Global Oleo Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

25.81 Billion

USD

40.21 Billion

2024

2032

USD

25.81 Billion

USD

40.21 Billion

2024

2032

| 2025 –2032 | |

| USD 25.81 Billion | |

| USD 40.21 Billion | |

|

|

|

|

Oleo Chemicals Market Analysis

The oleochemicals market is experiencing significant growth, driven by the rising demand for bio-based chemicals across industries such as personal care, pharmaceuticals, food, and industrial applications. Derived from natural sources such as vegetable oils and animal fats, oleochemicals serve as sustainable alternatives to petrochemical-based products, aligning with the global push for eco-friendly solutions. Technological advancements, including enzyme-based processing, green chemistry, and improved hydrogenation techniques, have enhanced product efficiency, purity, and cost-effectiveness. The adoption of oleochemicals in biodegradable plastics, lubricants, and surfactants is further fueling market expansion. In addition, the shift toward sustainable sourcing and traceable supply chains has encouraged key players to invest in certified raw materials and renewable feedstocks. Asia-Pacific dominates the market due to its strong raw material base and expanding end-use industries, while North America and Europe are witnessing growth through modernized production facilities and increasing regulatory support for bio-based products. As industries seek greener and more efficient alternatives, ongoing advancements in bio-refining, transesterification, and nanotechnology applications position the oleochemicals market for continued expansion in the coming years.

Oleo Chemicals Market Size

The global oleo chemicals market size was valued at USD 25.81 billion in 2024 and is projected to reach USD 40.21 billion by 2032, with a CAGR of 5.70 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Oleo Chemicals Market Trends

“Growing Adoption of Sustainable and Bio-Based Raw Materials”

One significant trend in the oleo chemicals market is the growing adoption of sustainable and bio-based raw materials to meet rising consumer demand for eco-friendly and biodegradable products. Companies are increasingly shifting toward certified sustainable palm oil (CSPO), non-GMO soybean oil, and waste-based feedstocks to reduce their carbon footprint and align with global sustainability goals. This shift is particularly evident in the personal care and cosmetics industry, where brands seek plant-based emulsifiers, surfactants, and emollients derived from oleochemicals. For instance, BASF SE launched Rainforest Alliance-certified personal care ingredients based on coconut oil, ensuring ethical sourcing and environmental responsibility. In addition, technological advancements in enzymatic processing and green chemistry are improving the efficiency of oleochemical production, making bio-based alternatives more competitive against petrochemical counterparts. As regulatory frameworks tighten and consumer preferences shift toward natural and renewable ingredients, the trend of sustainable oleochemicals is expected to drive long-term market growth.

Report Scope and Oleo Chemicals Market Segmentation

|

Attributes |

Oleo Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Cargill, Incorporated (U.S.), SABIC (Saudi Arabia), Vantage Specialty Chemicals, Inc. (U.S.), Kuala Lumpur Kepong Berhad (Malaysia), Emery Oleochemicals (Malaysia), Kao Corporation (Japan), Evonik Industries (Germany), Nouryon (Netherlands), IOI Corporation Berhad (Malaysia), Wilmar International Ltd (Singapore), Godrej Industries Group (India), Oleon NV (Belgium), Chemrez (Philippines), BASF (Germany), Akzo Nobel N.V. (Netherlands), and Emery Oleochemicals (Malaysia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oleo Chemicals Market Definition

Oleo chemicals are bio-based chemical compounds derived from natural oils and fats, primarily sourced from vegetable oils (such as palm, soybean, and coconut oil) and animal fats (such as tallow). They serve as sustainable alternatives to petrochemicals and are widely used in industries such as personal care, pharmaceuticals, food, detergents, lubricants, and polymers.

