Global Saturating Kraft Paper Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.31 Billion

2024

2032

USD

1.57 Billion

USD

2.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.31 Billion | |

|

|

|

|

What is the Global Saturating Kraft Paper Market Size and Growth Rate?

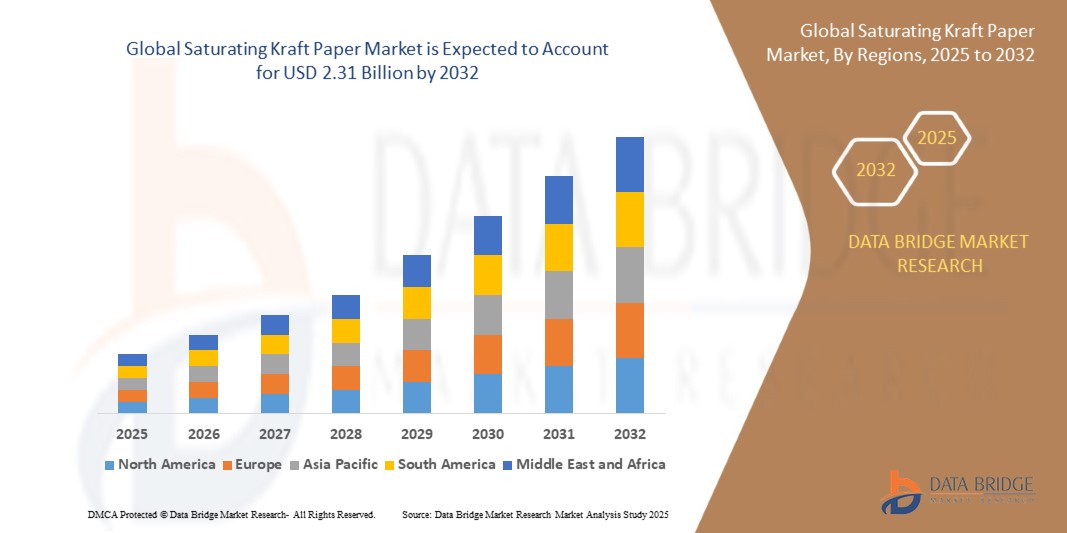

- The global saturating kraft paper market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.31 billion by 2032, at a CAGR of 4.96% during the forecast period

- The global saturating kraft paper market is experiencing steady growth fueled by the need for sustainable and robust packaging solutions. Renowned for its high strength, scratch resistance, and moisture barrier properties, saturating kraft paper finds extensive use in diverse packaging applications

- Recent trends indicate a rising adoption across sectors such as food and beverage, e-commerce, and consumer goods. Its eco-friendly characteristics and durability in harsh environments further drive its market expansion. As demand for sustainable packaging solutions continues to surge, the saturating kraft paper market is poised for continued growth

What are the Major Takeaways of Saturating Kraft Paper Market?

- In industries such as e-commerce, logistics, and food packaging, tear-resistant materials such as saturating kraft paper offer enhanced protection against tears and punctures, safeguarding goods from damage and contamination

- As consumers seek durable and reliable packaging solutions, tear-resistant materials become increasingly essential for maintaining product quality and reducing the risk of losses due to damaged goods in the supply chain. Thus, the surging demand for tear-resistant packaging stems from the need to ensure product integrity during handling, transportation, and storage

- Asia-Pacific dominated the saturating kraft paper market with the largest revenue share of 42.7% in 2024, driven by rapid industrial growth, expanding construction activities, and increasing demand for durable and moisture-resistant laminates in furniture and interior décor industries

- Europe is projected to grow at the fastest CAGR of 11.3% during the forecast period from 2025 to 2032, supported by rising emphasis on sustainable material sourcing, eco-label compliance, and green building certifications

- The Integrated System segment dominated the market with the largest market revenue share of 58.6% in 2024, owing to the increasing demand for automation, seamless production line integration, and real-time quality monitoring in high-volume manufacturing environments

Report Scope and Saturating Kraft Paper Market Segmentation

|

Attributes |

Saturating Kraft Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Saturating Kraft Paper Market?

