Global Natural Fertility Supplements Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

4.69 Billion

2024

2032

USD

2.28 Billion

USD

4.69 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 4.69 Billion | |

|

|

|

|

What is the Global Natural Fertility Supplements Market Size and Growth Rate?

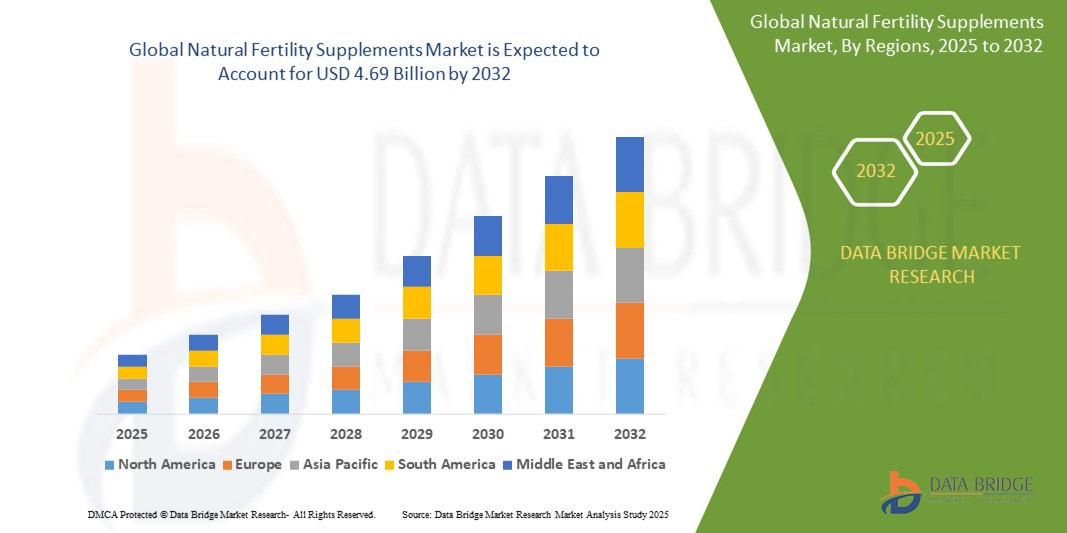

- The global natural fertility supplements market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 4.69 billion by 2032, at a CAGR of 9.40% during the forecast period

- Market growth is driven by rising infertility rates, increasing awareness of holistic reproductive health, and growing preference for non-invasive fertility solutions

- In addition, proactive government initiatives promoting maternal health and the trend toward evidence-based herbal supplements are accelerating adoption across developed and emerging economies

What are the Major Takeaways of Natural Fertility Supplements Market?

- Natural fertility supplements, comprising plant-based extracts, vitamins, and minerals, support reproductive health by enhancing hormonal balance, ovulation, and sperm quality

- Rising infertility concerns due to lifestyle stressors, environmental toxins, and delayed pregnancies are primary growth catalysts

- Asia-Pacific (APAC) dominated the natural fertility supplements market with the largest revenue share of 45.2% in 2024.This dominance is driven by massive population size, high and rising infertility rates in key countries such as India and China

- North America is expected to be the fastest-growing region in the natural fertility supplements market during the forecast period. Growth is driven by high infertility rates, advanced healthcare infrastructure and awareness, high disposable income enabling expenditure on premium supplements, a proactive consumer approach to health, delayed parenthood trends, strong presence of leading supplement brands, and robust e-commerce penetration

- The capsules segment dominated the natural fertility supplements market with the largest market revenue share of 39.6% in 2024, owing to their ease of consumption, extended shelf life, and high bioavailability of active ingredients

Report Scope and Natural Fertility Supplements Market Segmentation

|

Attributes |

Natural Fertility Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Natural Fertility Supplements Market?

“Personalized Supplementation through AI-Powered Wellness Platforms”

- A notable and rising trend in the global natural fertility supplements market is the integration of AI-driven health platforms that offer personalized fertility nutrition recommendations based on biometrics, lifestyle data, and hormonal profiles

- Companies are collaborating with digital health and fertility tracking apps to offer customized supplement regimens for individuals and couples, ensuring optimized dosage and nutrient selection for fertility enhancement

- For instance, Conceive Plus and Premama Wellness have begun integrating their supplement offerings with fertility tracking tools that use AI to recommend products based on ovulation cycles, diet patterns, and hormonal test results

- These AI-powered tools also help monitor progress and adjust formulations dynamically, enhancing user engagement and treatment efficacy

- This trend aligns with growing consumer demand for hyper-personalized health solutions, especially among millennials and Gen Z couples planning pregnancies

- As digital health ecosystems evolve, natural fertility supplements with AI compatibility are gaining traction, especially among tech-savvy consumers seeking precision-based solutions

What are the Key Drivers of Natural Fertility Supplements Market?

