Global Personal Hygiene Products Market

Market Size in USD Billion

CAGR :

%

USD

597.74 Billion

USD

844.86 Billion

2024

2032

USD

597.74 Billion

USD

844.86 Billion

2024

2032

| 2025 –2032 | |

| USD 597.74 Billion | |

| USD 844.86 Billion | |

|

|

|

|

Personal Hygiene Products Market Size

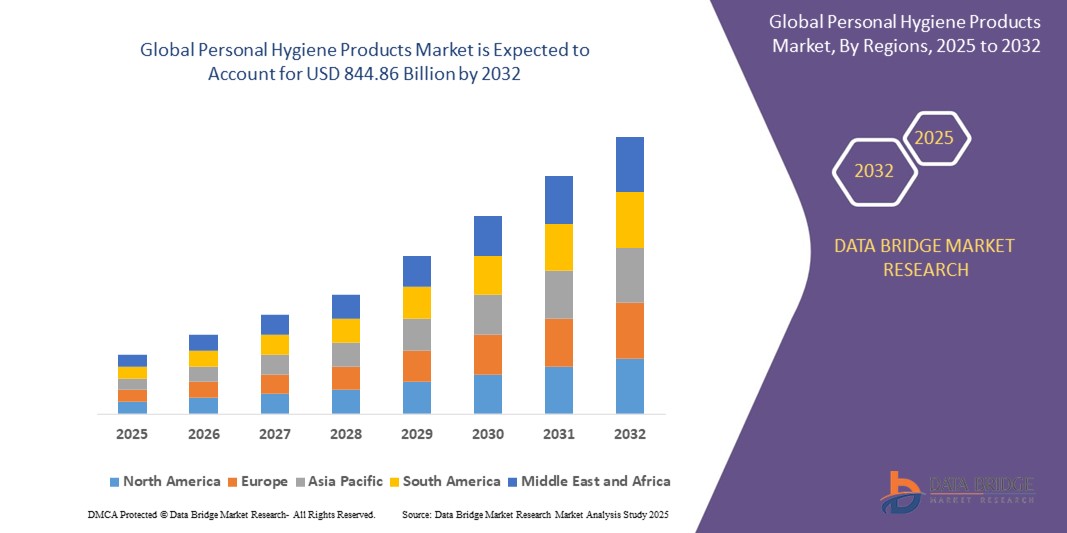

- The global personal hygiene products market was valued at USD 597.74 billion in 2024 and is expected to reach USD 844.86 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.42%, primarily driven by the increasing consumer awareness towards health and hygiene

- This growth is driven by factors such as the rising global population, increased spending on personal care, and growing demand for natural and eco-friendly hygiene products

Personal Hygiene Products Market Analysis

- Personal hygiene products are essential daily-use items that help maintain cleanliness, prevent infections, and promote overall health and well-being. This category includes items such as soaps, shampoos, toothpaste, sanitary products, deodorants, and more

- The demand for personal hygiene products is significantly driven by rising health consciousness, rapid urbanization, and increasing awareness about hygiene practices. The COVID-19 pandemic further accelerated the global shift toward routine hygiene maintenance and preventive healthcare

- The Asia-Pacific region stands out as one of the dominant markets for personal hygiene products, supported by its large population base, rising disposable income, and growing access to hygiene education

- For instance, countries such as India and China have witnessed significant growth in hygiene product consumption due to government initiatives such as Swachh Bharat Abhiyan and the increasing penetration of e-commerce platforms that make products widely accessible

- Globally, personal hygiene products rank among the top-selling consumer health goods, playing a vital role not only in disease prevention but also in enhancing consumer lifestyle and self-care practices

Report Scope and Personal Hygiene Products Market Segmentation

|

Attributes |

Personal Hygiene Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Personal Hygiene Products Market Trends

“Increasing Demand for Sustainable and Eco-friendly Products”

- One prominent trend in the global personal hygiene products market is the growing demand for sustainable and eco-friendly products

- Consumers are becoming increasingly conscious of the environmental impact of their purchasing decisions, driving the demand for personal hygiene items made with natural ingredients and eco-friendly packaging

- For instance, biodegradable or recyclable packaging, as well as products free from harmful chemicals, are gaining popularity as consumers prioritize sustainability in their daily routines

- Additionally, many brands are innovating by offering refillable packaging and reducing the carbon footprint of production processes, aligning with global efforts to reduce plastic waste

