Global Insoluble Dietary Fiber Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

1.72 Billion

2024

2032

USD

1.06 Billion

USD

1.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 1.72 Billion | |

|

|

|

|

Insoluble Dietary Fiber Market Size

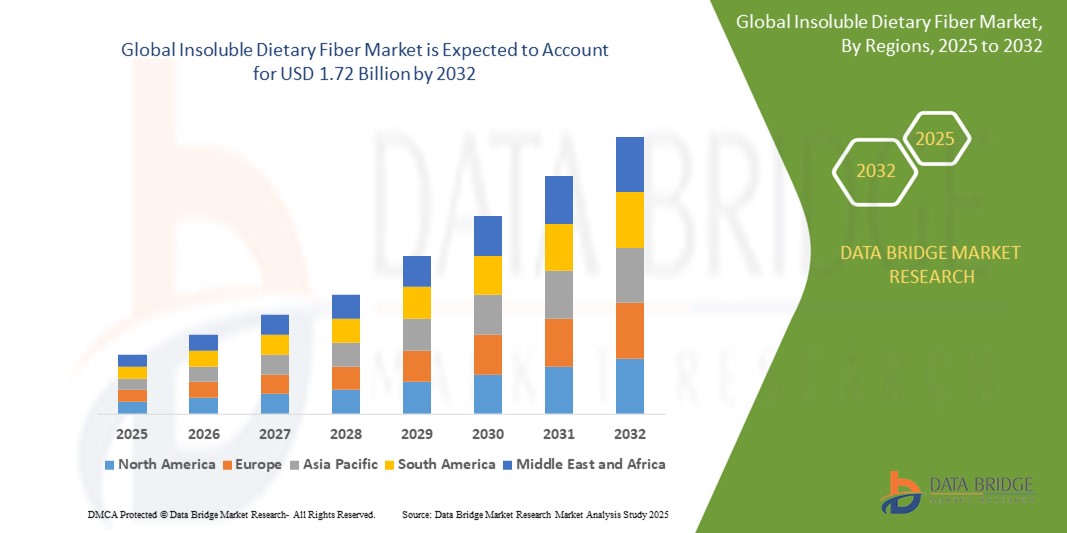

- The global insoluble dietary fiber market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 1.72 billion by 2032, at a CAGR of 6.25% during the forecast period

- This growth is driven by growing health awareness and demand for functional foods

Insoluble Dietary Fiber Market Analysis

-

The insoluble dietary fiber market has been witnessing steady growth, driven by increasing consumer focus on digestive health, weight management, and chronic disease prevention through high-fiber diets

- As health awareness rises globally, consumers are incorporating more fiber-rich products such as whole grains, cereals, and fiber-fortified snacks into their daily routines, thereby boosting demand for insoluble fibers

- Technological advancements in food processing and the development of novel insoluble fiber ingredients with enhanced functionality and stability are enabling their application across diverse food and beverage categories

- North America is expected to hold the largest share of the global insoluble dietary fiber market, supported by a well-established functional food industry, high consumption of fortified products, and growing demand for digestive wellness solutions in the U.S. and Canada

- Asia-Pacific is projected to register the highest compound annual growth rate (CAGR), driven by increasing awareness of fiber’s health benefits, growing middle-class populations, and expanding food processing sectors in countries such as India, China, and Indonesia

- The cellulose segment is expected to dominate the insoluble dietary fiber market with the largest market share of 29.15% in 2025, due to its excellent water-holding capacity, bulking properties, and digestive health benefits, making it ideal for use in a variety of food and pharmaceutical products

Report Scope and Insoluble Dietary Fiber Market Segmentation

|

Attributes |

Insoluble Dietary Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insoluble Dietary Fiber Market Trends

“Growing Preference for Clean-Label and Natural Ingredients”

- A prominent trend in the insoluble dietary fiber market is the increasing consumer demand for clean-label, plant-based, and minimally processed ingredients, driven by a desire for transparency and natural health solutions

- The use of natural fiber sources such as wheat bran, oat hulls, peas, and cellulose is gaining momentum as consumers avoid artificial additives and synthetic supplements

- Food and beverage manufacturers are reformulating products to include recognizable fiber sources while promoting claims such as “no additives,” “non-GMO,” and “100% natural”

- For instance, in 2024, Nestlé launched a line of high-fiber breakfast cereals using natural wheat bran and no artificial additives to meet clean-label demand

- The emphasis on ingredient simplicity is expected to significantly influence product development and consumer trust in fiber-enriched foods

Insoluble Dietary Fiber Market Dynamics

Driver

“Rising Prevalence of Digestive Disorders and Lifestyle Diseases”

- The growing incidence of constipation, obesity, type 2 diabetes, and cardiovascular issues is fueling demand for insoluble dietary fiber as a preventive health measure

- Consumers are increasingly turning to fiber-rich diets to improve gut health, regulate blood sugar levels, and manage weight, especially in urban populations

- Healthcare providers and nutritionists are widely recommending fiber intake to support digestive health and reduce chronic disease risks

- For instance, in 2023, Mayo Clinic published updated dietary guidelines emphasizing the importance of insoluble fiber for gut health and metabolic balance

