Global Mobility As A Service Market

Market Size in USD Billion

CAGR :

%

USD

167.41 Billion

USD

1,704.24 Billion

2024

2032

USD

167.41 Billion

USD

1,704.24 Billion

2024

2032

| 2025 –2032 | |

| USD 167.41 Billion | |

| USD 1,704.24 Billion | |

|

|

|

|

Mobility As A Service Market Size

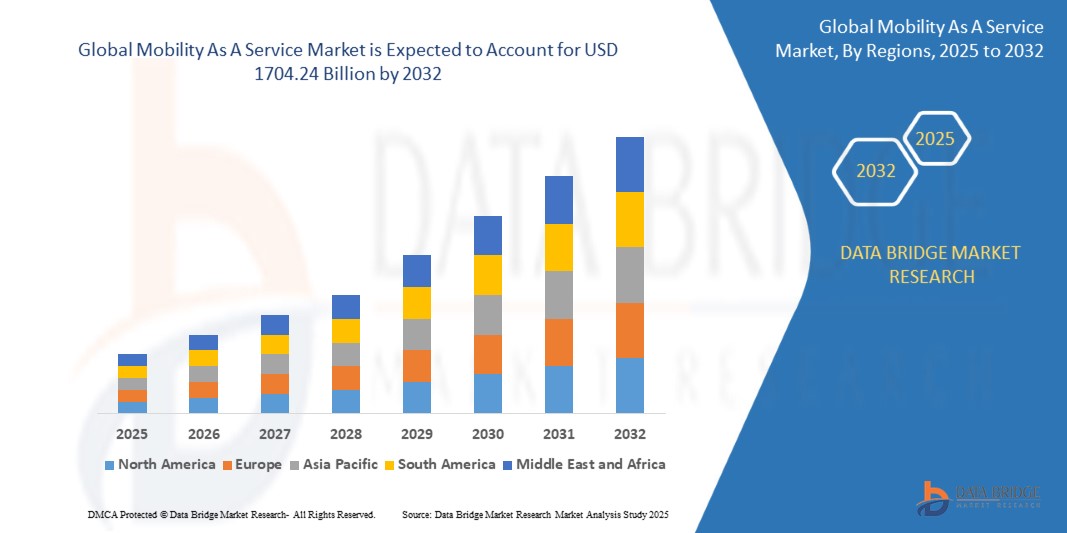

- The global mobility as a service market was valued at USD 167.41 billion in 2024 and is expected to reach USD 1704.24 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of33.65%, primarily driven by rising demand for convenient, cost-effective, and flexible transportation options

- This growth is driven by Increasing smartphone penetration, along with the availability of real-time data and mobile applications, enables seamless trip planning, booking, and payment integration across multiple modes of transport

Mobility As A Service Market Analysis

- The mobility as a service (maas) market is witnessing robust expansion, fueled by growing urbanization, changing consumer preferences, and increasing emphasis on sustainable transportation. The rising use of smartphones and mobile apps for travel planning and booking has enhanced user convenience, accelerating the adoption of maas platforms by both individual consumers and enterprises

- The integration of emerging technologies such as AI, IoT, GPS, and data analytics is improving real-time route optimization, demand forecasting, and fleet management—enabling providers to deliver efficient, multimodal transport solutions. Governments are also investing heavily in smart city initiatives, which further facilitate maas implementation through integrated transport policies and public-private partnerships

- For instance, in February 2023, the city of Helsinki, Finland, continued to expand its Whim app, a comprehensive MaaS platform that allows users to plan, book, and pay for various transportation modes (bikes, taxis, buses, and rentals) within a single app interface—setting a global benchmark for urban mobility integration

- The market is also being shaped by strategic alliances among transport operators, tech startups, and automotive companies. These collaborations are fostering the growth of services such as ride-hailing, micro-mobility, car-sharing, and integrated ticketing, which are transforming how people move within cities and reducing dependency on private vehicles

Report Scope and Mobility As A Service Market Segmentation

|

Attributes |

Mobility As A Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Mobility As A Service Market Trends

“Rise of Integrated Multimodal Transport Platforms”

- A key trend in the maas market is the growing implementation of integrated platforms that combine various modes of transportation—public transit, ride-sharing, micro-mobility (e-scooters, bikes), and car rentals—into a single digital interface

- This shift is being driven by increasing consumer demand for convenience, real-time updates, and flexible travel options, particularly in urban centers

- For instance, in June 2024, Moovit expanded its global MaaS app by integrating new micro-mobility and paratransit services, allowing users to plan and pay for entire journeys across different transport modes through one platform

- Municipalities and private players are collaborating to streamline ticketing, routing, and pricing into unified systems that improve urban mobility efficiency and accessibility

- This trend is enabling a shift away from private car ownership, reducing congestion and emissions while enhancing mobility equity and digital engagement

Mobility As A Service Market Dynamics

Driver

“Urbanization and the Shift toward Sustainable Transport”

- Rapid urbanization is placing pressure on existing transport infrastructure, prompting cities to explore sustainable and efficient solutions such as maas

- The focus on reducing carbon emissions and meeting climate goals is pushing governments and enterprises to encourage shared mobility, electric vehicles, and public transport usage

- Many local authorities are offering incentives for using maas platforms and reducing car usage through low-emission zones and congestion charges

