Global Medical Cyclotron Market

Market Size in USD Million

CAGR :

%

USD

228.20 Million

USD

466.85 Million

2025

2033

USD

228.20 Million

USD

466.85 Million

2025

2033

| 2026 –2033 | |

| USD 228.20 Million | |

| USD 466.85 Million | |

|

|

|

|

Medical Cyclotron Market Size

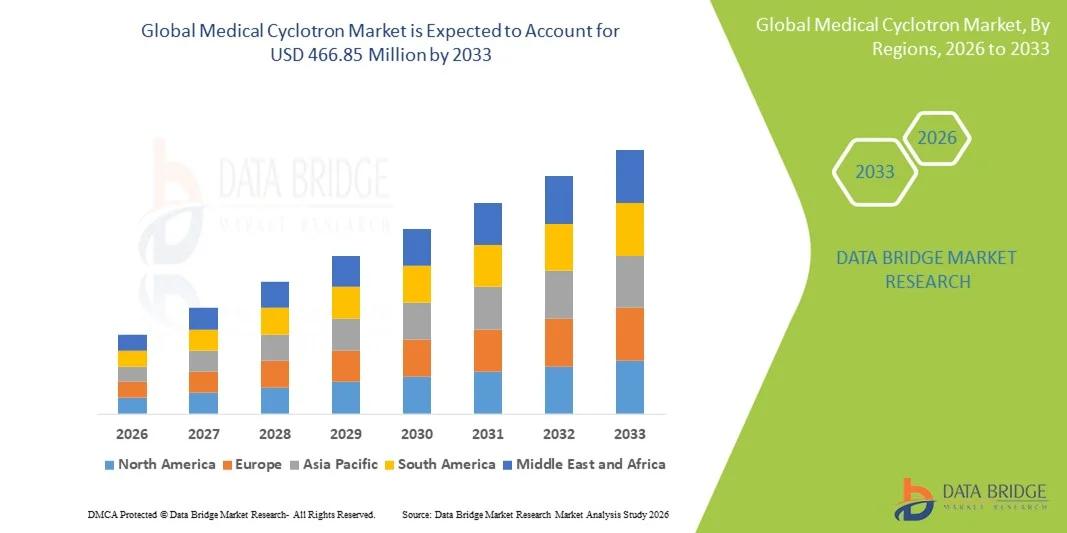

- The global medical cyclotron market size was valued at USD 228.20 million in 2025 and is expected to reach USD 466.85 million by 2033, at a CAGR of 9.36% during the forecast period

- The market growth is largely fueled by the rising demand for medical radioisotopes used in PET and SPECT imaging, along with increasing investments in nuclear medicine infrastructure and oncology diagnostics across hospitals and diagnostic centers

- Furthermore, growing prevalence of cancer and neurological disorders, coupled with technological advancements in compact and high-energy cyclotrons, is positioning medical cyclotrons as a critical component of modern diagnostic imaging. These converging factors are accelerating adoption, thereby significantly boosting overall market growth

Medical Cyclotron Market Analysis

- Medical cyclotrons, used for the production of short-lived radioisotopes essential in PET and SPECT imaging, are increasingly vital components of modern nuclear medicine infrastructure across hospitals, diagnostic imaging centers, and research institutions due to their role in early disease detection and precision diagnostics

- The escalating demand for medical cyclotrons is primarily fueled by the rising global burden of cancer and neurological disorders, increasing adoption of PET imaging procedures, and growing investments in advanced diagnostic technologies

- North America dominated the medical cyclotron market with the largest revenue share of 38.9% in 2025, supported by a well-established healthcare system, high adoption of nuclear medicine, and strong presence of cyclotron manufacturers, with the U.S. witnessing significant installations in academic medical centers and oncology-focused hospitals

- Asia-Pacific is expected to be the fastest growing region in the medical cyclotron market during the forecast period due to expanding healthcare infrastructure, increasing cancer incidence, and rising government support for nuclear medicine and radiopharmaceutical production