Oleo Chemicals Market Dynamics

Drivers

- Rising Demand for Bio-Based and Sustainable Chemicals

The increasing focus on environmental sustainability and the shift toward bio-based alternatives are key drivers of the oleochemicals market. Consumers and industries are seeking biodegradable, non-toxic, and renewable chemical solutions to replace petrochemical-based products. Governments worldwide are implementing stringent environmental regulations and promoting the use of low-carbon and sustainable materials in various industries, further accelerating this transition. For instance, the European Union’s Renewable Energy Directive (RED II) encourages the use of bio-based feedstocks, boosting demand for oleochemical-derived lubricants, surfactants, and polymers. In addition, leading companies such as Wilmar International and IOI Corporation Berhad are increasingly investing in certified sustainable palm oil (CSPO) to meet consumer expectations for eco-friendly products. As industries align with green chemistry principles, the demand for oleochemicals in packaging, detergents, and bioplastics continues to rise, positioning them as an essential component of the global sustainability movement.

- Expansion of the Personal Care and Cosmetics Industry

The personal care and cosmetics industry is experiencing rapid growth, significantly contributing to the increasing demand for oleochemicals. Consumers today prefer natural and plant-based ingredients in skincare, haircare, and beauty products, driving the adoption of oleochemical-derived emollients, emulsifiers, and surfactants. For instance, BASF SE introduced Rainforest Alliance-certified personal care ingredients based on coconut oil, reinforcing the industry’s move toward ethical sourcing and sustainability. In addition, fatty acids, fatty alcohols, and glycerol derived from vegetable oils are widely used in moisturizers, shampoos, and sunscreens, offering biodegradable and skin-friendly alternatives to synthetic chemicals. The surge in organic and clean-label beauty trends is also prompting brands to reformulate their products with plant-derived oleochemicals. As consumer awareness and regulatory requirements push for cleaner formulations, the personal care industry’s expansion remains a major driver of oleochemical market growth.

Opportunities

- Increasing Technological Advancements in Oleochemical Production

The oleochemicals market is benefiting significantly from technological advancements that enhance production efficiency, product purity, and sustainability. Innovations in enzymatic processing, green chemistry, and biorefinery techniques have led to the development of high-performance oleochemical derivatives with improved biodegradability and lower carbon footprints. For instance, Evonik Industries has introduced catalyst-based hydrogenation technology, which enhances the yield and purity of fatty alcohols and acids, making them more suitable for pharmaceutical and cosmetic applications. In addition, the integration of nanotechnology in oleochemical formulations is expanding their applications in bioplastics, coatings, and high-performance lubricants. These advancements are creating new market opportunities by enabling manufacturers to produce high-value, specialty oleochemicals that meet the evolving needs of industries focused on sustainability and performance efficiency. As demand for eco-friendly chemicals grows, continued investment in innovative oleochemical processing is expected to drive long-term market expansion.

- Growing Demand in Food and Beverage Sector

The food and beverage industry is increasingly incorporating oleochemicals as key ingredients in processing, preservation, and formulation. Glycerol, fatty acids, and methyl esters derived from plant-based sources are widely used as emulsifiers, stabilizers, and preservatives in food production. For instance, Kuala Lumpur Kepong Berhad’s DavosLife E3 is a bio-based ingredient that offers clinically proven health benefits, including heart and brain health support, making it a sought-after additive in functional food and nutrition applications. The rising consumer preference for natural, clean-label, and plant-based ingredients is further propelling the adoption of bio-derived oleochemicals in bakery, confectionery, dairy, and beverage products. In addition, increasing food safety regulations and sustainability initiatives are encouraging manufacturers to replace synthetic additives with renewable oleochemical-based alternatives. This growing application scope presents a lucrative market opportunity for oleochemical producers to expand their food-grade product offerings and cater to the health-conscious and eco-aware consumer base.

