Global Small Domestic Appliances Sda Market

Market Size in USD Billion

CAGR :

%

USD

328.99 Billion

USD

546.53 Billion

2024

2032

USD

328.99 Billion

USD

546.53 Billion

2024

2032

| 2025 –2032 | |

| USD 328.99 Billion | |

| USD 546.53 Billion | |

|

|

|

|

Small Domestic Appliances (SDA) Market Size

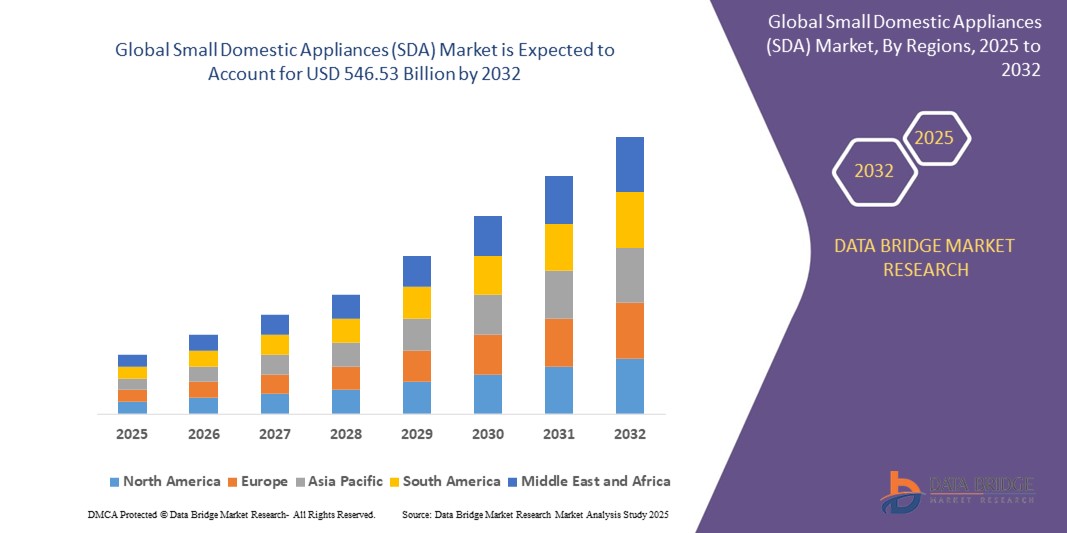

- The global small domestic appliances (SDA) market was valued at USD 328.99 billion in 2024 and is expected to reach USD 546.53 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.55%, primarily driven by rapid urbanization

- This growth is driven by rising disposable incomes and increasing consumer preference for convenience and time-saving solutions

Small Domestic Appliances (SDA) Market Analysis

- The small domestic appliances (SDA) market is witnessing robust growth due to rising urbanization, increased disposable income, and the growing need for time-saving and energy-efficient appliances in both residential and commercial settings. Innovations in smart technologies, compact designs, and multifunctional features are further driving market expansion across all segments

- Demand is significantly driven by evolving consumer lifestyles, the rise of nuclear families, and an increased focus on hygiene and convenience. Consumers are leaning towards appliances that offer automation, remote control capabilities, and energy savings, especially in kitchen, garment care, and floor care categories

- Asia-Pacific dominates the small domestic appliances (SDA) market, led by countries such as China and India, owing to the region’s strong manufacturing base, expanding middle class, and increasing e-commerce penetration. The presence of key manufacturers and production hubs has also contributed to cost efficiencies and broader market accessibility

- For instance, in 2024, LG and Samsung introduced AI-powered SDA lines in South Korea and India, featuring self-cleaning technologies and smart home integration—catering to rising consumer expectations for intelligent and user-friendly home solutions

- Globally, the SDA market is being transformed by trends such as IoT integration, energy labeling, and sustainable product innovation. These advancements are reshaping consumer expectations and positioning the industry for continued growth through customization, convenience, and environmental responsibility

Report Scope and Small Domestic Appliances (SDA) Market Segmentation

|

Attributes |

Small Domestic Appliances (SDA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Small Domestic Appliances (SDA) Market Trends

“Integration of Voice-Controlled and AI-Enabled Features in SDA”

- The small domestic appliances (SDA) market is experiencing a rapid shift toward smart home integration, with growing demand for AI-powered and voice-controlled functionalities across kitchen, floor care, and garment care appliances

- Consumers are increasingly adopting SDA products that support platforms such as Amazon Alexa, Google Assistant, and proprietary AI systems, enabling hands-free operation, personalized routines, and remote diagnostics

- These technologies enhance user convenience, energy efficiency, and real-time data tracking, allowing appliances to learn preferences, automate repetitive tasks, and improve long-term performance

- For instance, in January 2024, Whirlpool Corporation launched a new range of AI-enabled washing machines and refrigerators that respond to voice commands and auto-adjust settings based on user behaviour

- As smart living becomes the norm, the SDA market is set to benefit from rising AI adoption, propelling innovation in connected appliances that elevate user experience through automation and predictive capabilities

Small Domestic Appliances (SDA) Market Dynamics

Driver

“Evolving Urban Lifestyles and Demand for Compact, Multi-Functional Appliances”

- Urbanization and space constraints in major cities have led to a surge in demand for compact and versatile small domestic appliances, particularly in kitchens and laundry areas

- Consumers prefer appliances that combine multiple functionalities, such as microwave-oven-grill combos, robot vacuum-mop hybrids, and steam-iron-garment steamers, for space and cost efficiency

