturing solutions

- The demand for services offering highly controlled and biologically optimized surface textures is growing across both dental and orthopedic sectors as implant performance and patient outcomes become primary market differentiators

Implant-Grade Ceramic Surface Texturing Services Market Dynamics

Driver

“Rising Demand for Biocompatible and High-Performance Implants”

- The increasing need for implants with superior osseointegration, durability, and reduced healing times is a key driver for the growth of ceramic surface texturing services

- For instance, the adoption of zirconia and alumina implants with micro- and nano-textured surfaces is growing rapidly among dental and orthopedic manufacturers seeking improved clinical performance

- Enhanced patient-specific implant designs combined with precision surface engineering are encouraging OEMs to outsource surface texturing to specialized service providers

- Furthermore, the rising awareness of the role of surface topography in bone-implant integration is expanding demand for advanced surface texturing techniques in both mature and emerging markets

- Growing dental tourism and elective orthopedic procedures in Asia-Pacific and Latin America are creating additional demand for high-quality implant surfaces

- Increasing adoption of minimally invasive surgical procedures is boosting the need for optimized implant surfaces to ensure better integration and patient recovery

- The ability of textured implants to support faster healing and long-term stability is making these services essential for medical device manufacturers and driving investments in high-precision texturing capabilities

Restraint/Challenge

“High Cost and Stringent Regulatory Compliance”

- The relatively high cost of precision laser and nano-texturing equipment and associated services poses a challenge for widespread adoption, particularly among smaller manufacturers

- For instance, high-end laser surface texturing systems require significant capital investment and specialized technical expertise, increasing overall production costs for implants

- Strict regulatory requirements, including ISO 13485 and FDA approvals, make it challenging for service providers to quickly scale operations without extensive documentation and validation

- The need for thorough biocompatibility testing and surface characterization adds additional time and cost, potentially limiting rapid market penetration

- While emerging markets are adopting these services, cost sensitivity and compliance hurdles may slow adoption, particularly for non-critical or lower-cost implant segments

- Overcoming these challenges through cost-effective technologies, process standardization, and compliance support services is essential to maintain sustained market growth

- Limited availability of skilled workforce with expertise in precision ceramic texturing and surface characterization restricts market expansion

- Variability in material properties across different ceramic types (zirconia, alumina, bioactive ceramics) can complicate standardization of surface texturing processes, posing a technical challenge for service providers

Implant-Grade Ceramic Surface Texturing Services Market Scope

The market is segmented on the basis of service type, technology, application, and end user.

- By Service Type

On the basis of service type, the market is segmented into contract surface texturing services, R&D and surface engineering, surface finishing and post-treatment, characterization and validation services, and turnkey implant component supply. Contract Surface Texturing Services dominated the market with the largest revenue share in 2024, driven by the increasing trend of medical device OEMs outsourcing complex surface texturing operations to specialized service providers. This segment offers flexibility in production volumes, reduces capital expenditure for OEMs, and ensures access to advanced technologies such as laser and nano-texturing. Service providers also deliver consistent quality and regulatory compliance, making contract services the preferred choice for high-volume implant manufacturers. The demand is particularly strong in North America and Europe, where stringent quality standards encourage outsourcing to experienced vendors. The segment benefits from ongoing collaborations between OEMs and CMOs to accelerate time-to-market for new implant designs.

R&D and Surface Engineering is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing focus on developing biofunctionalized surfaces that enhance osseointegration and reduce healing time. This subsegment involves prototyping, experimentation with micro- and nano-scale textures, and development of proprietary surface patterns tailored to patient-specific implants. Growing investments in R&D by dental and orthopedic implant manufacturers, particularly in Asia-Pacific, are driving adoption. Academic collaborations and clinical research partnerships further accelerate innovation. Companies are leveraging simulation and AI tools in surface engineering, enabling predictive modeling of implant-tissue interactions, which strengthens the segment’s growth prospects.

- By Technology

On the basis of technology, the market is segmented into laser texturing, sandblasting, chemical etching, coating, oxidation treatments, and polishing. Laser Texturing dominated the market with the largest revenue share of 43% in 2024 due to its high precision, repeatability, and ability to produce controlled micro- and nano-scale topographies that significantly improve cell adhesion and implant integration. Laser texturing also allows customization for patient-specific geometries and is increasingly used for both dental and orthopedic implants. OEMs prefer laser-based services for high-value implants where surface consistency and regulatory compliance are critical. North America holds a strong share in this segment due to early adoption and technological maturity. The growing integration of laser texturing with AI and simulation software further boosts productivity and accuracy, reinforcing dominance.

Sandblasting is expected to witness the fastest growth from 2025 to 2032, driven by its cost-effectiveness and simplicity for creating micro-rough surfaces suitable for osseointegration. Sandblasting is widely used for both zirconia and alumina implants to enhance mechanical interlocking with bone tissue. Its adoption is increasing in emerging markets due to lower capital investment requirements compared to laser systems. The segment also benefits from technological improvements in abrasive materials and process control, enabling better uniformity and reproducibility. Growing awareness of its effectiveness in improving implant stability supports rapid market expansion.

