Global Lignin Market

Market Size in USD Billion

CAGR :

%

USD

2.17 Billion

USD

2.88 Billion

2021

2029

USD

2.17 Billion

USD

2.88 Billion

2021

2029

| 2022 –2029 | |

| USD 2.17 Billion | |

| USD 2.88 Billion | |

|

|

|

|

Global Lignin Market Analysis and Size

Lignin is highly complex chemical in nature and is responsible for binding cellulose fibre in certain plants. Lignin is majorly used as a by-product by the paper industry. Green Value SA (US), LENZING AG (Austria), Northway Lignin Chemical (Canada), Tembec (Canada), Innventia (Sweden) and WestRock Company (US) are the major players operating in this market.

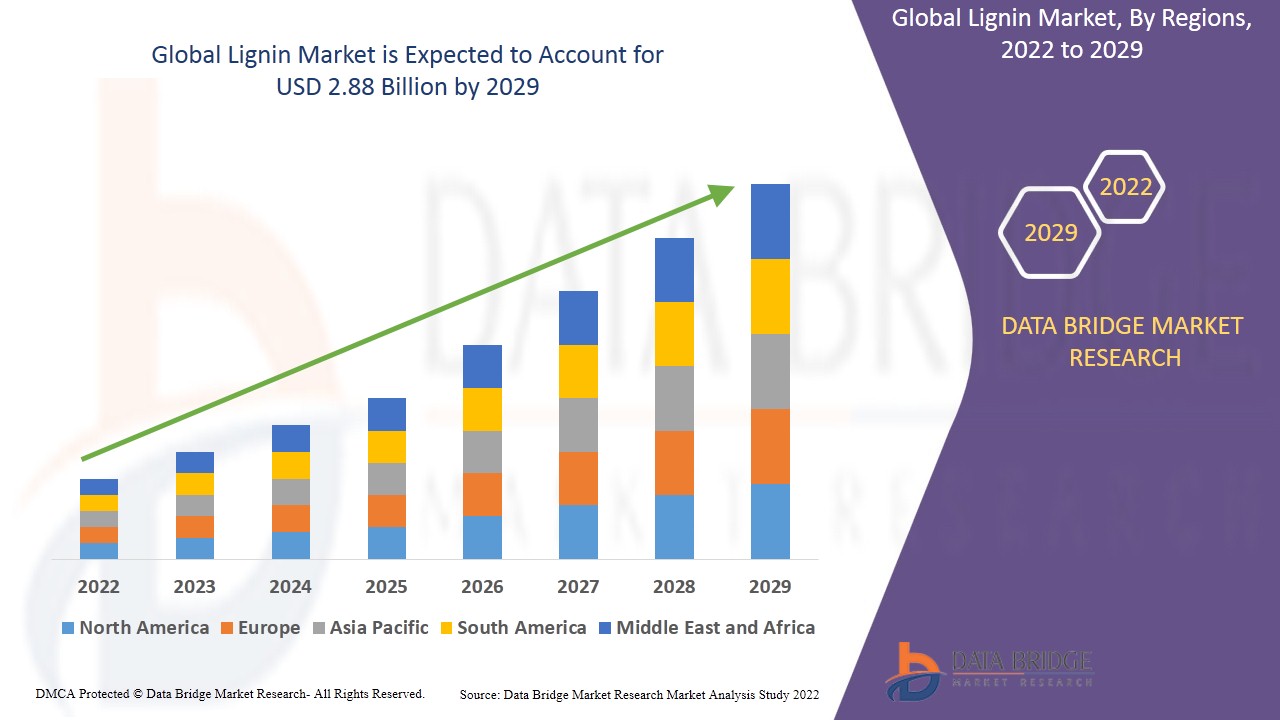

- Data Bridge Market Research analyses that the lignin market is expected to undergo a CAGR of 3.60% during the forecast period. This indicates that the market value, which was USD 2.17 billion in 2021, would rocket up to USD 2.88 billion by 2029. “Lignuosulfonate” dominates the product type segment of the lignin market owing to the high usage of lignin in by the gas industry to control mud viscosity in deep oil well drilling and in the preparation of smooth clay slips for ceramics.