Restraints/Challenges

- Competition from Petrochemical Alternatives

One of the significant challenges in the Oleo Chemicals Market is the intense competition from petrochemical-based alternatives, which often provide cost advantages, higher yield efficiencies, and better performance in certain applications. Despite being derived from renewable sources, oleo chemicals struggle to match the scalability and price competitiveness of petrochemical substitutes. Industries such as plastics, lubricants, surfactants, and pharmaceuticals continue to rely on petrochemical-derived fatty alcohols, esters, and glycerin, limiting the adoption of oleo chemicals. For instance, in the plastics industry, petroleum-based polyols used in polyurethane foams are often preferred over oleo chemical-based bio-polyols due to their lower production costs and well-established supply chains. As a result, manufacturers of oleo chemicals face the challenge of proving superior performance, cost-efficiency, and long-term sustainability benefits to compete effectively in the market.

- Regulatory and Compliance Challenges

The Oleo Chemicals Market operates in a highly regulated environment, where manufacturers must adhere to strict global and regional regulations related to product safety, sustainability, and environmental impact. Compliance requirements such as REACH (Europe), FDA (U.S.), and the Roundtable on Sustainable Palm Oil (RSPO) certification impose stringent guidelines on sourcing, production, and labeling. Companies must also ensure compliance with carbon footprint regulations and anti-deforestation policies, particularly for palm oil-derived oleo chemicals. For instance, the European Union’s Deforestation-Free Regulation (EUDR) has tightened restrictions on sourcing palm oil, making it difficult for manufacturers to operate without certified sustainable supply chains. Non-compliance can lead to export restrictions, financial penalties, and loss of consumer trust, adding to operational challenges. As regulatory frameworks continue to evolve, oleo chemical producers must invest heavily in supply chain transparency, sustainability certifications, and compliance monitoring, increasing overall costs and complexity in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Oleo Chemicals Market Scope

The market is segmented on the basis of type, form, method, feedstock, application, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Fatty Acid

- Fatty Alcohol

- Methyl Ester

- Glycerol

- Others

Form

- Liquid

- Solid

Method

- Hydrolysis

- Transesterification

- Hydrogenation

- Fractionation

Feedstock

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

Application

- Pharmaceutical and Personal Care

- Food and Beverages

- Soaps and Detergents

- Polymers

- Others

Sales Channel

- Direct

- Indirect

Oleo Chemicals Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, form, method, feedstock, application, and sales channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

