Global Medical Foods Market

Market Size in USD Billion

CAGR :

%

USD

24.83 Billion

USD

38.70 Billion

2024

2032

USD

24.83 Billion

USD

38.70 Billion

2024

2032

| 2025 –2032 | |

| USD 24.83 Billion | |

| USD 38.70 Billion | |

|

|

|

|

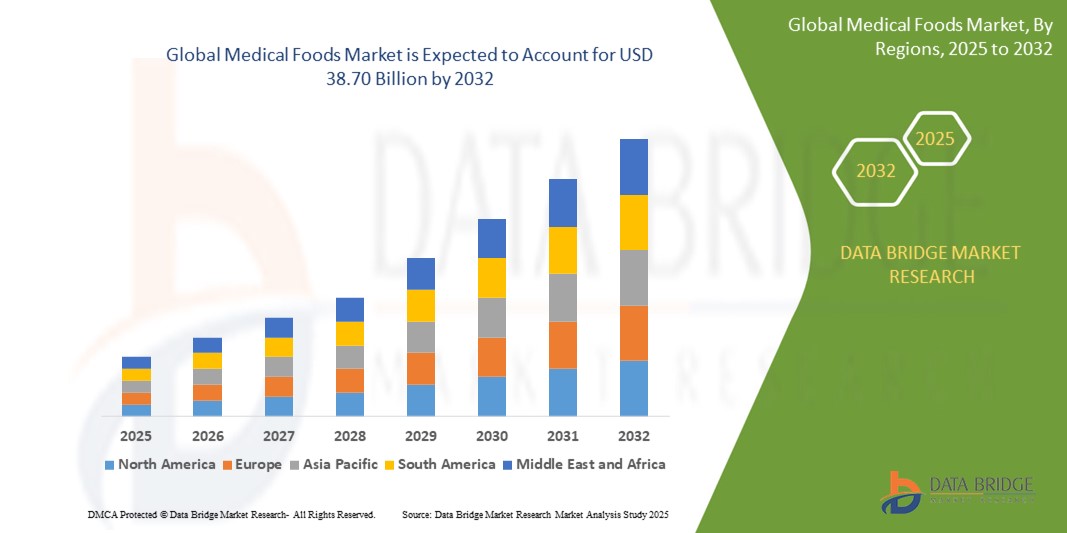

What is the Global Medical Foods Market Size and Growth Rate?

- The global medical foods market size was valued at USD 24.83 billion in 2024 and is expected to reach USD 38.70 billion by 2032, at a CAGR of 5.70% during the forecast period

- The medical foods market is experiencing robust growth driven by an increasing prevalence of chronic diseases and metabolic disorders, as well as a growing awareness of the role of tailored nutrition in managing health conditions

- The market is characterized by a rising demand for specialized nutritional products designed to meet the specific dietary needs of patients with conditions such as diabetes, phenylketonuria (PKU), and gastrointestinal diseases. Advances in medical research and the development of innovative formulations are contributing to the expansion of this market

- The market is also witnessing a shift towards personalized nutrition, with companies focusing on developing products tailored to specific genetic profiles or health conditions. This trend is expected to enhance market growth, as personalized medical foods offer targeted solutions for managing complex health issues

What are the Major Takeaways of Medical Foods Market?

- Increased awareness of the importance of dietary management and nutrition in treating and preventing diseases is a major driver of the medical foods market. Both consumers and healthcare professionals are increasingly acknowledging that nutrition plays a critical role in maintaining overall health and in managing specific medical conditions. This heightened awareness has resulted in a greater emphasis on incorporating medical foods into comprehensive treatment plans to address nutritional deficiencies and enhance health outcomes

- As individuals become more educated about the advantages of customized nutritional interventions, the demand for medical foods that cater to these needs is rising. This trend towards preventive and supportive dietary approaches highlights the growing significance of medical foods in contemporary healthcare

- North America dominated the medical foods market with the largest revenue share of 38.2% in 2024, fueled by growing demand for condition-specific nutrition solutions and a high prevalence of chronic diseases such as diabetes, cancer, and Alzheimer’s

- Asia-Pacific is expected to grow at the fastest CAGR of 12.89% from 2025 to 2032, driven by rising health awareness, a growing elderly population, and an uptick in chronic disease prevalence across major economies

- The Nutritionally Complete Formulas segment dominated the market with the largest revenue share of 46.5% in 2024, owing to their widespread use in the dietary management of chronic diseases such as Alzheimer’s, diabetes, and cancer

Report Scope and Medical Foods Market Segmentation

|

Attributes |

Medical Foods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Medical Foods Market?