- These appliances cater to the fast-paced lifestyle of millennials and working professionals who seek convenience, mobility, and smart design in limited living spaces

- For instance, in March 2024, Dyson introduced a multi-functional floor care system in Singapore, combining vacuuming, mopping, and air purifying into a single smart appliance for modern urban homes

- As urban populations grow, especially in developing economies, the SDA market will continue evolving to meet demands for space-saving, multi-use appliances that simplify daily routines

Opportunity

“Rising Penetration of E-Commerce and Direct-to-Consumer (DTC) Channels”

- With the growing popularity of online shopping, SDA brands have the opportunity to reach a broader consumer base through e-commerce platforms and DTC models

- Online sales enable brands to bypass intermediaries, offer personalized shopping experiences, and leverage customer data for targeted promotions and loyalty programs

- Strategic partnerships with e-commerce giants and the adoption of AR-powered product previews are further enhancing consumer engagement and conversion rates

For instance,

- In February 2024, Kenwood Limited partnered with Amazon India to launch an exclusive SDA product line with real-time demo videos, instant coupons, and AI-assisted shopping support

- In December 2023, Morphy Richards India rolled out its DTC website, offering customization options and bundled packages for festive and wedding seasons

- In November 2023, Groupe SEB expanded its logistics infrastructure in Southeast Asia to support same-day delivery for high-demand SDA products sold online

- As digital adoption accelerates, the SDA market will see massive opportunities in expanding online presence, improving supply chains, and building brand loyalty through seamless DTC and e-commerce experiences

Restraint/Challenge

“Short Product Lifespan and High Repair/Replacement Costs”

- Many SDA products face issues with durability and frequent technical faults, leading to high after-sales service costs and reduced consumer trust in certain brands

- Limited access to authorized repair centers, expensive spare parts, and poor warranty support deter consumers from opting for high-end models, affecting brand retention

- Environmental concerns around frequent disposal and electronic waste are also challenging the sustainability reputation of the industry

- For instance, in April 2024, Koninklijke Philips N.V. received consumer backlash in the U.K. over high replacement costs for defective air fryers, despite extended warranties

- To overcome this challenge, manufacturers must focus on enhancing product durability, providing accessible repair solutions, and adopting circular economy models to boost sustainability and customer satisfaction

Small Domestic Appliances (SDA) Market Scope

The market is segmented on the basis of product type, end use, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End Use |

|

|

By Distribution Channel |

|

Small Domestic Appliances (SDA) Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Small Domestic Appliances (SDA) Market”

- Asia-Pacific leads the small domestic appliances (SDA) market due to its large manufacturing base

- The region is home to many prominent SDA manufacturers, contributing significantly to global production

- China and India have emerged as key production hubs, boosting the region's dominance

- Asia-Pacific's dominance in the SDA market is expected to continue, driven by manufacturing capabilities and growing demand in emerging economies

“North America is projected to register the Highest Growth Rate”

- North America is experiencing increased demand for new and advanced kitchen and cleaning equipment

- The growth in demand is driven by a rise in consumer interest for innovative and efficient appliances

- Technological advancements in kitchen and cleaning equipment are further contributing to the market growth

- North America is expected to see a strong growth rate in the SDA market due to the increasing demand for advanced appliances

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Techtronic Floor Care Technology Limited (Hong Kong)

- Morphy Richards India (India)

- Kenwood Limited (U.K.)

- Robert Bosch GmbH (Germany)

- Stanley Black & Decker, Inc. (U.S.)

- Dyson (U.K.)

- Groupe SEB (France)

- Koninklijke Philips N.V. (Netherlands)

- Whirlpool Corporation (U.S.)

- Wipro Enterprises (P) Ltd. (India)

- Hettich Holding GmbH & Co. oHG (Germany)

- Tetra Pak International S.A. (Switzerland)

- Sulzer Ltd. (Switzerland)

- Marel (Iceland)

- ANKO FOOD MACHINE CO., LTD. (Taiwan)

- Electrolux Professional, Inc. (Sweden)

- KHS Group (Germany)

- Krones AG (Germany)

- Bühler AG (Switzerland)

Latest Developments in Global Small Domestic Appliances (SDA) Market

- In October 2023, Voltas, a leading player in the home appliance industry, ventured into the water heater segment with the launch of its Voltas Water Heaters. This move further solidified the company’s vision of becoming a comprehensive solution provider for all home appliances, and the product became available to consumers across India, including through online channels

- In April 2023, Haier India, a consumer durables company, invested USD 182.8 million in the second phase of expansion at its Greater Noida facility, along with an extension of its product portfolio. With this investment, the company aims to achieve a 33% growth in turnover, positioning itself for further market expansion

- In January 2023, GE Appliances launched a range of induction cooktop sets equipped with smart technologies, including features such as temperature control and heat monitoring, marking a significant step toward smarter cooking solutions

- In May 2022, Whirlpool Corporation introduced its new marketing organization, WoW Studios (World of Whirlpool Studios), in the U.S., comprising a multidisciplinary creative team that will manage the company’s brand portfolio, including KitchenAid, Whirlpool, Maytag, JennAir, and Amana

- In July 2021, Hitachi Global Life Solutions and Arçelik announced the formation of a new joint venture, ‘Arçelik Hitachi Home Appliances,’ to expand its manufacturing, sales, and after-sales service for Hitachi-branded home appliances across the Asia Pacific region, excluding Japan

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.