Global Medical Marijuana Market

Market Size in USD Billion

CAGR :

%

USD

33.05 Billion

USD

123.47 Billion

2024

2032

USD

33.05 Billion

USD

123.47 Billion

2024

2032

| 2025 –2032 | |

| USD 33.05 Billion | |

| USD 123.47 Billion | |

|

|

|

|

Medical Marijuana Market Size

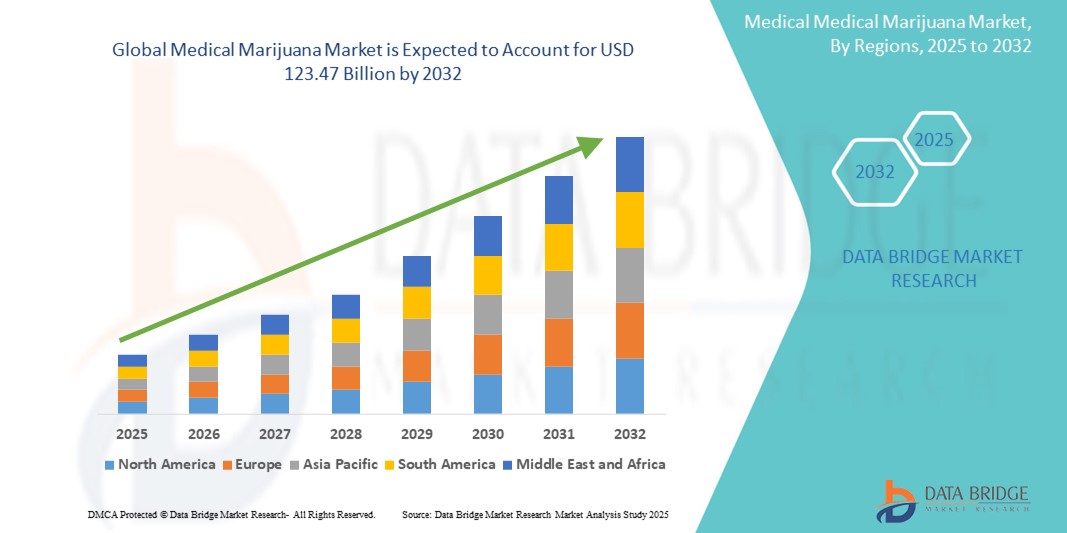

- The global medical marijuana market size was valued at USD 33.05 billion in 2024 and is expected to reach USD 123.47 billion by 2032, at a CAGR of 17.91% during the forecast period

- The market growth is largely fueled by the increasing legalization and acceptance of cannabis for therapeutic use across various countries, alongside a growing body of clinical evidence supporting its efficacy in managing chronic conditions such as pain, cancer, epilepsy, and multiple sclerosis

- Furthermore, rising patient awareness, evolving regulatory frameworks, and the expansion of medical cannabis product offerings are driving widespread adoption. These converging factors are accelerating the integration of medical marijuana into mainstream healthcare, thereby significantly boosting the industry’s growth

Medical Marijuana Market Analysis

- Medical marijuana, comprising cannabis-based products used to treat specific medical conditions, is increasingly becoming a vital component of chronic disease management due to its therapeutic potential, particularly in pain relief, appetite stimulation, and symptom control for cancer, epilepsy, and multiple sclerosis

- The escalating demand for medical marijuana is primarily fueled by the rising prevalence of chronic and neurological disorders, growing clinical acceptance, and ongoing legislative reforms that are broadening patient access across various global markets

- North America dominated the medical marijuana market with the largest revenue share of 49.2% in 2024, characterized by well-established legal frameworks in the U.S. and Canada, strong R&D investment, and increasing physician adoption of cannabis-based therapies, particularly within oncology and palliative care settings

- Europe is expected to be the fastest growing region in the medical marijuana market during the forecast period due to progressive regulatory changes, expanding patient registries, and increasing domestic cultivation initiatives

- The oil segment dominated the medical marijuana market with a market share of 40% in 2024, driven by its high patient preference for precise dosing, ease of administration, and rapid onset of therapeutic effects

Report Scope and Medical Marijuana Market Segmentation

|

Attributes |

Medical Marijuana Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Marijuana Market Trends

“Rising Therapeutic Applications and Product Innovation”

