Global Multicancer Early Detection Dna Blood Tests Market

Market Size in USD Billion

CAGR :

%

USD

1.02 Billion

USD

2.56 Billion

2025

2033

USD

1.02 Billion

USD

2.56 Billion

2025

2033

| 2026 –2033 | |

| USD 1.02 Billion | |

| USD 2.56 Billion | |

|

|

|

|

Multicancer Early Detection DNA Blood Tests Market Size

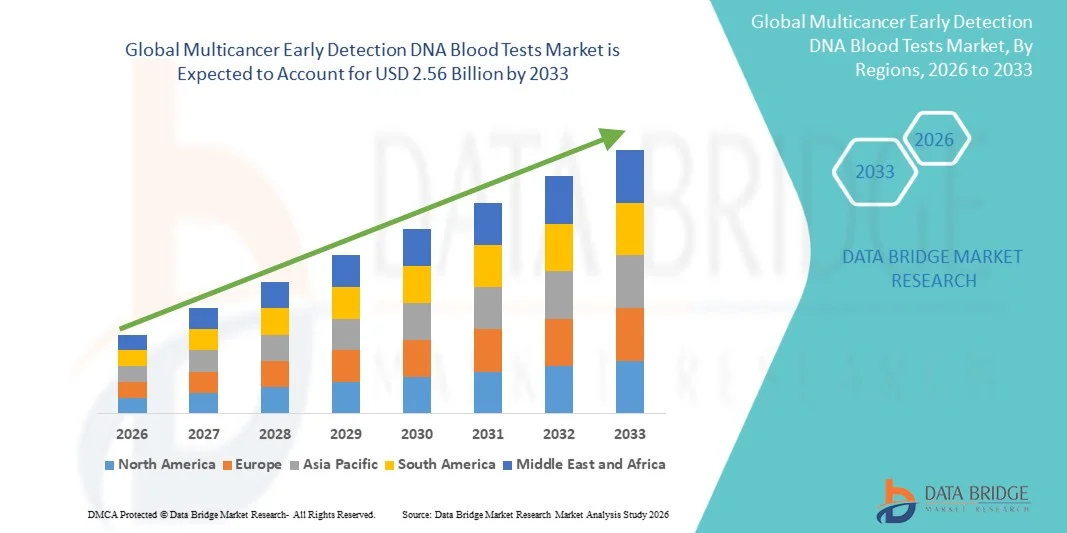

- The global multicancer early detection DNA blood tests market size was valued at USD 1.02 billion in 2025 and is expected to reach USD 2.56 billion by 2033, at a CAGR of 12.10% during the forecast period

- The market growth is primarily driven by rapid advancements in liquid biopsy technologies, next-generation sequencing, and artificial intelligence based analytics, along with increasing focus on early cancer detection and preventive healthcare

- In addition, rising cancer incidence, growing awareness of early-stage diagnosis benefits, and increasing investments by biotechnology companies and healthcare systems are positioning MCED DNA blood tests as a transformative solution in oncology screening, thereby significantly accelerating overall market growth

Multicancer Early Detection DNA Blood Tests Market Analysis

- Multicancer early detection DNA blood tests, which analyze circulating tumor DNA, methylation signatures, and other genomic biomarkers from a single blood sample, are becoming critical tools in preventive oncology and population-level cancer screening due to their non-invasive nature and ability to detect multiple cancers at early, more treatable stages

- The growing demand for multicancer early detection DNA blood tests is largely driven by the rising global cancer burden, increasing focus on early diagnosis and preventive healthcare, and rapid technological advancements in liquid biopsy, next-generation sequencing, and artificial intelligence–based data analytics

- North America dominated the multicancer early detection DNA blood tests market with the largest revenue share of 45.9% in 2025, supported by strong R&D investments, early adoption of advanced diagnostic technologies, and the presence of leading biotechnology companies, with the U.S. witnessing strong uptake through large-scale clinical trials, direct-to-consumer testing models, and collaborations with healthcare systems

- Asia-Pacific is expected to be the fastest-growing region in the multicancer early detection DNA blood tests market during the forecast period, driven by increasing cancer incidence, expanding healthcare access, rising awareness of early cancer detection, and growing investments in precision medicine and genomic diagnostics

