Global Raloxifene Market

Market Size in USD Million

CAGR :

%

USD

642.70 Million

USD

1,016.67 Million

2024

2032

USD

642.70 Million

USD

1,016.67 Million

2024

2032

| 2025 –2032 | |

| USD 642.70 Million | |

| USD 1,016.67 Million | |

|

|

|

|

Raloxifene Market Size

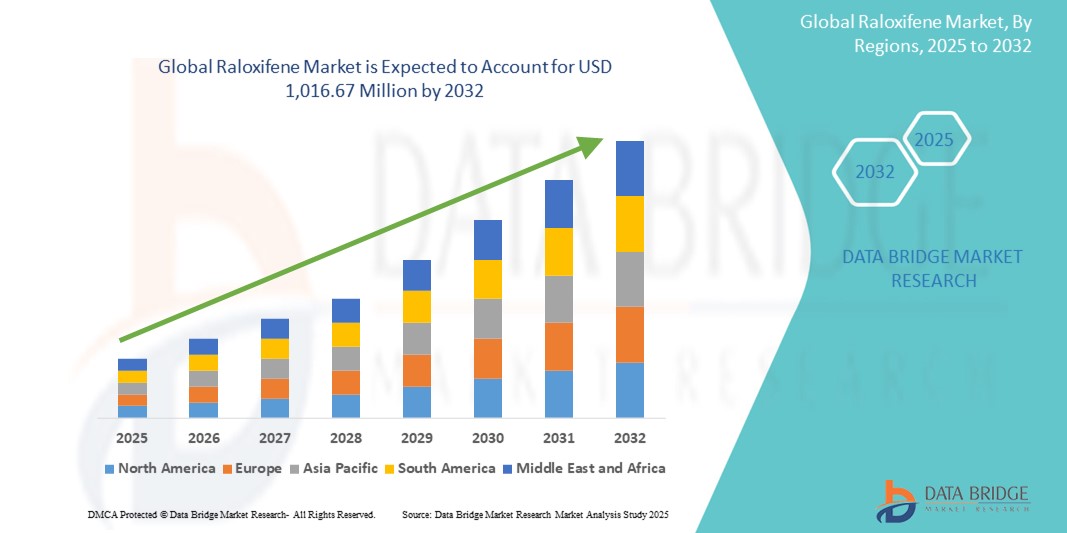

- The global raloxifene market size was valued at USD 642.70 million in 2024 and is expected to reach USD 1,016.67 million by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely driven by the increasing prevalence of osteoporosis and postmenopausal conditions, along with growing awareness and diagnosis rates among aging female populations globally

- Furthermore, the shift toward selective estrogen receptor modulators (SERMs) like raloxifene due to their dual benefit in reducing the risk of osteoporosis and certain types of breast cancer is strengthening market demand. These converging factors are accelerating the adoption of raloxifene-based therapies, thereby significantly boosting the industry’s growth

Raloxifene Market Analysis

- Raloxifene, a selective estrogen receptor modulator (SERM), plays a critical role in managing osteoporosis and reducing the risk of invasive breast cancer in postmenopausal women, making it an essential therapeutic agent in women’s health across both developed and emerging healthcare systems

- The increasing global burden of osteoporosis, growing awareness of postmenopausal health risks, and expanded screening programs are key drivers of demand for raloxifene-based treatments

- North America dominated the raloxifene market with the largest revenue share of 39.5% in 2024, supported by an aging female population, strong healthcare infrastructure, and favorable reimbursement policies, with the U.S. experiencing robust adoption due to proactive osteoporosis management and the presence of major pharmaceutical players

- Asia-Pacific is expected to be the fastest growing region in the raloxifene market during the forecast period due to improving healthcare access, rising awareness of osteoporosis, and increasing geriatric population across countries such as China, Japan, and India

- The osteoporosis segment dominated the raloxifene market with a market share of 47.4% in 2024, attributed to high global prevalence of postmenopausal osteoporosis and raloxifene’s proven efficacy in increasing bone mineral density and reducing fracture risk

Report Scope and Raloxifene Market Segmentation

|

Attributes |

Raloxifene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Raloxifene Market Trends

“Expanding Use in Postmenopausal Preventive Health Management”

- A significant and accelerating trend in the global raloxifene market is its expanding role in the prevention of postmenopausal complications beyond osteoporosis, particularly in reducing the risk of hormone-receptor-positive breast cancer. This broader therapeutic utility is enhancing its clinical appeal among healthcare providers and patients