- A significant and accelerating trend in the global medical marijuana market is the broadening of therapeutic applications supported by a growing body of clinical research and increasing physician acceptance. This expansion is fueling product innovation and the development of targeted cannabis-based treatments for a variety of conditions, including chronic pain, epilepsy, cancer-related symptoms, and mental health disorders

- For instance, GW Pharmaceuticals' Epidiolex, a cannabidiol-based treatment approved for severe childhood epilepsy, has paved the way for further pharmaceutical-grade cannabis development. Similarly, Tilray and Aurora Cannabis have introduced a wide array of medical cannabis formats—such as oils, capsules, and edibles—tailored to different patient needs and conditions

- Innovations in drug delivery methods are improving patient outcomes and enhancing convenience. Advances such as metered-dose inhalers, transdermal patches, and nanoemulsion formulations are making cannabis administration more efficient, predictable, and accessible for patients with varying therapeutic requirements

- The diversification of product offerings is also helping physicians tailor treatments to specific patient profiles, further legitimizing cannabis as a medical option. Companies such as Canopy Growth and Curaleaf are investing heavily in R&D to support evidence-based cannabis therapies and are working to meet stringent pharmaceutical and regulatory standards

- This trend towards precision medicine and evidence-backed cannabis therapeutics is transforming public perception and professional acceptance. As governments and medical communities increasingly recognize cannabis’ medical potential, the market is poised for deeper integration into conventional healthcare

- The demand for innovative, standardized, and condition-specific cannabis products is growing rapidly, with medical professionals and patients asuch as seeking safer and more effective alternatives to traditional pharmacological treatments

Medical Marijuana Market Dynamics

Driver

“Legalization Wave and Rising Chronic Disease Burden”

- The global shift toward the legalization of cannabis for medical use, paired with the rising burden of chronic diseases, is a major driver of growth in the medical marijuana market

- For instance, in 2024, Germany legalized cannabis for medical and limited recreational use, expanding access for patients and encouraging cultivation and investment. Similar policy changes in countries such as Australia, Thailand, and multiple U.S. states have opened new avenues for patient care and product availability

- As chronic conditions such as cancer, arthritis, neurological disorders, and mental health issues increase globally, patients and healthcare providers are turning to medical marijuana as a complementary or alternative treatment. Its analgesic, anti-inflammatory, and neuroprotective properties make it a viable option for long-term symptom management

- Moreover, increased public awareness, physician education programs, and the destigmatization of cannabis are promoting market adoption. Governments and private organizations are also funding research to support product development and clinical efficacy, further driving growth

- The availability of a broad range of consumption formats—from oils and capsules to sprays and edibles—enhances patient choice and compliance, helping medical marijuana gain traction in mainstream healthcare

Restraint/Challenge

“Regulatory Inconsistencies and Limited Clinical Evidence”

- Despite the global momentum toward legalization, regulatory inconsistencies across countries and within regions pose a significant barrier to market expansion. Differing laws regarding cultivation, distribution, and prescription of medical cannabis can delay product approvals and create market fragmentation

- For instance, while medical cannabis is federally legalized in countries such as Canada and Germany, it remains highly restricted or prohibited in several Asian and Middle Eastern nations, limiting global scalability for manufacturers

- In addition, the limited availability of large-scale clinical trials and standardized dosing guidelines continues to hinder wider physician adoption. Medical practitioners may hesitate to prescribe cannabis due to insufficient data on long-term effects, drug interactions, and optimal therapeutic protocols

- Quality control issues—stemming from variability in cannabinoid content, cultivation practices, and product labeling—also pose challenges for regulatory compliance and patient safety. Ensuring pharmaceutical-grade production standards is critical to address this gap

- Overcoming these challenges will require unified global frameworks, increased investment in clinical research, and efforts to ensure consistency and transparency in product manufacturing and labeling. Establishing cannabis as a scientifically validated treatment option will be essential for its full integration into formal healthcare systems

Medical Marijuana Market Scope

The market is segmented on the basis of form, product type, active ingredient, type, application, route of administration, and distribution channel.

- By Foam

On the basis of form, the medical marijuana market is segmented into solid, gas, and dissolvable/powders. The solid segment dominated the market with the largest market revenue share in 2024, driven by its widespread use in traditional formats such as dried flower and edibles. Solid forms offer ease of handling, standardization, and longer shelf life, making them the most widely adopted form for both patients and healthcare providers.