“Personalized Nutrition and Cognitive Health Drive Innovation in Medical Foods”

- A dominant trend in the medical foods market is the increasing focus on personalized nutrition, particularly targeting conditions such as Alzheimer’s, diabetes, and chronic inflammation. Medical foods are evolving beyond general health support to offer condition-specific formulations that cater to unique metabolic requirements

- For instance, Cerecin Inc. is developing brain-targeted medical foods using medium-chain triglycerides (MCTs) to manage early Alzheimer’s symptoms by improving ketone metabolism in the brain

- Innovations in nutrigenomics and gut microbiome research are enabling tailored dietary solutions that improve treatment outcomes and patient compliance. Companies are leveraging clinical insights to design medical foods that support cognitive performance, muscle recovery, and metabolic health

- In addition, there’s a surge in clean-label, sugar-free, and gluten-free formulations, reflecting growing demand for digestive-friendly and allergen-free options across all age groups

- Brands such as Nestlé Health Science and Danone Nutricia are investing heavily in AI-driven R&D to develop medical foods that integrate seamlessly with patient-centric care plans and digital health platforms

- This trend is transforming the market from a niche clinical category to a mainstream preventive healthcare solution, expanding its reach across hospitals, long-term care centers, and at-home patients

What are the Key Drivers of Medical Foods Market?

- The global rise in chronic diseases such as cancer, diabetes, and neurological disorders is significantly boosting demand for clinical nutrition therapies, particularly those administered through medical foods

- For instance, in January 2025, Abbott introduced a therapeutic drink under its Glucerna line targeting diabetes management with a low glycemic index and specialized slow-release carbohydrates

- An aging population, increased post-operative care, and the growing popularity of home-based nutritional therapy are supporting adoption among geriatric and immunocompromised patients

- In addition, regulatory support from bodies such as the U.S. FDA and EFSA has improved clarity on product classification and claims, encouraging new entrants and innovation

- The COVID-19 pandemic further accelerated awareness about immunity and recovery nutrition, catalyzing hospital procurement and physician-recommended use of disease-specific formulations

- Technological advancements in nutritional diagnostics and metabolomics are empowering manufacturers to offer evidence-backed formulations, driving trust among healthcare providers and consumers asuch as

Which Factor is challenging the Growth of the Medical Foods Market?

- A significant challenge lies in the strict regulatory landscape, where medical foods must meet stringent clinical trial, labeling, and compliance standards, differing widely across regions

- For instance, in 2024, Reckitt Benckiser Group PLC delayed a U.K. launch of a metabolic disorder formulation due to complex EFSA compliance hurdles related to disease-specific claims

- Limited consumer awareness and confusion between medical foods, dietary supplements, and functional foods also pose barriers, affecting retail visibility and prescription rates

- High development costs due to clinical evidence requirements, combined with challenges in palatability and shelf stability, make commercialization difficult for smaller companies

- In addition, reimbursement constraints in many countries limit accessibility, especially for patients in low- and middle-income economies, where out-of-pocket expenses are high

- Overcoming these challenges requires cross-sector collaboration between nutrition companies, healthcare systems, and regulatory bodies to streamline approvals and improve education among physicians and patients

How is the Medical Foods Market Segmented?

The market is segmented on the basis of source, type, function, and application.

- By Product Type

On the basis of product type, the medical foods market is segmented into Nutritionally Complete Formulas, Nutritionally Incomplete Formulas, and Oral Rehydration Products. The Nutritionally Complete Formulas segment dominated the market with the largest revenue share of 46.5% in 2024, owing to their widespread use in the dietary management of chronic diseases such as Alzheimer’s, diabetes, and cancer. These formulas provide all essential nutrients and are typically used under medical supervision, making them a preferred choice in clinical settings.

The Oral Rehydration Products segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing incidences of gastrointestinal disorders, dehydration in elderly populations, and rising demand for rapid hydration solutions in sports and emergency care.

- By Application

On the basis of application, the medical foods market is segmented into ADHD, Depression, Diabetes, Cancer, Alzheimer's Disease, Metabolic Disorders, and Others. The Diabetes segment held the largest market revenue share of 28.9% in 2024, due to the rising global prevalence of diabetes and the growing adoption of specialized nutritional therapies to support glycemic control and reduce disease complications.

The Alzheimer’s Disease segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing elderly population, growing awareness of neurodegenerative disorders, and the development of targeted nutritional interventions to support cognitive health.

- By Form

On the basis of form, the market is segmented into Powders, Liquid, Capsules, Tablets, and Bars. The Powders segment dominated the market with the largest revenue share of 33.7% in 2024, owing to their longer shelf life, ease of transport, and flexibility in dosage customization. Powders are widely used in both hospital and home care settings for patients with dysphagia or specialized nutritional needs.

The Bars segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by rising demand for on-the-go, condition-specific nutrition solutions and growing interest in convenient, clean-label functional snacks among the health-conscious population

- By Distribution Channel

On the basis of distribution channel, the medical foods market is segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Drug Stores, and Supermarkets. The Hospital Pharmacies segment accounted for the largest revenue share of 39.2% in 2024, primarily due to the clinical nature of Medical Foods and their prescription-based usage for chronic disease management and post-operative recovery.

The Online Pharmacies segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising digital healthcare adoption, increasing consumer preference for home delivery of specialized nutrition, and broader product availability through e-commerce platforms.

Which Region Holds the Largest Share of the Medical Foods Market?

