Global Smart Antenna Market

Market Size in USD Billion

CAGR :

%

USD

7.33 Billion

USD

13.36 Billion

2024

2032

USD

7.33 Billion

USD

13.36 Billion

2024

2032

| 2025 –2032 | |

| USD 7.33 Billion | |

| USD 13.36 Billion | |

|

|

|

|

Smart Antenna Market Size

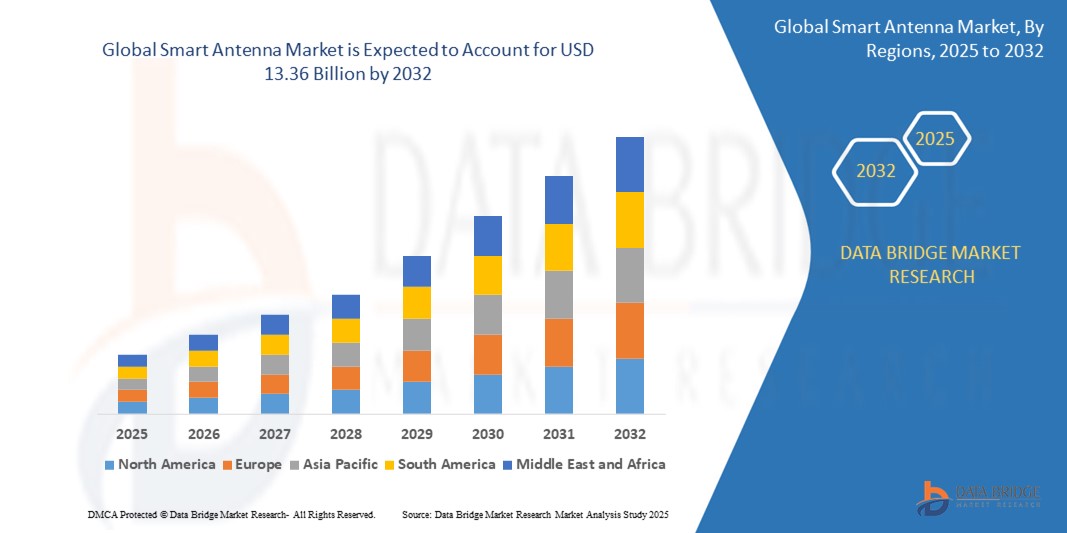

- The global smart antenna market was valued at USD 7.33 billion in 2024 and is expected to reach USD 13.36 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.80%, primarily driven by the growing demand for high-speed wireless communication

- This growth is driven by increasing adoption of IoT devices, and the rise in automotive safety systems that require reliable connectivity

Smart Antenna Market Analysis

- The smart antenna market is experiencing rapid global growth, driven by the increasing demand for high-speed wireless communication, the adoption of 5G networks, and the rising integration of IoT devices in various industries. These factors are propelling the need for advanced antennas that offer better signal quality, reliability, and connectivity, especially in mobile and automotive applications, thus improving overall communication efficiency and user experience

- Market expansion is further supported by favorable regulatory frameworks, technological advancements in beamforming and adaptive antenna systems, and the growing focus on smart city projects. These developments are enhancing connectivity across urban infrastructure, industrial automation, and vehicle safety systems, enabling more efficient communication networks worldwide

- For instance, in China, Huawei Technologies is leading the charge in 5G smart antenna development, enhancing both urban connectivity and vehicle-to-everything (V2X) communication, playing a pivotal role in transforming communication networks and driving the next wave of innovation in 5G technology

- Globally, the smart antenna market is being reshaped by innovations such as location-aware antennas, adaptive array systems, and multibeam technologies that provide more efficient and scalable solutions for telecommunications, automotive, and industrial sectors. These trends, coupled with increased investment from key industry players such as Ericsson and Qualcomm, are ensuring sustained growth and innovation in the smart antenna sector

Report Scope and Smart Antenna Market Segmentation

|

Attributes |

Smart Antenna Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Smart Antenna Market Trends

“Expansion of 5G and IoT Connectivity”

- A significant trend in the smart antenna market is the rapid expansion of 5G networks and the increasing integration of IoT devices, driving the need for advanced smart antenna solutions

- The growing demand for high-speed, low-latency connectivity in urban areas, coupled with the proliferation of smart devices, is fueling the adoption of next-gen smart antennas to support seamless communication

- For instance, Ericsson is at the forefront of providing smart antenna solutions for 5G, enabling faster data speeds and enhanced network capacity for telecom operators worldwide

- Smart antennas are becoming crucial in enabling IoT applications in sectors such as smart cities, healthcare, and logistics, providing improved coverage and performance

- This trend is transforming the global communications landscape, driving the smart antenna market’s growth as it supports emerging technologies and increasing demand for faster, reliable, and more efficient wireless communication

Smart Antenna Market Dynamics

Driver

“Increasing Adoption of Autonomous Vehicles”

- The growing demand for autonomous vehicles is a key driver of the smart antenna market, as these vehicles require advanced communication systems for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication

- Smart antennas are integral to real-time data exchange in autonomous vehicles, ensuring safe navigation, collision avoidance, and seamless connectivity with traffic systems and cloud services

- The global push towards autonomous driving and the digitalization of transportation networks are accelerating the adoption of smart antenna technologies

For instance,

- In December 2023, Qualcomm and Audi collaborated on integrating smart antenna solutions for advanced communication systems in autonomous vehicles.

