Global Medical Cannabis Market

Market Size in USD Billion

CAGR :

%

USD

25.86 Billion

USD

133.73 Billion

2024

2032

USD

25.86 Billion

USD

133.73 Billion

2024

2032

| 2025 –2032 | |

| USD 25.86 Billion | |

| USD 133.73 Billion | |

|

|

|

|

Medical Cannabis Market Size

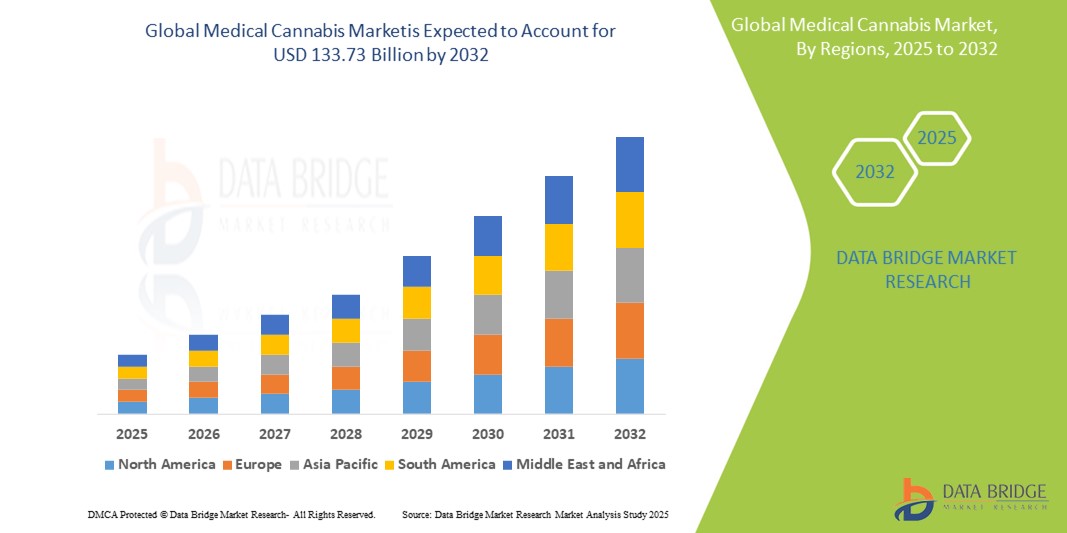

- The global medical cannabis market was valued at USD 25.86 billion in 2024 and is expected to reach USD 133.73 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 22.80%, primarily driven by increasing acceptance of cannabis for therapeutic purposes

- This growth is driven by rising prevalence of chronic conditions such as cancer, arthritis, and neurological disorders and the growing number of countries legalizing medical cannabis

Medical Cannabis Market Analysis

- Medical cannabis has gained significant importance in the healthcare sector due to its rapid adoption for managing chronic pain, neurological disorders, cancer-related symptoms, and mental health conditions. The market is witnessing strong clinical research momentum, with improvements in cannabinoid formulations, delivery methods, and regulatory frameworks boosting patient access and therapeutic outcomes

- The market is primarily driven by the growing acceptance of cannabis for medical use, increasing legalization across major countries, rising demand for alternative treatment options, and the expanding elderly population suffering from chronic illnesses. In addition, technological advancements in cannabis extraction methods, formulation development, and pharmaceutical-grade product innovations are further accelerating the growth of the medical cannabis treatment landscape

- For instance, in the U.S. and Canada, the expansion of medical cannabis programs, the approval of cannabis-based pharmaceuticals such as Epidiolex, and the introduction of GMP-certified cannabis cultivation facilities have significantly enhanced patient accessibility and confidence, driving overall market growth

- Globally, the medical cannabis market is steadily advancing with the integration of AI-based clinical trials, personalized cannabinoid therapy, and growing investment from pharmaceutical giants, ensuring continuous innovation, broader therapeutic adoption, and long-term market sustainability

Report Scope and Medical Cannabis Market Segmentation

|

Attributes |

Medical Cannabis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Cannabis Market Trends

