Global Metallized Paper Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

6.14 Billion

2024

2032

USD

4.47 Billion

USD

6.14 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 6.14 Billion | |

|

|

|

|

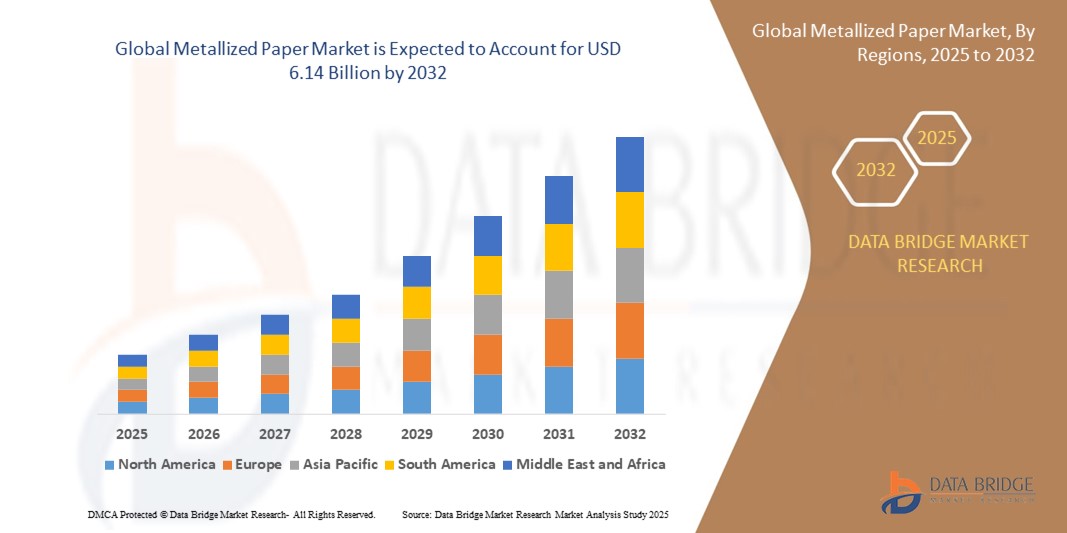

What is the Global Metallized Paper Market Size and Growth Rate?

- The global Metallized Paper market size was valued at USD 4.47 billion in 2024 and is expected to reach USD 6.14 billion by 2032, at a CAGR of 4.05% during the forecast period

- The metallized paper market is experiencing significant growth, driven by advancements in technology and innovative methods. One of the latest developments is the use of vacuum metallization, which enhances the paper's barrier properties while maintaining its lightweight nature

- This method involves depositing a thin layer of metal, typically aluminum, onto the paper substrate, providing excellent moisture and oxygen barriers, making it ideal for food packaging and other applications.

What are the Major Takeaways of Metallized Paper Market?

- Advancements in adhesive technologies have improved the bonding strength of metallized paper, enhancing its durability and performance in various applications, such as labels and gift wraps. The incorporation of sustainable practices, including recyclable and biodegradable metallized papers, is also gaining traction, appealing to environmentally conscious consumers.

- The growth in e-commerce and retail packaging is further fueling the demand for metallized paper, as brands seek visually appealing packaging solutions to attract consumers. With its versatility and enhanced properties, the metallized paper market is projected to expand significantly, driven by increased adoption across various sectors, including food, cosmetics, and pharmaceuticals, highlighting its pivotal role in modern packaging solutions

- North America dominated the global metallized paper market with the largest revenue share of 37.8% in 2024, driven by high consumption of packaged consumer goods, strong sustainability regulations, and innovation in packaging materials

- Asia-Pacific is expected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by increasing urbanization, rising middle-class income, and growing demand for sustainable packaging across emerging economies such as China, India, Indonesia, and Vietnam

- The lamination segment dominated the metallized paper market with the largest market revenue share of 57.4% in 2024, attributed to its wide applicability in packaging, labeling, and decorative uses

Report Scope and Metallized Paper Market Segmentation

|

Attributes |

Metallized Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Metallized Paper Market?

