Global Longevity And Wellness Biotech Market

Market Size in USD Billion

CAGR :

%

USD

4.95 Billion

USD

15.56 Billion

2024

2032

USD

4.95 Billion

USD

15.56 Billion

2024

2032

| 2025 –2032 | |

| USD 4.95 Billion | |

| USD 15.56 Billion | |

|

|

|

|

Longevity & Wellness Biotech Market Size

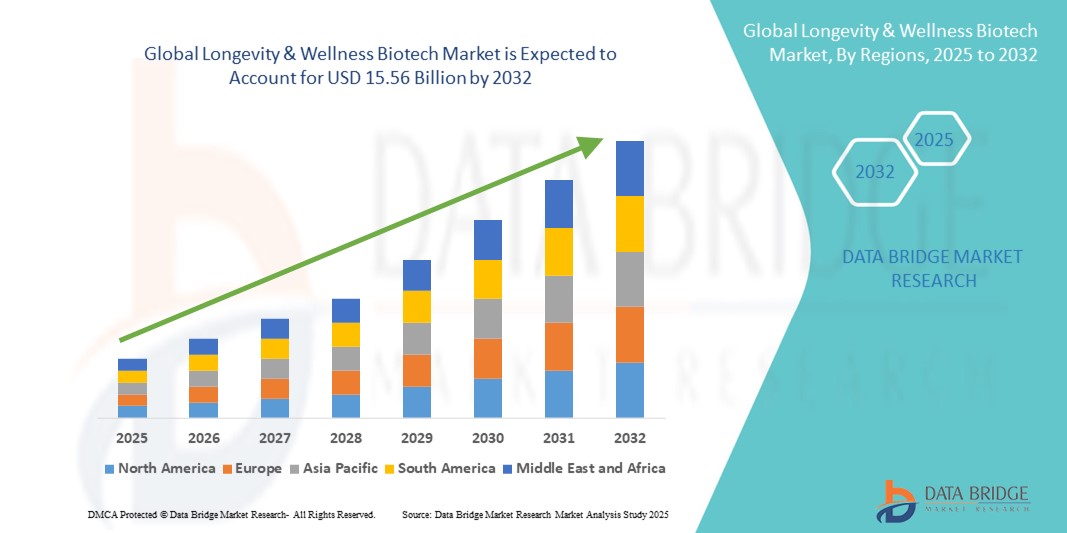

- The global longevity & wellness biotech market size was valued at USD 4.95 billion in 2024 and is expected to reach USD 15.56 billion by 2032, at a CAGR of 15.40% during the forecast period

- The market growth is primarily driven by increasing awareness and adoption of longevity and wellness solutions, coupled with significant technological advancements in biotechnology, genomics, and personalized healthcare. These innovations are enabling more precise interventions, early diagnostics, and preventive care strategies, which are transforming the health and wellness landscape

- Furthermore, the rising consumer focus on proactive health management, healthy aging, and improved quality of life is fueling demand for biotech-based products and services aimed at extending healthspan. Integrative wellness solutions, including nutraceuticals, regenerative medicine, and personalized lifestyle interventions, are becoming central to market expansion

Longevity & Wellness Biotech Market Analysis

- Longevity & Wellness Biotech solutions, encompassing nutraceuticals, regenerative medicine, personalized supplements, and digital health platforms, are becoming increasingly vital components of modern healthcare and wellness strategies in both preventive and therapeutic settings due to their ability to enhance healthspan, support disease prevention, and enable personalized interventions

- The market growth is largely driven by increasing awareness of preventive healthcare, personalized wellness solutions, and the rising adoption of biotechnology-based interventions to enhance longevity and overall well-being

- North America dominated the longevity & wellness biotech market with the largest revenue share of 42.0% in 2024, attributed to advanced biotechnology infrastructure, high healthcare expenditure, strong R&D investment, and a robust presence of key industry players. The U.S. experienced substantial growth in longevity and wellness biotech adoption, driven by innovations in personalized nutrition, regenerative medicine, and AI-enabled health monitoring solutions