- Pan-cancer test panels dominated the multicancer early detection DNA blood tests market with a market share of 55.2% in 2025, attributed to their ability to detect multiple cancer types from a single blood draw, higher clinical utility, improved patient compliance, and strong demand from healthcare providers seeking comprehensive early screening solutions

Report Scope and Multicancer Early Detection DNA Blood Tests Market Segmentation

|

Attributes |

Multicancer Early Detection DNA Blood Tests Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Multicancer Early Detection DNA Blood Tests Market Trends

“Rising Adoption of AI-Driven Liquid Biopsy Screening”

- A key and accelerating trend in the global multicancer early detection DNA blood tests market is the increasing use of artificial intelligence (AI) and machine-learning algorithms to analyze complex genomic and epigenomic data, significantly improving cancer signal detection accuracy and tissue-of-origin prediction

- For instance, several leading MCED developers are leveraging AI-based classifiers trained on large cfDNA methylation datasets to distinguish cancer signals from non-cancer noise and identify the likely cancer source from a single blood draw

- AI integration in multicancer early detection DNA blood tests enables continuous improvement of test performance, enhanced sensitivity for early-stage cancers, and more precise cancer localization. For instance, advanced algorithms refine detection models as clinical datasets expand, supporting improved clinical confidence and utility over time

- The convergence of liquid biopsy technologies with AI-driven analytics allows healthcare providers to manage large-scale screening data efficiently and supports the potential rollout of population-level cancer screening programs using centralized, high-throughput testing platforms

- This trend toward data-driven, highly scalable cancer screening solutions is reshaping expectations for early cancer diagnostics. Consequently, biotechnology companies are prioritizing AI-enabled multicancer early detection DNA blood tests to strengthen clinical validation, regulatory positioning, and long-term adoption

- The demand for AI-enhanced multicancer early detection DNA blood tests is growing across healthcare systems, research institutions, and preventive screening initiatives, as stakeholders increasingly value early detection accuracy and actionable clinical insights

Multicancer Early Detection DNA Blood Tests Market Dynamics

Driver

“Growing Burden of Cancer and Shift Toward Preventive Healthcare”

- The rising global incidence of cancer, combined with a growing emphasis on early diagnosis and preventive healthcare, is a major driver fueling demand for multicancer early detection DNA blood tests

- For instance, ongoing large-scale clinical studies and pilot screening programs are being conducted to evaluate the effectiveness of multicancer early detection DNA blood tests in identifying cancers before symptom onset, supporting broader clinical adoption

- As healthcare systems face increasing costs associated with late-stage cancer treatment, multicancer early detection DNA blood tests offer a compelling solution by enabling earlier intervention, improved survival outcomes, and potential long-term cost savings

- Furthermore, increasing awareness among physicians, payers, and patients about the benefits of early cancer detection is accelerating interest in blood-based screening approaches that complement existing single-cancer screening methods

- The ability to screen for multiple cancers using a single, minimally invasive blood test enhances patient compliance and positions multicancer early detection DNA blood tests as an attractive option for routine preventive health assessments

- Government-led initiatives and funding programs aimed at improving early cancer detection rates are supporting pilot deployments and real-world evaluation of multicancer early detection DNA blood tests

- The increasing preference for non-invasive diagnostic solutions among aging populations is further driving demand for blood-based multicancer screening approaches that reduce reliance on invasive procedures

Restraint/Challenge

“Clinical Validation Complexity and Reimbursement Uncertainty”

- Challenges related to extensive clinical validation requirements and evolving regulatory and reimbursement frameworks pose significant barriers to widespread adoption of multicancer early detection DNA blood tests

- For instance, demonstrating real-world clinical utility, population-level effectiveness, and favorable health-economic outcomes requires long-term, large-scale studies, which can delay regulatory approvals and payer acceptance

- Establishing standardized clinical guidelines and determining how multicancer early detection DNA blood tests fit into existing cancer screening pathways remains complex, contributing to cautious adoption by healthcare providers