- This trend is reshaping the market landscape, with an increasing number of consumers opting for environmentally responsible alternatives, pushing companies to invest in sustainable product development and packaging solutions

Personal Hygiene Products Market Dynamics

Driver

“Rising Awareness of Health and Hygiene Practices”

- The increasing awareness of personal health and hygiene is significantly driving the demand for personal hygiene products globally

- With the ongoing emphasis on cleanliness and prevention, especially following the COVID-19 pandemic, consumers are more focused on maintaining proper hygiene to prevent illnesses and infections

- The rising awareness about the importance of maintaining hygiene in both personal and public spaces is encouraging consumers to invest in products such as sanitizers, disinfectants, and personal care items

- Government initiatives and public health campaigns promoting hygiene practices further amplify this trend, particularly in emerging markets where access to hygiene products is expanding rapidly

- As people become more health-conscious and hygiene-focused, the demand for personal hygiene products continues to grow, fostering innovation and product development in the market

For instance,

- In 2020, a report by the World Health Organization emphasized the importance of hand hygiene to prevent the spread of infectious diseases, which led to a surge in demand for hand sanitizers, soaps, and disinfectants across global markets

- As a result of the rising awareness of personal health and hygiene, there is a significant boost in demand for a wide variety of personal hygiene products, further propelling market growth

Opportunity

“Leveraging Digitalization and Smart Technology in Personal Hygiene Products”

- The integration of smart technology and digitalization in personal hygiene products is an emerging opportunity, offering new ways for consumers to monitor and enhance their hygiene routines

- Smart devices such as electric toothbrushes with connectivity features, UV sanitizing devices, and health-tracking personal care products are becoming increasingly popular, providing consumers with personalized insights and convenience

- Additionally, the use of mobile apps that sync with hygiene products allows for better tracking of personal hygiene routines, offering reminders and guidance to improve effectiveness and consistency

For instance,

- In March 2024, according to an article published in Consumer Electronics Daily, smart toothbrushes with AI-powered sensors now offer personalized feedback to consumers on brushing techniques and oral hygiene habits, helping them improve their dental care routines. These products track brushing time, pressure, and coverage to ensure optimal oral hygiene

- In June 2023, a report from Market Research Future highlighted the growth of UV sterilizers for personal care products, especially in Asia-Pacific, as consumers increasingly prioritize hygiene and cleanliness, driven by the ongoing emphasis on sanitization in the wake of the pandemic

- The integration of digital and smart technology in personal hygiene products provides a unique opportunity for brands to innovate, creating more customized, data-driven products that enhance user experience, improve hygiene outcomes, and appeal to a tech-savvy consumer base

Restraint/Challenge

“Rising Raw Material Costs and Supply Chain Disruptions”

- The increasing cost of raw materials, such as natural ingredients, packaging, and chemicals, is becoming a significant challenge for the global personal hygiene products market

- Price hikes in essential components like plastics, paper, and bio-based materials are forcing manufacturers to either absorb the costs or pass them onto consumers, potentially limiting affordability

- Additionally, global supply chain disruptions, such as those caused by the COVID-19 pandemic and geopolitical tensions, have resulted in delays and shortages of raw materials, further affecting production schedules and product availability

For instance,

- In February 2024, according to a report published by Packaging Digest, the rising cost of sustainable packaging materials is impacting the pricing strategy of personal hygiene products, as brands are striving to maintain their eco-friendly initiatives while managing higher operational costs

- In March 2023, an article from Supply Chain Digital highlighted how ongoing supply chain challenges, including port congestion and labor shortages, have led to delays in the production and distribution of personal hygiene items, thereby causing inventory shortages and increased costs for both manufacturers and consumers

- Consequently, these challenges can hinder the growth of the market, especially for small-to-medium-sized enterprises that may struggle to absorb these rising costs, potentially limiting product availability and innovation

Personal Hygiene Products Market Scope

The market is segmented on the basis type, application, pricing, product type, gender, usability, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Pricing |

|

|

By Product Type |

|

|

By Gender |

|

|

By Usability |

|

|

By Distribution Channel |

|

Personal Hygiene Products Market Regional Analysis

“North America is the Dominant Region in the Personal Hygiene Products Market”

- North America dominates the global personal hygiene products market, driven by high consumer awareness, advanced retail infrastructure, and a strong presence of leading hygiene product manufacturers