Expansion of Pharmaceutical-Grade Medical Cannabis Products

- Pharmaceutical companies are increasingly developing standardized, high-purity medical cannabis formulations such as oils, capsules, and sublingual sprays to meet regulatory standards and ensure patient safety

- Growing investments in clinical trials for cannabis-based therapeutics targeting conditions such as epilepsy, multiple sclerosis, and chronic pain are elevating the medical credibility of cannabis products

- The introduction of prescription-only cannabis medications is improving physician confidence and driving higher patient adoption rates in regulated markets

For instance,

- In February 2025, Tilray Brands, Inc. launched a new pharmaceutical-grade CBD oil targeting neurological disorders in Europe

- In November 2024, GW Pharmaceuticals expanded clinical trials for Epidiolex in new therapeutic areas including autism spectrum disorders

- In October 2024, Aurora Cannabis Inc. introduced a GMP-certified medical cannabis capsule line in Canada

- As pharmaceutical-grade products gain traction, the medical cannabis market will see enhanced legitimacy, broader healthcare integration, and stronger patient adherence

Medical Cannabis Market Dynamics

Driver

Rising Legalization and Favorable Regulatory Changes

- Increasing legalization of medical cannabis across North America, Europe, and parts of Asia-Pacific is significantly expanding patient access and encouraging market growth

- Streamlined regulatory frameworks are facilitating faster product approvals, boosting innovation and commercialization of new cannabis therapies

- Health insurance coverage for certain cannabis treatments is improving in progressive regions, making therapies more affordable for patients

For instance,

- In March 2025, Germany passed a law to legalize medical cannabis reimbursements under public health insurance schemes

- In January 2025, Australia eased import regulations to allow faster access to medical cannabis for approved patients

- In October 2024, Thailand expanded its medical cannabis program by allowing private clinics to prescribe cannabis therapies

- As regulatory environments become more supportive, the global medical cannabis market is poised for rapid and sustained expansion

Opportunity

Emergence of Novel Delivery Systems for Enhanced Bioavailability

- Innovations such as nanoemulsions, transdermal patches, and inhalable formulations are improving the bioavailability and onset time of medical cannabis products.

- Research efforts are focusing on optimizing cannabinoid delivery to target sites within the body, reducing side effects and maximizing therapeutic outcomes.

- Companies are launching patient-friendly formats such as dissolvable strips and metered-dose inhalers to cater to diverse medical needs

For instance,

- In March 2025, MediPharm Labs introduced a nanoemulsion-based cannabis oral spray to improve absorption rates

- In December 2024, Canopy Growth Corporation unveiled a transdermal patch designed for chronic pain management

- In September 2024, Elixinol Wellness Limited launched an innovative water-soluble CBD powder targeting the wellness market

- As novel delivery technologies advance, they will unlock new therapeutic potential for medical cannabis, attracting a broader patient base and enhancing treatment outcomes

Restraint/Challenge

Limited Clinical Evidence and Physician Reluctance

- Despite growing usage, there remains a lack of large-scale, long-term clinical studies validating the efficacy and safety of many medical cannabis treatments

- Physician skepticism about prescribing cannabis persists due to inconsistent study results and concerns over patient misuse

- Regulatory agencies in several countries still classify cannabis as a controlled substance, limiting research opportunities and product approvals

For instance

- In February 2025, the U.S. FDA emphasized the need for more rigorous clinical trials before approving additional cannabis-based drugs

- In November 2024, a survey by the European Pain Federation found that 47% of physicians remained hesitant to recommend medical cannabis due to insufficient clinical data

- In August 2024, Health Canada issued updated research guidelines aiming to encourage more structured clinical trials in medical cannabis

- To address this challenge, stakeholders must invest in robust clinical research, physician education programs, and clear regulatory pathways to foster broader acceptance and integration into mainstream medicine

Medical Cannabis Market Scope

The market is segmented on the basis of product, source, species, derivatives, application, route of administration, treatment type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Source |

|

|

By Species |

|

|

By Application |

|

|

By Derivatives |

|

|

By Treatment Type |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel |

|

Medical Cannabis Market Regional Analysis

North America is the Dominant Region in the Medical Cannabis Market

- North America holds the largest share in the medical cannabis market, driven by early legalization efforts, widespread acceptance of cannabis for therapeutic purposes, and strong investments in research and development