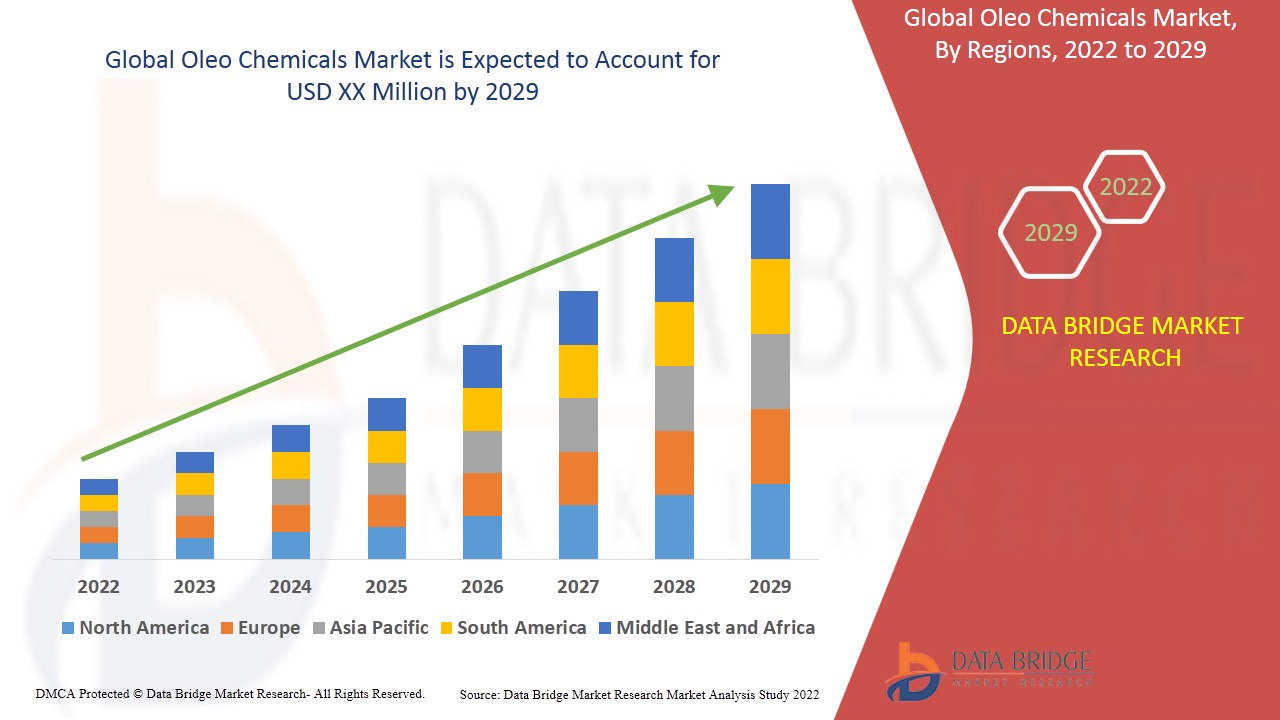

Asia-Pacific dominates the oleo chemicals market due to its abundant availability of feedstock such as palm oil, coconut oil, and soybean oil, which serve as primary raw materials. The region benefits from a well-established supply chain and cost-effective production facilities, enabling large-scale manufacturing. In addition, the rapid growth of key end-use industries, including pharmaceuticals, personal care, food, and detergents, is driving demand for oleo chemical-based products. With continuous investments in industrial expansion and technological advancements, Asia-Pacific remains a dominant force in the global oleo chemicals market.

North America is expected to witness fastest growth in the oleo chemicals market during the forecast period, driven by recent advancements and modernization in manufacturing facilities. The region is investing heavily in cutting-edge production technologies, enhancing efficiency and sustainability in oleo chemical processing. In addition, the increasing demand for bio-based chemicals in industries such as personal care, pharmaceuticals, and food is fueling market expansion. With ongoing R&D efforts and infrastructure upgrades, North America is poised to strengthen its position in the global oleo chemicals industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Oleo Chemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Oleo Chemicals Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- SABIC (Saudi Arabia)

- Vantage Specialty Chemicals, Inc. (U.S.)

- Kuala Lumpur Kepong Berhad (Malaysia)

- Emery Oleochemicals (Malaysia)

- Kao Corporation (Japan)

- Evonik Industries (Germany)

- Nouryon (Netherlands)

- IOI Corporation Berhad (Malaysia)

- Wilmar International Ltd (Singapore)

- Godrej Industries Group (India)

- Oleon NV (Belgium)

- Chemrez (Philippines)

- BASF (Germany)

Latest Developments in Oleo Chemicals Market

- In May 2024, Corbion entered into a partnership agreement with IMCD, a key distributor and formulating company specializing in specialty chemicals and ingredients, to include Corbion’s various products in the food & beverage sector in Thailand

- In April 2024, Vantage Specialty Chemicals expanded the production capacity of METAUPON NMT (N-Methyl Taurine)* at its Leuna site, aiming to meet the growing consumer demand in the personal care, industrial, and household sectors

- In January 2024, Godrej Industries signed an MoU with the Gujarat government to invest USD 71.8 million over the next four years, increasing the production capacity of oleochemicals to cater to the rising demand in the personal care, pharmaceuticals, and food industries

- In August 2022, the Kuala Lumpur Kepong Berhad Group introduced DavosLife E3, a product designed for use in food and nutrition applications, offering clinically proven health benefits for heart, liver, and brain health

- In July 2022, BASF launched the first Rainforest Alliance-certified personal care ingredients derived from coconut oil, establishing a renewable supply chain to enhance sustainability and maximize revenue

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oleo Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oleo Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oleo Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.