Global Lignin Market Definition

Lignin is a by-product from lignocellosic bio-refineries and is used as a renewable raw material in numerous industrial applications. Lignin is a valuable renewable source of chemical industry and is the second most used and bulky plant derived polymer. Lignin is responsible for protecting the plants from collapsing while growing so that they can grow straight.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Borregaard LignoTech (US), Rayonier Advanced Materials (US), Domtar Corporation (US), Domsjo Fabriker (Sweden), Stora Enoo Oyj (Finland), Burgo Group Spa (Italy), The Dallas Group of America (US), Chengzhou Shanfeng Chemical Industry Corporation (China), NIPPON PAPER INDUSTRIES CO LTD. (Japan), Metsa Group (Finland), Ingevity (US), Fibria Cellulose (Brazil), Sigma-Aldrich Co. (US), West Fraser (Canada), Lignin Lignin Company LLC (US), Green Value SA (US), LENZING AG (Austria), Northway Lignin Chemical (Canada), Tembec (Canada), Innventia (Sweden) and WestRock Company (US) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

De Rigo Vision S.p.A. (Italy), Essilor (france), Fielmann (Germany), Lanvin (France), Marchon Eyewear, Inc. (US), Marcolin SpA. (Italy), Maui Jim (US), Safilo Group S.p.A. (Italy), Alexander McQueen (UK), Michael Kors (US), Pivothead (US), Specsavers (Guernsey), FASTRACK LTD. (India), CHARMANT Group (US), Kyboe. (US), Procter & Gamble (US), Estée Lauder Inc (US), THE AVON COMPANY (UK), HOYA Corporation (Japan) and Shanghai Conant Optics Co., Ltd (China) |

|

Market Opportunities |

|

Lignin Market Dynamics

Drivers

-

Raw Material Availability Influenced the Market Growth

Rising availability of raw material availability and easy production is widening the scope of growth for the market. In other words, lignin can be extracted using a arnage of methods such as sulfite pulping, kraft pulping, organosolv pulping, soda pulping, and hydrolysis techniques which is directly influencing the market growth of the market. Also, growth and expansion of agricultural industry is directly influencing the market growth rate.

-

Growing Awareness to Direct the Market Demand and Supply

Increased awareness about the range of application of lignin is inducing increased demand and supply on global scale. Low purity lignin can also be extracted from wastes produced in various sectors, such as pulp and paper and bio refineries which is inducing a good market growth rate.

-

Growing Demand for Paints and Coatings to Direct the Market Growth

Lignin is an ideal substitute for crude-oil-derived naphtha which in turn is inducing the market growth rate. Lignin is a primary source of aromatic substrate and aromatic compounds are vital for the production of paints and coatings. This will yet again bolster the growth of the market.

Opportunities

-

Rising Research and Development Operations

Increased funding from federal government pertaining to the research and development proficiencies is also bolstering the growth of the market. Research and developmental operations directed towards sustainable development will ensure optimum and judicious use of resources, thereby improving the market value.

-

Rise in the Technological Advancements

Rising technological advancements pertaining to the manufacturing technology is further inducing growth in the market value. Increasing number of technological advancements driven with a view to minimize the production costs and wastage coupled with rise in the acceptance of laundry services that are accessible over the internet has ensured a bright future for the market.

Furthermore, upsurge in the strong demand for various end-use industries will positively impact the market’s growth rate. Additionally, growing preferences and the increase in the sectors like agriculture, animal feed and concrete segment will further cushion the market's growth rate. Also, growth in the industrial cleaners, industrial binders, battery, water treatment and rise in awareness for things like air pollution, respiratory disorders and organic materials will further increase the demand of the smart bottle market.

Restraints/Challenges Global Lignin Market

On the other hand, high cost associated with the research and development proficiencies, construction of green buildings instead of using lignin as an additive and dearth of awareness in the backward economies are expected to obstruct market growth. Also, fluctuation in the prices of lignin, high costs associated with the products and lack of suitable infrastructure in low- and middle-income countries are projected to challenge the market in the forecast period of 2022-2029.

