Global Phytoestrogen Supplements Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

2.02 Billion

2024

2032

USD

1.14 Billion

USD

2.02 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.02 Billion | |

|

|

|

|

Phytoestrogen Supplements Market Size

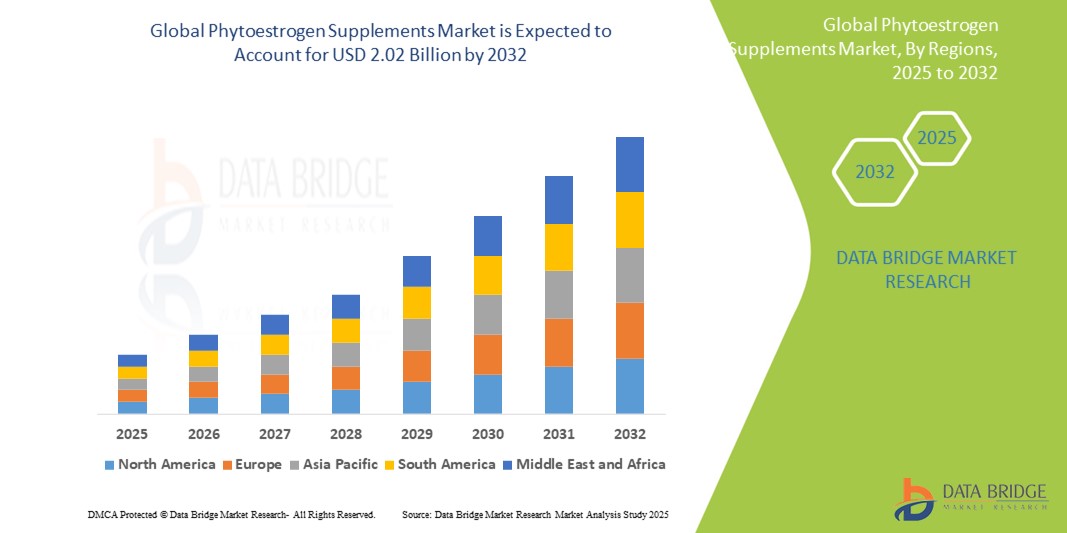

- The global phytoestrogen supplements market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 2.02 billion by 2032, at a CAGR of 7.80% during the forecast period

- This growth is driven by factors such as the increasing awareness of women's health, rising demand for natural alternatives to hormone replacement therapy, and growing prevalence of menopausal and hormonal disorders

Phytoestrogen Supplements Market Analysis

- Phytoestrogen supplements are natural compounds found in plants that mimic estrogen in the body. These supplements are commonly used for managing menopausal symptoms, supporting bone health, and improving cardiovascular function. They include compounds such as isoflavones, lignans, and coumestans

- The demand for phytoestrogen supplements is driven by increasing awareness of women's health, rising demand for natural alternatives to hormone replacement therapy (HRT), and a growing prevalence of menopausal and age-related health conditions

- North America is expected to dominate the phytoestrogen supplements market with a market share of 31.5 %, due to growing health consciousness, high demand for natural alternatives to hormone replacement therapy (HRT), and widespread product availability

- Asia-Pacific is expected to be the fastest growing region in the phytoestrogen supplements market with a market share of 23.5%, during the forecast period due to rising awareness of women’s health and increasing demand for plant-based health solutions

- Soy Products segment is expected to dominate the market with a market share of 82.3% due to its high isoflavone content, widespread availability, and proven efficacy in alleviating menopausal symptoms

Report Scope and Phytoestrogen Supplements Market Segmentation

|

Attributes |

Phytoestrogen Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phytoestrogen Supplements Market Trends

“Rising Adoption of Natural Alternatives for Hormonal Balance & Menopausal Support”

- One prominent trend in the phytoestrogen supplements market is the increasing consumer shift toward plant-based, natural alternatives to conventional hormone replacement therapies (HRT), especially for managing menopausal symptoms

- This trend is supported by a growing preference for nutraceuticals and functional supplements that offer health benefits without the risks associated with synthetic hormones