- For instance, in September 2023, Paris launched its Citymapper-powered MaaS pilot program, integrating metro, buses, scooters, and bikes into a single app to promote green commuting options

- This driver is expected to support long-term investment in mobility infrastructure that prioritizes user experience, accessibility, and environmental sustainability

Opportunity

“Expansion of MaaS in Tier II and Tier III Cities”

- While maas has seen strong adoption in metropolitan areas, there’s a growing opportunity to expand services into smaller cities where public and private transportation remains fragmented

- These regions are experiencing rising smartphone penetration and digital awareness, creating favorable conditions for mobile-based mobility solutions

- Local partnerships with transport operators, fuel stations, and logistics firms can help develop tailored MaaS models that address regional needs

- For instance, in January 2024, Ola Mobility launched a pilot MaaS program in Bhopal, India, integrating autorickshaws, e-bikes, and buses to improve last-mile connectivity for residents and students

- This opportunity can unlock untapped user bases, increase service provider revenues, and promote balanced regional mobility development

Restraint/Challenge

“Regulatory and Data Privacy Concerns”

- The operation of maas platforms often involves multiple stakeholders and massive volumes of user data, raising concerns about data privacy, security, and regulatory compliance

- Differences in municipal regulations, transport policies, and data-sharing standards across regions create friction in seamless maas deployment

- Service providers must balance innovation with regulatory adherence while ensuring transparency in user data collection and usage

- For instance, in July 2023, Germany’s Federal Cartel Office raised antitrust concerns over the integration of multiple services into a single maas app by a major telecom firm, citing the need for open access to public transport APIs

- Overcoming this challenge will require industry-wide standardization, government collaboration, and robust cybersecurity frameworks to build user trust and platform reliability

Mobility As A Service Market Scope

The market is segmented on the basis of service type, solution, transportation type, vehicle type, application platform, requirement type, organization size, and usage.

|

Segmentation |

Sub-Segmentation |

|

By Service Type

|

|

|

By Solution |

|

|

By Transportation Type |

|

|

By Vehicle Type |

|

|

By Application Platform |

|

|

By Requirement Type |

|

|

By Organization Size |

|

|

By Usage |

|

Mobility As A Service Market Regional Analysis

“North America is the Dominant Region in the Mobility As A Service Market”

- North America dominates the market due to the widespread adoption of EMV (Europay, Mastercard, and Visa) chip technology for payment and transactions

- These secure and efficient payment methods have become integral to maas (mobility as a service) platforms, offering users convenience and reliability

- The deployment of EMV chips ensures seamless transactions and enhances the user experience, driving further uptake of maas services in the region

- This trend is expected to persist and strengthen during the forecast period, as North America continues to invest in technological advancements and infrastructure to support the growing demand for maas solutions

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is experiencing substantial growth, primarily driven by the increasing penetration of the internet and the widespread utilization of mobile data for diverse applications

- The rise in internet access has facilitated greater connectivity, leading to a surge in activities such as social media usage and mobile banking

- This trend reflects the region's growing digitalization and the adoption of technology in everyday life

- As more individuals access the internet via mobile devices, the demand for mobile data services is expected to soar, fostering opportunities for telecom companies and digital service providers

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Avis Budget Group (U.S.)

- Beijing Xiaoju Technology Co., Ltd. (Didi Chuxing) (China)

- Mobiag (Portugal)

- movmi (Canada)

- Uber Technologies Inc. (U.S.)

- Careem (U.A.E.)

- Bolt Technology OÜ (Estonia)

- Gett (U.K.)

- Aptiv (Ireland)

- Enterprise Holdings Inc. (U.S.)

- Europcar Mobility Group SA (France)

- Curb Mobility, LLC (U.S.)

Latest Developments in Global Mobility As A Service Market

- In February 2023, Uber partnered with financial services firm HSBC to launch a digital payments solution that enables unbanked drivers in Egypt to receive on-demand cash outs directly into mobile wallets. Through this collaboration, drivers on the Uber platform can access 100% of their earnings conveniently and in real-time using HSBC Net's payment system, enhancing financial inclusion and driver satisfaction

- In January 2023, DiDi began working with Jordan Transfer Guidance to launch taxi dispatch services on routes that include last-mile transportation via the transfer guidance app. This collaboration, part of Jordan’s MaaS service and tourism DX initiative, is aimed at supporting the country’s tourism recovery post-COVID, particularly welcoming tourists from countries such as China

- In November 2022, Moovit announced a new feature that enables commuters to reduce stress and uncertainty by tracking their transit lines in real-time along a live map. Available for multiple modes of transport such as buses, trains, trams, subways, ferries, and cable cars with GPS tracking, this feature initially launched in over 220 cities across 38 countries, offering users an added layer of confidence and convenience

- In October 2022, Citymapper launched its Cycling SDK, which allows easy integration of cycle routing and turn-by-turn navigation into third-party apps with minimal coding. The SDK is highly customizable with options for colors, fonts, and icons, enabling developers to align it with their brand identity while improving cycling support in urban mobility platforms

- In October 2022, SkedGo announced its support for the Leicester Buses Partnership in the U.K., introducing personalized, door-to-door bus trip planning based on user preferences. This integration also aims to highlight and encourage the use of local bus travel options, promoting smarter and more sustainable public transportation choices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.