Global Luxury Apparel Market

Market Size in USD Billion

CAGR :

%

USD

83.47 Billion

USD

118.71 Billion

2024

2032

USD

83.47 Billion

USD

118.71 Billion

2024

2032

| 2025 –2032 | |

| USD 83.47 Billion | |

| USD 118.71 Billion | |

|

|

|

|

Luxury Apparel Market Size

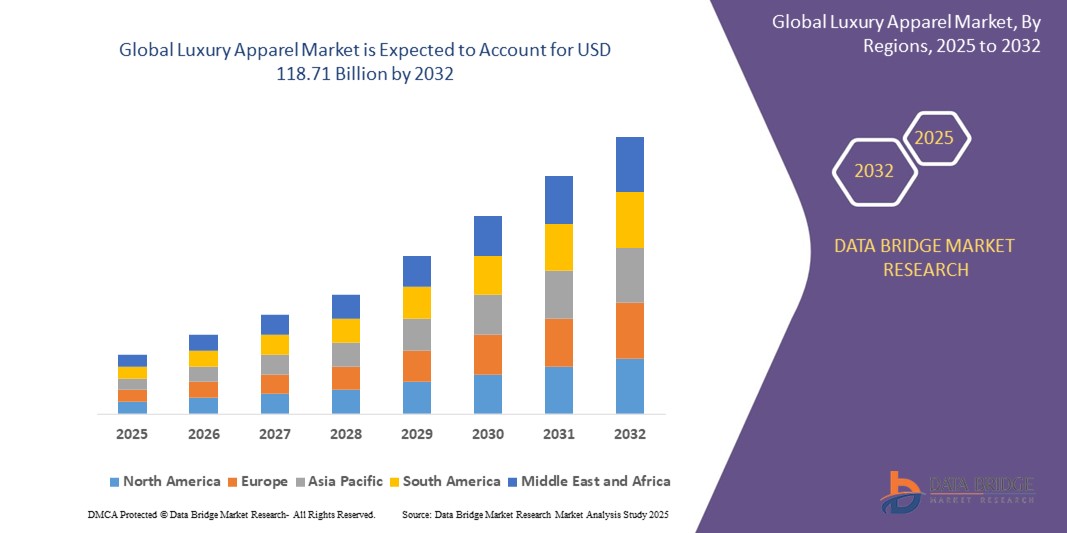

- The global luxury apparel market was valued at USD 83.47 billion in 2024 and is expected to reach USD 118.71 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.50%, primarily driven by rising disposable incomes and a growing affluent population

- This growth is driven by Increasing consumer preference for premium and high-quality fashion

Luxury Apparel Market Analysis

- The luxury apparel market is growing steadily due to rising disposable incomes, increasing fashion consciousness, and consumer preference for premium brands. Digital innovations, sustainable production, and celebrity endorsements are further enhancing global demand for exclusive and high-quality clothing

- Rising lifestyle changes, strong influence of social media, and the desire for status symbols among millennials and Gen Z consumers are major drivers. Availability of luxury collections for casual, formal, and seasonal wear continues to expand the global market

- Europe leads the luxury apparel market with strong demand in France, Italy, and the U.K., driven by iconic brands, high craftsmanship, and luxury tourism. Fashion weeks, flagship stores, and a strong retail network sustain regional dominance

- For instance, in Italy, brands such as Gucci, Prada, and Versace are expanding stores and enhancing online channels, attracting a wider international audience seeking Italian luxury fashion's rich heritage, superior quality, and innovative designs

- Globally, sustainable luxury fashion, tech-integrated apparel, and gender-neutral collections are shaping the future of luxury apparel. Continuous innovation in fabrics, eco-friendly practices, and digital engagement strategies are key to maintaining growth across traditional and emerging markets

Report Scope and Luxury Apparel Market Segmentation

|

Attributes |

Luxury Apparel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Luxury Apparel Market Trends

“Growing Influence of Digital Fashion and Virtual Try-Ons”

