Global Rice Protein Market

Market Size in USD Million

CAGR :

%

USD

303.21 Million

USD

424.64 Million

2024

2032

USD

303.21 Million

USD

424.64 Million

2024

2032

| 2025 –2032 | |

| USD 303.21 Million | |

| USD 424.64 Million | |

|

|

|

|

Rice Protein Market Size

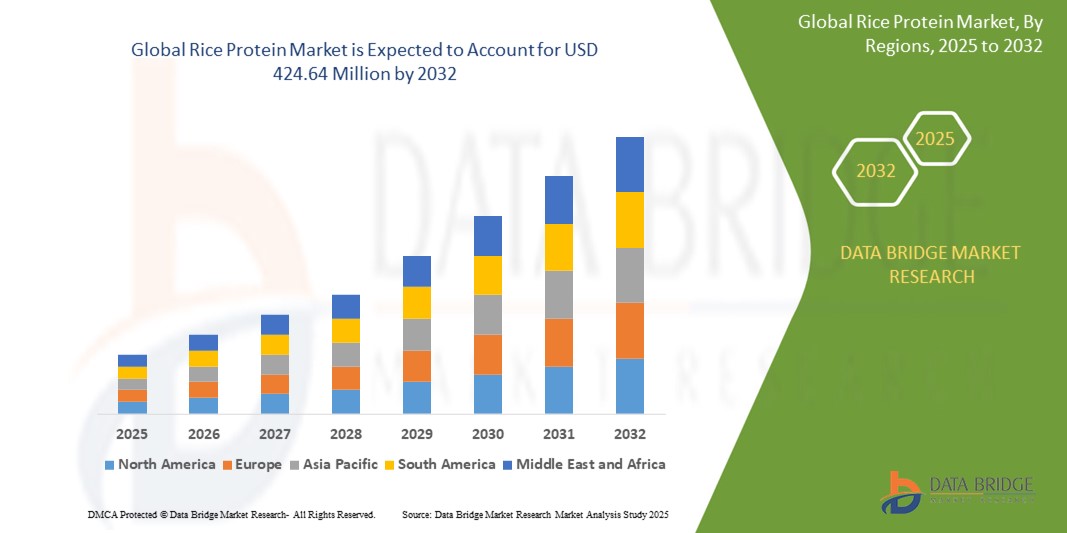

- The global rice protein market size was valued at USD 303.21 million in 2024 and is expected to reach USD 424.64 million by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of plant-based diets, rising demand for vegan and allergen-free protein sources, and the growing preference for clean-label ingredients in the food and beverage sector

- Furthermore, rising adoption across sports nutrition, dietary supplements, and functional foods is accelerating the uptake of rice protein products globally. These factors collectively contribute to the robust expansion of the rice protein industry

Rice Protein Market Analysis

- Rice Protein, derived from both white and brown rice, is gaining traction as a plant-based, hypoallergenic protein alternative in a wide range of applications including sports nutrition, bakery products, dairy alternatives, and personal care formulations

- The escalating demand for vegan-friendly, gluten-free, and non-GMO products is a key factor driving rice protein adoption across multiple consumer segments

- Advancements in protein extraction technologies and increasing incorporation of rice protein in formulated health foods are further fueling market expansion. The market is also benefiting from the growing focus on sustainable and ethical food production practices

- North America dominated the global rice protein market with the largest revenue share of 44.57% in 2024, fueled by growing demand for plant-based nutrition, clean-label ingredients, and allergen-free protein alternatives

- Asia-Pacific market is poised to grow at the fastest CAGR of 10.87% from 2025 to 2032, thanks to rising disposable incomes, urbanization, and increased adoption of plant-based diets in key markets such as China, India, and Japan

- The Isolates segment dominated the largest market revenue share of 47.3% in 2024, owing to its high protein content (typically above 80%), which makes it a preferred choice in high-performance sports nutrition and functional food applications

Report Scope and Rice Protein Market Segmentation

|

Attributes |

Rice Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rice Protein Market Trends

“Shift Toward Plant-Based Nutrition”

- The global shift toward plant-based nutrition has significantly influenced the demand for rice protein, particularly among vegan, vegetarian, and lactose-intolerant consumers. Rice protein is gluten-free, dairy-free, and hypoallergenic, making it a popular alternative to soy and whey protein