- Asia-Pacific is expected to be the fastest-growing region in the longevity & wellness biotech market during the forecast period, owing to rising disposable incomes, growing health awareness, rapid urbanization, and increasing investment in biotechnology and wellness initiatives

- The genetic testing segment dominated the longevity & wellness biotech market with the largest market revenue share of 43.5% in 2024, fueled by growing consumer interest in understanding individual genetic predispositions to aging, chronic conditions, and nutrition needs

Report Scope and Longevity & Wellness Biotech Market Segmentation

|

Attributes |

Longevity & Wellness Biotech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Longevity & Wellness Biotech Market Trends

Rising Focus on Personalized and Preventive Health Solutions

- A significant and accelerating trend in the global longevity & wellness biotech market is the increasing emphasis on personalized and preventive healthcare solutions. Companies are leveraging advances in genomics, biomarker profiling, and digital health platforms to offer tailored wellness and longevity interventions.

- For instance, personalized supplement plans are now being designed based on individual genetic profiles and lifestyle data, enabling users to optimize nutrition, address deficiencies, and support healthy aging. Similarly, digital health platforms provide real-time monitoring of key health metrics, facilitating proactive interventions

- Integration of biomarker profiling with wearable devices and mobile apps allows users to track physiological parameters such as cardiovascular health, metabolic function, and sleep patterns. These insights guide personalized lifestyle recommendations, improving outcomes in preventive care and chronic disease management

- Telehealth solutions are increasingly being used to deliver personalized wellness consultations and monitor patient adherence to lifestyle and therapeutic interventions, enhancing engagement and long-term health benefits

- The shift towards preventive and personalized solutions is driving innovation in nutraceuticals, regenerative medicine, and anti-aging therapeutics, creating opportunities for new product development and tailored wellness services

- This trend is reshaping consumer expectations in the wellness and biotech space, as individuals seek more precise, science-backed, and convenient ways to maintain health, improve longevity, and manage chronic conditions

- Companies in the Longevity & Wellness Biotech sector are increasingly focusing on combining multi-modal solutions—such as personalized nutrition, digital health monitoring, and lifestyle interventions—to offer comprehensive and integrated wellness programs that address both prevention and overall well-being

Longevity & Wellness Biotech Market Dynamics

Driver

Growing Need Due to Rising Health Awareness and Wellness Adoption

- The increasing prevalence of lifestyle-related health concerns, coupled with rising awareness of personalized wellness solutions, is a significant driver for the heightened demand for longevity and wellness biotech products

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced a strategic collaboration to integrate advanced biosensor-based health monitoring into its wellness platforms. Such initiatives by key companies are expected to drive the Longevity & Wellness Biotech industry growth in the forecast period

- As consumers become more conscious of preventative healthcare and long-term wellness, biotech solutions offer advanced features such as personalized diagnostics, genomic profiling, and AI-assisted health recommendations, providing a compelling upgrade over traditional wellness methods

- Furthermore, the growing popularity of personalized nutrition, fitness tracking, and digital health ecosystems is making biotech solutions an integral component of daily health management, offering seamless integration with mobile applications and other health-monitoring platforms

- The convenience of home-based diagnostics, continuous health monitoring, and AI-assisted lifestyle guidance are key factors propelling the adoption of longevity and wellness biotech products across both individual and institutional users. The trend towards preventive healthcare and the increasing availability of user-friendly biotech solutions further contributes to market growth

Restraint/Challenge

Concerns Regarding Data Privacy and High Initial Costs

- Concerns surrounding the privacy and security of personal health data pose a significant challenge to broader market penetration. As longevity and wellness biotech solutions rely on sensitive health information and cloud-based analytics, they are susceptible to data breaches and misuse, raising anxieties among potential consumers

- For instance, high-profile reports of data leaks in digital health platforms have made some consumers hesitant to adopt connected wellness solutions

- Addressing these privacy concerns through robust data encryption, secure authentication protocols, and transparent data-handling policies is crucial for building consumer trust. In addition, the relatively high initial cost of advanced biotech wellness systems can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or for budget-conscious individuals

- While entry-level wellness monitoring solutions have become more affordable, premium features such as integrated genomics, continuous biomarker tracking, or AI-driven lifestyle recommendations often come with a higher price tag

- While costs are gradually decreasing, the perceived premium for advanced wellness technology can still hinder widespread adoption, especially for consumers who do not immediately recognize the benefits of personalized health interventions

- Overcoming these challenges through enhanced data security measures, consumer education on health analytics, and the development of more affordable Longevity & Wellness Biotech solutions will be vital for sustained market growth

Longevity & Wellness Biotech Market Scope

The market is segmented on the basis of product type, delivery platform, personalization mechanism, and application area.