- Consumers are increasingly shifting their focus towards natural and holistic approaches to health, including fertility, driven by a growing awareness of the benefits of natural remedies. This heightened awareness is fueled by a desire to avoid pharmaceutical treatments, which may have unwanted side effects or be perceived as less natural

- As individuals become more informed about the potential advantages of natural fertility supplements, including their ability to support reproductive health without synthetic additives, demand for these products is rising

- This trend reflects a broader movement towards integrating natural solutions into health and wellness regimens, as people seek to enhance their overall well-being in a more organic and sustainable manner.

- Consumers are increasingly prioritizing measures that prevent health issues before they arise, aligning with broader trends towards maintaining and improving health through proactive strategies

- This shift is driving the consumption of supplements designed to enhance fertility and overall reproductive health, as individuals look for ways to optimize their well-being and prevent fertility-related challenges

- As preventive health becomes a key focus, natural fertility supplements are gaining traction as part of a comprehensive approach to maintaining reproductive health, reflecting a broader trend towards holistic and proactive health management. The growing emphasis on preventive healthcare is significantly impacting the natural fertility supplements market

Which Factor is challenging the Growth of the Natural Fertility Supplements Market?

- Natural fertility supplements face significant regulatory challenges due to varying standards and requirements across different regions. These regulatory hurdles can complicate market entry and product approval, potentially limiting market growth and affecting the availability of products in certain markets

- The need to comply with diverse regulations, including those related to ingredient safety, health claims, and labeling, poses a barrier for manufacturers

- Efficacy concerns are a notable restraint for the natural fertility supplements market. Consumers may be wary of the effectiveness of these products due to inconsistent results and a lack of strong clinical evidence supporting their benefits

- The perception that natural supplements may not deliver the desired outcomes can deter individuals from using them, impacting market growth

How is the Natural Fertility Supplements Market Segmented?

The market is segmented on the basis of product, end-use, and distribution channel.

• By Product

On the basis of product, the natural fertility supplements market is segmented into capsules, tablets, soft gels, powders, and liquids. The capsules segment dominated the Natural Fertility Supplements market with the largest market revenue share of 39.6% in 2024, owing to their ease of consumption, extended shelf life, and high bioavailability of active ingredients. Capsules are widely preferred by consumers due to their tasteless nature, quicker absorption, and consistent dosage forms.

The soft gels segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by their enhanced bioavailability and consumer preference for fast-dissolving formats. Soft gels also appeal to users looking for easier swallowing and more pleasant ingestion experiences, especially in prenatal and hormonal balance formulations.

• By End-Use

On the basis of end-use, the natural fertility supplements market is segmented into men and women. The women segment held the largest market revenue share of 62.3% in 2024, attributed to the higher prevalence of fertility-related concerns among women, greater awareness of reproductive health, and the wider variety of supplement formulations targeting female fertility. The segment is also supported by increasing healthcare expenditure and rising demand for natural hormone balance and ovulation-support supplements.

The men segment is expected to register the fastest growth from 2025 to 2032, driven by growing awareness about male infertility, improved access to fertility diagnostics, and rising demand for sperm health enhancement supplements. Increased openness around men’s reproductive health and wellness is encouraging product uptake.

• By Distribution Channel

On the basis of distribution channel, the natural fertility supplements market is segmented into OTC (over-the-counter) and prescribed. The OTC segment dominated the market with the largest market revenue share of 68.1% in 2024, primarily due to the rising preference for self-medication, ease of availability across online platforms, pharmacies, and health stores, and the perception of natural supplements as safe alternatives to pharmaceuticals.

The prescribed segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by increasing visits to fertility specialists, physician recommendations, and clinical endorsement of specific supplement formulations for targeted reproductive outcomes.

Which Region Holds the Largest Share of the Natural Fertility Supplements Market?

- Asia-Pacific (APAC) dominated the natural fertility supplements market with the largest revenue share of 45.2% in 2024.This dominance is driven by massive population size, high and rising infertility rates in key countries such as India and China

- Rapidly growing disposable incomes, cultural acceptance and tradition of using herbal/natural remedies for health, and a thriving domestic manufacturing base offering a wide range of products at various price points. Urbanization and increasing health awareness further contribute

China Natural Fertility Supplements Market Insight

China accounted for the largest market share within APAC in 2024. Growth is propelled by the ending of the one-child policy, rising infertility linked to pollution and lifestyle, a huge population, growing middle class with spending power, strong domestic TCM (Traditional Chinese Medicine) companies integrating modern supplements (e.g., Tong Ren Tang), and widespread e-commerce adoption.