- The Low Energy Medical Cyclotron segment dominated the medical cyclotron market with a market share of 45.6% in 2025, driven by its widespread use in producing commonly used PET isotopes such as Fluorine-18 and its suitability for hospital-based installations

Report Scope and Medical Cyclotron Market Segmentation

|

Attributes |

Medical Cyclotron Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Cyclotron Market Trends

Shift Toward Compact and Hospital-Based Cyclotron Systems

- A significant and accelerating trend in the global medical cyclotron market is the shift toward compact, self-shielded, and hospital-based cyclotron systems designed to enable on-site production of medical radioisotopes for PET and SPECT imaging, improving supply reliability and clinical efficiency

- For instance, companies such as IBA Radiopharma Solutions and GE HealthCare have developed compact cyclotron models specifically suited for installation within hospitals and diagnostic centers, reducing reliance on centralized radioisotope suppliers

- Technological advancements in cyclotron design are enabling higher yield production, improved automation, and reduced operational complexity, making cyclotrons more accessible to mid-sized healthcare facilities. For instance, newer systems offer automated target handling and integrated quality control modules to streamline isotope production

- The integration of cyclotrons with radiopharmaceutical manufacturing workflows supports faster turnaround times for short half-life isotopes such as Fluorine-18, which is critical for timely diagnostic imaging procedures

- This trend toward localized and efficient radioisotope production is reshaping operational models in nuclear medicine. Consequently, companies such as Siemens Healthineers are focusing on modular cyclotron solutions that support scalable radiopharmaceutical output

- Advancements in digital monitoring and remote diagnostics are enabling predictive maintenance of cyclotron systems, improving uptime and reducing unexpected operational disruptions in clinical settings

- The demand for compact, hospital-based cyclotrons is growing rapidly across developed and emerging healthcare markets as providers prioritize operational autonomy, cost control, and reliable isotope availability

Medical Cyclotron Market Dynamics

Driver

Rising Demand for PET Imaging and Oncology Diagnostics

- The increasing global burden of cancer and neurological disorders, coupled with the expanding adoption of PET imaging for early and accurate diagnosis, is a major driver for the growing demand for medical cyclotrons

- For instance, in March 2025, several academic medical centers in the U.S. announced investments in on-site cyclotron facilities to support rising PET scan volumes and advanced oncology research programs

- As healthcare providers focus on precision medicine and early disease detection, cyclotrons enable consistent supply of critical radioisotopes required for high-resolution molecular imaging

- Furthermore, growing investments in nuclear medicine infrastructure and favorable reimbursement policies in developed markets are encouraging hospitals and diagnostic centers to install cyclotron systems

- Growing government and private funding for cancer screening programs is increasing PET imaging volumes, indirectly driving demand for reliable in-house radioisotope production

- Expanding clinical research in neurology and cardiology is further supporting the installation of cyclotrons to ensure uninterrupted access to specialized diagnostic isotopes

- The increasing use of PET imaging in cardiology, neurology, and oncology, along with expanding clinical indications, continues to propel sustained growth in the medical cyclotron market

Restraint/Challenge

High Capital Investment and Regulatory Complexity

- The high upfront capital cost associated with medical cyclotron installation, including shielding, facility construction, and radiation safety infrastructure, remains a significant challenge for widespread adoption

- For instance, stringent regulatory approvals and licensing requirements for radioactive material handling can delay cyclotron deployment, particularly in emerging markets with evolving nuclear regulations

- Compliance with radiation safety standards, regular inspections, and skilled workforce requirements adds to the operational complexity and cost burden for healthcare providers

- In addition, the need for specialized personnel such as radiochemists and cyclotron engineers limits adoption in regions facing workforce shortages

- Limited availability of standardized regulatory frameworks across countries complicates multinational deployment strategies for cyclotron manufacturers

- Long installation timelines, including facility construction and radiation shielding validation, can delay return on investment and discourage smaller healthcare providers from adoption

- Overcoming these challenges through regulatory harmonization, workforce training initiatives, and cost-optimized cyclotron designs will be critical for expanding market penetration and long-term growth

Medical Cyclotron Market Scope

The market is segmented on the basis of type, product, classification, application, and end user.