- By Product Type

On the basis of product type, the global longevity & wellness biotech market is segmented into Nutraceuticals, Functional Foods, Anti-Aging Therapeutics, Regenerative Medicine, and Others. The Nutraceuticals segment dominated the largest market revenue share of 41.5% in 2024, driven by the growing consumer preference for natural health supplements, fortified foods, and bioactive compounds that support healthy aging. These products are widely adopted for their preventive benefits, ease of consumption, and scientifically backed health claims. Nutraceuticals are increasingly incorporated into daily diets, addressing nutritional deficiencies, boosting immunity, and supporting cognitive and cardiovascular health. The segment benefits from high awareness levels, strong distribution networks, and regulatory approvals that encourage trust and adoption. Nutraceuticals are commonly used across all demographics, including the aging population, which is actively seeking solutions to maintain vitality and prevent chronic diseases. In addition, ongoing R&D in bioactive compounds and functional ingredients continues to expand product offerings and effectiveness, strengthening market growth.

The Anti-Aging Therapeutics segment is expected to witness the fastest CAGR of 22.0% from 2025 to 2032, fueled by rising demand for interventions that slow aging, improve skin health, and enhance physiological function. This segment includes small molecules, peptides, and biologics designed to target cellular senescence, oxidative stress, and metabolic pathways. Anti-aging therapeutics are increasingly integrated with personalized approaches, where genetic profiling and biomarker assessment guide optimal treatment selection. Clinical evidence supporting efficacy and safety continues to grow, further encouraging adoption among consumers and healthcare providers. The growing prevalence of age-related diseases, rising disposable incomes, and increasing awareness of longevity solutions also contribute to the rapid market expansion of anti-aging therapeutics globally.

- By Delivery Platform

On the basis of delivery platform, the global longevity & wellness biotech market is segmented into digital health platforms, wearable devices, telehealth solutions, mobile apps, and others. The digital health platforms segment dominated the largest market revenue share of 42.0% in 2024, driven by the increasing adoption of cloud-based platforms that allow users to monitor health metrics, receive personalized recommendations, and track wellness goals in real time. These platforms provide centralized access to lifestyle data, enabling seamless integration with other health devices and services. Healthcare providers and wellness companies leverage digital platforms for remote monitoring, longitudinal tracking, and personalized guidance, ensuring higher engagement and compliance. Digital platforms also support predictive analytics, risk stratification, and population-level insights, aiding preventive and personalized interventions. In addition, growing consumer interest in holistic health management and the convenience of platform-based solutions further fuel demand.

The Wearable Devices segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032, supported by technological advancements in sensors, connectivity, and battery efficiency. Wearables monitor physiological parameters such as heart rate, sleep quality, activity levels, and metabolic health, enabling personalized health insights. Integration with AI and mobile apps allows real-time feedback, goal setting, and adherence tracking, making wearables essential tools in preventive care, fitness, and wellness management. Increased health consciousness, adoption by fitness enthusiasts, and corporate wellness programs contribute to rapid market growth. Wearables also provide valuable longitudinal health data for research, personalized interventions, and early detection of potential health issues.

- By Personalization Mechanism

On the basis of personalization mechanism, the global longevity & wellness biotech market is segmented into genetic testing, biomarker profiling, personalized supplements, lifestyle & nutrition plans, and others. The genetic testing segment dominated the largest market revenue share of 43.5% in 2024, fueled by growing consumer interest in understanding individual genetic predispositions to aging, chronic conditions, and nutrition needs. Genetic testing enables the design of tailored wellness and longevity programs, providing insights into metabolism, nutrient absorption, disease risk, and responsiveness to therapies. Increasing accessibility, affordability, and accuracy of testing technologies encourage broader adoption. Genetic insights are integrated with digital platforms, wearables, and personalized supplement plans, facilitating actionable recommendations for preventive healthcare. The segment also benefits from expanding partnerships between biotech companies, wellness providers, and research institutions, enhancing service offerings.