- For instance, Evista (raloxifene hydrochloride) continues to gain attention due to its FDA-approved dual indication for both osteoporosis treatment and invasive breast cancer risk reduction in postmenopausal women. This multi-functionality is positioning raloxifene as a preferred option in comprehensive postmenopausal care

- Clinical advancements have highlighted raloxifene’s ability to mimic estrogen’s positive effects on bone density without stimulating endometrial tissue, offering a safer alternative to traditional hormone replacement therapies. This characteristic is contributing to increased prescriptions among women with contraindications to estrogen therapy

- Furthermore, patient adherence programs and educational campaigns by healthcare providers are emphasizing the long-term benefits of raloxifene, encouraging early initiation of treatment in women at risk. As awareness rises regarding the importance of bone and breast health post-menopause, raloxifene is being integrated into broader preventive health strategies

- The development of generic formulations and regional manufacturing is improving access and affordability, especially in cost-sensitive markets across Asia and Latin America, contributing to the drug’s growing adoption

- This trend toward holistic and preventive postmenopausal healthcare, supported by raloxifene’s proven clinical profile, is reshaping market dynamics and driving increased uptake across global healthcare systems

Raloxifene Market Dynamics

Driver

“Rising Incidence of Osteoporosis and Hormone-Related Conditions”

- The growing global prevalence of osteoporosis, particularly among postmenopausal women, is a major factor driving the demand for raloxifene, which is recognized for its ability to reduce fracture risk and maintain bone mineral density

- For instance, in April 2024, the International Osteoporosis Foundation launched a global initiative promoting early screening and intervention, spotlighting medications like raloxifene as essential tools in reducing osteoporosis-related health burdens. Such campaigns are expected to drive long-term market growth

- As global populations continue to age and awareness surrounding women’s health expands, raloxifene’s clinical advantages, including its cancer risk-reduction profile, are making it a go-to therapy in both developed and emerging markets

- Furthermore, the increasing availability of raloxifene in generic form is improving affordability, supporting broader access in lower-income regions and national health programs that prioritize cost-effective treatment options for age-related conditions

- The shift toward value-based care and preventive medicine is also reinforcing the inclusion of raloxifene in long-term treatment plans for postmenopausal women, contributing significantly to market expansion

Restraint/Challenge

“Side Effects and Limited Awareness in Developing Regions”

- Despite its therapeutic benefits, raloxifene presents challenges such as the risk of side effects including hot flashes, leg cramps, and venous thromboembolism, which may deter long-term patient adherence and limit its use in certain populations

- For instance, healthcare providers often exercise caution in prescribing raloxifene to women with a history of cardiovascular issues or clotting disorders, which may impact overall prescription volumes and market penetration

- In addition, limited awareness about osteoporosis and breast cancer prevention in developing regions remains a critical barrier. Inadequate health infrastructure, cultural taboos around menopause, and insufficient access to diagnostic tools hinder timely diagnosis and treatment initiation

- Overcoming these challenges requires a combination of public health education, clinician training, and expanded screening programs to ensure earlier detection and appropriate therapeutic intervention. Pharmaceutical companies must also address concerns related to adverse effects through improved risk communication and ongoing pharmacovigilance

- Further progress in next-generation SERMs with enhanced safety profiles, along with the development of patient-friendly raloxifene formulations, will be essential to overcoming these limitations and sustaining market growth

Raloxifene Market Scope

The market is segmented on the basis of drug class, application, demographic, dosage form, route of administration, end-user, and distribution channel.

- By Drug Class

On the basis of drug class, the raloxifene market is segmented into antineoplastic agents and selective estrogen receptor modulators (SERMs). The selective estrogen receptor modulators (SERMs) segment dominated the market with the largest revenue share in 2024, owing to raloxifene’s primary classification and its widespread use in treating and preventing osteoporosis and breast cancer in postmenopausal women. The clinical success of SERMs is attributed to their ability to act as estrogen agonists in bone and lipid metabolism while acting as antagonists in breast and uterine tissues.

The antineoplastic segment is expected to witness fastest growth from 2025 to 2032, driven by the increasing emphasis on cancer prevention strategies in high-risk populations. Raloxifene’s role in reducing the incidence of hormone-receptor-positive invasive breast cancer is fostering its adoption within oncology protocols focused on chemoprevention

- By Application

On the basis of application, the raloxifene market is segmented into osteoporosis, breast cancer prevention, and others. The osteoporosis segment accounted for the largest market share of 47.4% in 2024, driven by high global prevalence among aging women and raloxifene’s proven efficacy in improving bone mineral density and reducing vertebral fracture risk.