This lignin market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the lignin market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Lignin Market

COVID-19 had a negative impact on the market. This was because of the shutdown of the manufacturing facilities and plants owing to the lockdown and restrictions. Supply chain and transportation disruptions further crated hindrances for the market. In other words, the industry faced a backlash owing to the disruptions in value chain, including workforce losses, raw materials supply, trade and logistics, and uncertain consumer demand. Manufacturers from lignin market are taking efforts to recover from the losses. However, increase in production and demand for concrete additive and rising demand for lignin as an organic additive is a positive sign. The future as well of the market is on the brighter side owing to the increased proliferation of internet and e-commerce channels.

Recent Development

- In December 2021, Nippon Paper and Finland’s Stora Enso signed a partnership agreement to use trees to revolutionize the battery industry. The research concentrates on the replacement for lithium-ion and rare-metal batteries by Lignin.

Global Lignin Market Scope

The lignin market is segmented on the basis of source, product type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Kraft Pulping

- Sulphite Pulping

- Cellulosic Ethanol

Based on the source, lignin market is segmented as kraft pulping, sulphate pulping and cellulosic ethanol.

Product type

- Lignuosulfonate

- Kraft Lignin

- High-Purity Lignin

- Milled Wood Lignin

- Chemical Lignin

- Klason Llignin

- Pyrolytic Lignin

- Carbon Fiber

- BTX

- Other Product Types

On the basis of product type, lignin market is segmented as lignosulfonate, kraft-lignin, high purity lignin, milled wood lignin, chemical lignin, klason lignin, pyrolytic lignin, carbon fixer, BTX and other product types.

Application

- Activated Carbon

- Animal Feed

- Carbon Fires

- Concrete Additives

- Dispersants

- Phenol

- Cement

- Binders

- Batteries

- Concrete Additives

- Dye Stuff

- Cosmetics

- Absorbents

- Dervatives

- Plastic/Polymers

- Resins

- Vanillin

- Macromolecule

- Aromatic

- Anti-Scaling Agent

- Strengthening Agent

- Bonding Agent

- Other Applications

Based on the application, lignin market is segmented as activated carbon, carbon fires, animal feed, concrete additives, dispersants, phenol, cement, binders, batteries, concrete additives, dye stuff, cosmetics, absorbents, dervatives, plastic/polymers, resins, vanilian, macromolecule, aromatic, anti-scaling agent, strengthening agent, bonding agent and other applications.

Lignin Market Regional Analysis/Insights

The lignin market is analysed and market size insights and trends are provided by country, source, product type, and application as referenced above.

The countries covered in the lignin market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe dominates the lignin market owing to the presence of regulatory norms for restriction of greenhouse gas emissions coupled with the prominent production base of biopolymers in France, Belgium, Germany, and the Netherlands, increasing demand for lightweight motor vehicles and the presence of major vehicle manufacturing facilities.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Lignin Market Share Analysis

The lignin market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to lignin market.

Some of the major players operating in the lignin market are:

- Borregaard LignoTech (US)

- Rayonier Advanced Materials (US)

- Domtar Corporation (US)

- Domsjo Fabriker (Sweden)

- Stora Enoo Oyj (Finland)

- Burgo Group Spa (Italy)

- The Dallas Group of America (US)

- Chengzhou Shanfeng Chemical Industry Corporation (China)

- NIPPON PAPER INDUSTRIES CO LTD. (Japan)

- Metsa Group (Finland)

- Ingevity (US)

- Fibria Cellulose (Brazil)

- Sigma-Aldrich Co. (US)

- West Fraser (Canada)

- Lignin Lignin Company LLC (US)

- Green Value SA (US)

- LENZING AG (Austria)

- Northway Lignin Chemical (Canada)

- Tembec (Canada)

- Innventia (Sweden)

- WestRock Company (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LIGNIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LIGNIN MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL LIGNIN MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL LIGNIN MARKET, BY TYPE, 2018-2032 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 LIGNO-SULPHONATES