- By Type

On the basis of type, the medical cyclotron market is segmented into Ring Cyclotron and Azimuthally Varying Field (AVF) Cyclotron. The AVF Cyclotron segment dominated the market with the largest revenue share in 2025, driven by its long-standing clinical reliability and widespread deployment for medical radioisotope production. AVF cyclotrons are extensively used for producing commonly required PET isotopes due to their stable beam performance and cost-effective operation. Their proven track record, lower technical complexity, and compatibility with existing nuclear medicine infrastructure support broad adoption across hospitals and commercial isotope producers. In addition, availability of trained personnel familiar with AVF systems further reinforces their dominance. The segment benefits from strong aftermarket support and established regulatory acceptance. These factors collectively sustain its leading market position.

The Ring Cyclotron segment is expected to witness the fastest growth during the forecast period, fueled by advancements in compact design and higher beam current capabilities. Ring cyclotrons offer improved energy efficiency, enhanced beam stability, and reduced operational footprint, making them suitable for hospital-based installations. Growing demand for decentralized isotope production is accelerating adoption of ring cyclotron systems. Their capability to support higher production volumes and novel isotopes aligns with emerging theranostic applications. Continuous R&D investments by manufacturers are enhancing system performance and automation. As a result, ring cyclotrons are gaining rapid traction in modern nuclear medicine facilities.

- By Product

On the basis of product, the market is segmented into Cyclotron 10–12 MeV, Cyclotron 16–18 MeV, Cyclotron 19–24 MeV, and Cyclotron 24 MeV and Above. The Cyclotron 16–18 MeV segment dominated the market in 2025 due to its optimal balance between production capability and installation feasibility. These systems are widely used for producing Fluorine-18, the most commonly used PET isotope. Their suitability for hospital-based deployment and relatively lower shielding requirements support broad adoption. The segment benefits from consistent demand driven by routine PET imaging procedures. In addition, compatibility with automated radiochemistry modules enhances workflow efficiency. These factors collectively position 16–18 MeV cyclotrons as the industry standard.

The Cyclotron 19–24 MeV segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing demand for diversified and higher-yield radioisotope production. These cyclotrons enable production of a broader range of isotopes used in both diagnostics and emerging therapeutic applications. Growing interest in theranostics and research-based isotope development is accelerating adoption. Higher beam energy supports improved scalability for commercial radioisotope manufacturers. Investments in oncology-focused imaging and treatment further strengthen demand. As advanced clinical applications expand, this segment is expected to experience rapid growth.

- By Classification

On the basis of classification, the market is segmented into low energy medical cyclotron and high energy medical cyclotron type. The Low Energy Medical Cyclotron segment accounted for the largest market share of 45.6% in 2025, supported by its widespread use in hospital and diagnostic center settings. These systems are primarily utilized for routine PET isotope production, especially Fluorine-18. Lower capital investment, reduced shielding needs, and simpler regulatory compliance favor adoption. Their compact size makes them suitable for urban healthcare facilities with space constraints. The segment benefits from steady PET scan volumes globally. As a result, low energy cyclotrons remain the most commonly installed systems.

The High Energy Medical Cyclotron segment is expected to register the fastest growth over the forecast period due to expanding applications in research and therapeutic isotope production. High energy cyclotrons enable generation of non-conventional and longer-lived isotopes used in advanced diagnostics and targeted therapies. Increasing focus on personalized medicine and radiotheranostics is driving demand. Research institutions and commercial isotope manufacturers are key adopters of these systems. Technological advancements are improving operational efficiency and safety. These trends collectively support rapid growth of the high energy segment.

- By Application

On the basis of application, the market is segmented into diagnostic and treatment, research and development, and others. The Diagnostic and Treatment segment dominated the market in 2025, driven by the extensive use of PET imaging in oncology, cardiology, and neurology. Cyclotrons play a critical role in producing short half-life isotopes required for routine diagnostic procedures. Growing global cancer prevalence continues to sustain high PET scan demand. Hospitals prioritize diagnostic applications due to immediate clinical returns. Favorable reimbursement policies in developed markets further support this segment. Consequently, diagnostic and treatment applications represent the largest share of cyclotron utilization.