“Sustainability-Driven Innovation in Packaging and Labeling”

- A dominant trend in the metallized paper market is the increasing shift toward eco-friendly and recyclable packaging materials, driven by regulatory mandates and consumer demand for sustainable solutions. Metallized paper is emerging as a sustainable alternative to plastic films and foil-based substrates in labeling and decorative packaging

- Brands across food & beverage, cosmetics, and personal care are opting for metallized paper due to its plastic-free composition, biodegradability, and compatibility with conventional paper recycling streams—enabling reduced environmental impact without sacrificing shelf appeal

- Companies such as UPM Raflatac and AR Metallizing are introducing FSC-certified, water-based coated metallized papers that offer excellent printability, gloss, and barrier properties, catering to luxury and FMCG brands alike

- In January 2024, AR Metallizing launched "SilberBoard Eco", a recyclable board offering high metallic finish with compostable and repulpable properties—ideal for sustainable carton packaging

- As circular economy principles gain traction, the demand for mono-material, fully recyclable packaging solutions is accelerating, positioning metallized paper as a critical enabler of eco-conscious branding and compliance with Extended Producer Responsibility (EPR) framework

- This transition is transforming metallized paper from a premium packaging option to a mainstream sustainable material, fostering innovation in both aesthetics and environmental performance

What are the Key Drivers of Metallized Paper Market?

- Rising demand for premium product presentation and anti-counterfeit solutions in industries such as beverages, personal care, and tobacco is fueling the adoption of metallized paper. The material offers superior shine, gloss, and barrier protection, enhancing product visibility while deterring tampering or imitation

- In March 2024, Multi-Color Corporation expanded its metallized label offerings for global beverage brands, combining foil-like effects with recyclable substrates to support both branding and sustainability

- Growing environmental regulations banning plastic-based packaging in several regions (e.g., E.U. single-use plastics directive) are pushing converters and brands to switch to paper-based alternatives such as metallized paper

- In addition, increasing urbanization and rising disposable incomes are propelling the demand for attractive, high-quality packaging, especially in premium segments such as alcohol, cosmetics, and confectionery

- The material’s excellent runnability on standard printing presses, compatibility with flexographic and offset printing, and cost-effective recyclability make it a preferred choice for large-scale packaging operations seeking visual appeal and compliance

Which Factor is challenging the Growth of the Metallized Paper Market?

- A key challenge facing the market is the relatively higher cost of metallized paper compared to traditional paper and plastic-based alternatives, particularly for price-sensitive packaging applications

- Small-to-medium-sized enterprises (SMEs) in developing regions may hesitate to adopt premium metallized substrates due to budget constraints, limited awareness, or lack of access to affordable suppliers

- In addition, performance limitations in high-moisture environments, such as frozen food or chilled beverage labels, restrict metallized paper usage where synthetic films still dominate due to superior water resistance

- In 2023, several packaging converters cited compatibility and durability concerns when transitioning from PET-based laminates to metallized paper in high-humidity applications, particularly in the Asia-Pacific food sector

- Moreover, fluctuations in raw material prices (aluminum, specialty coatings) and the availability of fiber-based substrates impact production cost stability and profit margins for manufacturers

- To overcome these barriers, companies must invest in cost-competitive manufacturing processes, develop hybrid-grade variants for moisture-sensitive products, and educate converters and end-users about the material’s recyclability, performance benefits, and regulatory compliance

How is the Metallized Paper Market Segmented?

The market is segmented on the basis of type, application, sales channel, thickness type, and end-use industries.

- By Type

On the basis of type, the metallized paper market is segmented into lamination and vacuum lamination. The lamination segment dominated the Metallized Paper market with the largest market revenue share of 57.4% in 2024, attributed to its wide applicability in packaging, labeling, and decorative uses. Lamination offers high gloss, barrier protection, and printability, making it a preferred choice for consumer goods packaging. The ease of integration with standard printing processes further strengthens its position.

