Global Recreational Cannabis Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

3.27 Billion

2024

2032

USD

2.00 Billion

USD

3.27 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 3.27 Billion | |

|

|

|

|

Recreational Cannabis Market Size

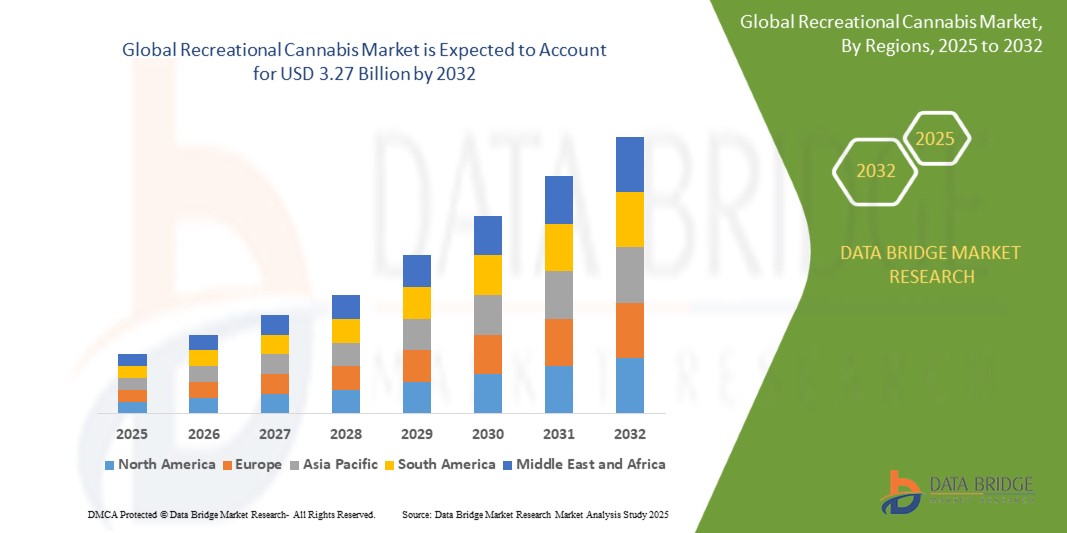

- The global recreational cannabis market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 3.27 billion by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is largely fueled by the increasing legalization of cannabis for recreational use across multiple regions, coupled with shifting consumer perceptions and greater social acceptance of cannabis as a lifestyle and wellness product

- Furthermore, rising demand for diverse cannabis-infused product formats such as edibles, beverages, topicals, and concentrates is expanding consumption beyond traditional smoking, thereby significantly boosting the industry's growth

Recreational Cannabis Market Analysis

- Recreational cannabis products are derived from the cannabis plant and consumed primarily for non-medical purposes, offering psychoactive effects that promote relaxation, stress relief, and social interaction. These products are available in various forms, including flower, concentrates, edibles, beverages, and vape products, catering to evolving consumer preferences

- The escalating demand for recreational cannabis is primarily driven by favorable regulatory reforms, increased investments in product innovation, and the growing trend of cannabis use for wellness and entertainment, particularly among younger demographics

- North America dominated the recreational cannabis market with a share of 76.5% in 2024, due to widespread legalization, high consumer acceptance, and increasing investment in cannabis product development

- Asia-Pacific is expected to be the fastest growing region in the recreational cannabis market with a share of during the forecast period due to evolving policy landscapes, rising awareness, and increased investment in cannabis research and cultivation across select markets

- THC-dominant segment dominated the market with a market share of 57.9% in 2024, due to its psychoactive effects that appeal to recreational users seeking euphoria, relaxation, and mood enhancement. THC-dominant products remain at the forefront of recreational markets, particularly in regions with mature legalization frameworks where high-potency products are in demand

Report Scope and Recreational Cannabis Market Segmentation

|

Attributes |

Recreational Cannabis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recreational Cannabis Market Trends

“Growing Demand for Cannabis-Infused Edibles and Beverages”

- A significant and accelerating trend in the global recreational cannabis market is the growing demand for cannabis-infused edibles and beverages such as gummies, chocolates, sparkling drinks, and teas

- For instance, companies such as Canopy Growth and Tilray are expanding their product portfolios to include a wide range of cannabis-infused consumables, targeting consumers who prefer alternatives to traditional smoking or vaping

- The adoption of innovative infusion technologies enables precise dosing, consistent potency, and improved taste profiles in edibles and beverages, enhancing consumer experience and safety

- Cannabis-infused products are increasingly formulated with natural flavors, low or zero sugar, and functional ingredients such as adaptogens and vitamins to appeal to health-conscious consumers

