Global Service Market Data Center Market

Market Size in USD Billion

CAGR :

%

USD

100.68 Billion

USD

317.77 Billion

2024

2032

USD

100.68 Billion

USD

317.77 Billion

2024

2032

| 2025 –2032 | |

| USD 100.68 Billion | |

| USD 317.77 Billion | |

|

|

|

|

Service Market for Data Centre Market Size

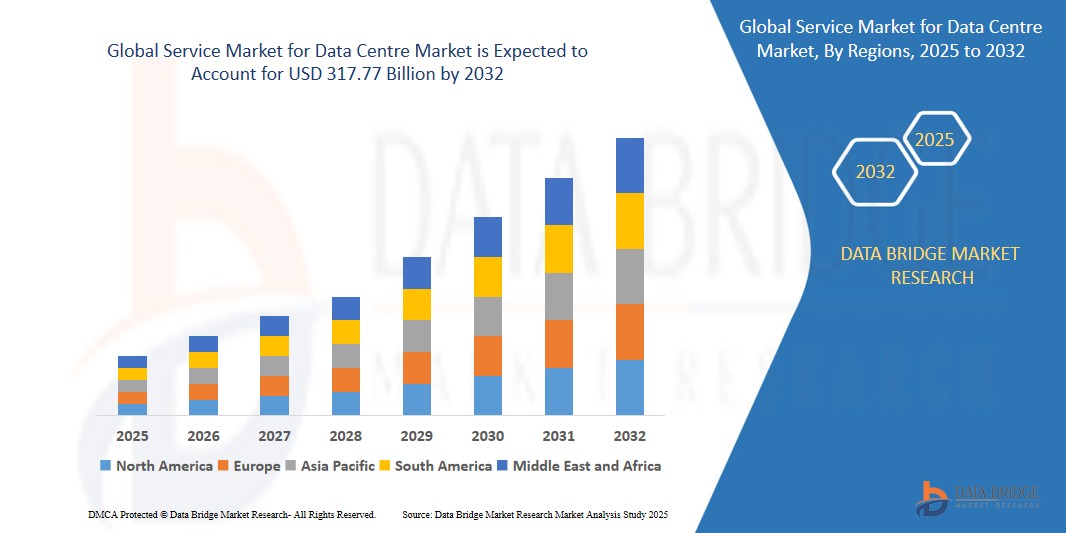

- The global service market for data centre market size was valued at USD 100.68 billion in 2024 and is expected to reach USD 317.77 billion by 2032, at a CAGR of 15.45% during the forecast period

- This growth is driven by rising globalization and growing application of advanced IT solutions by a wide range of end user verticals

Service Market for Data Centre Market Analysis

- Service Market for Data Centres are essential portable energy storage devices widely used across various sectors including consumer electronics, automotive, medical devices, industrial applications, and travel accessories, due to their convenient recharging capability, compact design, and ability to support multiple devices simultaneously

- The demand for service market for data centres is largely driven by increased smartphone penetration, growing digital dependency, and rising demand for backup power solutions across on-the-go consumers and professionals

- North America is expected to dominate the service market for data centre market with the largest market share of 35.71%, driven by the region’s mature IT infrastructure, strong demand for hyperscale and colocation data centres, and rapid adoption of cloud-based services

- Asia-Pacific region is expected to experience the highest CAGR in the service market for data centre, owing to increasing demand for scalable digital infrastructure in emerging economies and an uptick in internet and cloud usage

- The installation and deployment segment is expected to dominate the market with the largest market share of 38.31% due to rapid expansion of data centres driven by increasing digitalization, cloud adoption, and demand for edge computing infrastructure

Report Scope and Service Market for Data Centre Market Segmentation

|

Attributes |

Service Market for Data Centre Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Service Market for Data Centre Market Trends

“Growing Demand for Edge Data Centre Services”

- A prominent trend in the service market for data centre is the surge in demand for edge computing services, driven by the need for faster data processing and reduced latency near the data source.