- Leading brands such as Nutribiotic and Growing Naturals are expanding their rice protein product lines, highlighting their suitability for sensitive diets and clean-label preferences

- Consumer interest in clean-label products has surged. A 2023 report by Innova Market Insights showed a 22% year-on-year increase in launches of clean-label plant proteins, with rice protein frequently featured due to its natural, minimally processed profile

- Fitness-conscious individuals and athletes are also embracing rice protein due to its balanced amino acid profile and ease of digestion, often blending it with pea protein for complete protein intake

- Product innovation is accelerating, with rice protein now being used in ready-to-drink shakes, protein bars, and infant nutrition. In 2024, Orgain launched a new organic protein shake featuring brown rice protein, targeted at the U.S. fitness and wellness market

- The growing trend of sustainable food choices further boosts the appeal of rice protein, as it requires less land and water compared to animal-based protein production

Rice Protein Market Dynamics

Driver

“Rising Demand from Sports Nutrition and Functional Foods”

- As consumers become increasingly health-conscious, the demand for high-quality plant proteins in sports nutrition and functional foods is rising sharply. Rice protein offers an easily digestible, allergen-friendly protein source that appeals to athletes and fitness enthusiasts

- For instance, NOW Sports and Sunwarrior have both reported increased sales in their plant-based protein blends containing rice protein, especially in the post-workout recovery segment

- A 2024 study by the Plant-Based Foods Association revealed that over 40% of sports nutrition users now prefer plant-based protein powders, with rice protein often preferred due to its neutral taste and blendability

- Moreover, rising awareness of gut health and digestion is supporting rice protein demand, especially among consumers looking to avoid common irritants found in dairy or soy-based proteins

- The expansion of e-commerce channels and direct-to-consumer platforms has also made it easier for brands to market rice protein-based health products to niche and global audiences

- This rising integration into sports, wellness, and lifestyle products is expected to be a core growth engine for the rice protein market through 2032

Restraint/Challenge

“Limitations in Amino Acid Profile and Functional Texture”

- Despite its growing popularity, rice protein is often criticized for its incomplete amino acid profile, particularly its low lysine content, which may limit its standalone use as a complete protein

- Functional limitations also exist in terms of texture and solubility, which may affect its application in high-protein beverages or creamy food formulations where soy or whey proteins perform better

- To overcome this, manufacturers are increasingly blending rice protein with pea or quinoa protein to create complete plant-based protein formulations, adding complexity and cost to product development

- In 2023, Roquette reported a 15% increase in R&D spending to enhance the textural and functional properties of rice protein through enzyme treatments and fermentation techniques

- In addition, concerns exist over gritty mouthfeel or chalky taste, which can negatively impact consumer acceptance in beverages or premium applications such as dairy alternatives

- These sensory and nutritional drawbacks require significant formulation expertise, which can be a barrier for small and medium-sized food manufacturers entering the plant protein space

- Addressing these formulation challenges through advanced processing technologies and protein blending strategies is crucial for unlocking the full potential of rice protein across all food segments

Rice Protein Market Scope

The market is segmented on the basis of type, category, source type, extraction process, modification type, protein concentration, form, fortification, and application.

• By Type

On the basis of type, the rice protein market is segmented into Isolates, Concentrates, and Hydrolysates. The Isolates segment dominated the largest market revenue share of 47.3% in 2024, owing to its high protein content (typically above 80%), which makes it a preferred choice in high-performance sports nutrition and functional food applications. Isolates are also favored in dairy-free and allergen-free formulations, catering to the growing demand for plant-based, clean-label products.

The Hydrolysates segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior digestibility and bioavailability. Hydrolysates are increasingly used in infant nutrition, elderly nutrition, and clinical nutrition, where rapid protein absorption is critical.

• By Category

On the basis of category, the rice protein market is segmented into Conventional and Organic. The Conventional segment held the largest market revenue share in 2024, due to its broad availability and cost-effectiveness, making it suitable for large-scale food production and animal feed applications.

The Organic segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for clean-label, pesticide-free, and sustainable ingredients.

• By Source Type

On the basis of source type, the rice protein market is segmented into Brown, White, Red, Black, and Others. The Brown Rice Protein segment dominated the market in 2024, accounting for the largest share due to its balanced amino acid profile and lower processing cost. It is extensively used in beverages, dietary supplements, and sports nutrition.