“Sustainable Material Innovation and Recyclable Product Demand”

- A major trend shaping the saturating kraft paper market is the shift towards sustainable, bio-based, and recyclable raw materials in response to global environmental concerns and stricter regulations. Manufacturers are increasingly focusing on creating kraft papers that are FSC-certified, free from harmful chemicals, and compatible with circular economy models

- For instance, Ahlstrom launched its GreaseShield range of compostable and PFAS-free saturating kraft papers in 2023, which cater to growing demand in food packaging, laminates, and industrial applications. Similarly, Mondi has developed barrier-coated kraft paper solutions that maintain recyclability while offering durability and moisture resistance

- Innovations in resin formulations and water-based saturating chemicals are further accelerating this trend, helping improve the mechanical properties of kraft papers while reducing environmental impact. The integration of renewable fibers and low-VOC resins ensures compliance with EU Green Deal and U.S. EPA guidelines

- This sustainability-focused evolution is driven by end-user industries such as construction, furniture, and foodservice, which increasingly prioritize eco-friendly alternatives to plastic-laminated substrates. Brands seek packaging and laminates that are biodegradable yet functional

- Companies such as WestRock, International Paper, and Kotkamills are actively investing in R&D to deliver next-gen kraft paper variants tailored for high-performance laminating, printing, and coating applications while meeting sustainability target

- As climate regulations tighten and consumer preferences shift, sustainable innovation is becoming a core differentiator, driving growth and competitive advantage in the saturating kraft paper market

What are the Key Drivers of Saturating Kraft Paper Market?

- Rising demand for durable, high-resin absorption base papers in the construction, furniture, and laminate flooring industries is a key growth driver. Saturating kraft paper is widely used in decorative laminates, which are in turn driven by real estate growth and modular interior design trends

- For instance, in February 2024, Nordic Paper expanded its production capacity for saturating kraft paper grades to meet rising European demand for decorative surface solutions and industrial laminates

- The growth of ready-to-assemble (RTA) furniture and modular interior solutions further fuels demand, as these products often use melamine-impregnated paper layers bonded to MDF or particle board substrates for durability and aesthetics

- In the packaging sector, saturating kraft paper is gaining traction as a sustainable alternative to plastic-laminated cartons and pouches, especially in food contact applications. Its printability, strength, and resin compatibility make it suitable for high-barrier packaging solutions

- In addition, infrastructure projects, commercial furniture expansion, and DIY renovation activities across emerging markets such as India, Brazil, and Southeast Asia are generating large-scale demand for cost-effective decorative surfaces and insulation solutions based on kraft substrates

Which Factor is challenging the Growth of the Saturating Kraft Paper Market?

- A key challenge restraining the market is the volatility in raw material prices, especially in pulp and wood fiber supply, which significantly affects the profit margins of paper producers. The dependence on natural resources makes the industry vulnerable to climate-related disruptions, deforestation regulations, and international trade tariffs

- For instance, global pulp prices witnessed a surge in late 2023 due to supply chain bottlenecks and export restrictions in South Amrica and Southeast Asia, leading to cost pressures on saturating kraft paper producers.

- In addition, technological limitations in adapting kraft papers for extreme performance needs such as high moisture resistance, fire retardancy, or ultra-thin applications can limit adoption in certain high-value sectors such as aerospace or medical laminates

- Manufacturers also face tight environmental standards around emissions from saturating processes, especially in the use of formaldehyde-based resins, which require costly process upgrades or the shift to safer alternatives

- Smaller mills and regional players may struggle with the capital-intensive upgrades required to meet global quality and sustainability standards, thereby limiting their competitiveness against vertically integrated global players

- To mitigate these challenges, companies are investing in closed-loop recycling systems, low-impact coatings, and alternative cellulose fibers such as hemp or straw pulp to ensure resilience and compliance in the evolving regulatory landscape

How is the Saturating Kraft Paper Market Segmented?