- Edge data centres are gaining traction as they support applications requiring real-time analysis such as autonomous vehicles, smart cities, and AR/VR.

- Service providers are increasingly investing in micro data centres and localised IT infrastructure to offer tailored support for decentralized workloads.

- For instance, in March 2024, Equinix Inc. announced its expansion of edge data centre offerings in Asia and North America to support the growing demand for real-time processing across IoT and AI applications.

- This shift toward edge computing is expected to reshape the service market for data centre, pushing companies to decentralize and scale their service delivery frameworks.

Service Market for Data Centre Market Dynamics

Driver

“Rising Data Traffic from Cloud-Based Applications”

- The exponential growth in cloud services adoption from SaaS platforms to cloud-native enterprise applications has significantly increased the volume of data processed in data centres.

- To handle this surge, organizations are investing in managed services, data centre automation, and infrastructure support to ensure uptime, scalability, and security.

- Enterprises demand robust service solutions to handle high-speed transactions, data integrity, and seamless storage across multi-cloud environments.

- For instance, in 2023, Amazon Web Services (AWS) reported a 30% YoY increase in enterprise demand for hybrid cloud and support services across its global data centre network.

- This ongoing cloud adoption trend is expected to remain a major driver for the growth of the service market for data centre globally.

Opportunity

“Expansion of Hyperscale Data Centres in Emerging Markets”

- Rapid digitalization in countries such as India, Brazil, and Indonesia is fueling demand for hyperscale facilities supported by localized service providers.

- Global players are partnering with regional firms to build or operate new hyperscale centres, creating demand for installation, maintenance, and network services.

- Government initiatives supporting digital infrastructure and data localization are accelerating this growth further.

- For instance, in January 2024, Google Cloud announced its partnership with AdaniConneX to establish new hyperscale data centres in India, offering opportunities for managed service providers and infrastructure specialists.

- This creates a promising avenue for service vendors to tap into fast-growing data centre markets in emerging regions.

Restraint/Challenge

“Shortage of Skilled IT Personnel for Data Centre Operations”

- A significant challenge in the service market for data centre is the growing talent gap in IT operations, cybersecurity, and infrastructure management.

- As the complexity of data centres increases especially with hybrid and multi-cloud models finding and retaining skilled personnel becomes more difficult.

- Smaller service providers may struggle to scale due to limited access to high-level technical talent.

- For instance, a 2024 report by Uptime Institute noted that 54% of data centre operators globally face difficulty in recruiting qualified engineers, especially for roles in security, networking, and systems architecture.

- This persistent talent shortage could impede service scalability and slow market growth in regions lacking specialized workforce availability.

Service Market for Data Centre Market Scope

The market is segmented on the basis of service type, tier type, end-user, and data centre type.

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Tier Type |

|

|

By End-User |

|

|

By Data Centre Type |

|

In 2025, the large data centre is projected to dominate the market with a largest share in data centre type segment

The small data centres segment is expected to dominate the service market for data centre market with the largest share of 41.44% in 2025 due to increased deployment of advanced infrastructure such as AI-driven automation, high-density computing, and liquid cooling systems.

The installation and deployment is expected to account for the largest share during the forecast period in service type segment

In 2025, the installation and deployment segment is expected to dominate the market with the largest market share of 38.31% due to rapid expansion of data centres driven by increasing digitalization, cloud adoption, and demand for edge computing infrastructure.