- For instance, isoflavone-rich soy supplements and flaxseed-based lignans are gaining traction among postmenopausal women due to their ability to alleviate symptoms such as hot flashes, night sweats, and bone loss, with fewer side effects

- These developments are transforming women’s health supplementation by promoting safer, long-term options for hormonal balance, thereby fueling the demand for phytoestrogen-rich products across global markets

Phytoestrogen Supplements Market Dynamics

Driver

“Rising Demand for Natural Hormonal Support in Aging Populations”

- The increasing prevalence of hormonal imbalances, especially among aging women experiencing menopause, is a major driver for the global phytoestrogen supplements market

- As the global population ages, more individuals seek natural alternatives to hormone replacement therapy (HRT) for managing symptoms such as hot flashes, mood swings, and osteoporosis

- Phytoestrogen supplements offer plant-based estrogenic effects, providing a safer and more accessible option for long-term health maintenance, especially in postmenopausal women

For instance,

- According to a 2022 WHO report, by 2030, one in six people globally will be aged 60 or older. With the rise in postmenopausal populations, the demand for natural hormonal support, such as phytoestrogens, is projected to grow significantly.

- As a result, the aging global population and increased health awareness are directly fueling the demand for phytoestrogen supplements, making them a critical component in women's health and wellness markets

Opportunity

“Innovation in Delivery Formats and Functional Food Integration”

- Advancements in supplement formulation and delivery technologies present a significant opportunity for expanding the reach and effectiveness of phytoestrogen supplements

- This includes the development of innovative formats such as gummies, effervescent tablets, and fortified functional foods

- These novel delivery methods enhance consumer convenience and compliance, especially among populations less inclined to take traditional pills or capsules

For instance,

- In 2024, several nutraceutical companies launched soy isoflavone-enriched plant-based beverages and protein bars targeted at menopausal women. These products combine daily nutrition with hormonal support, making them highly appealing in both wellness and preventive healthcare markets

- The growing demand for functional foods and health-oriented lifestyle choices is paving the way for phytoestrogens to be included in everyday consumables, creating new market segments and driving sustained growth in the global phytoestrogen supplements market

Restraint/Challenge

“Regulatory Uncertainty and Variability in Product Standardization”

- One of the key challenges in the phytoestrogen supplements market is the lack of consistent global regulatory standards and quality control, which creates barriers to market penetration and consumer trust

- Phytoestrogens are classified differently across regions—sometimes as dietary supplements, other times as herbal remedies or even functional foods—leading to confusion in product labeling, efficacy claims, and permissible dosages

For instance,

- In 2023, the European Food Safety Authority (EFSA) issued stricter guidelines for isoflavone-based supplements, limiting health claims due to inconclusive clinical evidence, while the U.S. FDA continued to regulate them as dietary supplements with minimal oversight. This inconsistency hinders product development and international expansion for manufacturers

- Consequently, companies face challenges in navigating complex regulatory environments and ensuring compliance, which can delay product launches, restrict innovation, and affect consumer confidence—ultimately restraining growth in the global phytoestrogen supplements market

Phytoestrogen Supplements Market Scope

The market is segmented on the basis of type, source, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Source |

|

|

By Application |

|

|

By End User

|

|

In 2025, the soy products is projected to dominate the market with a largest share in source segment

The soy products segment is expected to dominate the phytoestrogen supplements market with the largest share of 82.3% in 2025 due to its high isoflavone content, widespread availability, and proven efficacy in alleviating menopausal symptoms. Consumers increasingly prefer soy-based supplements as a natural alternative to hormone replacement therapy, boosting demand in both developed and emerging markets

The flavonoids is expected to account for the largest share during the forecast period in type market

In 2025, the flavonoids segment is expected to dominate the market with the largest market share of 25% due to its strong estrogen-like activity, especially from compounds such as isoflavones, which help manage menopausal and hormonal imbalances. Their plant-based origin, health benefits, and integration into dietary and nutraceutical products make flavonoids a preferred choice among health-conscious consumers

Phytoestrogen Supplements Market Regional Analysis

“North America Holds the Largest Share in the Phytoestrogen Supplements Market”