The dissolvable/powders segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for water-soluble cannabis formulations that offer rapid onset of action, precise dosing, and easy integration into beverages and food items.

- By Product Type

On the basis of product type, the medical marijuana market is segmented into buds, oils, tinctures, and others. The oils segment dominated the market with the largest market revenue share of 40%, in 2024, owing to its precise dosing capabilities, discreet usage, and high therapeutic acceptance among physicians for chronic disease treatment. Cannabis oils are preferred in clinical environments for their controlled concentration and versatility in administration.

The tinctures segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for sublingual products that offer fast absorption, convenience, and adaptability across different patient populations, especially in pediatric and geriatric care.

- By Active Ingredient

On the basis of active ingredient, the medical marijuana market is segmented into Tetrahydrocannabinol (THC) and Cannabidiol (CBD). The Tetrahydrocannabinol (THC) segment dominated the market with the largest market revenue share in 2024, supported by its effectiveness in treating chronic pain, appetite loss, and nausea—particularly in oncology and palliative care.

The Cannabidiol (CBD) segment is expected to witness the fastest CAGR from 2025 to 2032, due to its non-psychoactive nature, expanding legalization across countries, and proven benefits in treating epilepsy, anxiety, and inflammation without the intoxicating effects associated with THC.

- By Type

On the basis of type, the medical marijuana market is segmented into flowers, concentrates, edibles, and others. The flowers segment held the largest market revenue share in 2024, attributed to its wide patient familiarity, affordability, and immediate therapeutic effects through inhalation.

The edibles segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by consumer preference for smoke-free alternatives and advancements in edible product formulation that ensure consistent dosing and prolonged relief for chronic symptoms.

- By Application

On the basis of application, the medical marijuana market is segmented into chronic pain, arthritis, cancer, neurology, oncology, and others. The chronic pain segment dominated the market with the largest market revenue share in 2024, driven by the global rise in musculoskeletal disorders and increasing preference for cannabis as a safer alternative to opioids.

The neurology segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by growing clinical research on the effectiveness of cannabis in treating neurological disorders such as epilepsy, multiple sclerosis, and Parkinson’s disease.

- By Route Of Administration

On the basis of route of administration, the medical marijuana market is segmented into inhalation, oral, and topical. The inhalation segment dominated the market with the largest market revenue share in 2024, driven by its rapid onset of action and high bioavailability, commonly utilized through vaporizers and traditional smoking.

The oral segment is projected to witness the fastest CAGR from 2025 to 2032, due to increasing demand for user-friendly cannabis formats such as capsules, oils, and edibles, offering sustained effects and suitability for long-term therapeutic use.

- By Distribution Channel

On the basis of distribution channel, the medical marijuana market is segmented into retail and pharmacy stores and online platforms. The retail and pharmacy stores segment accounted for the largest market revenue share in 2024, supported by regulated access to prescription cannabis and the growing number of licensed dispensaries across major markets.

The online platforms segment is expected to grow at the fastest rate from 2025 to 2032, driven by increasing digital adoption, convenience of home delivery, and expansion of e-commerce capabilities in regions with progressive medical cannabis legislation.

Medical Marijuana Market Regional Analysis

- North America dominated the medical marijuana market with the largest revenue share of 49.2% in 2024, characterized by well-established legal frameworks in the U.S. and Canada, strong R&D investment, and increasing physician adoption of cannabis-based therapies, particularly within oncology and palliative care settings

- Consumers in the region increasingly recognize the therapeutic value of medical marijuana, especially for chronic pain, epilepsy, and cancer-related symptoms, contributing to widespread adoption across varied demographics

- This strong market presence is further supported by favorable regulatory frameworks, expanding insurance coverage, physician awareness, and continued investment in research and product innovation, solidifying North America’s leadership in the global medical marijuana landscape

U.S. Medical Marijuana Market Insight

The U.S. medical marijuana market captured the largest revenue share of 83% in 2024 within North America, driven by widespread legalization across multiple states and growing clinical acceptance of cannabis-based therapies. Consumers are increasingly turning to medical marijuana for chronic pain, anxiety, and neurological disorders, supported by a well-developed dispensary infrastructure and physician networks. Advancements in product offerings, ranging from oils to edibles, and integration with health and wellness trends further boost adoption. Continued federal discussions around legalization are expected to accelerate market expansion.