- In August 2023, Toyota launched a pilot program using smart antennas for V2X communication in urban areas.

- In June 2023, Waymo integrated smart antenna technology into their autonomous fleet to enhance communication with surrounding infrastructure

- The adoption of smart antennas in autonomous vehicles is expected to grow as the demand for safer and more efficient transportation increases globally

Opportunity

“Integration of Smart Antennas in Industrial Automation”

- There is a growing opportunity for the integration of smart antennas in industrial automation as industries seek to enhance communication systems and improve operational efficiency

- The use of smart antennas in machine-to-machine (M2M) communication, remote monitoring, and asset tracking is driving their adoption in industries such as manufacturing, logistics, and energy

- The increasing investment in Industry 4.0 technologies, including AI, robotics, and IoT, further fuels the demand for efficient and reliable communication systems powered by smart antennas

For instance,

- In November 2023, Siemens incorporated smart antennas in its IoT-based industrial solutions to enhance real-time data collection in manufacturing plants

- In July 2023, Honeywell adopted smart antenna technology in its automated warehouse systems for seamless communication between machines and control systems

- In March 2023, General Electric deployed smart antennas in its smart grid solutions to optimize energy distribution and improve grid reliability

- As industries continue to embrace automation, smart antennas will play a key role in driving efficiency and innovation in industrial settings

Restraint/Challenge

“High Cost of Advanced Antenna Systems”

- One of the significant challenges in the smart antenna market is the high cost of advanced smart antenna systems, which can hinder their widespread adoption, particularly in price-sensitive markets

- The initial investment required for cutting-edge technologies such as beamforming and MIMO (Multiple Input, Multiple Output) antennas can be prohibitive for small and medium-sized enterprises (SMEs) and emerging economies

- The complexity of designing, manufacturing, and maintaining advanced smart antennas increases costs, limiting their integration into low-cost devices and systems

For instance,

- In January 2024, Qualcomm and Samsung faced challenges in reducing the cost of 5G antennas for smartphones, impacting the affordability of 5G-enabled devices

- To overcome this challenge, industry players must invest in cost-effective manufacturing techniques, increase economies of scale, and collaborate with telecom providers to make smart antennas more affordable for a broader range of applications

Smart Antenna Market Scope

The market is segmented on the basis of technology, type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Technology

|

|

|

By Type |

|

|

By Application |

|

Smart Antenna Market Regional Analysis

“North America is the Dominant Region in the Smart Antenna Market”

- North America leads the smart antenna market due to its advanced wireless communication infrastructure

- The region has a thriving smartphone market, driving demand for better signal quality and connectivity

- There is a growing need for vehicle safety communication systems, boosting smart antenna adoption in the automotive sector

- North America's dominance is fueled by technological advancement and rising consumer and automotive connectivity needs

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to register the highest growth rate in the smart antenna market

- Rapid urbanization and digitization are driving the demand for advanced communication systems in the region

- Expanding 5G infrastructure and increasing investments in smart city projects are key growth enablers

- Asia-Pacific's growth trajectory is supported by large-scale tech adoption and government-backed digital initiatives

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Telefonaktiebolaget LM Ericsson (Sweden)

- Huawei Technologies Co., Ltd (China)

- Semtech Corporation (U.S.)

- Nokia (Finland)

- Qualcomm Technologies, Inc. (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- CommScope (U.S.)

- Airgain (U.S.)

- SAMSUNG (South Korea)

- ZTE Corporation (China)

Latest Developments in Global Smart Antenna Market

- In May 2024, Zetifi, an Australian-based company, introduced the world’s first location-aware smart antennas, aiming to revolutionize the product segment by transforming traditional passive vehicle antennas into intelligent devices that enhance phone coverage. This launch marks a significant leap in vehicle antenna technology and connectivity optimization.

- In February 2024, Septentrio, a leader in high-precision GNSS/INS positioning systems, launched the AntaRx-Si3, the industry's first GNSS/INS Smart Antenna encased in an ultra-rugged shell, engineered for easy integration into machines such as agricultural robots. This innovation pushes the boundaries of durability and precision in industrial smart antenna applications.

- In January 2024, Texas Instruments, headquartered in Dallas, released advanced semiconductor radar chips designed to enhance automotive intelligence and safety, with the AWR2544 featuring a 3D wavelength antenna built directly onto printed circuit boards. This breakthrough enables compact sensor designs, promoting smarter and safer vehicle systems.

- In September 2023, KP Performance Antennas, a brand of Infinite Electronics, launched a new line of high-precision vehicle GPS antennas, built to set new benchmarks in accuracy and dependability for automotive applications. This release redefines navigation standards, ensuring superior performance and reliability.

- In August 2023, Airgain, Inc., a key player in wireless connectivity, introduced the ULTRAMAX Glass 5G high-performance antenna, tailored for windshield or dashboard mounting and optimized for compact spaces. This product enhances 5G connectivity while maintaining a sleek, unobtrusive design.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.