Global Medical Foam Market

Market Size in USD Billion

CAGR :

%

USD

32.33 Billion

USD

53.51 Billion

2024

2032

USD

32.33 Billion

USD

53.51 Billion

2024

2032

| 2025 –2032 | |

| USD 32.33 Billion | |

| USD 53.51 Billion | |

|

|

|

|

Medical Foam Market Size

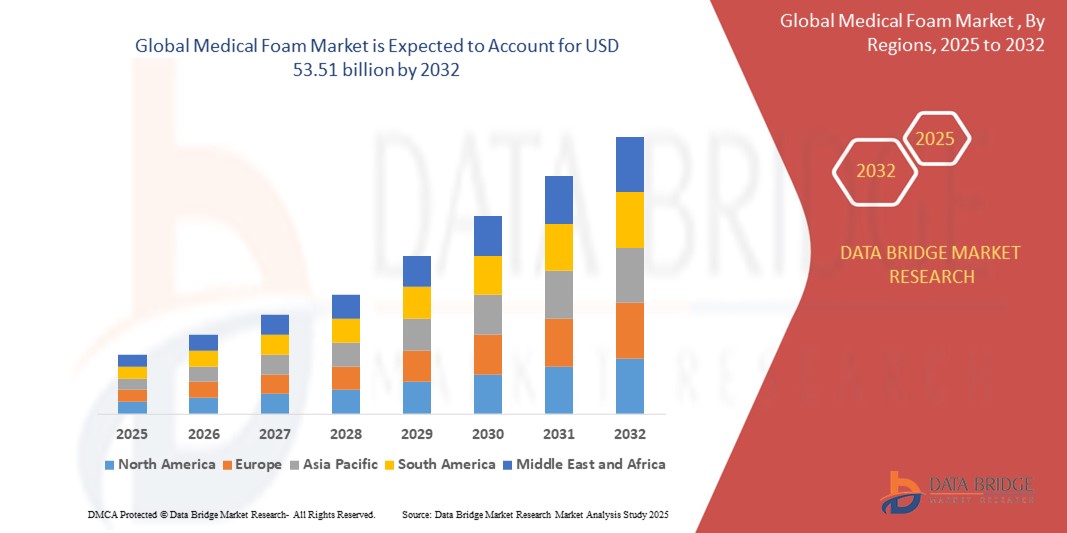

- The global medical foam market was valued at USD 32.33 Billion in 2024 and is expected to reach USD 53.51 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.50%, primarily driven by rising demand for advanced wound care solutions

- This growth is driven by growing healthcare expenditures and technological advancements in medical devices

Medical Foam Market Analysis

- The medical foam market is growing steadily, driven by their critical role in improving patient comfort, providing superior cushioning, and offering infection resistance in applications such as wound care, medical devices, surgical drapes, and bedding, with rising demand fueled by the expanding healthcare, medical packaging, and diagnostics sectors

- Major growth drivers include increasing healthcare expenditure, the growing aging population, rising incidence of chronic and lifestyle diseases, along with innovations in lightweight, antimicrobial, and sustainable foam materials aligned with global healthcare quality standards and regulations promoting patient safety

- Asia-Pacific dominates the market due to strong demand from countries such as China, India, and Japan, supported by advancements in healthcare infrastructure, rising medical tourism, government healthcare initiatives, and increased investments in local medical device manufacturing capabilities

- For instance, in 2023, Mölnlycke AB expanded its production facility in Malaysia, boosting its supply capacity for medical foam-based wound care products to meet the growing healthcare demands across Asia-Pacific’s developing economies

- Globally, the medical foam market is evolving toward sustainability and innovation, with trends such as bio-based foams, advanced antimicrobial technologies, and recyclable materials encouraging manufacturers to invest heavily in R&D, strategic partnerships, and facility expansions to capture emerging green and next-generation healthcare opportunities.

Report Scope and Medical Foam Market Segmentation

|

Attributes |

Medical Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Foam Market Trends

Rising Demand for Antimicrobial Medical Foams

- Growing concerns over hospital-acquired infections (HAIs) are boosting the demand for antimicrobial medical foams used in wound care, bedding, and surgical products to ensure better patient safety

- Healthcare facilities are increasingly adopting foam-based products with built-in antimicrobial properties to reduce infection risks and enhance hygiene standards

- Technological advancements are enabling the development of foams infused with silver ions, copper particles, and other antimicrobial agents offering long-lasting protection

For instance

- In January 2024, Mölnlycke Health Care launched a new antimicrobial foam dressing targeting wound care management

- In October 2023, Smith & Nephew introduced silver-embedded foam wound dressings to combat HAIs

- In August 2022, Rynel, Inc. developed biodegradable antimicrobial foams for surgical applications

- As healthcare safety standards rise globally, antimicrobial medical foams are poised to become standard across medical facilities, driving steady market growth

Medical Foam Market Dynamics

Driver

Growth of Home Healthcare and Point-of-Care Services

- The expanding elderly population and preference for at-home medical care are increasing demand for medical foam-based products such as cushions, orthopedic supports, and wearable devices