- This trend toward convenient, discreet, and enjoyable consumption formats is fundamentally reshaping product development and marketing strategies in the recreational cannabis industry. Companies such as Aurora Cannabis and Cronos Group are investing in research and partnerships to launch new edible and beverage lines that cater to diverse consumer preferences

- The demand for cannabis-infused edibles and beverages is growing rapidly across both established and emerging markets, as legalization expands and consumers seek novel ways to enjoy cannabis

Recreational Cannabis Market Dynamics

Driver

“Rising Health and Wellness Consciousness”

- The increasing focus on health and wellness, coupled with changing perceptions about cannabis, is a significant driver for the growth of the recreational cannabis market

- For instance, companies such as Curaleaf and Green Thumb Industries are introducing low-dose, microdosed, and wellness-oriented cannabis products that appeal to consumers interested in relaxation, stress relief, and holistic well-being

- As consumers become more educated about the potential benefits of cannabis, there is a growing demand for products that offer controlled effects, natural ingredients, and minimal side effects

- The trend toward integrating cannabis into self-care routines and social occasions is making recreational cannabis an attractive option for a wider audience, including new and occasional users

- The convenience of purchasing cannabis products through licensed dispensaries, delivery services, and online platforms is propelling adoption. The expansion of legal markets and ongoing destigmatization further contribute to industry growth

Restraint/Challenge

“Increased Costs of Recreational Cannabis Quality”

- Increased costs associated with maintaining high quality in recreational cannabis production, including compliance with strict testing, cultivation, and packaging standards, pose a significant challenge to profitability and accessibility

- For instance, companies such as Trulieve and Cresco Labs must invest in advanced cultivation technologies, quality control laboratories, and secure packaging to meet regulatory requirements and consumer expectations

- Addressing these challenges through operational efficiencies, automation, and economies of scale is crucial for maintaining competitive pricing and market share. Brands are focusing on streamlining production processes and leveraging technology to reduce costs without compromising quality

- The high cost of compliance can be a barrier for smaller producers and new market entrants, impacting product affordability and market diversity

- Overcoming these challenges through industry collaboration, advocacy for regulatory reform, and the development of cost-effective quality assurance methods will be vital for sustained market growth and consumer trust

Recreational Cannabis Market Scope

The market is segmented on the basis of product type, distribution channel, species, compound, application, administration, and end use.

• By Product Type

On the basis of product type, the recreational cannabis market is segmented into oils tinctures, transdermal patches, isolates tablets, flower, concentrates, edibles, topicals, tinctures, and others. The flower segment dominated the largest market revenue share in 2024, driven by its widespread cultural acceptance and the established consumer preference for traditional cannabis consumption methods. Smoking or vaporizing cannabis flower remains popular among recreational users due to its rapid onset of effects, wide strain variety, and customizable consumption experience. The segment's growth is also supported by advancements in cultivation techniques ensuring higher quality, potency, and flavor profiles.

The edibles segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising preference for discreet, smoke-free consumption and longer-lasting effects. Edibles, including gummies, chocolates, and beverages, appeal to new and casual users due to precise dosing, improved taste profiles, and growing product innovation that enhances safety and consistency.

• By Distribution Channel

On the basis of distribution channel, the recreational cannabis market is segmented into online and offline channels. The offline segment held the largest market revenue share in 2024, driven by the regulated retail framework in many regions where licensed dispensaries provide education, personalized product recommendations, and immediate product access. Consumers often rely on physical stores for expert guidance, especially first-time buyers seeking tailored advice and quality assurance.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing consumer comfort with e-commerce platforms, privacy concerns, and the convenience of home delivery. Expanding legalization has encouraged online sales with user-friendly platforms offering product variety, promotional discounts, and discreet packaging, particularly benefiting customers in remote or underserved areas.

• By Species

On the basis of species, the recreational cannabis market is segmented into Cannabis Indica, Cannabis Sativa, and Hybrid. The hybrid segment dominated the market revenue share in 2024 due to its versatility in catering to diverse user preferences. Hybrid strains combine traits from both Indica and Sativa species, offering balanced effects such as relaxation with mental stimulation, making them suitable for a broader range of recreational experiences. The popularity of hybrids is also driven by breeders' ability to develop strains with tailored cannabinoid profiles, enhancing user satisfaction.

The Cannabis Sativa segment is projected to witness the fastest growth from 2025 to 2032, supported by rising demand for uplifting, energizing effects preferred by social and daytime users. Sativa strains are known for enhancing creativity and sociability, aligning with the lifestyle of younger and recreational-focused consumers seeking functional cannabis experiences.