-

Digital fashion and virtual try-on technologies are gaining traction in the luxury apparel market, offering immersive shopping experiences, reducing returns, and enhancing customer engagement through personalized, tech-driven interactions across online and offline platforms

-

Brands are leveraging augmented reality (AR) and artificial intelligence (AI) to allow consumers to virtually try luxury outfits, improving convenience, boosting confidence in purchases, and appealing especially to tech-savvy Gen Z and millennial shoppers

-

For instance, in September 2024, Gucci partnered with Snapchat to launch a virtual try-on experience, allowing users to digitally test the brand’s luxury sneakers and outfits, enhancing online shopping convenience and brand interaction

-

The integration of digital fashion innovations is redefining luxury retail strategies, prompting brands to invest heavily in tech-driven solutions that bridge the physical and virtual shopping worlds, creating futuristic and highly engaging brand ecosystems

-

As virtual fashion trends expand, luxury apparel brands embracing AR and AI technologies are expected to differentiate themselves, attract digital-native consumers, and sustain competitive advantage in an increasingly digitalized luxury retail landscape

Luxury Apparel Market Dynamics

Driver

“Rising Popularity of Sustainable and Ethical Fashion”

- Growing environmental concerns and ethical consumerism are driving strong demand for sustainable luxury apparel crafted from eco-friendly, recycled, and responsibly sourced materials, encouraging brands to innovate and adopt greener production methods

- Leading brands are emphasizing carbon-neutral initiatives, cruelty-free practices, and transparent supply chains to align with consumer values, appealing particularly to environmentally conscious millennials and Gen Z demographics seeking authenticity and responsibility

- Key luxury markets such as France, the U.S., and Japan are witnessing premium eco-luxury collections being launched, supported by consumer willingness to pay a premium for brands demonstrating genuine environmental stewardship

- For instance, in January 2025, Stella McCartney introduced a new sustainable luxury line made from mushroom leather and recycled fibers, reinforcing its leadership in ethical fashion innovation and commitment to environmental responsibility

- As demand for responsible fashion continues to grow, luxury apparel brands prioritizing sustainability are well-positioned to build brand loyalty, enhance reputation, and drive long-term profitability across global markets

Opportunity

“Expansion across Tier-II and Tier-III Cities”

- Rapid urbanization, rising disposable incomes, and digital penetration in Tier-II and Tier-III cities are creating new opportunities for luxury apparel brands to tap into previously underserved and aspirational consumer segments

- Brands are expanding retail footprints, launching localized marketing campaigns, and offering accessible luxury ranges to cater to evolving fashion tastes and the growing purchasing power in smaller, emerging urban centers

- Omni-channel strategies integrating online marketplaces and flagship experience stores are proving successful in attracting and engaging consumers in new geographies seeking premium lifestyle products and global brand experiences

For instance,

- In December 2024, Louis Vuitton announced plans to open five new stores in India’s Tier-II cities, citing strong growth in luxury demand beyond metros

- In October 2024, Burberry expanded its online presence targeting emerging cities across Southeast Asia

- In September 2024, Prada launched a pop-up luxury experience in Chengdu, China to attract younger, aspirational consumers

- As smaller cities continue evolving into key consumption hubs, luxury apparel brands can unlock significant growth potential by customizing offerings and building strong brand presence in these vibrant, untapped markets

Restraint/Challenge

“Counterfeit Products and Brand Dilution”

-

The luxury apparel market is challenged by the growing presence of counterfeit products, which erode brand value, damage consumer trust, and lead to significant revenue losses for authentic luxury fashion houses worldwide

-

Advanced counterfeit techniques and online marketplaces make it increasingly difficult for brands to control authenticity, pushing them to invest heavily in anti-counterfeiting technologies, legal actions, and consumer education initiatives

- Counterfeit goods are particularly prevalent in emerging markets, where price-sensitive consumers may opt for imitations, negatively impacting the exclusivity and desirability associated with true luxury apparel