- By Application

On the basis of application, the market is segmented into dental implants and abutments, orthopedic implants, maxillofacial implants, and other implantable devices. Dental Implants and Abutments dominated the market with the largest revenue share in 2024, driven by the high volume of dental implant procedures and increasing demand for biocompatible zirconia implants with superior surface textures. Textured surfaces enhance osseointegration, reduce healing time, and improve long-term stability, making them essential in modern dental implantology. Rising dental tourism in Asia-Pacific and Europe contributes to adoption. OEMs focus on quality, precision, and regulatory compliance in dental implant manufacturing, further reinforcing this segment. Advanced technologies such as laser and nano-texturing are widely applied in this subsegment to meet stringent performance standards.

Orthopedic Implants is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of hip, knee, and small bone implants with enhanced surface topographies. Texturing improves mechanical fixation, reduces micromotion, and supports faster bone integration. The growing prevalence of musculoskeletal disorders and aging populations globally is driving demand. Technological advancements, including AI-guided laser texturing for patient-specific implants, further accelerate growth. Collaborations between implant OEMs and surface engineering service providers strengthen the market potential in this application segment.

- By End User

On the basis of end user, the market is segmented into medical device OEMS, contract manufacturing organizations (CMOs), research institutes & universities, and dental laboratories. Medical Device OEMs dominated the market with the largest revenue share in 2024, as they rely on specialized surface texturing services to maintain product quality, meet regulatory standards, and reduce time-to-market. OEMs prefer outsourcing high-precision surface engineering processes to experienced service providers with validated technologies. North America and Europe are leading regions due to stringent compliance requirements and established implant manufacturing hubs. OEMs also benefit from turnkey services that combine texturing, finishing, and validation.

Contract Manufacturing Organizations (CMOs) are expected to witness the fastest growth from 2025 to 2032, driven by increasing outsourcing of surface texturing and related services by OEMs seeking scalability, cost efficiency, and access to advanced technologies. CMOs provide flexibility in handling prototype to large-scale production, offering specialized capabilities such as laser and nano-texturing. Growing partnerships between CMOs and implant OEMs in Asia-Pacific and emerging markets are fueling rapid adoption. In addition, CMOs support innovation through R&D collaborations, accelerating the commercialization of next-generation implants.

Implant-Grade Ceramic Surface Texturing Services Market Regional Analysis

- North America dominated the implant-grade ceramic surface texturing services market with the largest revenue share of 40.3% in 2024, supported by a strong base of medical device OEMs, stringent regulatory standards (FDA, ISO 13485), and early adoption of precision texturing technologies, particularly in the U.S. and Canada

- Manufacturers in the region prioritize precision, regulatory compliance (FDA, ISO 13485), and high-quality surface textures, making contract texturing and turnkey services critical for dental and orthopedic implant production

- The widespread adoption is further supported by strong R&D infrastructure, collaborations between OEMs and specialized service providers, and significant investments in advanced laser and nano-texturing technologies, establishing North America as a key market hub

U.S. Implant-Grade Ceramic Surface Texturing Services Market Insight

The U.S. implant-grade ceramic surface texturing services market captured the largest revenue share of 82% in 2024, driven by the presence of leading medical device OEMs and a strong focus on advanced implant technologies. Manufacturers increasingly prioritize precision laser and nano-texturing to enhance osseointegration and long-term implant performance. The growing adoption of dental and orthopedic implants, combined with strict regulatory requirements (FDA, ISO 13485), further propels the market. In addition, collaborations between OEMs and specialized service providers for R&D and turnkey solutions are expanding the use of high-precision surface engineering. The trend toward patient-specific and biofunctionalized implants is also boosting demand for surface texturing services.

Europe Implant-Grade Ceramic Surface Texturing Services Market Insight

The Europe implant-grade ceramic surface texturing services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards and increasing demand for high-performance implants in dental and orthopedic applications. Rising urbanization and a growing aging population are fostering the adoption of advanced implant solutions. European manufacturers are integrating precision surface engineering and nano-texturing to meet clinical performance and biocompatibility standards. The market is witnessing strong growth across new implant production and refurbishing of existing implant technologies. Collaborative R&D efforts and innovation hubs in Germany, France, and Switzerland further support market expansion.

U.K. Implant-Grade Ceramic Surface Texturing Services Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising investments in dental and orthopedic implant manufacturing and increasing awareness of surface-engineered implants. Concerns over implant longevity and patient outcomes are encouraging OEMs and CMOs to adopt advanced laser and chemical texturing techniques. The U.K.’s focus on innovation and a robust medical device industry infrastructure supports the uptake of turnkey and contract surface texturing services. Increasing collaborations with research institutes and universities are also accelerating technology adoption. Regulatory compliance with CE marking and ISO standards ensures high-quality, market-ready products.