• By Compound

On the basis of compound, the recreational cannabis market is segmented into THC-dominant, CBD-dominant, and balanced THC and CBD products. The THC-dominant segment captured the largest market revenue share of 57.9% in 2024, owing to its psychoactive effects that appeal to recreational users seeking euphoria, relaxation, and mood enhancement. THC-dominant products remain at the forefront of recreational markets, particularly in regions with mature legalization frameworks where high-potency products are in demand.

The balanced THC and CBD segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing consumer awareness of wellness-oriented cannabis use. Products offering a combination of THC and CBD are gaining traction for providing mild psychoactive effects with enhanced therapeutic benefits, such as reduced anxiety or improved sleep, appealing to health-conscious recreational users.

• By Application

On the basis of application, the recreational cannabis market is segmented into chronic pain, mental disorders, cancer, and others. The mental disorders segment held the largest market revenue share in 2024, as many recreational users report using cannabis to manage stress, anxiety, and mood regulation, contributing to its appeal beyond purely recreational motives. The overlap between wellness and recreation is driving product demand among consumers seeking both relaxation and emotional well-being.

The chronic pain segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing recognition of cannabis's analgesic properties among adult users seeking alternatives to conventional pain management. Recreational users experiencing mild to moderate pain often turn to cannabis products, especially topicals and edibles, for perceived relief without the stigma or side effects associated with pharmaceutical painkillers.

• By Administration

On the basis of administration, the recreational cannabis market is segmented into oral, topical, inhalation, rectal, and sublingual methods. The inhalation segment accounted for the largest market revenue share in 2024, driven by the rapid onset of effects through smoking or vaping, offering immediate gratification to recreational users. The inhalation method remains the most familiar and accessible, especially for experienced consumers valuing fast, controllable dosing.

The sublingual segment is anticipated to witness the fastest growth from 2025 to 2032, as consumers seek smoke-free, discreet consumption options with faster absorption compared to edibles. Sublingual products, such as tinctures or sprays, are gaining popularity for their convenience, precise dosing, and relatively quick effect onset, aligning with evolving consumer preferences for healthier and portable cannabis formats.

• By End Use

On the basis of end use, the recreational cannabis market is segmented into pharmaceuticals, food, beverages, tobacco, personal care, and research and development centers. The food segment dominated the largest market revenue share in 2024, supported by the growing popularity of cannabis-infused edibles such as baked goods, snacks, and confectionery. The integration of cannabis into food products offers a familiar, approachable consumption route, appealing to new and casual users wary of smoking or vaping.

The beverages segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing product innovation in cannabis-infused drinks, including sparkling waters, teas, and functional wellness beverages. The beverage format offers a socially acceptable, discreet, and controlled cannabis experience, gaining traction among health-conscious consumers and younger demographics looking for alcohol alternatives with psychoactive or relaxing effects.

Recreational Cannabis Market Regional Analysis

- North America dominated the recreational cannabis market with the largest revenue share of 76.5% in 2024, driven by widespread legalization, high consumer acceptance, and increasing investment in cannabis product development

- The region benefits from a mature regulatory framework and strong retail infrastructure, making cannabis readily accessible for recreational use across various formats, including edibles, beverages, and flower products

- The growing normalization of cannabis consumption, coupled with advanced cultivation technologies and diverse product offerings, continues to support market growth across both established and emerging U.S. and Canadian markets

U.S. Recreational Cannabis Market Insight

The U.S. recreational cannabis market captured the largest revenue share within North America in 2024, fueled by the rapid state-level legalization and the expanding consumer base across multiple demographics. Product innovation remains a key growth driver, with increasing demand for cannabis-infused edibles, beverages, and discreet consumption formats appealing to both new and experienced users. The strong presence of dispensaries, delivery services, and retail chains has improved accessibility and convenience, while robust consumer education campaigns continue to destigmatize cannabis use. Furthermore, cannabis tourism, celebrity endorsements, and strategic partnerships across food, beverage, and personal care sectors are playing a vital role in driving the growth of the U.S. recreational cannabis industry.

Europe Recreational Cannabis Market Insight

The Europe recreational cannabis market is expected to expand at a substantial CAGR during the forecast period, supported by progressive legalization trends, increased public awareness, and shifting consumer attitudes towards cannabis use. Several European countries are exploring policy reforms, creating growth opportunities for both domestic and international cannabis players. The demand for wellness-focused, low-THC, and CBD-dominant recreational products is rising, as consumers seek alternatives to alcohol and tobacco for relaxation and social purposes. Europe’s established medical cannabis infrastructure is providing a foundation for controlled recreational cannabis markets, particularly in countries such as Germany, the Netherlands, and parts of Southern Europe. The region’s growing investment in cannabis research, cultivation, and retail development is expected to further fuel market growth.