- In addition, uncertainty around reimbursement coverage and pricing, particularly for population screening use cases, can limit accessibility and slow market penetration despite strong technological promise

- Addressing these challenges through robust clinical evidence generation, payer engagement, and alignment with public health screening frameworks will be essential to unlock the full growth potential of the multicancer early detection DNA blood tests market

- Variability in test performance across different cancer types and stages presents challenges in demonstrating consistent clinical benefit, which may affect physician confidence and adoption rates

- Ethical concerns related to false positives, overdiagnosis, and downstream diagnostic follow-up burden pose additional challenges for large-scale implementation of multicancer early detection DNA blood tests

Multicancer Early Detection DNA Blood Tests Market Scope

The market is segmented on the basis of test type, technology, application, and end user.

- By Test Type

On the basis of test type, the multicancer early detection DNA blood tests market is segmented into pan-cancer MCED tests, targeted multi-cancer panels, and single-cancer DNA blood tests. The pan-cancer MCED tests segment dominated the market in 2025 with a market share of 55.2%, driven by its ability to detect signals from multiple cancer types using a single blood sample, offering high clinical utility for population-wide screening. These tests are increasingly favored by healthcare systems due to their potential to streamline screening workflows and reduce dependency on multiple single-cancer tests. Strong alignment with preventive healthcare strategies and large-scale clinical studies further supports adoption. Higher patient compliance due to non-invasive testing also strengthens demand. In addition, pan-cancer tests attract significant investment from biotechnology firms seeking scalable screening solutions.

The targeted multi-cancer panels segment is expected to witness the fastest growth during the forecast period, fueled by higher sensitivity for selected high-incidence cancers and clearer clinical actionability. These panels are often easier to integrate into existing diagnostic pathways, supporting faster physician adoption. Lower testing costs compared to pan-cancer assays improve accessibility in emerging markets. Targeted panels also face fewer regulatory and reimbursement complexities. Growing use in pilot screening programs is accelerating their market expansion.

- By Technology

On the basis of technology, the market is segmented into cfDNA methylation profiling, cfDNA mutation analysis, fragmentomics, multi-analyte, and other epigenomic approaches. The cfDNA methylation profiling segment held the largest market share in 2025, driven by its strong capability to differentiate cancer-derived DNA from background noise and accurately predict tissue of origin. This technology demonstrates robust performance in early-stage cancer detection, which is critical for screening applications. High compatibility with next-generation sequencing platforms supports scalability. Extensive clinical validation data further boosts confidence among healthcare providers. Its applicability across multiple cancer types reinforces dominance.

The multi-analyte segment is anticipated to grow at the fastest rate during the forecast period, supported by its ability to combine genomic and proteomic signals to enhance sensitivity and reduce false positives. This integrated approach improves real-world screening performance and clinical confidence. Multi-analyte tests are gaining traction in advanced clinical trials. Increasing investments in comprehensive diagnostic platforms are accelerating development. As demand for more actionable screening results grows, adoption of this technology is expected to rise rapidly.

- By Application

On the basis of application, the market is segmented into asymptomatic population screening, diagnostic support, cancer recurrence monitoring, and complementary screening. The asymptomatic population screening segment dominated the market in 2025, as multicancer early detection DNA blood tests are primarily designed to identify cancers before symptom onset. This application aligns strongly with public health goals aimed at reducing cancer mortality. Healthcare systems increasingly recognize early detection as a long-term cost-saving approach. Large population-based studies and pilot programs are driving adoption. Improved patient participation due to simple blood-based testing supports market leadership.

The complementary screening segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing use of MCED tests alongside established screening methods such as mammography and colonoscopy. Complementary screening helps close detection gaps for cancers lacking routine screening options. Physicians value these tests for enhancing diagnostic confidence. This positioning also supports smoother regulatory acceptance. Growing adoption of integrated screening strategies is accelerating segment growth.

- By End User

On the basis of end user, the market is segmented into reference laboratories, hospital laboratories, clinics, and direct-to-consumer users. The reference laboratories segment accounted for the largest market share in 2025, driven by advanced sequencing infrastructure and high-throughput testing capabilities. Most MCED assays are currently offered as laboratory-developed tests, favoring centralized reference labs. These labs also play a major role in clinical validation and data generation. Established provider and payer relationships further support dominance. Their scalability makes them critical for large screening initiatives.