The Black rice protein segment is projected to grow at the highest rate from 2025 to 2032, benefiting from its rich anthocyanin content and increasing usage in functional foods and premium supplement products.

• By Extraction Process

On the basis of extraction process, the rice protein market is segmented into Wet Processing and Dry Processing. The Wet Processing segment held the largest revenue share in 2024, attributed to its ability to yield high-purity protein isolates and better flavor profiles. This method is commonly adopted in nutraceuticals and infant nutrition.

Dry Processing is expected to experience rapid growth from 2025 to 2032, driven by its sustainability, reduced water usage, and cost-efficiency.

• By Modification Type

On the basis of modification type, the rice protein market is segmented into Thermal Modification, Chemical Modification, and Enzyme Modification. Enzyme Modification dominated the market in 2024, as it enhances functional properties such as solubility, emulsification, and digestibility, making it ideal for various beverage and protein bar formulations.

Thermal Modification is projected to grow at the fastest CAGR during 2025–2032, supported by its application in improving textural and sensory properties in processed food products.

• By Protein Concentrates

On the basis of protein content, the rice protein market is segmented into >70% Protein, Between 20%-70%, and <20% Protein. The >70% Protein segment captured the largest revenue share in 2024, driven by demand in performance nutrition and health supplements.

The Between 20%-70% protein segment is expected to grow fastest through 2032, due to increasing usage in mainstream food and beverage products where moderate protein enrichment is preferred.

• By Form

On the basis of form, the rice protein market is segmented into Dry and Liquid. The Dry segment held the dominant share in 2024, as dry rice protein powders are easier to store, transport, and incorporate into powdered supplements and baked goods.

The Liquid segment is set to grow rapidly through 2032, particularly in ready-to-drink beverages and infant formulas.

• By Fortification

On the basis of fortification, the rice protein market is segmented into Regular and Fortified. The Fortified segment accounted for the largest market share in 2024, owing to rising consumer preference for value-added nutrition, including fortified blends with vitamins, minerals, and amino acids.

Regular rice proteins are expected to gain steady traction due to their affordability and clean-label appeal.

• By Application

On the basis of application, the rice protein market is segmented into Food Products, Nutraceuticals and Dietary Supplements, Beverages, Animal Feed, Cosmetics and Personal Care, Pharmaceuticals, and Others. The Food Products segment dominated the market with the largest revenue share in 2024, due to widespread use in protein bars, cereals, and dairy alternatives.

The Nutraceuticals and Dietary Supplements segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the surging popularity of plant-based protein powders among athletes, vegans, and health-conscious consumers.

Rice Protein Market Regional Analysis

- North America dominated the global rice protein market with the largest revenue share of 44.57% in 2024, fueled by growing demand for plant-based nutrition, clean-label ingredients, and allergen-free protein alternatives

- The region benefits from a mature sports nutrition, dietary supplement, and functional food industry, where rice protein is increasingly favored over soy and whey

- Rising health awareness, increasing vegan population, and innovations in plant protein formulations are contributing to continued market expansion

U.S. Rice Protein Market Insight

The U.S. captured the largest revenue share in 2024 within North America, driven by rising consumer interest in veganism, lactose-free diets, and non-GMO food products. Leading companies such as Axiom Foods and Nutribiotic are spearheading growth by offering rice protein in sports drinks, nutrition bars, and meal replacements. The demand is further reinforced by growth in fitness culture, an expanding health-conscious demographic, and increasing awareness of food intolerances.

Europe Rice Protein Market Insight

The European rice protein market is projected to grow at a healthy CAGR through the forecast period, supported by an increasing preference for sustainable and cruelty-free protein sources. European nations are seeing rice protein incorporated into meat alternatives, fortified snacks, and dairy-free beverages in response to demand for clean, plant-based nutrition. Countries such as Germany, the U.K., and France are leading the way due to robust regulatory standards and consumer demand for natural, organic protein options.

U.K. Rice Protein Market Insight

The U.K. rice protein market is expected to grow significantly due to rising interest in flexitarian diets and a cultural shift toward plant-forward living. A booming vegan food sector, heightened concern for animal welfare, and increasing e-commerce penetration of nutritional supplements drive the trend. Rice protein is now widely used in sports nutrition powders, dairy alternatives, and meal replacement shakes across British consumers.

