Global Pea Flakes Market

Market Size in USD Billion

CAGR :

%

USD

2.29 Billion

USD

5.10 Billion

2024

2032

USD

2.29 Billion

USD

5.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.29 Billion | |

| USD 5.10 Billion | |

|

|

|

|

Pea Flakes Market Size

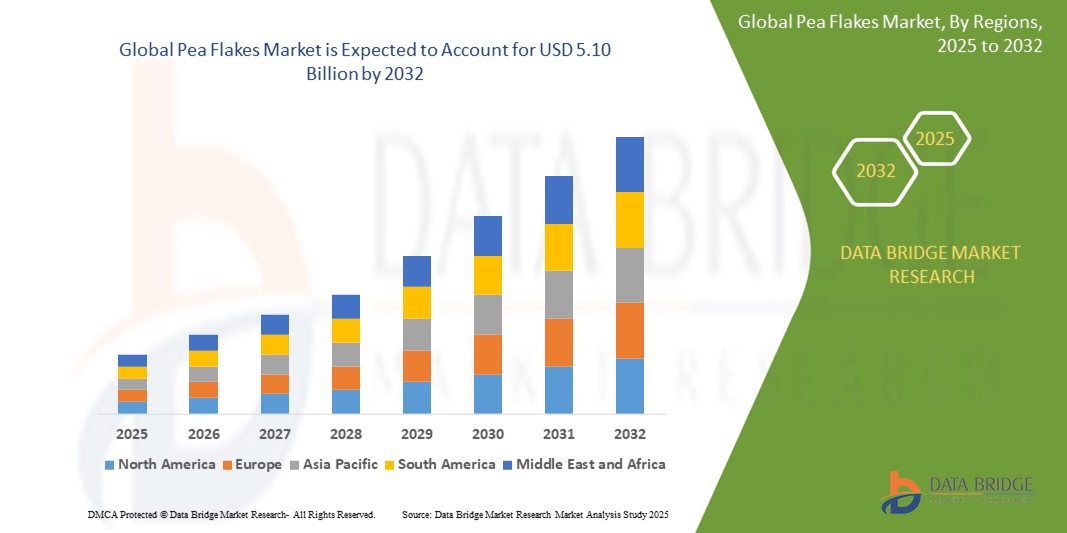

- The global pea flakes market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 5.10 billion by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by rising consumer demand for clean-label, plant-based, and protein-rich food ingredients, with pea flakes gaining traction across food processing, pet food, and feed sectors due to their nutritional benefits and functional versatility

- Furthermore, increasing awareness of sustainable agriculture and the shift toward allergen-free and gluten-free diets are positioning pea flakes as a preferred ingredient in modern formulations. These converging factors are accelerating adoption across industries, thereby significantly boosting the market's growth

Pea Flakes Market Analysis

- Pea flakes are flat, dehydrated pieces of peas that are commonly used in animal feed, particularly for pets such as rabbits, guinea pigs, and other small animals. These flakes are made by pressing and rolling peas, then drying them. They retain much of the nutritional content of whole peas, such as protein, fiber, and vitamins, making them a healthy and convenient feed option

- The escalating demand for pea flakes is primarily driven by the global shift toward plant-based diets, rising consumer preference for allergen-free and gluten-free ingredients, and increasing adoption in sustainable and functional food formulations

- North America dominated the pea flakes market with a share of 35.1% in 2024, due to growing demand for plant-based protein ingredients across food processing and animal nutrition sectors

- Asia-Pacific is expected to be the fastest growing region in the pea flakes market with a share of during the forecast period due to rising demand for plant-based and protein-rich ingredients amid rapid urbanization and dietary diversification

- Food processing segment dominated the market with a market share of 36.4% in 2024, due to the rising use of pea flakes in clean-label and plant-based food formulations. Food manufacturers are increasingly incorporating pea flakes for their high fiber and protein content, appealing to vegan, vegetarian, and allergen-conscious consumers