The Research and Development segment is projected to grow at the fastest rate during the forecast period, supported by increasing investments in nuclear medicine research. Academic institutions and pharmaceutical companies are expanding research into novel isotopes and radiopharmaceuticals. Cyclotrons are essential for experimental isotope production and clinical trial support. Government funding and public-private partnerships are accelerating research activities. Emerging applications in neurology and immuno-oncology further enhance growth prospects. This makes R&D the fastest growing application segment.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centers, commercial radioisotope manufacturers, and research and academic institutes. The Hospitals segment dominated the market in 2025 due to increasing installation of on-site cyclotron facilities to ensure uninterrupted isotope supply. Hospitals prioritize cyclotrons to reduce dependency on external suppliers and minimize logistical delays. Rising patient volumes for PET imaging reinforce hospital demand. Integration of cyclotrons with in-house radiopharmacy operations enhances efficiency. Large healthcare systems are increasingly investing in nuclear medicine infrastructure. These factors collectively support hospital dominance.

The Commercial Radioisotope Manufacturers segment is expected to witness the fastest growth during the forecast period, driven by expanding global demand for medical isotopes. These players invest in high-capacity cyclotrons to support regional and international distribution. Growth in diagnostic imaging centers and emerging therapeutic applications is increasing isotope consumption. Commercial manufacturers benefit from economies of scale and technological advancements. Expansion into emerging markets further accelerates growth. As isotope demand diversifies, this segment is poised for rapid expansion.

Medical Cyclotron Market Regional Analysis

- North America dominated the medical cyclotron market with the largest revenue share of 38.9% in 2025, supported by a well-established healthcare system, high adoption of nuclear medicine, and strong presence of cyclotron manufacturers, with the U.S. witnessing significant installations in academic medical centers and oncology-focused hospitals

- Healthcare providers in the region highly value the reliability of on-site radioisotope production, advanced cyclotron technology, and seamless integration with radiopharmaceutical manufacturing and imaging workflows

- This widespread adoption is further supported by favorable reimbursement frameworks, a strong presence of leading cyclotron manufacturers, and significant funding for cancer research and nuclear medicine programs, establishing medical cyclotrons as a critical component of modern diagnostic and research facilities

U.S. Medical Cyclotron Market Insight

The U.S. medical cyclotron market captured the largest revenue share within North America in 2025, fueled by the high volume of PET imaging procedures and strong investments in oncology and nuclear medicine infrastructure. Healthcare providers increasingly prioritize reliable, on-site radioisotope production to support growing diagnostic demand. The expanding focus on precision medicine, along with the presence of leading cyclotron manufacturers and radiopharmaceutical companies, further propels market growth. Moreover, favorable reimbursement policies and sustained funding for cancer research significantly contribute to the expansion of the medical cyclotron market in the U.S.

Europe Medical Cyclotron Market Insight

The Europe medical cyclotron market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and increasing adoption of PET imaging across public healthcare systems. Strong regulatory emphasis on early diagnosis and preventive healthcare is fostering cyclotron installations. European countries are witnessing growing demand for localized radioisotope production to reduce dependency on imports. The region is experiencing notable growth across hospitals, diagnostic centers, and research institutions, supported by continuous investments in nuclear medicine modernization.

U.K. Medical Cyclotron Market Insight

The U.K. medical cyclotron market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding PET imaging capacity within the National Health Service (NHS). Increasing focus on early cancer detection and molecular imaging is supporting cyclotron adoption. In addition, government-backed investments in radiopharmaceutical research and clinical trials are stimulating demand. The U.K.’s strong academic research base and collaborations between hospitals and universities continue to support steady market growth.