- Medical device manufacturers are designing foam solutions that combine comfort, breathability, and durability to meet the needs of at-home patients

- Home healthcare providers are increasingly investing in foam-based packaging and portable medical device foams to ensure safe and efficient patient care

For instance

- In February 2024, UFP Technologies, Inc. expanded its product line for home healthcare device components

- In May 2023, Freudenberg Performance Materials introduced new foam products specifically designed for wearable medical devices

- In September 2022, Zotefoams plc collaborated with a healthcare startup to develop patient-friendly foam supports

- As home healthcare services continue to grow, the demand for versatile and comfortable medical foam products will witness a significant rise

Opportunity

Advances in Sustainable and Biodegradable Medical Foams

- Rising environmental concerns are driving the need for sustainable and biodegradable medical foam alternatives used in medical packaging, orthotics, and wound care products

- Manufacturers are investing in the development of plant-based foams, recycled materials, and compostable solutions to align with global sustainability goals

- Healthcare companies are increasingly adopting eco-friendly foams to meet regulatory requirements and appeal to environmentally conscious consumers

For instance

- In March 2024, Rogers Corporation introduced a range of biodegradable medical foams for wound dressing applications

- In June 2023, Woodbridge launched plant-based polyurethane foams targeting healthcare furniture and bedding

- In November 2 022, Huntsman International LLC developed medical-grade foams using recycled content

- As sustainability becomes a top priority, companies offering green medical foam solutions will gain a competitive advantage in the evolving healthcare landscape

Restraint/Challenge

Stringent Regulatory Compliance and Approval Processes

For instance

- In April 2024, Allied Foam Fabricators, LLC faced regulatory delays for a new range of medical cushioning foams

- Navigating stringent regulatory frameworks remains a significant hurdle, pushing manufacturers to prioritize quality assurance and invest in regulatory expertise early in product development

Medical Foam Market Scope

The market is segmented on the basis of form, material type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Material Type |

|

|

By Application

|

|

|

By End User

|

|

Medical Foam Market Regional Analysis

Asia-Pacific is the Dominant Region in the Medical Foam Market

- Asia-Pacific is experiencing strong demand for polyurethane-based medical foams due to the rapid expansion of healthcare and medical device industries

- Countries such as China, India, and Japan are witnessing increased manufacturing capabilities and technological advancements in medical materials

- Rising healthcare spending and government initiatives to improve medical facilities are fueling the demand for medical foams across the region

- Driven by robust industrial growth and healthcare advancements, Asia-Pacific is positioned as the dominant region in the global medical foam market

North America is projected to register the Highest Growth Rate

- The medical foam market in North America is benefiting from increasing demand for advanced healthcare solutions and medical devices

- Growing investments in healthcare infrastructure and technological innovations are supporting the rapid expansion of medical foam applications

- Supportive government initiatives and a strong presence of leading medical device manufacturers are further boosting market growth across the region

- As a result of these factors, North America is projected to register the highest growth rate in the global medical foam market

Medical Foam Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- American Excelsior Company (U.S.)

- American Foam Products (U.S.)

- Heubach GmbH (U.S.)

- General Plastics Manufacturing Company (U.S.)

- LEXTECH GLOBAL SERVICES (U.S.)

- UFP Technologies, Inc. (U.S.)

- FXI (U.S.)

- Rogers Corporation (U.S.)

- Dow (U.S.)

- Huntsman International LLC (U.S.)

- 3M (U.S.)

- Allied Foam Fabricators, LLC (U.S.)

- Rempac Foam, LLC (U.S.)

- VPC Group (Canada)

- Woodbridge (Canada)

- Freudenberg Performance Materials (Germany)

- Avon Group Manufacturing Ltd (U.K.)

- Trelleborg AB (Sweden)

- Mölnlycke AB (Sweden)

- Carpenter Engineered Foams (Belgium)

Latest Developments in Global Medical Foam Market

- In December 2023, Roflumilast topical foam 0.3% received approval from the U.S. Food & Drug Administration (FDA) for treating Seborrheic Dermatitis in patients aged nine years and older, further strengthening advancements in dermatological foam therapies

- In September 2023, Tristel sought regulatory certification for its Tristel ULT disinfection foam, with Parker Laboratories, Tristel’s North American partner, responsible for manufacturing, marking a significant step toward expanding disinfection solutions in healthcare

- In May 2023, Probo Medical successfully acquired the MRI coil repair operation from Creative Foam, enabling in-house complex MRI coil repairs and enhancing customer satisfaction and operational efficiency in diagnostic imaging

- In January 2023, Convatec launched ConvaFoam, an innovative foam dressing designed for versatile wound management and skin protection, simplifying clinical applications across various stages of the healing process

- In March 2022, Foamtec Medical introduced BactiBlock Antimicrobial Foam, a medical-grade foam infused with antimicrobial agents, providing a solution to reduce infection risks in healthcare environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medical Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medical Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medical Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.