Report Scope and Pea Flakes Market Segmentation

|

Attributes |

Pea Flakes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pea Flakes Market Trends

“Increasing Interest in Sustainable Farming”

- A significant trend in the global pea flakes market is the growing consumer and industry interest in sustainably sourced ingredients, which is encouraging wider adoption of peas cultivated using eco-friendly farming practices

- For instance, companies such as Benson Hill are investing in vertically integrated supply chains and sustainable agriculture technologies to reduce environmental impact while improving the nutritional profile of plant-based ingredients such as pea flakes

- Sustainable farming practices, including crop rotation and minimal pesticide use, support soil health and also align with clean-label trends and environmental values held by conscious consumers

- The traceability of raw materials and ethical sourcing are becoming more important in buyer decision-making, especially for food processors and retailers targeting the premium health and wellness segment

- With growing regulatory and consumer pressure to reduce carbon footprints, brands are increasingly marketing their use of sustainably sourced pea flakes in product formulations, from snacks to pet food

- This shift towards environmentally responsible production and transparent supply chains is expected to further drive demand for pea flakes, positioning them as a preferred sustainable protein and fiber source in global markets

Pea Flakes Market Dynamics

Driver

“Rising Demand for Plant-Based Diets”

- The global rise in plant-based eating habits, influenced by health, environmental, and ethical concerns, is a major driver of pea flakes demand across food, feed, and pet food sectors

- For instance, Gold&Green Foods introduced protein flakes made from pea, oat bran, and fava bean protein, meeting consumer demand for versatile, high-protein, and plant-based ingredients in clean-label applications

- As consumers increasingly seek gluten-free, allergen-friendly alternatives to soy and wheat, pea flakes offer a nutritionally dense and digestible option for a wide range of applications including snacks, meat alternatives, and cereal-based products

- In the pet food industry, pea flakes are gaining momentum as a hypoallergenic protein source suitable for sensitive animals, while in aqua feed, they support sustainable aquaculture practices. Food manufacturers are responding to this demand by reformulating existing products and launching new ones featuring pea flakes, thereby expanding the market across both developed and emerging economies

- The compatibility of pea flakes with current trends in health and wellness, clean-label transparency, and environmentally responsible sourcing makes them a critical component of modern plant-based diets

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Volatility in pea crop yields due to climate conditions, regional supply-demand imbalances, and trade disruptions presents a challenge to the consistent pricing and availability of pea flakes

- For instance, drought conditions in key pea-producing countries such as Canada have led to sharp fluctuations in yellow pea prices, impacting input costs for manufacturers using pea flakes as a core ingredient. This pricing unpredictability can affect profit margins for food and feed processors, especially in price-sensitive markets where cost efficiency is a key consideration

- Moreover, the dependence on a limited number of major suppliers or geographies for raw peas can create vulnerabilities in the supply chain, hindering long-term production planning

- Smaller manufacturers may face challenges in securing high-quality, competitively priced pea flakes, potentially limiting their ability to scale production or maintain price parity with conventional alternatives

- Mitigating this issue will require investments in diversified sourcing strategies, local production, and partnerships with growers to ensure more stable supply chains and pricing models for pea flakes over the long term

Pea Flakes Market Scope

The market is segmented on the basis of nature, type, end-use, packaging, application, and distribution channel.

• By Nature

On the basis of nature, the pea flakes market is segmented into organic and conventional. The conventional segment accounted for the largest revenue share in 2024, primarily due to its widespread availability, cost-effectiveness, and strong acceptance among food processors and feed manufacturers. Conventional pea flakes are widely used in both human and animal consumption, particularly in regions where organic certification is limited or price-sensitive purchasing prevails. The stable yield and lower input costs associated with conventional farming practices further support its dominant market presence.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness among consumers and growing demand for clean-label, non-GMO, and pesticide-free products. Increasing adoption of organic feed ingredients in pet food and aqua feed, along with stricter food safety regulations and sustainable sourcing practices, are accelerating demand for organically produced pea flakes.