Europe Medical Marijuana Market Insight

The Europe medical marijuana market is projected to expand at a substantial CAGR throughout the forecast period, primarily due to progressive regulatory changes and rising demand for alternative therapies in pain and oncology management. The region is witnessing growing medical cannabis use across countries such as Germany, Italy, and the U.K., driven by government-backed health programs and increasing physician education. A well-established pharmaceutical landscape and domestic cultivation initiatives are also supporting market growth across the continent.

U.K. Medical Marijuana Market Insight

The U.K. medical marijuana market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by easing regulatory frameworks and a surge in public demand for cannabis-based treatments. Increasing prescriptions for epilepsy, multiple sclerosis, and chronic pain are shaping the market landscape. Efforts by domestic firms to partner with the NHS and import licensed cannabis products have accelerated access and patient enrollment in medical marijuana programs, paving the way for sustained market growth.

Germany Medical Marijuana Market Insight

The Germany medical marijuana market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s status as Europe’s largest medical cannabis market. Government reimbursement programs, a regulated supply chain, and a growing number of certified physicians prescribing cannabis treatments are propelling the market. The country’s strong focus on pharmaceutical-grade quality, local cultivation, and healthcare system integration makes Germany a central hub for medical marijuana growth in Europe.

France Medical Marijuana Market Insight

The France medical marijuana market is projected to grow steadily during the forecast period, supported by ongoing government-led pilot programs and increasing acceptance among healthcare professionals. The country launched a two-year medical cannabis trial involving thousands of patients in 2021, which has laid the groundwork for broader legalization and structured cannabis distribution. France’s robust pharmaceutical industry, combined with growing public and clinical interest in cannabis-based therapies for pain, cancer, and neurological disorders, is driving demand. As the regulatory framework evolves, France is expected to emerge as a significant player in the European medical marijuana landscape.

Medical Marijuana Market Share

The medical marijuana industry is primarily led by well-established companies, including:

- Canopy Growth Corporation (Canada)

- Cannabis Sativa, Inc. (U.S.)

- Jazz Pharmaceuticals, Inc. (U.K.)

- Emerald Health Therapeutics Inc. (Canada)

- Tilray (Canada)

- Aurora Cannabis (Canada)

- Cara Therapeutics, Inc. (U.S.)

- Medical Marijuana, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- GB Sciences, Inc. (U.S.)

- MediPharm Labs Corp. (Canada)

- MedReleaf Australia (Australia)

- Green Relief Inc. (Canada)

- Peace Naturals Project Inc. (Canada)

- VIVO Cannabis Inc. (Canada)

- The Cronos Group (Canada)

- United Cannabis (U.S.)

What are the Recent Developments in Global Medical Marijuana Market?

- In April 2023, Tilray Brands, Inc., a leading global cannabis-lifestyle and consumer packaged goods company, expanded its European footprint by launching medical cannabis products in the Czech Republic. This strategic move is part of Tilray’s broader initiative to strengthen its presence across Europe by leveraging local partnerships and meeting the growing demand for pharmaceutical-grade cannabis, especially in pain and neurology management

- In March 2023, Aurora Cannabis Inc. announced the successful completion of its first shipment of medical cannabis to Australia under its supply agreement with MedReleaf Australia. This milestone signifies Aurora’s growing influence in the Asia-Pacific region and reinforces its role as a key supplier of high-quality cannabis to emerging regulated markets, supporting patients with chronic pain and other medical conditions

- In March 2023, Curaleaf Holdings, Inc. launched a new line of precision-dosed THC and CBD capsules under its medical division in the U.S. market. These products are formulated to provide patients with consistent and controlled dosing for managing conditions such as anxiety, arthritis, and insomnia. This development emphasizes Curaleaf’s commitment to clinical precision and expanding access to alternative therapies

- In February 2023, Canopy Growth Corporation announced a strategic shift to focus more heavily on its medical marijuana operations, including the expansion of its German subsidiary, C³ Cannabinoid Compound Company. This move aligns with Germany’s progressive regulatory environment and growing patient base, supporting Canopy’s goal of establishing leadership in the European medical cannabis market

- In January 2023, Jazz Pharmaceuticals plc, the parent company of GW Pharmaceuticals, initiated a new phase of research into expanded indications for Epidiolex, its FDA-approved CBD-based treatment for severe forms of epilepsy. This advancement highlights continued efforts to broaden the therapeutic scope of medical cannabis and reinforce its clinical credibility across new neurological applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.