- This growing health awareness is expected to remain a strong driver for the global expansion of insoluble fiber products

Opportunity

“Increased Application in Functional and Fortified Foods”

- With the rising demand for functional and fortified food products, manufacturers are incorporating insoluble fibers into categories such as bakery, snacks, beverages, and meat substitutes

- Insoluble fiber adds texture, bulk, and water retention capacity, making it ideal for use in low-calorie, high-fiber product formulations

- Fortified food products with health claims (e.g., digestive support, satiety enhancement) are attracting interest from fitness-conscious and senior populations

- For instance, in 2024, Kellogg’s introduced a new line of fiber-fortified snack bars targeting the wellness segment, using oat and pea fiber to enhance digestive benefits

- This expansion into functional foods opens new revenue streams and strengthens market positioning for insoluble fiber manufacturers

Restraint/Challenge

“Taste and Texture Limitations in Product Formulations”

- With the rising demand for functional and fortified food products, manufacturers are incorporating insoluble fibers into categories such as bakery, snacks, beverages, and meat substitutes

- Insoluble fiber adds texture, bulk, and water retention capacity, making it ideal for use in low-calorie, high-fiber product formulations

- Fortified food products with health claims (e.g., digestive support, satiety enhancement) are attracting interest from fitness-conscious and senior populations

- For instance, in 2024, Kellogg’s introduced a new line of fiber-fortified snack bars targeting the wellness segment, using oat and pea fiber to enhance digestive benefits

- This expansion into functional foods opens new revenue streams and strengthens market positioning for insoluble fiber manufacturers

Insoluble Dietary Fiber Market Scope

The market is segmented on the basis of type, source and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Source |

|

|

By Application |

|

In 2025, the cellulose is projected to dominate the market with a largest share in type segment

The cellulose segment is expected to dominate the insoluble dietary fiber market with the largest market share of 29.15% in 2025, due to its excellent water-holding capacity, bulking properties, and digestive health benefits, making it ideal for use in a variety of food and pharmaceutical products.

The functional food and beverages is expected to account for the largest share during the forecast period in application segment

In 2025, the functional food and beverages segment is expected to dominate the market with the largest market share of 46.66%, due to wide range of fortified products, including probiotic drinks, vitamin-enriched snacks, and plant-based functional beverages, catering to specific health needs.

Insoluble Dietary Fiber Market Regional Analysis

“North America Holds the Largest Share in the Insoluble Dietary Fiber Market”

- North America is expected to dominate the global insoluble dietary fiber market, driven by increasing consumer awareness of gut health, digestive wellness, and the role of fiber in preventive healthcare

- The U.S. remains the dominant market due to high demand for functional foods, a growing aging population, and widespread inclusion of dietary fibers in fortified foods and supplements

- Ongoing innovations in fiber-enriched products, strong presence of key market players, and the availability of high-fiber bakery and snack items in mainstream retail channels will support the region’s continued market leadership

“Asia-Pacific is Projected to Register the Highest CAGR in the Insoluble Dietary Fiber Market”

- Asia-Pacific is expected to witness the fastest compound annual growth rate (CAGR), fueled by rising health consciousness, rapid urbanization, and increasing dietary diversification

- Countries such as India and China are emerging as key markets, supported by growing awareness of lifestyle diseases, increased fiber intake through plant-based diets, and a booming food processing industry

- Japan and Australia are also contributing steadily, driven by high consumer interest in digestive health and demand for clean-label, high-fiber products

- The expansion of organized retail, investment in food fortification, and government-backed nutrition programs are accelerating growth in the region

- Rising demand for functional and fortified food products, along with innovations in fiber-based ingredients, will further propel market expansion across Asia-Pacific

Insoluble Dietary Fiber Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- Grain Processing Corporation (U.S.)

- Ingredion (U.S.)

- J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany)

- Roquette Frères (France)

- SunOpta (Canada)

- Nexira (France)

- AdvoCare (U.S.)

- Tate & Lyle (U.K.)

- ADM (U.S.)

Latest Developments in Global Insoluble Dietary Fiber Market

- In July 2024, Tate & Lyle launched a new line of insoluble dietary fiber ingredients tailored for the functional food sector, enhancing product texture and nutritional value without compromising taste. This strategic launch strengthens Tate & Lyle’s position in the growing functional ingredients market

- In March 2023, J. Rettenmaier & Söhne acquired Algaia, a French seaweed-based company, aiming to expand its footprint across the feed, food, agriculture, and pharmaceutical sectors. The acquisition reflects the company's diversification strategy and commitment to sustainable, natural ingredients

- In November 2024, Cargill Inc., a leading global food ingredients manufacturer, introduced a dietary fiber solution featuring 30% reduced sugar, designed to enhance the nutritional profile of products in the bakery, dairy, and beverage segments. This launch underscores Cargill’s focus on health-driven innovations for diverse food applications

- In September 2020, Batory Foods entered a partnership with BioHarvest Sciences Inc., a pioneer in proprietary Biofarming technology, to exclusively enter the U.S. Edible CBD and Nutraceuticals markets. This move marked a strategic diversification of Batory Foods’ product offerings into high-growth wellness categories

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insoluble Dietary Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insoluble Dietary Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insoluble Dietary Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.