Service Market for Data Centre Market Regional Analysis

“North America Holds the Largest Share in the Service Market for Data Centre Market”

- North America is expected to dominate the service market for data centre market with the largest market share of 35.71%, driven by the region’s mature IT infrastructure, strong demand for hyperscale and colocation data centres, and rapid adoption of cloud-based services

- The presence of leading tech giants and service providers such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure drives significant investments in service contracts, system integration, and managed services

- Stringent data security regulations, coupled with increasing focus on operational resilience and digital transformation, are prompting enterprises to partner with expert service providers to ensure compliant and efficient data centre operations

“Asia-Pacific is Projected to Register the Highest CAGR in the Service Market for Data Centre Market”

- Asia-Pacific is expected to experience the highest CAGR in the service market for data centre, owing to increasing demand for scalable digital infrastructure in emerging economies and an uptick in internet and cloud usage

- Government-led programs such as “Digital India,” “China’s Cloud Computing Strategy,” and initiatives in Japan and South Korea to build smart cities and 5G networks are accelerating data centre construction and service deployment

- Rising enterprise IT spending, expanding e-commerce, and cloud-native business models are encouraging local and global data centre operators to expand service offerings in the region, especially in India, China, and Southeast Asia

Service Market for Data Centre Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM (U.S.)

- Schneider Electric (France)

- Cisco Systems, Inc. (U.S.)

- Dell (U.S.)

- FUJITSU (Japan)

- Vertiv Group Corp. (U.S.)

- Hitachi, Ltd. (Japan)

- Equinix, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Bharat Sanchar Nigam Limited (India)

- CtrlS Datacenters Ltd (India)

- Netmagic Solutions (India)

- Tata Communications (India)

- Reliance Industries Limited (India)

- Capgemini (France)

- HCL Technologies Limited (India)

- Sungard Availability Services (U.S.)

- CenturyLink (U.S.)

- Verizon (U.S.)

- KDDI CORPORATION (Japan)

- NTT DATA Corporation (Japan)

- AT&T Intellectual Property (U.S.)

- DuPont (U.S.)

Latest Developments in Global Service Market for Data Centre Market

- In May 2024, Microsoft unveiled its first data center region in Mexico, the Mexico Central data center region, marking a significant step in providing local access to scalable, highly available, and resilient cloud services for global organizations. This initiative emphasizes Microsoft's commitment to driving digital transformation and sustainable innovation in Mexico, benefiting companies such as Binaria ID and DocSolutions. The launch demonstrates Microsoft’s strategic push in expanding its cloud infrastructure

- In August 2024, Hewlett Packard Enterprise Development LP launched a new managed data center hosting service in the U.A.E., in collaboration with Khazna Data Centers. This service aligns with the U.A.E.'s national AI strategy and supports AI initiatives in partnership with top regional institutions. The service provides high-performance computing technologies and is specifically designed for AI, featuring computing, software, networking, and direct liquid cooling solutions. This development highlights HPE's role in driving innovation in the Middle East’s AI landscape

- In November 2024, Nokia signed a five-year agreement to supply Microsoft Azure with data center switches and routers, improving the scalability and reliability of Azure’s global data centers. The partnership allows Nokia to extend its reach to more than 30 countries and strengthens its position as a key supplier for Microsoft’s global cloud infrastructure. This collaboration also furthers efforts on open-source SONiC, showcasing Nokia's innovation in high-capacity network solutions for data centers. This deal significantly enhances both companies' roles in global cloud computing

- In June 2024, Cisco expanded its security footprint by launching the first security cloud data centers in Jakarta, Indonesia. This move responds to the growing demand for security services, particularly in the public sector, financial services, and state-owned enterprises. By doing so, Cisco helps businesses in Indonesia align with local data regulations and compliance requirements, demonstrating its commitment to strengthening cyber security across the region

- In August 2023, Digital Realty introduced high-density data center colocation services across 28 markets in Asia Pacific, EMEA, and North America. The service supports up to 70 kilowatts of workload per rack, providing clients with increased performance and scalability. This expansion underscores Digital Realty’s continued growth and its ability to meet the evolving demands of businesses for robust data center services

- In March 2024, Eaton, a leading intelligent power management company, unveiled its new modular data center solution in North America. The SmartRack modular data centers are designed to meet the growing needs of edge computing, machine learning, and AI, offering rapid deployment for various facilities, from enterprise data centers to manufacturing plants. Eaton’s innovative approach supports organizations in adapting quickly to technological advancements and changing demands in the data center sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.