The breast cancer prevention segment is expected to grow at the fastest rate during the forecast period, supported by growing awareness of raloxifene’s risk-reduction benefits for postmenopausal women at elevated risk of invasive breast cancer. Increasing screening initiatives and genetic testing (e.g., BRCA mutations) are encouraging early intervention with preventive therapeutics like raloxifene.

- By Demographic

On the basis of demographic, the raloxifene market is segmented into adult, pediatric, and others. The adult segment dominated the market in 2024, as raloxifene is primarily prescribed to postmenopausal women over the age of 50. This age group represents the largest target population due to increased vulnerability to osteoporosis and hormone-related cancers.

The pediatric segment, though limited in scope, is projected to experience gradual growth during forecast period, as off-label and rare-use cases in pediatric oncology and bone disorders gain attention in advanced clinical settings. However, raloxifene remains predominantly indicated for adult use.

- By Dosage Form

On the basis of dosage form, the raloxifene market is segmented into tablets and capsules. The tablet segment held the largest share in 2024, attributed to its established formulation and ease of administration for long-term therapy. Tablets are widely available in both branded and generic forms, enhancing their market penetration.

The capsule segment is anticipated to grow moderately over the forecast period, driven by patient preference for alternative oral formulations and advancements in pharmaceutical manufacturing that support extended-release formats and enhanced bioavailability.

- By Route of Administration

On the basis of route of administration, the raloxifene market is segmented into oral and others. The oral segment dominated the market in 2024, as raloxifene is currently approved for oral administration only. Its once-daily oral dosage improves patient adherence and simplifies long-term treatment regimens.

While the “others” segment has fastest growth during forecast period, due to ongoing research into alternative delivery routes such as transdermal or subcutaneous formulations may drive innovation in this space in the long term.

- By End-User

On the basis of end-user, the raloxifene market is segmented into clinics, hospitals, and others. The hospital segment held the largest market share in 2024 due to the high volume of prescriptions originating from specialist consultations and comprehensive patient management settings. Hospitals serve as key points for osteoporosis and cancer risk assessment, diagnosis, and therapeutic planning.

The clinics segment is expected to see steady growth during forecast period, particularly in developed markets, where outpatient care models and women’s health centers are expanding. Clinics play a vital role in the ongoing management and follow-up of raloxifene therapy, especially for non-critical and preventive cases.

- By Distribution Channel

On the basis of distribution channel, the raloxifene market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment dominated the market in 2024, as most raloxifene prescriptions are filled in community pharmacies due to the drug’s routine use in chronic disease management.

The online pharmacy segment is anticipated to register the fastest growth through 2032, driven by increasing patient preference for home delivery of medications, growth of digital healthcare platforms, and expanding e-commerce infrastructure. Convenience, cost transparency, and access to generic options are further contributing to the rapid growth of this channel.

Raloxifene Market Regional Analysis

- North America dominated the raloxifene market with the largest revenue share of 39.5% in 2024, supported by an aging female population, strong healthcare infrastructure, and favorable reimbursement policies

- Consumers in the region increasingly rely on preventive therapies such as raloxifene due to widespread awareness, regular health screenings, and the presence of leading pharmaceutical manufacturers ensuring product availability and affordability

- This high market uptake is further supported by favorable reimbursement policies, advanced diagnostic capabilities, and a strong focus on women’s health management, establishing raloxifene as a preferred solution for long-term bone and breast health care in both hospital and outpatient settings

U.S. Raloxifene Market Insight

The U.S. raloxifene market captured the largest revenue share of 79% in 2024 within North America, fueled by a high prevalence of osteoporosis and proactive preventive healthcare practices. The presence of established healthcare providers and widespread screening programs supports early diagnosis and long-term therapy adoption. Increasing awareness of raloxifene’s dual benefits in bone health and breast cancer prevention, alongside favorable reimbursement policies and access to generic options, further enhances market growth across both clinical and outpatient settings.

Europe Raloxifene Market Insight

The Europe raloxifene market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by an aging population and a strong focus on preventive women’s healthcare. The region's emphasis on evidence-based clinical protocols and widespread access to osteoporosis screening tools contribute to the drug’s uptake. Increasing demand for hormone-free treatment alternatives and public health initiatives promoting early intervention in postmenopausal women are fostering the expansion of raloxifene use across primary care and specialty settings.