India Natural Fertility Supplements Market Insight

India is a major and rapidly growing market within APAC. Drivers include one of the highest infertility rates globally, a vast population, increasing urbanization and stress, rising awareness, a strong tradition of Ayurvedic medicine driving demand for herbal blends (e.g., Himalaya, Zydus), and a growing middle class. Affordability and local brands are key.

Which Region is the Fastest Growing Region in the Natural Fertility Supplements Market?

North America is expected to be the fastest-growing region in the natural fertility supplements market during the forecast period. Growth is driven by high infertility rates, advanced healthcare infrastructure and awareness, high disposable income enabling expenditure on premium supplements, a proactive consumer approach to health, delayed parenthood trends, strong presence of leading supplement brands, and robust e-commerce penetration. Increasing openness about fertility struggles also fuels demand.

U.S. Natural Fertility Supplements Market Insight

The U.S. captured the overwhelming majority of the North American market share in 2024. Growth is fueled by the highest national healthcare spending, widespread consumer familiarity with supplements, strong D2C brand presence (e.g., Bird&Be, Fairhaven), extensive online retail, recommendations from a large network of fertility clinics, and high consumer demand for clinically-backed and clean-label products. Trends such as personalized nutrition strongly resonate here.

Canada Natural Fertility Supplements Market Insight

Canada exhibits steady growth, driven by similar factors to the US: high infertility rates, delayed childbearing, health consciousness, and access to US and international brands. The regulatory environment (Health Canada NPNs) provides some structure. Affordability and insurance coverage nuances can be differentiating factors compared to the US.

Which are the Top Companies in Natural Fertility Supplements Market?

The natural fertility supplements industry is primarily led by well-established companies, including:

- Royal Cosun (Netherlands)

- Greenyard (Belgium)

- Himalaya Food International Ltd. (India)

- J.R. Simplot Company (U.S.)

- Lamb Weston Holdings, Inc. (U.K.)

- General Mills, Inc. (U.S.)

- Mondelez International, Inc. (U.S.)

- THE KRAFT HEINZ COMPANY (U.S.)

- Royal Ingredients Group (Netherlands)

- Pioneer Industries Limited (India)

- Cargill, Incorporated (U.S.)

- Meelunie B.V. (Netherlands)

- Permolex Ltd (Canada)

- Amilina AB (Lithuania)

- Z&F Sungold Corporation (China)

- Tereos SCA (France)

- Ardent Mills LLC (U.S.)

- Bryan W. Nash & Sons Limited (U.K.)

What are the Recent Developments in Global Natural Fertility Supplements Market?

- In April 2023, Indian pharmaceutical company Mankind Pharma established a dedicated manufacturing facility in Udaipur, Rajasthan, focused on the production of Duphaston (dydrogesterone), a synthetic hormone commonly used to prevent miscarriages and treat infertility. This strategic expansion reflects the growing demand for fertility-related therapeutics in India and strengthens the company’s position in the fertility supplements market

- In December 2022, Laboratorio Reig Jofre, in collaboration with the Barcelona Center for Male Infertility and Analysis (CIMAB), launched TRIFERTY-ATM, a dietary supplement designed to support male fertility by aiding sperm formation, energy metabolism, and reducing oxidative stress. This product highlights the increasing attention to male reproductive health and expands the offerings in the male fertility supplements segment

- In April 2022, Wellbeing Nutrition, a leading name in plant-based health products, introduced SLOW, a time-release nutraceutical series for both men and women, featuring 13 targeted supplements including options to support fertility health.

- This launch underscores the shift toward time-conscious, holistic wellness solutions in the fertility supplement industry

- In April 2022, Fertility Nutraceuticals, LLC rolled out two advanced prenatal vitamin supplements—Advanced Prenatal and Advanced Prep 35-39—which include the full daily value of choline for pregnant and nursing women, with the latter containing 25 mg of patented FERTINATAL (micronized DHEA), tailored for women aged 35–39. These offerings meet the specialized nutritional needs of women in advanced reproductive age, highlighting targeted innovation in prenatal care

- In April 2022, Ovaterra by Fertility Nutraceuticals also launched Advanced Prenatal and Advanced Prep 35-39, both formulated with individually packaged servings to provide on-the-go convenience and complete prenatal nutrition, particularly for women aged 35 to 39. This development reinforces the trend toward age-specific, clinically supported fertility supplements designed for modern, mobile lifestyles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Fertility Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Fertility Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Fertility Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.