The vacuum lamination segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its superior metallic sheen and enhanced barrier properties. It is increasingly adopted in premium packaging and branding applications across beverages, cosmetics, and luxury goods.

- By Application

On the basis of application, the metallized paper market is segmented into printing, packaging, labels, wraps/overwraps, decoration, mailing envelopes, and graphic paper. The labels segment held the largest market revenue share of 33.1% in 2024, driven by rising demand from beverage and personal care industries for eye-catching, sustainable labeling solutions. Metallized paper offers excellent print quality and recyclability, making it ideal for premium brand presentation.

The packaging segment is expected to witness the fastest growth during 2025 to 2032 due to the growing focus on plastic-free, recyclable packaging alternatives. Its attractive finish and strong shelf appeal make it suitable for food, confectionery, and consumer goods packaging.

- By Sales Channel

On the basis of sales channel, the metallized paper market is segmented into service provider and aftermarket. The service provider segment dominated with the largest revenue share of 64.7% in 2024, driven by bulk orders from FMCG companies, converters, and printers requiring custom printing and lamination services. This channel supports large-scale production runs and value-added solutions such as embossing and anti-counterfeit features.

The aftermarket segment is projected to grow at the highest CAGR through 2032, fueled by demand from small businesses and printing service shops seeking short-run, specialty metallized papers for niche applications such as promotional wraps, event decoration, and artisan packaging.

- By Thickness

On the basis of thickness, the metallized paper market is categorized into up to 50 GSM, 51–100 GSM, 101–150 GSM, and above 150 GSM. The 51–100 GSM segment captured the largest market revenue share of 39.6% in 2024, favored for its balance of flexibility, strength, and print compatibility. This range is widely used in labeling, flexible packaging, and lightweight wraps across food and personal care products.

The above 150 GSM segment is expected to witness the fastest CAGR from 2025 to 2032 due to growing applications in luxury packaging, cartons, and decorative print materials requiring enhanced rigidity and premium aesthetics.

- By End-Use Industry

On the basis of end-use industry, the metallized paper market is segmented into food, beverages, home care, personal care, electrical, chemicals, and banking. The beverages segment led the market with the highest revenue share of 28.5% in 2024, primarily due to increasing demand for premium and sustainable labeling in beer, wine, and energy drinks. Metallized paper enhances shelf appeal and aligns with recyclability goals, particularly in glass and aluminum packaging.

The personal care segment is anticipated to grow at the fastest CAGR through 2032, fueled by rising demand for visually appealing, sustainable packaging in skincare, fragrance, and cosmetics. The material’s compatibility with decorative effects such as foil stamping and embossing supports brand differentiation in a competitive market.

Which Region Holds the Largest Share of the Metallized Paper Maret?

- North America dominated the global metallized paper market with the largest revenue share of 37.8% in 2024, driven by high consumption of packaged consumer goods, strong sustainability regulations, and innovation in packaging materials

- The increasing demand for eco-friendly and visually appealing packaging, particularly in the food, beverage, and personal care sectors, has fueled the adoption of metallized paper across the U.S. and Canada

- The region’s advanced printing technologies and strong retail presence further support market expansion. In addition, heightened consumer awareness regarding recyclability and environmental impact has encouraged manufacturers to transition from plastic-based laminates to sustainable alternatives such as metallized paper

U.S. Metallized Paper Market Insight

U.S. dominated the North American metallized paper market revenue in 2024, owing to robust demand from the food and beverage packaging industries. The country’s leading FMCG and retail sectors prefer metallized paper for premium labeling and high-end packaging. In addition, the U.S. government’s emphasis on reducing plastic waste has led to increased adoption of recyclable, paper-based packaging materials across industries.

Canada Metallized Paper Market Insight

Canada is projected to witness steady growth through the forecast period, driven by rising demand for premium packaging in alcoholic beverages and confectionery products. Canadian packaging regulations increasingly favor sustainable materials, making metallized paper a preferred choice among brands aiming to improve visual appeal while reducing environmental impact.