The direct-to-consumer users segment is projected to witness the fastest growth during the forecast period, fueled by rising consumer awareness of preventive healthcare and willingness to pay for early cancer detection. DTC models improve accessibility by reducing dependence on physician referrals. Convenience and ease of testing support strong consumer interest. Improvements in post-test care pathways are strengthening trust. This segment reflects the broader shift toward consumer-driven healthcare solutions.

Multicancer Early Detection DNA Blood Tests Market Regional Analysis

- North America dominated the multicancer early detection DNA blood tests market with the largest revenue share of 45.9% in 2025, supported by strong R&D investments, early adoption of advanced diagnostic technologies, and the presence of leading biotechnology companies, with the U.S. witnessing strong uptake through large-scale clinical trials, direct-to-consumer testing models, and collaborations with healthcare systems

- Healthcare providers and patients in the region highly value the non-invasive nature, early-stage detection capability, and potential to complement existing cancer screening programs offered by multicancer early detection DNA blood tests

- This strong adoption is further supported by advanced healthcare infrastructure, favorable clinical research ecosystems, early acceptance of innovative diagnostic technologies, and the presence of leading biotechnology companies, positioning multicancer early detection DNA blood tests as a key component of preventive oncology in the region

U.S. Multicancer Early Detection DNA Blood Tests Market Insight

The U.S. multicancer early detection DNA blood tests market captured the largest revenue share within North America in 2025, driven by high cancer prevalence, strong emphasis on early diagnosis, and rapid adoption of advanced genomic technologies. Healthcare providers are increasingly prioritizing blood-based screening solutions to improve early-stage cancer detection and patient outcomes. The presence of leading biotechnology companies, extensive clinical trials, and growing direct-to-consumer testing models further supports market expansion. Moreover, strong research funding, favorable innovation ecosystems, and rising awareness of preventive oncology are significantly contributing to market growth in the U.S.

Europe Multicancer Early Detection DNA Blood Tests Market Insight

The Europe multicancer early detection DNA blood tests market is projected to expand at a notable CAGR during the forecast period, primarily driven by increasing focus on early cancer diagnosis and preventive healthcare strategies. Rising cancer incidence and strong public healthcare systems are encouraging adoption of innovative screening technologies. European healthcare providers are increasingly evaluating MCED tests to complement existing national screening programs. The region is witnessing steady growth across clinical research, hospital-based testing, and pilot population screening initiatives, supported by advancements in precision medicine.

U.K. Multicancer Early Detection DNA Blood Tests Market Insight

The U.K. multicancer early detection DNA blood tests market is expected to grow at a noteworthy CAGR during the forecast period, supported by strong government-backed healthcare infrastructure and emphasis on early cancer detection. Growing awareness of the benefits of early diagnosis among clinicians and patients is driving interest in blood-based screening tests. The U.K.’s active participation in large-scale clinical studies and translational research programs further supports adoption. Integration of MCED testing within preventive healthcare pathways is expected to continue stimulating market growth.

Germany Multicancer Early Detection DNA Blood Tests Market Insight

The Germany multicancer early detection DNA blood tests market is anticipated to expand at a steady CAGR during the forecast period, driven by strong focus on technological innovation, diagnostic accuracy, and evidence-based healthcare. Germany’s advanced laboratory infrastructure and emphasis on precision medicine support the adoption of liquid biopsy technologies. Increasing investments in oncology diagnostics and clinical validation studies are fostering market growth. A strong preference for high-quality, clinically validated screening solutions aligns well with MCED test adoption in the country.

Asia-Pacific Multicancer Early Detection DNA Blood Tests Market Insight

The Asia-Pacific multicancer early detection DNA blood tests market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising cancer incidence, rapid urbanization, and improving access to advanced healthcare services across countries such as China, Japan, and India. Increasing government initiatives focused on early cancer detection and expanding genomic testing capabilities are supporting adoption. Growing awareness of preventive healthcare and rising healthcare expenditures are further accelerating market growth across the region.