The personalized supplements segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by rising consumer demand for customized formulations targeting specific health goals such as immunity, cognitive function, and longevity. Personalized supplements are designed based on genetic profiles, biomarker data, and lifestyle factors, ensuring optimal efficacy. The market growth is supported by increasing awareness of preventive healthcare, expansion of direct-to-consumer channels, and the integration of AI and digital health tools to deliver individualized recommendations. Rising interest in non-pharmaceutical interventions for wellness further accelerates segment adoption.

- By Application Area

On the basis of application area, the global longevity & wellness biotech market is segmented into preventive healthcare, chronic disease management, fitness & wellness, mental health & cognitive enhancement, and others. The preventive healthcare segment dominated the largest market revenue share of 41.8% in 2024, driven by a growing emphasis on early interventions, disease prevention, and healthy aging. Consumers are increasingly adopting lifestyle modifications, nutraceuticals, digital monitoring, and personalized wellness programs to proactively maintain health. Preventive healthcare solutions are widely promoted by insurance providers, corporate wellness programs, and government initiatives, supporting market penetration. Awareness campaigns and health tech innovations also contribute to increased adoption, as consumers seek to reduce long-term healthcare costs and improve quality of life.

The fitness & wellness segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, propelled by rising health consciousness, urbanization, and disposable incomes. This segment includes personalized exercise plans, nutrition guidance, and wearable-enabled tracking solutions, allowing individuals to optimize performance, manage weight, and maintain overall well-being. Integration with mobile apps, digital health platforms, and lifestyle monitoring tools enhances user engagement and retention. The increasing adoption of corporate wellness programs, gym memberships, and online fitness subscriptions further drives rapid market growth globally.

Longevity & Wellness Biotech Market Regional Analysis

- North America dominated the longevity & wellness biotech market with the largest revenue share of 42.0% in 2024, attributed to advanced biotechnology infrastructure, high healthcare expenditure, strong R&D investment, and a robust presence of key industry players.

- Widespread government and private funding for biotech research, coupled with increasing consumer demand for health optimization and preventive care, further strengthens the region's leadership. Key market segments such as nutraceuticals, functional foods, and personalized supplements continue to expand, with adoption in both clinical and consumer wellness applications

- The emphasis on innovation and high-quality healthcare services also promotes rapid commercialization of new biotech products, reinforcing North America’s dominant position

U.S. Longevity & Wellness Biotech Market Insight

The U.S. longevity & wellness biotech market captured the largest revenue share of 56% within North America in 2024, driven by growing investment in regenerative medicine, anti-aging therapeutics, and personalized health solutions. Adoption is fueled by a combination of high disposable incomes, technological awareness, and the presence of leading biotechnology and wellness companies. The market is also supported by cutting-edge research in nutraceuticals and functional foods, alongside the development of advanced digital health platforms and wearable devices that enable monitoring of personalized health metrics. Consumers are increasingly focusing on preventive healthcare and chronic disease management, accelerating the demand for innovative longevity solutions.

Europe Longevity & Wellness Biotech Market Insight

The Europe longevity & wellness biotech market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising consumer awareness of health and wellness, coupled with significant investment in biotechnology research. Countries such as Germany, France, and the U.K. are investing heavily in anti-aging therapeutics, regenerative medicine, and personalized nutrition solutions. The region benefits from well-established healthcare infrastructure, stringent quality standards, and supportive government initiatives promoting biotechnology adoption. Preventive healthcare and chronic disease management remain major application areas, contributing to robust market growth across both residential and clinical settings.

U.K. Longevity & Wellness Biotech Market Insight

The U.K. longevity & wellness biotech market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing focus on wellness, preventive healthcare, and the development of personalized therapeutic solutions. The market is supported by strong research capabilities, a growing biotechnology startup ecosystem, and increased investment in digital health solutions, wearable devices, and AI-assisted health monitoring. Public and private initiatives for health awareness, combined with rising disposable incomes, further contribute to market expansion.