Which Region is the Fastest Growing Region in the Metallized Paper Market?

Asia-Pacific is expected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by increasing urbanization, rising middle-class income, and growing demand for sustainable packaging across emerging economies such as China, India, Indonesia, and Vietnam. Rapid industrialization, a growing FMCG sector, and a shift towards visually attractive and eco-friendly packaging are significantly boosting the demand for metallized paper. Moreover, government initiatives to reduce plastic pollution and promote circular economy practices are accelerating adoption across food, beverage, personal care, and household products.

China Metallized Paper Market Insight

China held the largest market share in Asia-Pacific in 2024, fueled by strong domestic manufacturing, high consumption of packaged goods, and increasing environmental regulations. The push for sustainable materials and local innovation in eco-friendly packaging have contributed to the widespread use of metallized paper, especially in labeling and gift wrap applications.

India Metallized Paper Market Insight

India is poised for exceptional growth, driven by the expanding packaging sector, rising consumer awareness, and increasing demand for attractive and recyclable packaging materials. Government bans on single-use plastics and a rising preference for biodegradable options in personal care and food packaging are further supporting the adoption of metallized paper in the country.

Which are the Top Companies in Metallized Paper Market?

The metallized paper industry is primarily led by well-established companies, including:

- UPM (Finland)

- Polyplex (India)

- Lecta (Spain)

- Glatfelter Corporation (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Verso Corporation (U.S.)

- UFlex Limited (India)

- Vacmet India (India)

- syscogroup (India)

- THE GRIFF NETWORK (U.S.)

- Grafix Plastics (U.S.)

- Alufoil Products Company, Inc. (U.S.)

- Nova Films and Foils (U.S.)

- AR Metallizing (Belgium)

- Cheever Specialty Paper & Film (U.S.)

- Unifoil (U.S.)

- Sierra Coating Technologies LLC (U.S.)

- All Foils, Inc. (U.S.)

What are the Recent Developments in Global Metallized Paper Market?

- In August 2023, Amcor Limited announced the acquisition of Phoenix Flexibles, a flexible packaging company operating a plant in Gujarat, India. This move was a strategic step aimed at expanding Amcor's presence and production capabilities in the rapidly growing Indian market. The acquisition strengthens Amcor’s regional footprint and supports its long-term growth strategy in Asia

- In April 2023, Sealed Air and Koenig & Bauer AG revealed the signing of a non-binding letter of intent to expand their strategic partnership focused on digital printing machines. This collaboration is intended to enhance packaging design possibilities by developing advanced digital printing technology, equipment, and support services. The alliance is expected to accelerate innovation and value in printed packaging solutions

- In February 2023, Huhtamaki Oyj completed the acquisition of full ownership in Huhtamaki Tailored Packaging Pty Ltd (HTP), a leading Australian food service packaging distributor and wholesaler. This acquisition supports Huhtamaki’s strategy to strengthen its position in the food service packaging segment across key Asia-Pacific market

- In October 2022, Mondi Group relaunched its premium Appetitt brand in collaboration with Norwegian pet food company Felleskjøpet, transitioning to recyclable high-barrier packaging. The new FlexiBag Recyclable solution will be used for packing dry dog and cat food, emphasizing sustainability without compromising protection. This move demonstrates Mondi’s commitment to sustainable packaging innovation

- In May 2022, Amcor Limited expanded its pharmaceutical packaging portfolio by introducing High Shield laminates, which offer high-performance barrier properties required by the pharma industry. This product innovation caters to the demand for reliable and advanced packaging in the pharmaceutical sector

- In April 2022, Sonoco Products Company acquired the remaining one-third ownership interest in Sonoco do Brasil Participacoes, Ltda from private investors. The joint venture specializes in flexible packaging solutions in Brazil, and this acquisition solidifies Sonoco’s control over its South American operations. The move enhances the company's flexibility and decision-making capacity in a key growth market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metallized Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metallized Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metallized Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.