- The U.S. holds a significant share due to the growing focus on health and hygiene, increased consumer spending on personal care, and the widespread adoption of eco-friendly hygiene products

- The availability of well-established distribution networks, coupled with a robust e-commerce platform, further strengthens the market in the region

- Additionally, the growing demand for premium, natural, and sustainable hygiene products, along with continuous innovations by key market players, is fueling market expansion across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the personal hygiene products market, driven by rapid urbanization, rising disposable income, and an increasing focus on personal care and hygiene

- Countries such as China, India, and Japan are emerging as key markets due to a growing middle-class population, increased awareness of hygiene practices, and rising health consciousness

- India, with its large and young population, continues to drive significant demand for personal hygiene products such as soaps, oral care products, and feminine hygiene items, as the country becomes more health-conscious

- China, with its expanding consumer base and growing demand for eco-friendly and premium hygiene products, is expected to see considerable market growth. The rising awareness around hygiene in urban areas, along with improved accessibility to personal care items, further contributes to market growth

Personal Hygiene Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Procter & Gamble (P&G) (U.S.)

- Unilever (U.K.)

- Kimberly-Clark (U.S.)

- Johnson & Johnson (U.S.)

- Essity (Sweden)

- Unicharm (Japan)

- Henkel (Germany)

- Reckitt Benckiser (U.K.)

- L'Oréal (France)

- Colgate-Palmolive (U.S.)

- Procter & Gamble Hygiene & Health Care Ltd. (India)

- Godrej Consumer Products Ltd. (India)

- Hindustan Unilever Ltd. (HUL) (India)

- Beiersdorf AG (Germany)

- COTY Inc. (U.S.)

- Edgewell Personal Care (U.S.)

- Kimberly-Clark Professional (U.S.)

- SC Johnson Professional (U.S.)

- PZ Cussons (U.K.)

- Lion Corporation (Japan)

Latest Developments in Global Personal Hygiene Products Market

- In February 2025 Plush, a prominent brand in the personal hygiene products sector, is set to expand its retail footprint by targeting a presence in 2,000 stores within the next six months. This expansion will significantly increase its current retail network of 500 stores, which are primarily located in major cities including Bengaluru, Chennai, Mumbai, Delhi, and Hyderabad. This strategic move underscores the growing demand for personal hygiene products in India, as well as the brand's commitment to enhancing accessibility to its diverse product range

- In May 2024 PEE SAFE, a leading wellness and hygiene brand, has launched PeePal, an AI-driven chatbot designed to promote awareness around hygiene and self-care practices. This innovative initiative aims to educate consumers on the importance of hygiene, providing personalized guidance and tips to improve personal care routines. The introduction of PeePal aligns with the increasing integration of digital technology in the personal hygiene industry, as brands seek to engage and educate consumers through more interactive and personalized experiences. This move reflects a broader trend in the global personal hygiene products market, where there is a rising focus on consumer education, convenience, and digital solutions to enhance product accessibility and user experience

- In May 2023 CONTI, a prominent player in the personal hygiene sector, has introduced its enhanced Conti Wet Wipes. Manufactured in the U.K., these advanced wet wipes offer a comprehensive range of cleansing solutions tailored specifically to meet the needs of individuals requiring care or support. The new product line emphasizes superior quality and effectiveness, catering to a growing demand for specialized hygiene products in both healthcare and personal care markets. This launch is in alignment with the broader trends in the global personal hygiene products market, where there is an increasing focus on providing specialized, high-quality hygiene solutions that meet the diverse needs of consumers, particularly in the healthcare and elderly care sectors

- In September 2023 L’Oréal Groupe has entered into a strategic partnership with Shinehigh Innovation, a biotech company based in China, agreeing to invest in the company to jointly develop innovative and environmentally sustainable beauty solutions. This collaboration focuses on leveraging cutting-edge biotechnology to create eco-friendly products that align with the growing consumer demand for sustainability in the beauty and personal care industry. This move is aligned with the broader trends in the global personal hygiene products market, where there is an increasing emphasis on sustainability and innovation

- In April 2023 Pacifica launched its new body care collection, Wake Up Beautiful, featuring innovative products designed for skin renewal, including a body serum and lotion enriched with retinoids and mushroom-based ingredients. The product line emphasizes the use of sustainable and eco-friendly ingredients, with mushrooms known for their skin-hydrating properties playing a key role in the formulation. This launch aligns with the growing trend in the global personal hygiene products market toward clean beauty and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.