• By Type

On the basis of type, the market is segmented into yellow peas and green peas. Yellow peas held the largest market share in 2024 due to their higher protein content, greater digestibility, and more widespread cultivation. Their versatility in food processing applications such as protein isolates, soups, and snacks contributes to consistent demand across both B2B and B2C markets. Yellow peas are also preferred in animal feed due to their lower antinutritional factors compared to green peas.

The green peas segment is projected to register the highest growth during the forecast period, largely attributed to their expanding use in health foods and specialty dietary products. Green pea flakes appeal to health-conscious consumers due to their slightly sweeter taste and vibrant color, and they are gaining traction in retail and gourmet food segments.

• By End-Use

On the basis of end-use, the market is segmented into food processing, animal feed, aqua feed, and household/retail. The food processing segment dominated the market in 2024 due to its extensive use of pea flakes in ready-to-eat meals, baked goods, extruded snacks, and plant-based proteins. Manufacturers value pea flakes for their natural texture, protein profile, and gluten-free nature, which align with current health and wellness trends.

The aqua feed segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for sustainable and plant-based aquaculture feed alternatives. With pressure to reduce fishmeal dependency and cost, pea flakes offer an eco-friendly and nutritious solution, particularly in regions investing in sustainable fish farming.

• By Packaging

On the basis of packaging the market is segmented into retail, pouches, paper bags, tins, and bulk. The bulk packaging segment dominated in 2024, driven by strong demand from food processors and feed manufacturers requiring large volumes for industrial use. Bulk packaging ensures cost efficiency in transportation and storage, making it the preferred option for B2B buyers.

The pouches segment is anticipated to grow at the fastest rate from 2025 to 2032, as consumer preference shifts toward convenient, resealable, and lightweight packaging for household use. Pouches are increasingly used in retail channels to meet demand for smaller, user-friendly pack sizes, especially in the health food and pet food segments.

• By Application

On the basis of application, the market is segmented into food processing and animal feed. Food processing held the highest market share of 36.4% in 2024, supported by the rising use of pea flakes in clean-label and plant-based food formulations. Food manufacturers are increasingly incorporating pea flakes for their high fiber and protein content, appealing to vegan, vegetarian, and allergen-conscious consumers.

The animal feed segment is expected to grow at the fastest pace through 2032, driven by the rising need for alternative protein sources in livestock and pet nutrition. Pea flakes offer digestibility and amino acid profiles favorable for animal health, making them a viable supplement or replacement for conventional grains and soy in feed mixes.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B/Direct, B2C/Indirect, supermarkets/hypermarkets, modern grocery stores, specialty stores, pet stores, and online retailers. The B2B/Direct segment accounted for the largest revenue share in 2024, supported by the consistent supply chain relationships between manufacturers and bulk buyers such as food and feed processors. Direct procurement reduces cost margins and enhances traceability, particularly important in feed-grade and organic segments.

Online retailers are forecast to grow at the fastest rate between 2025 and 2032, as consumers increasingly turn to e-commerce platforms for convenience, variety, and better access to specialty or organic pea flakes. Enhanced digital marketing and doorstep delivery are also enabling small brands and niche products to thrive online.

Pea Flakes Market Regional Analysis

- North America dominated the pea flakes market with the largest revenue share of 35.1% in 2024, driven by growing demand for plant-based protein ingredients across food processing and animal nutrition sectors

- Consumers and manufacturers in the region are increasingly incorporating pea flakes into functional foods, pet food, and clean-label products due to their high protein and fiber content

- The region’s well-established food processing industry, rising interest in sustainable feed alternatives, and strong distribution networks contribute to North America’s market leadership

U.S. Pea Flakes Market Insight

The U.S. pea flakes market captured the largest revenue share within North America in 2024, supported by the rising popularity of vegan and allergen-free diets. Increasing demand for natural and minimally processed ingredients is encouraging the use of pea flakes in snacks, meat alternatives, and sports nutrition. In addition, the animal feed sector is adopting pea flakes as a cost-effective and digestible plant-based protein source, enhancing market penetration across commercial and household applications.