U.K. Raloxifene Market Insight

The U.K. raloxifene market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national guidelines emphasizing fracture prevention and cancer risk management in postmenopausal women. The NHS’s structured screening and treatment programs, combined with rising awareness of postmenopausal risks, are encouraging clinicians to prescribe raloxifene more frequently. Additionally, efforts to reduce long-term healthcare costs through preventive therapies are supporting its adoption in both public and private healthcare sectors.

Germany Raloxifene Market Insight

The Germany raloxifene market is expected to expand at a considerable CAGR during the forecast period, supported by a robust healthcare infrastructure and high demand for advanced therapeutic options. Public health campaigns focusing on osteoporosis awareness and cancer prevention, along with Germany’s emphasis on pharmacovigilance and safe medication practices, are encouraging the use of SERMs like raloxifene. The country’s strong pharmaceutical distribution network also ensures broad accessibility to both branded and generic versions.

Asia-Pacific Raloxifene Market Insight

The Asia-Pacific raloxifene market is poised to grow at the fastest CAGR of 23.6% during the forecast period of 2025 to 2032, driven by rapid population aging, increasing healthcare expenditure, and expanding awareness of postmenopausal health. Countries such as China, Japan, and India are investing in osteoporosis and breast cancer screening programs, boosting demand for cost-effective preventive therapies. The availability of generics and localized production is improving affordability, supporting broader access across urban and semi-urban populations.

Japan Raloxifene Market Insight

The Japan raloxifene market is gaining momentum due to the country’s aging demographic and emphasis on high-quality healthcare. Japanese patients and clinicians prioritize medications with proven safety profiles, and raloxifene’s dual benefits align well with national prevention guidelines. Government support for postmenopausal health, along with the integration of raloxifene into long-term care plans for the elderly, is contributing to its rising use in both hospital and home care settings.

India Raloxifene Market Insight

The India raloxifene market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to increasing public health awareness, rapid urbanization, and growing demand for affordable osteoporosis and cancer prevention treatments. Government programs promoting women's health, combined with strong domestic pharmaceutical manufacturing, are making raloxifene widely available at lower costs. Rising diagnostic rates, healthcare outreach in rural areas, and the expansion of insurance coverage are also fueling market growth across diverse population segments.

Raloxifene Market Share

The Raloxifene industry is primarily led by well-established companies, including:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla (India)

- Lilly (U.S.)

- Camber Pharmaceuticals, Inc. (U.S.)

- Luzsana Biotechnology, Inc. (U.S.)

- Taj Pharmaceuticals Limited (India)

- Cadila Pharmaceuticals (India)

- Zydus Group (India)

- Aurobindo Pharma (India)

- Amneal Pharmaceuticals LLC (U.S.)

- GLENMARK PHARMACEUTICALS LTD (India)

- ScieGen Pharmaceuticals (U.S.)

- Apotex Inc. (Canada)

- Dr. Reddy’s Laboratories Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Omicron Pharma (India)

- Lupin (India)

- Ajanta Pharma Ltd. (India)

What are the Recent Developments in Global Raloxifene Market?

- In May 2023, Eli Lilly and Company announced the expansion of its osteoporosis product portfolio by enhancing global distribution of raloxifene under the Evista brand, aiming to improve accessibility in emerging markets. This move reflects the company’s strategy to strengthen its leadership in women’s health and address the growing demand for osteoporosis treatment options, especially in regions with rising aging populations and underdiagnosed bone health conditions

- In April 2023, Teva Pharmaceutical Industries Ltd. launched a generic version of raloxifene hydrochloride tablets in several European countries, offering a cost-effective alternative to branded formulations. This launch is part of Teva’s commitment to expanding its generics portfolio and enhancing treatment affordability for postmenopausal women at risk of osteoporosis and invasive breast cancer

- In March 2023, Amneal Pharmaceuticals, Inc. received FDA approval for its generic raloxifene hydrochloride 60 mg tablets, positioning the company to serve the U.S. market with a therapeutically equivalent, high-quality solution. The approval reinforces Amneal’s focus on increasing access to essential therapies and underscores the importance of generics in reducing healthcare costs

- In February 2023, Cipla Limited introduced raloxifene tablets in India under its women’s health division, targeting the increasing incidence of osteoporosis among postmenopausal women. The launch complements Cipla’s broader initiative to address chronic conditions affecting the aging population and reflects the company’s proactive approach to improving long-term patient outcomes

- In January 2023, Aurobindo Pharma Limited announced the successful commercialization of its raloxifene hydrochloride product across several Latin American markets. This strategic move aligns with the company’s international growth plans and addresses the rising demand for affordable osteoporosis therapies in regions with limited access to branded medications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.