Japan Multicancer Early Detection DNA Blood Tests Market Insight

The Japan multicancer early detection DNA blood tests market is gaining momentum due to the country’s advanced healthcare system, strong research capabilities, and growing demand for early and accurate cancer diagnosis. Japan places significant emphasis on early intervention and preventive medicine, supporting the uptake of blood-based screening tests. Integration of MCED tests into clinical research and hospital diagnostics is increasing. In addition, the aging population is driving demand for non-invasive, efficient cancer screening solutions in both clinical and preventive settings.

India Multicancer Early Detection DNA Blood Tests Market Insight

The India multicancer early detection DNA blood tests market accounted for a leading share in Asia-Pacific in 2025, supported by a large patient population, rising cancer burden, and improving diagnostic infrastructure. Increasing awareness of early cancer detection, coupled with expanding private healthcare and diagnostic laboratory networks, is driving adoption. India’s growing focus on preventive healthcare and precision medicine initiatives further supports market growth. The emergence of cost-optimized testing models and local biotechnology players is expected to enhance accessibility and accelerate adoption across the country.

Multicancer Early Detection DNA Blood Tests Market Share

The Multicancer Early Detection DNA Blood Tests industry is primarily led by well-established companies, including:

- GRAIL, Inc., (U.S.)

- Exact Sciences Corporation, (U.S.)

- Guardant Health (U.S.)

- Freenome Holdings, Inc., (U.S.)

- Burning Rock Biotech Limited, (China)

- Singlera Genomics, Inc., (U.S.)

- Foundation Medicine, Inc., (U.S.)

- Elypta AB (Sweden)

- VolitionRx Limited (Belgium)

- CellMax Life (China)

- StageZero Life Sciences (U.S.)

- C2i Genomics (Israel)

- ArcherDX, Inc., (U.S.)

- 1drop Inc., (U.S.)

- Laboratory for Advanced Medicine, Inc., (U.S.)

- GENECAST Biotechnology Co., Ltd., (China)

- Prenetics Global Limited (Hong Kong)

- Quibim S.L., (Spain)

- Harbinger Health, Inc., (U.S.)

- Myriad Genetics, Inc., (U.S.)

What are the Recent Developments in Global Multicancer Early Detection DNA Blood Tests Market?

- In October 2025, GRAIL released results from its PATHFINDER 2 study, showing that the addition of the Galleri® test to standard cancer screening significantly increased overall cancer detection rates in adults aged 50 and older. The study demonstrated that Galleri® identified cancers that were not detected by conventional screening methods recommended by the U.S. Preventive Services Task Force

- In September 2025, Exact Sciences announced the launch of Cancerguard™, a first-of-its-kind multicancer early detection DNA blood test designed to screen for more than 50 cancer types using a single blood draw. The test integrates multiple biomarker classes, including cfDNA methylation and mutation signals, combined with advanced bioinformatics to improve early-stage cancer detection

- In June 2025, the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation to Guardant Health’s Shield™ multi-cancer detection (MCD) test, recognizing its potential to address unmet needs in early cancer detection. The designation is intended to accelerate regulatory review and clinical development by enabling closer FDA interaction. Shield™ leverages cfDNA-based liquid biopsy technology to identify multiple cancer types from a single blood sample

- In April 2023, research findings presented at the American Association for Cancer Research (AACR) Annual Meeting demonstrated strong performance of a liquid biopsy–based multicancer early detection test capable of detecting 12 different cancer types, including cancers with low DNA shedding. The study showed promising sensitivity for early-stage disease, addressing one of the key challenges in blood-based cancer screening

- In June 2021, GRAIL commercially launched its Galleri® multi-cancer early detection blood test, making it one of the first MCED tests available for clinical use. Galleri® screens for signals associated with more than 50 cancer types and predicts tissue of origin using cfDNA methylation patterns. The launch marked a major milestone in translating MCED research into real-world clinical practice. Galleri® has since been widely used in clinical studies and early adoption programs, positioning it as a benchmark product in the MCED market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.