Europe Pea Flakes Market Insight

The Europe pea flakes market is projected to grow at a robust CAGR throughout the forecast period, driven by stringent regulations promoting clean-label and sustainable ingredients. Rising consumer interest in plant-based foods and the increasing adoption of pea-based formulations in bakery, breakfast cereals, and extruded snacks are fueling growth. The region also sees expanding use of pea flakes in eco-conscious animal and aqua feed, aligned with European sustainability goals.

U.K. Pea Flakes Market Insight

The U.K. pea flakes market is expected to register strong growth, propelled by a surging demand for organic, non-GMO ingredients in both human and animal nutrition. The expanding vegan food sector and heightened consumer awareness regarding health and sustainability are driving adoption. In addition, the rise in pet ownership and the demand for premium pet food products support growth in the pea flakes segment within the U.K.

Germany Pea Flakes Market Insight

Germany’s pea flakes market is anticipated to grow steadily, underpinned by its leadership in plant-based innovation and functional food development. German consumers prioritize natural, traceable, and high-protein ingredients, making pea flakes an appealing option across a variety of food applications. The country’s strong focus on sustainability and the circular economy further accelerates the use of pea flakes in feed and food industries.

Asia-Pacific Pea Flakes Market Insight

The Asia-Pacific pea flakes market is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for plant-based and protein-rich ingredients amid rapid urbanization and dietary diversification. Countries such as China, India, and Japan are witnessing increased consumption of functional and processed foods, as well as an expanding animal feed sector. Government support for sustainable agriculture and growing awareness of nutritional health benefits are further propelling regional demand.

Japan Pea Flakes Market Insight

The Japan pea flakes market is gaining traction due to the rising health consciousness and preference for traditional foods with modern nutritional enhancements. With an aging population and a growing demand for easy-to-digest, protein-rich ingredients, pea flakes are increasingly used in soups, porridges, and health supplements. The alignment with clean-label and minimally processed trends supports broader adoption in Japan’s food industry.

China Pea Flakes Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a massive consumer base, strong domestic production capacity, and demand for cost-effective protein sources. The increasing popularity of meat alternatives, coupled with the integration of pea flakes in animal feed and aquaculture, is expanding the market. Local manufacturers are capitalizing on export opportunities and domestic consumption to reinforce China’s leadership in the regional market.

Pea Flakes Market Share

The pea flakes industry is primarily led by well-established companies, including:

- Nutiva Inc (U.S.)

- The Simply Good Food Co (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- Danone SA (France)

- Orgain Inc. (U.S.)

- True Nutrition (U.S.)

- Garden Valley Foods. (U.S.)

- SOTEXPRO (France)

- JR FARM GmbH (Germany)

- B P Milling Ltd (U.K.)

- Dumoulin BV (Belgium)

- Inland Empire Foods Inc (U.S.)

- Wheeky Pets, LLC. (U.S.)

Latest Developments in Global Pea Flakes Market

- In January 2022, Benson Hill’s acquisition of ZFS Creston marked a strategic move to enhance its plant-based ingredient portfolio, reinforcing the market’s momentum toward diversified, sustainable, and high-quality protein sources. This acquisition is expected to accelerate innovation and supply chain efficiency within the pea flakes and broader plant-based ingredients market

- In October 2021, Gold&Green Foods launched protein granules and flakes made from oat bran, pea, and fava bean protein, contributing to the expansion of versatile, nutrient-rich plant-based solutions. By offering ingredients with a neutral flavor profile, adaptable texture, and high nutritional value, this development supports the growing demand for functional, clean-label products across food applications, further stimulating market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pea Flakes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pea Flakes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pea Flakes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.