10.3 KRAFT LIGNIN

10.4 PYROLYTIC LIGNIN

10.5 SODA LIGNIN

10.6 HYDROLYZED LIGNIN

10.7 LOW-PURITY LIGNIN

10.8 ORGANOSOLV LIGNIN

10.9 VANILLIN

10.1 CARBON FIBER

10.11 PHENOL

10.12 BTX

10.13 OTHERS

11 GLOBAL LIGNIN MARKET, BY GRADE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 FOOD-GRADE

11.3 COMMERCIAL GRADE

11.4 INDUSTRIAL GRADE

11.5 OTHERS

12 GLOBAL LIGNIN MARKET, BY EXTRACTION SOURCE, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 WOOD

12.3 STRAW

12.4 CRUSHED CORN STALKS

12.5 OTHERS

13 GLOBAL LIGNIN MARKET, BY PRODUCT TYPE , 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 PHENOLIC RESINS

13.2.1 FOOD-GRADE

13.2.2 COMMERCIAL GRADE

13.2.3 INDUSTRIAL GRADE

13.2.4 OTHERS

13.3 ACTIVATED CARBON

13.3.1 FOOD-GRADE

13.3.2 COMMERCIAL GRADE

13.3.3 INDUSTRIAL GRADE

13.3.4 OTHERS

13.4 CARBON FIBERS

13.4.1 FOOD-GRADE

13.4.2 COMMERCIAL GRADE

13.4.3 INDUSTRIAL GRADE

13.4.4 OTHERS

13.5 PHENOL

13.5.1 FOOD-GRADE

13.5.2 COMMERCIAL GRADE

13.5.3 INDUSTRIAL GRADE

13.5.4 OTHERS

13.6 OTHERS

14 GLOBAL LIGNIN MARKET, BY SOURCE, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 KRAFT PULPING

14.2.1 PHENOLIC RESINS

14.2.2 ACTIVATED CARBON

14.2.3 CARBON FIBERS

14.2.4 PHENOL

14.2.5 OTHERS

14.3 SULPHITE PULPING

14.3.1 PHENOLIC RESINS

14.3.2 ACTIVATED CARBON

14.3.3 CARBON FIBERS

14.3.4 PHENOL

14.3.5 OTHERS

14.4 CELLULOSIC ETHANOL

14.4.1 PHENOLIC RESINS

14.4.2 ACTIVATED CARBON

14.4.3 CARBON FIBERS

14.4.4 PHENOL

14.4.5 OTHERS

14.5 OTHERS

15 GLOBAL LIGNIN MARKET , BY APPLICATION, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 BIOFUELS

15.2.1 BIOFUELS, BY APPLICATION

15.2.1.1. BIO-OIL

15.2.1.2. SYNGAS

15.2.1.3. GREEN DIESEL

15.2.1.4. HEAT

15.2.1.5. OTHERS

15.2.2 BIOFUELS, BY TYPE

15.2.2.1. LIGNO-SULPHONATES

15.2.2.2. KRAFT LIGNIN

15.2.2.3. PYROLYTIC LIGNIN

15.2.2.4. SODA LIGNIN

15.2.2.5. HYDROLYZED LIGNIN

15.2.2.6. LOW-PURITY LIGNIN

15.2.2.7. ORGANOSOLV LIGNIN

15.2.2.8. VANILLIN

15.2.2.9. CARBON FIBER

15.2.2.10. PHENOL

15.2.2.11. BTX

15.2.2.12. OTHERS

15.3 CHEMICALS

15.3.1 CHEMICALS, BY APPLICATION

15.3.1.1. PHENOLIC COMPOUNDS

15.3.1.2. DISPERSANTS

15.3.1.3. FLOCCULANTS

15.3.1.4. PAINTS

15.3.1.5. ADHESIVES

15.3.1.6. OTHERS

15.3.2 CHEMICALS, BY TYPE

15.3.2.1. LIGNO-SULPHONATES

15.3.2.2. KRAFT LIGNIN

15.3.2.3. PYROLYTIC LIGNIN

15.3.2.4. SODA LIGNIN

15.3.2.5. HYDROLYZED LIGNIN

15.3.2.6. LOW-PURITY LIGNIN

15.3.2.7. ORGANOSOLV LIGNIN

15.3.2.8. VANILLIN

15.3.2.9. CARBON FIBER

15.3.2.10. PHENOL

15.3.2.11. BTX

15.3.2.12. OTHERS

15.4 SPECIALTY MATERIALS

15.4.1 SPECIALTY MATERIALS, BY APPLICATION

15.4.1.1. BIOCOMPOSITES

15.4.1.2. BIOPLASTICS

15.4.1.3. CARBON FIBERS

15.4.1.4. ACTIVATED CARBON

15.4.1.5. ADSORBENT

15.4.1.6. BOARD BINDER

15.4.1.7. FOAMS