The market is segmented on the basis of weight, paper grade, application, and end use.

• By Weight

On the basis of weight, the saturating kraft paper market is segmented into Less Than 50 GSM, 50 to 100 GSM, 100 to 200 GSM, and More Than 200 GSM. The 50 to 100 GSM segment dominated the market with the largest revenue share of 37.5% in 2024, driven by its optimal balance of durability and flexibility, making it widely suitable for lamination, countertops, and high-pressure laminates.

The 100 to 200 GSM segment is projected to register the fastest CAGR from 2025 to 2032 due to its rising usage in industrial-grade applications such as heavy-duty partitions, insulation, and structural panels, where enhanced strength and load resistance are required.

• By Paper Grade

On the basis of paper grade, the market is segmented into Unbleached Saturating Kraft Paper and Bleached Saturating Kraft Paper. The Unbleached segment held the largest market share of 63.8% in 2024, owing to its cost-effectiveness, superior resin absorption, and eco-friendly properties, making it the preferred choice for industrial laminates and furniture surfaces.

The Bleached Saturating Kraft Paper segment is expected to witness the fastest growth rate during the forecast period, attributed to its superior printability and visual appeal, which are ideal for decorative laminates, retail shelving, and premium interior design applications.

• By Application

On the basis of application, the market is segmented into Countertop, Partition, Shelving, Flooring, Panels, and Others. The Countertop segment dominated the market with the largest revenue share of 29.6% in 2024, due to the high use of resin-impregnated kraft paper in producing durable, aesthetic, and moisture-resistant surface layers for kitchen and commercial countertops.

The Flooring segment is projected to register the fastest CAGR from 2025 to 2032, driven by the growing demand for decorative and functional laminated flooring in residential and commercial spaces, especially in urbanizing economies.

• By End Use

On the basis of end use, the saturating kraft paper market is segmented into Household and Industrial. The Industrial segment led the market in 2024 with the largest revenue share of 66.4%, fueled by its extensive application in high-pressure laminate manufacturing, furniture components, insulation materials, and packaging substrates across sectors such as construction, transportation, and retail.

The Household segment is anticipated to witness the fastest CAGR during the forecast period, supported by the rising use of kraft laminates in home décor, DIY shelving, and small-scale renovation projects, aided by increased consumer preference for recyclable and sustainable materials.

Which Region Holds the Largest Share of the Saturating Kraft Paper Market?

- Asia-Pacific dominated the saturating kraft paper market with the largest revenue share of 42.7% in 2024, driven by rapid industrial growth, expanding construction activities, and increasing demand for durable and moisture-resistant laminates in furniture and interior décor industries

- Countries such as China, India, and Indonesia are experiencing strong demand for affordable and sustainable paneling and cabinetry materials, encouraging widespread adoption of Saturating Kraft Paper in laminates and engineered wood products

- The region’s dominance is further fueled by cost-effective manufacturing ecosystems, supportive government policies for industrial development, and increasing usage in shelving, partitions, and flooring across commercial and residential infrastructure projects

China Saturating Kraft Paper Market Insight

The China saturating kraft paper market captured the largest revenue share in Asia-Pacific in 2024, attributed to the booming real estate and infrastructure sectors, large-scale furniture production, and government investment in eco-friendly materials. China is home to leading paper manufacturers that produce a wide variety of kraft grades catering to both domestic and international markets. Demand for unbleached kraft paper remains strong due to its affordability and compatibility with resin impregnation processes used in high-pressure laminates.

India Saturating Kraft Paper Market Insight

The India saturating kraft paper market is witnessing robust growth due to increased demand from the modular furniture, packaging, and construction sectors. The rising preference for cost-efficient, recyclable, and durable alternatives to wood-based products is driving market penetration. Government housing projects, growing middle-class consumer spending, and industrial expansion are creating significant opportunities for kraft paper usage in countertops, partitions, and laminate flooring solutions.