Germany Implant-Grade Ceramic Surface Texturing Services Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on precision engineering, quality assurance, and technological innovation in medical devices. German manufacturers are adopting laser and nano-texturing technologies to optimize implant surfaces for enhanced osseointegration and biomechanical performance. The country’s well-developed industrial and research infrastructure, combined with a focus on sustainable and reproducible processes, promotes the adoption of advanced surface texturing services. Integration with digital design and simulation tools is increasing efficiency, while partnerships with OEMs and CMOs strengthen market penetration. Demand spans dental, orthopedic, and maxillofacial implants.

Asia-Pacific Implant-Grade Ceramic Surface Texturing Services Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 25% from 2025 to 2032, driven by rising investments in medical device manufacturing, urbanization, and increasing awareness of implant performance benefits. Countries such as China, Japan, South Korea, and India are emerging as key hubs for laser and chemical surface texturing, supporting both domestic production and exports. The region’s growing dental and orthopedic implant procedures, coupled with government initiatives promoting healthcare infrastructure and smart manufacturing, are fueling adoption. Increasing availability of cost-effective surface texturing services from local providers is expanding access to high-precision implants across residential and commercial healthcare sectors.

Japan Implant-Grade Ceramic Surface Texturing Services Market Insight

The Japan market is gaining momentum due to its high-tech manufacturing culture, aging population, and increasing demand for dental and orthopedic implants. Advanced surface engineering, including laser and nano-texturing, is widely applied to improve implant longevity and patient outcomes. Integration with digital modeling and patient-specific design is accelerating adoption. The market benefits from strong collaboration between implant OEMs, CMOs, and research institutions. Furthermore, the focus on minimally invasive procedures and biofunctionalized implants drives continuous demand for precision surface texturing services across both residential and hospital sectors.

India Implant-Grade Ceramic Surface Texturing Services Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rising middle-class population, and increasing awareness of implant quality and performance. India is emerging as a hub for affordable yet high-precision surface texturing services, including laser and chemical texturing for dental and orthopedic implants. Growing dental tourism, rapid urbanization, and initiatives toward smart healthcare facilities are accelerating adoption. Domestic service providers are collaborating with international OEMs to offer turnkey and contract texturing solutions, expanding access to advanced implants across residential, hospital, and clinic settings.

Implant-Grade Ceramic Surface Texturing Services Market Share

The Implant-Grade Ceramic Surface Texturing Services industry is primarily led by well-established companies, including:

- CeramTec GmbH (Germany)

- Dentsply Sirona, (U.S.)

- Institut Straumann AG (Switzerland)

- Nobel Biocare Services AG (Switzerland)

- Zimmer Biomet. (U.S.)

- Osstem Implant Co., Ltd. (South Korea)

- Dentium. (South Korea)

- MegaGen Implant Co., Ltd. (South Korea)

- BioHorizons, Inc. (U.S.)

- Implant Direct Corporation (U.S.)

- Bicon (U.S.)

- Neodent (Brazil)

- Hiossen Implant (South Korea)

- Alpha-Bio Tec (Israel)

- Implantium (South Korea)

- Dentis (South Korea)

- K3V Implant System (South Korea)

- Klockner Implant Systems (Germany)

- Biomate Implant System (South Korea)

What are the Recent Developments in Global Implant-Grade Ceramic Surface Texturing Services Market?

- In August 2025, the European Society for Ceramic Implantology reported significant supply shortages of zirconium dioxide ceramic implants across Europe. Factors contributing to these shortages include high demand, limited production, and company restructuring. Manufacturers such as CeramTec and the Straumann Group have made strategic decisions to expand production capacity and focus on alternative ceramic solutions to meet the growing demand

- In August 2025, research published in the Journal of Functional Biomaterials introduced a novel glass–ceramic spray deposition technology. This method promotes surface energy and osteoblast viability on zirconia implant abutments, potentially improving the integration and longevity of ceramic implants

- In July 2025, ReCerf received its CE Mark, advancing access to ceramic hip resurfacing across Europe. This approval followed its initial use in 2018 and subsequent approval by Australia's Therapeutic Goods Administration in November 2024. Over 1,600 patients have received the device, with patient-reported outcomes being highly positive and a low revision rate of up to six years

- In April 2025, a critical review published in Clinical Biomechanics highlighted the effects of laser surface texturing on implant biocompatibility and osseointegration. The study emphasized how laser-induced surface modifications can enhance the mechanical properties and biological performance of implants

- In November 2024, Henniker Plasma, a manufacturer of plasma surface treatment equipment, highlighted the benefits of plasma treatment in improving the osseointegration of dental implants. This surface modification technique enhances the surface chemistry, morphology, and energy of dental implants, creating a more favorable environment for cell attachment, proliferation, and differentiation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.