Germany Longevity & Wellness Biotech Market Insight

The Germany longevity & wellness biotech market is expected to expand at a considerable CAGR during the forecast period, fueled by strong R&D capabilities, a well-developed healthcare system, and rising demand for anti-aging and regenerative solutions. Germany’s emphasis on innovation, quality, and sustainability promotes the adoption of nutraceuticals, functional foods, and personalized supplements. Additionally, preventive healthcare and chronic disease management are significant growth areas, supported by government health initiatives and increasing consumer awareness.

Asia-Pacific Longevity & Wellness Biotech Market Insight

The Asia-Pacific longevity & wellness biotech market is expected to be the fastest-growing region with a CAGR during 2025–2032, driven by rising disposable incomes, growing health awareness, rapid urbanization, and increasing investment in biotechnology and wellness initiatives. Countries such as China, Japan, and India are witnessing rapid adoption of nutraceuticals, functional foods, regenerative medicine, and digital health platforms. Government initiatives supporting biotechnology innovation, coupled with a growing middle-class population focused on preventive healthcare, are key drivers of growth.

Japan Longevity & Wellness Biotech Market Insight

The Japan longevity & wellness biotech market is gaining momentum due to high health consciousness, advanced biotech research, and an aging population seeking effective anti-aging and regenerative solutions. Strong emphasis on preventive healthcare, personalized nutrition, and wearable health monitoring devices is driving the market forward. Japan’s robust R&D infrastructure and early adoption of innovative health solutions support the development and commercialization of new longevity products.

China Longevity & Wellness Biotech Market Insight

The China longevity & wellness biotech market accounted for the largest revenue share in Asia-Pacific in 2024, owing to rapid urbanization, rising disposable incomes, growing health awareness, and increasing investment in biotechnology. China is emerging as a major hub for nutraceuticals, regenerative medicine, and digital health innovations. Government initiatives promoting wellness, coupled with the expansion of biotechnology research centers and manufacturing capabilities, are driving market growth. Preventive healthcare and chronic disease management remain significant focus areas, supporting increased adoption of longevity and wellness biotech solutions.

Longevity & Wellness Biotech Market Share

The longevity & wellness biotech industry is primarily led by well-established companies, including:

- Calico Life Sciences (U.S.)

- Altos Labs (U.S.)

- Unity Biotechnology (U.S.)

- Insilico Medicine (U.S.)

- Human Longevity Inc. (U.S.)

- Elysium Health (U.S.)

- Life Biosciences, Inc. (U.S.)

- Novogenia Marketing GmbH (Austria)

- Longevity Biotech (U.S.)

- Retro (U.S.)

- Procter & Gamble (U.S.)

- Unilever PLC (UK)

- Bayer AG (Germany)

- Nestlé (Switzerland)

- Herbalife International of America, Inc. (U.S.)

- Amway India Enterprises Pvt. Ltd. (India)

- Nature’s Bounty (U.S.)

- Thorne (U.S.)

Latest Developments in Global Longevity & Wellness Biotech Market

- In January 2025, tech billionaires like Jeff Bezos, Sam Altman, and Peter Thiel invested heavily in the longevity industry, creating a USD25 billion market for life-extending therapeutics. These investments include funding for labs such as Retro Biosciences and Altos Labs, and contributions to the Methuselah Foundation, which aims to significantly extend healthy life spans

- In June 2025, ProZenith launched a U.S.-made natural weight-management supplement, combining BHB, functional mushrooms, and Dead Sea-inspired minerals to support energy, appetite control, and metabolism. The trend was further supported by lifestyle shifts post-pandemic, greater awareness of gut-brain and cellular health connections, and the introduction of convenient formats like gummies, powders, and ready-to-drink shots that appeal to younger, health-conscious consumers

- In May 2025, the Longevity Expo 2025 was held in West Palm Beach, Florida, bridging the gap between breakthrough science and everyday health practices. The event, hosted by personalized precision medicine pioneer Sara Gottfried, MD, and in an educational partnership with A4M, provided consumers with practical tools for lifelong wellness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.