- U.S. leads the regional market, with a robust network of dispensaries, increasing physician support, and expanding insurance coverage for medical cannabis treatments

- Canada’s fully legalized framework and ongoing advancements in medical cannabis product innovation are further strengthening North America's dominance in the global landscape

- Overall, North America is expected to maintain its leadership in the medical cannabis market due to a mature regulatory environment, growing patient base, and continuous product and clinical innovations

Asia-Pacific is projected to register the Highest Growth Rate

- Asia-Pacific is expected to witness the highest growth rate in the medical cannabis market, fueled by increasing government support for medical cannabis research and gradual legalization across emerging economies

- Countries such as Australia, Thailand, and South Korea are leading the way with regulatory reforms, pilot programs, and investments in medical cannabis cultivation and healthcare integration

- Rising awareness about the therapeutic benefits of cannabis and expanding healthcare infrastructure are creating strong demand for medical cannabis products across the region

- Asia-Pacific is poised to become a major growth engine for the medical cannabis market, driven by progressive regulations, increasing patient acceptance, and significant market potential

Medical Cannabis Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- MediPharm Labs (Canada)

- Tilray Brands, Inc. (Canada)

- Aurora Cannabis Inc. (Canada)

- Cresco Labs (U.S.)

- Peace Naturals Project (Canada)

- CANOPY GROWTH CORPORATION (Canada)

- Medical Marijuana, Inc. (U.S.)

- Seed Cellar (U.S.)

- EcoGen Biosciences (U.S.)

- Seeds For Me Seed Bank (U.S.)

- Humboldt Seed Company (U.S.)

- Extractas (U.S.)

- Crop King Seeds (Canada)

- BARNEY'S FARM (Netherlands)

- FOLIUM Science (U.S.)

- PharmaHemp (U.K.)

- Elixinol Wellness Limited (Australia)

- Endoca (Netherlands)

- Meet Harmony (U.K.)

- MARY’S Nutritionals (U.S.)

- PUSATJUDIONLINE (U.S.)

- Jazz Pharmaceuticals, Inc. (U.S.)

- Upstate Elevator Supply Company (U.S.)

- Apothecanna (U.S.)

- IDT Australia (Australia)

Latest Developments in Global Medical Cannabis Market

- In July 2023, Carer, an oncology-focused organization in India, announced a partnership with Wholeleaf, a certified medicinal cannabis and cannabidiol producer. The collaboration is designed to enhance cancer patient care by providing nutrition support for caregivers, along with physical therapy and mental health services. With approval from the Ayush Ministry, both companies plan to manufacture and distribute their products nationwide, offering a holistic approach to cancer treatment

- In February 2023, Aurora Cannabis Inc., a Canadian global cannabis distributor, partnered with MedReleaf Australia to introduce CraftPlant, a new medical cannabis brand tailored for the Australian market. The brand's first three strains—Greendae, Navana, and HiVolt—feature high THC concentrations, are developed by Aurora’s genetics division Occo, and are packaged in 10g canisters produced under strict EU-GMP-certified standards

- In September 2022, Alternaleaf, a renowned clinic assisting Australians in accessing medicinal cannabis, announced its expansion into the United Kingdom. Research forecasts that England is set to become Europe's second-largest market for medicinal cannabis, largely driven by rising demand and a growing opioid addiction crisis, which medicinal cannabis could help alleviate

- In April 2022, MediCane Health Inc. and Dr. Reddy’s Laboratories Ltd. launched a medical cannabis product in Germany to address the rising demand for therapeutic cannabis treatments. This partnership marks an important step in expanding patient access to medical cannabis solutions across the German healthcare market

- In April 2022, New York City celebrated its first legal sales of recreational marijuana, just one month after seven licensed medical marijuana companies were approved to serve the adult-use market. This development represents a major shift in New York’s cannabis policy, aiming to establish a regulated market, strengthen local economies, and promote consumer safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.