15.4.1.8. DENSIFICATION OF BIOMASS PELLETS

15.4.1.9. BATTERY COMPONENTS

15.4.1.10. ENERGY STORAGE

15.4.1.11. OTHERS

15.4.2 SPECIALTY MATERIALS, BY TYPE

15.4.2.1. LIGNO-SULPHONATES

15.4.2.2. KRAFT LIGNIN

15.4.2.3. PYROLYTIC LIGNIN

15.4.2.4. SODA LIGNIN

15.4.2.5. HYDROLYZED LIGNIN

15.4.2.6. LOW-PURITY LIGNIN

15.4.2.7. ORGANOSOLV LIGNIN

15.4.2.8. VANILLIN

15.4.2.9. CARBON FIBER

15.4.2.10. PHENOL

15.4.2.11. BTX

15.4.2.12. OTHERS

15.5 PULP AND PAPER

15.5.1 PULP AND PAPER, BY APPLICATION

15.5.1.1. SIZING AGENT

15.5.1.2. PACKAGING AND LAMINATION

15.5.1.3. OTHERS

15.5.2 PULP AND PAPER, BY TYPE

15.5.2.1. LIGNO-SULPHONATES

15.5.2.2. KRAFT LIGNIN

15.5.2.3. PYROLYTIC LIGNIN

15.5.2.4. SODA LIGNIN

15.5.2.5. HYDROLYZED LIGNIN

15.5.2.6. LOW-PURITY LIGNIN

15.5.2.7. ORGANOSOLV LIGNIN

15.5.2.8. VANILLIN

15.5.2.9. CARBON FIBER

15.5.2.10. PHENOL

15.5.2.11. BTX

15.5.2.12. OTHERS

15.6 PHARMACEUTICAL

15.6.1 PHARMACEUTICAL, BY APPLICATION

15.6.1.1. ANTIOXIDANTS

15.6.1.2. ANTIMICROBIAL AGENTS

15.6.1.3. PREBIOTICS

15.6.1.4. OTHERS

15.6.2 PHARMACEUTICAL, BY TYPE

15.6.2.1. LIGNO-SULPHONATES

15.6.2.2. KRAFT LIGNIN

15.6.2.3. PYROLYTIC LIGNIN

15.6.2.4. SODA LIGNIN

15.6.2.5. HYDROLYZED LIGNIN

15.6.2.6. LOW-PURITY LIGNIN

15.6.2.7. ORGANOSOLV LIGNIN

15.6.2.8. VANILLIN

15.6.2.9. CARBON FIBER

15.6.2.10. PHENOL

15.6.2.11. BTX

15.6.2.12. OTHERS

15.7 ENVIRONMENT AND AGRICULTURE

15.7.1 ENVIRONMENT AND AGRICULTURE, BY APPLICATION

15.7.1.1. DUST CONTROLLING AGENT

15.7.1.2. SOIL STABILIZATION

15.7.1.3. PESTICIDE

15.7.1.4. HERBICIDE

15.7.1.5. WATER RETENTION AGENT

15.7.1.6. HEVAY METAL ADSORPTION

15.7.1.7. OTHERS

15.7.2 ENVIRONMENT AND AGRICULTURE, BY TYPE

15.7.2.1. LIGNO-SULPHONATES

15.7.2.2. KRAFT LIGNIN

15.7.2.3. PYROLYTIC LIGNIN

15.7.2.4. SODA LIGNIN

15.7.2.5. HYDROLYZED LIGNIN

15.7.2.6. LOW-PURITY LIGNIN

15.7.2.7. ORGANOSOLV LIGNIN

15.7.2.8. VANILLIN

15.7.2.9. CARBON FIBER

15.7.2.10. PHENOL

15.7.2.11. BTX

15.7.2.12. OTHERS

15.8 COSMETICS

15.8.1 COSMETICS, BY TYPE

15.8.1.1. LIGNO-SULPHONATES

15.8.1.2. KRAFT LIGNIN

15.8.1.3. PYROLYTIC LIGNIN

15.8.1.4. SODA LIGNIN

15.8.1.5. HYDROLYZED LIGNIN

15.8.1.6. LOW-PURITY LIGNIN

15.8.1.7. ORGANOSOLV LIGNIN

15.8.1.8. VANILLIN

15.8.1.9. CARBON FIBER

15.8.1.10. PHENOL

15.8.1.11. BTX

15.8.1.12. OTHERS

15.9 INDUSTRIAL

15.9.1 INDUSTRIAL, BY TYPE

15.9.1.1. LIGNO-SULPHONATES

15.9.1.2. KRAFT LIGNIN

15.9.1.3. PYROLYTIC LIGNIN

15.9.1.4. SODA LIGNIN

15.9.1.5. HYDROLYZED LIGNIN

15.9.1.6. LOW-PURITY LIGNIN

15.9.1.7. ORGANOSOLV LIGNIN

15.9.1.8. VANILLIN

15.9.1.9. CARBON FIBER

15.9.1.10. PHENOL

15.9.1.11. BTX

15.9.1.12. OTHERS

15.1 OTHERS

15.10.1 OTHERS, BY TYPE

15.10.1.1. LIGNO-SULPHONATES

15.10.1.2. KRAFT LIGNIN

15.10.1.3. PYROLYTIC LIGNIN

15.10.1.4. SODA LIGNIN