- North America dominates the phytoestrogen supplements market with a market share of estimated 31.5%, driven by growing health consciousness, high demand for natural alternatives to hormone replacement therapy (HRT), and widespread product availability

- U.S. dominates the phytoestrogen supplements market, due to large population of postmenopausal women, advanced nutraceutical sector, and well-established retail and e-commerce channels for supplement distribution

- The strong consumer awareness of phytoestrogens’ benefits for managing menopausal symptoms, bone health, and cardiovascular well-being supports consistent demand

- In addition, the increased investments in clinical research, coupled with a favorable regulatory environment for dietary supplements, continue to support market leadership in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Phytoestrogen Supplements Market”

- Asia-Pacific is expected to witness the highest growth rate in the phytoestrogen supplements market with a market share of 23.5%, driven by rising awareness of women’s health and increasing demand for plant-based health solutions

- Countries such as China, India, and Japan are key growth engines, as urbanization, disposable income, and interest in preventive healthcare drive consumer adoption

- Japan continues to lead in innovation, with a focus on functional foods and advanced supplement formulations incorporating soy isoflavones and lignans for aging-related health concerns

- India is projected to register the highest CAGR in the region, supported by growing public awareness, a burgeoning nutraceutical industry, and increased adoption of traditional and herbal remedies integrated with modern supplements

Phytoestrogen Supplements Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Life Extension (U.S.)

- Amgen Inc. (U.S.)

- Herbalife International of America, Inc. (U.S.)

- Nature's Way Brands, LLC. (U.S.)

- NOW Foods (U.S.)

- Solgar Inc. (U.S.)

- Nature’s Bounty (U.S.)

- Pure Encapsulations, LLC. (U.S.)

- New Chapter (U.S.)

- Swanson Health Products (U.S.)

- GNC Holdings, LLC (U.S.)

- Nature's Sunshine Products, Inc. (U.S.)

- Kerry Group plc. (Ireland)

- Puredia (U.S.)

- The Bountiful Company (U.S.)

- Floradix (Germany)

- Piping Rock Health Products (U.S.)

- Futrzak Biotech (Poland)

- Herb Pharm (U.S.)

- Yoli (U.S.)

Latest Developments in Global Phytoestrogen Supplements Market

- In October 2024, researchers from Korea published a study in the journal Nutrients examining the effects of a phytoestrogen complex containing Styphnolobium japonicum fruit and germinated soybean embryo. The study found that this combination exhibited estrogen-like effects, improved lipid profiles, enhanced bone density, and alleviated menopause symptoms in rats. The findings suggest that this phytoestrogen complex could serve as a natural alternative to hormone replacement therapy for managing postmenopausal symptoms

- In September 2024, Yakult Honsha announced its significant entry into the plant-based market by launching a new brand, "The Power of Soy Milk." Leveraging its existing plant-based yogurt business and production facilities acquired from Pokka Sapporo Food & Beverage, Yakult aims to establish a new production subsidiary called Yakult Plants Factory in October. This move underscores the company's commitment to expanding its presence in the plant-based sector

- In August 2024, Life Extension introduced "Estrogen Balance Elite," a dietary supplement formulated with standardized fenugreek seed extract. This product aims to alleviate discomforts associated with age-related declines in estrogen production, such as hot flashes and night sweats. A survey conducted by the company revealed that over 80% of female customers experienced hormone-related discomforts at least once a week

- In 2024, Feel launched its PRO Menopause supplement, a natural formula combining seven distinct types of phytoestrogens, including soy isoflavones (Genistein, Daidzein, Glycitein), red clover, and lignans. This blend aims to support mental performance and alleviate menopausal symptoms. The product is designed to minimize over-reliance on a single phytoestrogen source, offering a balanced effect for women during their menopause transition

- In July 2024, Itafoods, Puredia introduced "Omegia," a USDA and EU-certified organic sea buckthorn formula rich in plant-based omega-3, 6, 7, and 9 fatty acids. This supplement is positioned as a candidate for menopause support products, demonstrating benefits such as improved skin hydration by 49%, skin elasticity by 26%, and reduced wrinkles by 14%. In addition, it supports vaginal health and alleviates subjective experiences of menopausal symptom

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.