Which Region is the Fastest Growing Region in the Saturating Kraft Paper Market?

Europe is projected to grow at the fastest CAGR of 11.3% during the forecast period from 2025 to 2032, supported by rising emphasis on sustainable material sourcing, eco-label compliance, and green building certifications. Saturating Kraft Paper is gaining traction in the region as it aligns with environmental regulations and supports circular economy models. Applications in premium-grade laminated panels, acoustic boards, and recyclable partitions are increasingly prominent. Furthermore, the growth of engineered wood and prefabricated furniture industries is fueling regional adoption.

Germany Saturating Kraft Paper Market Insight

The Germany saturating kraft paper market led Europe in 2024, driven by its strong foundation in engineered wood manufacturing and the presence of global leaders in laminate and panel production. Stringent environmental standards and the preference for low-emission, high-durability materials make kraft paper an essential component in flooring, panels, and furniture production. German manufacturers are also investing in advanced impregnation technologies that improve the performance and lifespan of kraft-based laminates.

U.K. Saturating Kraft Paper Market Insight

The U.K. saturating kraft paper market is expanding steadily, fueled by demand in the home improvement, commercial refurbishment, and retail shelving segments. Consumers and businesses are opting for lightweight, durable, and cost-effective alternatives to traditional wood, especially in urban settings where space and cost efficiency are key. The push for recyclable interior solutions and rising interest in do-it-yourself (DIY) projects are further boosting the market’s footprint across residential and small business applications.

Which are the Top Companies in Saturating Kraft Paper Market?

The saturating kraft paper industry is primarily led by well-established companies, including:

- WestRock Company (U.S.)

- International Paper (U.S.)

- MM Kotkamills (Finland)

- Nordic Paper (Sweden)

- Pudumjee Paper Products (India)

- Venkraft Paper Mills Pvt. Ltd. (India)

- Ahlstrom (Finland)

- Fleenor Company, Inc. (U.S.)

- Fortune Paper Mills LLP (India)

- Millenium Papers Pvt. Ltd. (India)

- Koehler Paper Group (Germany)

- Shanghai Plastech International Trading Co., Ltd. (China)

- Onyx Papers (U.S.)

- SWM Group (U.S.)

- Oji Holdings Corporation (Japan)

- Canfor (Canada)

- J Hill Container Company, Inc. (Canada)

- Canadian Kraft Paper Ltd. (Canada)

- Ranheim Paper & Board AS (Norway)

- Holland Manufacturing Company (U.S.)

- Midland (U.S.)

- Mondi (U.K.)

- Leizhan (China)

What are the Recent Developments in Global Saturating Kraft Paper Market?

- In April 2024, Essentia Organic Mattress introduced a kraft paper-based wrap for its roll-pack mattresses, replacing plastic with biodegradable, compostable, and recyclable kraft paper for both internal and external packaging. This strategic shift underscores the company’s commitment to sustainability and aligns with growing consumer demand for eco-friendly packaging alternatives, helping strengthen its green brand image

- In February 2024, Fourniture Industrie Service (FIS) developed a bubble wrap made from recycled kraft paper, addressing the dual need for product protection and environmental responsibility. This innovation reflects the increasing push toward plastic-free packaging solutions and supports market expansion in sustainable packaging formats, positioning FIS as a forward-looking industry player

- In June 2022, Stora Enso launched a 100% virgin fiber-based kraftliner, designed to meet the requirements of high-performance packaging applications. The product boosts both strength and environmental sustainability, catering to market preferences for robust and responsible materials, and enhances Stora Enso’s leadership in the eco-conscious packaging space

- In April 2021, Bellmer partnered with Segezha Group to construct a new paper machine in Sokol, Vologda Region, Russia, with operations planned to begin in 2023. This initiative is intended to boost production capacity and support regional economic growth through the adoption of advanced kraft paper manufacturing technologies, expanding both firms' influence in the European paper industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Saturating Kraft Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Saturating Kraft Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Saturating Kraft Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.