Germany Medical Cyclotron Market Insight

The Germany medical cyclotron market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure and strong emphasis on medical technology innovation. Germany’s leadership in diagnostic imaging and nuclear medicine supports sustained cyclotron demand. Hospitals and research institutes increasingly invest in cyclotrons to ensure stable isotope supply. The country’s focus on regulatory compliance, safety, and technological efficiency aligns well with the adoption of advanced cyclotron systems.

Asia-Pacific Medical Cyclotron Market Insight

The Asia-Pacific medical cyclotron market is poised to grow at the fastest CAGR during the forecast period, driven by expanding healthcare infrastructure, rising cancer prevalence, and increasing access to advanced diagnostic imaging. Countries such as China, Japan, and India are witnessing rapid growth in PET scan installations. Government initiatives aimed at strengthening nuclear medicine capabilities are accelerating cyclotron deployment. In addition, growing domestic manufacturing capabilities are improving affordability and accessibility across the region.

Japan Medical Cyclotron Market Insight

The Japan medical cyclotron market is gaining momentum due to the country’s advanced healthcare system, high adoption of diagnostic imaging technologies, and strong emphasis on early disease detection. Japan places significant importance on reliable radioisotope availability, supporting widespread cyclotron use. The integration of cyclotrons with hospital-based radiopharmacy operations is expanding. Moreover, Japan’s aging population is driving demand for advanced diagnostic solutions, further supporting market growth.

India Medical Cyclotron Market Insight

The India medical cyclotron market accounted for a significant revenue share in Asia Pacific in 2025, attributed to expanding oncology infrastructure and rising demand for PET imaging. Rapid urbanization and increasing healthcare investments are supporting cyclotron adoption in major hospitals. India’s focus on strengthening domestic radiopharmaceutical production is reducing reliance on imported isotopes. Government initiatives promoting cancer care expansion, along with growing private-sector participation, are key factors propelling market growth in India.

Medical Cyclotron Market Share

The Medical Cyclotron industry is primarily led by well-established companies, including:

- IBA Worldwide (Belgium)

- Advanced Cyclotron Systems, Inc. (Canada)

- Best Theratronics Ltd. (Canada)

- IONETIX Corporation (U.S.)

- GE HealthCare (U.S.)

- Sumitomo Heavy Industries, Ltd. (Japan)

- Siemens Healthineers AG (Germany)

- TRIUMF (Canada)

- TeamBest Cyclotron Systems (U.S.)

- PMB‑Alcen (France)

- Acsion Industries (U.S.)

- Zhengzhou Hanbang Technology Co., Ltd. (China)

- Shinva Medical Instrument Co., Ltd. (China)

- Elekta AB (Sweden)

- Hitachi, Ltd. (Japan)

- Pro Tom International (U.S.)

- Mevion Medical Systems (U.S.)

- Global Medical Solutions (U.S.)

- Nueclear Healthcare Limited (India)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

What are the Recent Developments in Global Medical Cyclotron Market?

- In December 2025, GE HealthCare revealed that the world’s first MINItrace Magni cyclotron would be installed at the University of Szeged, Hungary, signifying a major advancement for compact cyclotron technology and local radiopharmaceutical production to support theranostics and PET imaging

- In December 2024, the Institute for Radioelements (IRE) announced the arrival of a 30 MeV IBA cyclotron at its Fleurus site to strengthen production capacities and self-sufficiency in germanium-68 (Ge-68) for PET tracer manufacture, marking a strategic expansion in radiopharmaceutical supply chain infrastructure

- In June 2024, IRE ELiT and Grand Pharmaceutical Co. Ltd. signed a partnership to distribute Galli Eo (Gallium-68) generators in China, expanding access to PET isotopes in one of the fastest-growing radiopharmaceutical markets worldwide

- In March 2023, the Institute for Radioelements completed its conversion to 100% low-enriched uranium (LEU) production for key radioisotopes including Mo-99 and I-131, enhancing safety and aligning with non-proliferation objectives across nuclear medicine supply chains

- In March 2023, the nuclear research center SCK CEN and IRE broke ground on the RECUMO facility to convert radioactive residues into low-enriched uranium and purify materials, a key R&D infrastructure step to support future large-scale isotope production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.