- North America dominated the medical foods market with the largest revenue share of 38.2% in 2024, fueled by growing demand for condition-specific nutrition solutions and a high prevalence of chronic diseases such as diabetes, cancer, and Alzheimer’s. The region benefits from strong clinical infrastructure and supportive reimbursement policies that encourage the use of medical foods in healthcare settings

- The U.S. accounts for the majority of the North American market share, owing to its robust presence of key manufacturers, advanced R&D capabilities, and a rising number of FDA-approved medical foods tailored for therapeutic needs

- The region’s aging population and proactive adoption of personalized nutrition further drive consumption across hospitals, pharmacies, and online platforms, with consumers showing a strong preference for liquid and powder-based formulations designed for ease of digestion and absorption

U.S. Medical Foods Market Insight

The U.S. held a dominant position in North America’s medical foods market in 2024, driven by its mature healthcare system and high disease awareness among consumers. Key players such as Abbott, Nestlé, and Danone are actively launching clinical nutrition products backed by strong scientific validation. Increasing insurance coverage for therapeutic nutrition and regulatory clarity under the Orphan Drug Act are also encouraging physicians to prescribe medical foods more frequently.

Canada Medical Foods Market Insight

Canada is experiencing steady market growth, supported by rising demand for nutritionally complete formulas for cancer care, metabolic disorders, and pediatric nutrition. Government-supported health programs and expanding geriatric demographics are boosting demand for medical foods in long-term care facilities. In addition, Canadian consumers are increasingly favoring clean-label formulations with minimal additives and high bioavailability.

Which Region is the Fastest Growing in the Medical Foods Market?

Asia-Pacific is expected to grow at the fastest CAGR of 12.89% from 2025 to 2032, driven by rising health awareness, a growing elderly population, and an uptick in chronic disease prevalence across major economies. Rapid urbanization and the rise of middle-income populations in China, India, and Southeast Asia are accelerating demand for therapeutic nutrition products. The region's diverse dietary requirements, including vegetarian, halal, and kosher preferences, are also pushing manufacturers to innovate allergen-free, plant-based medical foods for broad market appeal. Government initiatives supporting elderly care nutrition and increased penetration of e-commerce platforms are expanding consumer access, particularly in urban and semi-urban areas.

China Medical Foods Market Insight

China accounted for the largest share in the Asia-Pacific medical foods market in 2024, supported by its booming healthcare sector and growing emphasis on preventive nutrition. The government's push for “Healthy China 2030” and an expanding middle class are driving demand for disease-specific formulas. Local players and multinational companies are investing in product development and strategic collaborations to meet the country’s evolving dietary needs.

Japan Medical Foods Market Insight

Japan continues to exhibit strong growth due to its aging demographic and high healthcare expenditure. Medical Foods targeting dementia, Alzheimer’s, and metabolic disorders are gaining significant traction. Consumer trust in pharmaceutical-grade nutrition and a cultural emphasis on longevity and wellness are encouraging the integration of Medical Foods into both hospital settings and mainstream retail channels. Innovative formats such as ready-to-drink formulas and nutrient-dense capsules are witnessing rising adoption.

Which are the Top Companies in Medical Foods Market?

The medical foods industry is primarily led by well-established companies, including:

- Danone S.A. (France)

- Nestlé (Switzerland)

- Abbott (U.S.)

- Primus Pharmaceuticals, Inc. (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Medtrition, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Meiji Holdings Co., Ltd. (Japan)

- Reckitt Benckiser Group PLC (U.K.)

- Cerecin Inc. (U.S.)

- Metagenics (U.S.)

- ENTERA HEALTHCARE (U.S.)

- Bausch Health Companies Inc. (Canada)

- Upsher-Smith Laboratories, LLC (U.S.)

What are the Recent Developments in Global Medical Foods Market?

- In November 2023, Danone introduced its first adult medical nutrition product, Fortimel, in China under the "foods for special medical purposes" category. This launch is a key part of Danone’s strategy to expand its scientific, life-stage-based product portfolio and establish a strong foothold in the adult medical nutrition segment in China. This initiative reflects Danone’s growing focus on addressing adult nutritional needs in high-potential markets

- In September 2023, Danone announced a USD 53.78 million expansion of its Opole production facility in Poland to support rising global demand for medical nutrition solutions. This investment aims to strengthen the company’s role in the adult nutrition sector amid growing rates of chronic illnesses and aging populations worldwide. The move is expected to boost Danone’s global supply capabilities and improve patient accessibility to clinical nutrition

- In March 2023, Danone acquired ProMedica, a Poland-based company specializing in at-home patient care services, as part of its effort to grow its specialized nutrition business in Central Europe. This strategic acquisition aims to expand Danone’s influence in therapeutic care and personalized nutrition. It underscores Danone’s intent to offer more integrated and localized healthcare nutrition services

- In February 2023, Nestlé entered into a research partnership with EraCal Therapeutics to explore and develop new nutraceuticals focused on regulating food intake. The collaboration aims to advance innovation in personalized nutrition and support better appetite control strategies. This partnership highlights Nestlé’s commitment to scientific exploration in the field of metabolic health and nutritional science

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medical Foods Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medical Foods Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medical Foods Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.