Germany Recreational Cannabis Market Insight

The Germany recreational cannabis market is projected to expand at a considerable CAGR during the forecast period, driven by the country's progressive steps towards legalizing and regulating recreational cannabis use. Germany's status as Europe's largest economy and its emphasis on consumer safety, product quality, and compliance provide favorable conditions for market growth. The transition from medical to recreational cannabis is expected to be supported by Germany’s established cultivation, distribution, and retail infrastructure. Additionally, rising consumer demand for legal, safe cannabis products, coupled with ongoing public debates and government-backed reforms, positions Germany as a key European market for recreational cannabis in the coming years.

Asia-Pacific Recreational Cannabis Market Insight

The Asia-Pacific recreational cannabis market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by evolving policy landscapes, rising awareness, and increased investment in cannabis research and cultivation across select markets. While recreational cannabis remains largely prohibited across much of the region, countries such as Thailand are leading the shift towards controlled legalization, providing new growth avenues for the industry. Urbanization, shifting cultural perceptions, and the development of cannabis tourism are contributing to emerging demand. Additionally, cross-border collaborations and research initiatives aimed at unlocking the medical and recreational potential of cannabis are laying the foundation for gradual market expansion across APAC.

Thailand Recreational Cannabis Market Insight

The Thailand recreational cannabis market is witnessing rapid momentum following the country's groundbreaking move to decriminalize cannabis, making it the first Southeast Asian nation to embrace controlled recreational cannabis use. Thailand’s growing tourism industry, favorable climate for cannabis cultivation, and government-backed efforts to promote the sector have accelerated market growth. Domestic consumption is increasing, supported by greater product variety, including edibles, beverages, and wellness-focused options. The country's regulatory approach, combined with rising investment from both local and international businesses, is positioning Thailand as a regional hub for cannabis production, innovation, and tourism, contributing to its expanding recreational cannabis market.

Recreational Cannabis Market Share

The recreational cannabis industry is primarily led by well-established companies, including:

- AURORA CANNABIS INC (Canada)

- Cannabis Science Inc. (U.S.)

- Medical Marijuana, Inc. (U.S.)

- STENOCARE A/S (Denmark)

- CannabisNL (U.S.)

- Controlled Environments Limited (Canada)

- The Cronos Group (Canada)

- Maricann Inc (Canada)

- Tikun Olam (Israel)

- Canopy Growth Corporation (Canada)

- TerrAscend (Canada)

- VIVO Cannabis Inc. (Canada)

- Harvest Health & Recreation, Inc (U.S.)

- Curaleaf Holdings Inc. (U.S.)

- HEXO Corp. (Canada)

- INDIVA. (Canada)

- Cresco Labs (U.S.)

- Organigrams Holding Inc. (Canada)

- Trulieve (U.S.)

Latest Developments in Global Recreational Cannabis Market

- In June 2024, The Cannabist Company, a prominent U.S.-based cultivator, manufacturer, and retailer of cannabis products, announced a strategic multi-state partnership with The Bloom Brand, a recognized leader in cannabis concentrates and vape technology. The collaboration, launching initially in New Jersey and Virginia, marks Bloom’s expansion into its 6th and 7th state markets. This partnership is expected to strengthen The Cannabist Company’s product portfolio in the high-demand concentrates and vape segment while accelerating market penetration in the Eastern U.S. It reflects the increasing consumer shift toward vape products and enhances both companies’ competitive positioning in key growth markets, supporting overall industry expansion

- In January 2024, Aurora Cannabis Inc, a leading Canadian global medical cannabis company, announced the launch of three new cannabis-infused beverages, initially available exclusively to veteran patients through Aurora Medical. The beverages, produced by Vacay and Versus in flavors such as Neon Rush, Strawberry Pineapple Tropical Fizz, and Pineapple Coconut Fizz, cater to rising consumer demand for alternative cannabis consumption methods. This product expansion strengthens Aurora’s presence in the growing cannabis beverage segment, aligning with market trends favoring discreet, convenient, and functional cannabis formats

- In May 2023, Toast and Nirvana Group forged a partnership aimed at bringing innovative products to patients and consumers in Oklahoma and New Mexico, leveraging Toast's expertise in cannabis products and Nirvana Group's market presence to offer new solutions to meet the evolving needs of consumers in the region

- In April 2023, Hello Juice and Smoothie partnered with Beleaf Co. to launch CBD-infused juice shots, combining the health-conscious trend of juice consumption with the wellness benefits of CBD, offering a unique product in the local U.S. market

- In May 2022, Canopy Growth expanded its product line with the introduction of orange and grape flavors for its cannabis-infused carbonated drinks, catering to the growing demand for diverse cannabis-infused beverages in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recreational Cannabis Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recreational Cannabis Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recreational Cannabis Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.