Germany Rice Protein Market Insight

Germany is emerging as a strong player in the rice protein market, driven by a deep-rooted organic food culture, high environmental awareness, and demand for functional clean-label proteins. The product is popular in both B2C applications (such as protein powders and beverages) and B2B formulations for plant-based meat and baked goods. Growth is supported by proactive R&D efforts in clean-label food manufacturing and sustainable ingredient sourcing.

Asia-Pacific Rice Protein Market Insight

Asia-Pacific market is poised to grow at the fastest CAGR of 10.87% from 2025 to 2032, thanks to rising disposable incomes, urbanization, and increased adoption of plant-based diets in key markets such as China, India, and Japan. With Asia being a major producer of rice, local access to raw materials supports cost-effective production of rice protein isolates and concentrates. Government-backed nutrition initiatives and the growing awareness of food intolerances also contribute to rising demand.

Japan Rice Protein Market Insight

Japan’s market is gaining traction due to strong consumer interest in functional foods and healthy aging. Rice protein is increasingly featured in easy-to-digest dietary products, health supplements, and elderly nutrition solutions due to its hypoallergenic profile. Japan’s innovation-led food industry is incorporating rice protein into on-the-go snacks, beverages, and fortified meals aligned with wellness trends.

China Rice Protein Market Insight

China led the Asia-Pacific rice protein market in 2024 in terms of revenue share, driven by a rising middle class, fitness trends, and a surge in plant-based product consumption. Domestic companies are leveraging the country's massive rice production capacity to develop rice protein for functional foods, infant nutrition, and sports supplements. Government initiatives supporting nutrition security and plant protein R&D are further accelerating market growth in China.

Rice Protein Market Share

The Rice Protein industry is primarily led by well-established companies, including:

- Kerry Group plc. (Ireland)

- Gulshan Polyols Ltd. (India)

- Gehl Foods, LLC. (U.S.)

- Shafi Gluco Chem (Pakistan)

- Prinova Group LLC. (U.S.)

- SACCHETTO S.P.A. (Italy)

- Farbest Brands (U.S.)

- BENEO (Germany)

- Tiba Trade (Egypt)

- Bioway (Xi'An) Organic Ingredients Co., Ltd. (China)

- Pioneer Industries Private Limited (India)

- SWEET ADDITIONS, LLC. (U.S.)

- ETChem (China)

- VR Enterprises (India)

- Axiom Foods, Inc. (U.S.)

- Singsino Group Limited (China)

- AIDP (U.S.)

- Titan Biotech (India)

- Z-COMPANY (Netherlands)

- Golden Grain Group Limited (China)

- Foodchem International Corporation (China)

- Lotioncrafter (U.S.)

- Creative Enzymes (U.S.)

- The Green Labs LLC. (U.S.)

- RAJVI ENTERPRISE (India)

Latest Developments in Global Rice Protein Market

- In August 2023, Bioway (Xi'An) Organic Ingredients Co., Ltd. announced the visit of Anurag, a buyer from India, to discuss a potential collaboration on procuring plant-based protein powder for a long-term partnership. The meeting aimed to establish a sustainable supply chain for Bioway Organic's high-quality organic protein powder

- In March 2023, Creative Enzymes was a part of the PepTalk 2023. This helped the company connect with protein science researchers from around the globe to share case studies, unpublished data, and solutions to enhance biotherapeutics R&D

- In February 2023, Creative Enzymes participated in the Annual Biophysical Society Meeting in San Francisco, California. This helped the company to showcase innovative solutions, unlocking new possibilities

- In September 2021, Prinova Group LLC. (“Prinova”), a NAGASE Group Company, entered into a definitive agreement to acquire industry expert The Ingredient House, LLC (“TIH”). TIH has a significant presence in the sweetener, polyol, and specialty ingredient sectors both in the U.S. and internationally. This purchase represented another stride forward in Prinova’s long history of growth in the ingredient distribution space

- In August 2021, in the span of 125 years, Gehl Foods, LLC. achieved numerous milestones, evolving from a modest three-room creamery in Germantown, Wisconsin, to pioneering as the first FDA-approved aseptic manufacturer. Presently, it stands as the nation's foremost aseptic manufacturer. This helped the company to expand market share, and achieve a competitive edge in the aseptic manufacturing sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rice Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rice Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rice Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.