For instance,

- In August 2024, Chanel filed lawsuits against major counterfeit networks operating in China and the U.S., aiming to protect its brand integrity

- In June 2024, Louis Vuitton enhanced its blockchain-based authentication program to combat counterfeit sales

- In May 2024, Hermès introduced new digital watermarks in products to strengthen anti-counterfeiting efforts

- As counterfeit threats persist, luxury brands must continuously innovate in authentication, consumer engagement, and legal protection to safeguard brand prestige and maintain loyal customer bases worldwide

Luxury Apparel Market Scope

The market is segmented on the basis of product type, distribution channel, end user, and material.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By End User |

|

|

By Material |

|

Luxury Apparel Market Regional Analysis

“Europe is the Dominant Region in the Luxury Apparel Market”

- Europe hosts renowned luxury fashion houses such as Louis Vuitton, Gucci, and Chanel, strengthening its leadership in the luxury apparel market

- European consumers show a strong preference for premium products, supported by high disposable incomes and a rich fashion heritage

- Major cities such as Paris, Milan, and London attract global tourists who significantly contribute to luxury apparel sales

- With its iconic brands, affluent consumers, and tourism-driven demand, Europe will continue to dominate the luxury apparel market in the foreseeable future

“Asia-Pacific is projected to register the Highest Growth Rate”

- Rising disposable incomes and an expanding middle-class population in countries such as China, India, and Japan are fueling the demand for luxury apparel

- Increasing urbanization and growing fashion consciousness among younger consumers are driving rapid market expansion

- Global luxury brands are strengthening their presence in Asia-Pacific through collaborations, flagship stores, and localized marketing strategies

- Supported by economic growth and evolving consumer preferences, Asia-Pacific is expected to register the highest growth rate in the luxury apparel market in the coming years

Luxury Apparel Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hermès (France)

- KERING (France)

- Gianni Versace S.r.l. (Italy)

- PRADA (Italy)

- Dolce & Gabbana S.r.l. (Italy)

- Giorgio Armani S.p.A (Italy)

- Burberry Limited (U.K.)

- KATE SPADE LLC (U.S.)

- 3.1 Phillip Lim (U.S.)

- PVH Corp. (U.S.)

- Calvin Klein (U.S.)

- Ralph Lauren Media LLC (U.S.)

- CHRISTIAN DIOR (France)

- Michael Kors (U.S.)

- COACH IP HOLDINGS LLC, COACH (U.S.)

- Nike, Inc. (U.S.)

- NNNOW (India)

- Levi Strauss & Co (U.S.)

- Jockey (U.S.)

Latest Developments in Global Luxury Apparel Market

- In July 2024, Giorgio Armani launched the Mare 2024 Collection at an exclusive cocktail event at Little Beach House Malibu, featuring tropical palm patterns in turquoise with wood and light gold accents, perfectly capturing the collection’s summer luxury against the Pacific Ocean backdrop, setting a new standard for immersive luxury experiences

- In December 2022, Dior introduced the "Dior Tears" campaign in collaboration with Denim Tears for the Fall 2023 collection, following a series of notable partnerships with designers such as Eli Russell Linnetz, Shawn Stussy, sacai, KAWS, and Daniel Arsham, further cementing Dior’s innovative approach to luxury fashion collaborations

- In November 2022, Prada unveiled a collection inspired by the abaya, dedicating the proceeds to support Qatar’s creative industry, showcasing the brand’s commitment to cultural appreciation and social responsibility in the luxury sector

- In November 2022, Burberry and Minecraft partnered to launch a unique game and fashion collection, blending creativity, exploration, and self-expression, highlighting Burberry’s efforts to merge digital innovation with luxury fashion experiences

- In November 2022, The New Concepts Nordstrom platform and Burberry introduced Concept 019, featuring a capsule collection of outerwear staples such as trench coats and puffer jackets, as well as ready-to-wear and accessories for all ages, enhancing Burberry’s visibility and customer engagement through innovative retail concepts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.