15.10.1.5. HYDROLYZED LIGNIN

15.10.1.6. LOW-PURITY LIGNIN

15.10.1.7. ORGANOSOLV LIGNIN

15.10.1.8. VANILLIN

15.10.1.9. CARBON FIBER

15.10.1.10. PHENOL

15.10.1.11. BTX

15.10.1.12. OTHERS

16 GLOBAL LIGNIN MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (KILO TONS)

GLOBAL LIGNIN MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 RUSSIA

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 NETHERLANDS

16.2.11 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA& NEW ZEALAND

16.3.6 HONG KONG

16.3.7 TAIWAN

16.3.8 SINGAPORE

16.3.9 THAILAND

16.3.10 INDONESIA

16.3.11 MALAYSIA

16.3.12 PHILIPPINES

16.3.13 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 SAUDI ARABIA

16.5.4 UNITED ARABEMIRATES

16.5.5 ISRAEL

16.5.6 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL LIGNIN MARKET , COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.4 COMPANY SHARE ANALYSIS: EUROPE

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 SWOT ANALYSIS

19 GLOBAL LIGNIN MARKET – COMPANY PROFILES

19.1 ALBERTA PACIFIC

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT UPDATES

19.2 BORREGAARD LIGNOTECH

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT UPDATES

19.3 CIMV

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATES

19.4 DOMTAR

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT UPDATES

19.5 DOMSJÖ

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT UPDATES

19.6 TEMBEC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 UPM

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT UPDATES

19.8 WEYERHAEUSER

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT UPDATES

19.9 RAYONIER ADVANCED MATERIALS

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT UPDATES

19.1 STORA ENSO OYJ

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT UPDATES

19.11 THE DALLAS GROUP OF AMERICA

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT UPDATES

19.12 BURGO GROUP SPA

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT UPDATES

19.13 METSA GROUP

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT UPDATES

19.14 CHANGZHOU SHANFENG CHEMICAL INDUSTRY COMPANY

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT UPDATES

19.15 LIQUID LIGNIN COMPANY

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT UPDATES

19.16 NIPPON PAPER INDUSTRIES CO., LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT UPDATES

19.17 SIGMA ALDRICH

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT UPDATES

19.18 SUZANO SA

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT UPDATES

19.19 WEST FRASER

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT UPDATES

19.2 INGEVITY CORPORATION

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 SQUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.