Global Thermoplastic Polyurethane Market For Medical Applications

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

1.91 Billion

2024

2032

USD

1.23 Billion

USD

1.91 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.91 Billion | |

|

|

|

|

What is the Global Thermoplastic Polyurethane Market for Medical Applications Size and Growth Rate?

- The global thermoplastic polyurethane market for medical applications size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.91 billion by 2032, at a CAGR of 5.60% during the forecast period

- Growing demand for advanced medical devices, driven by an aging population coupled with a higher focus on patient care and treatment, is expected to promote the market movement. Thermoplastic polyurethane can induce superior versatility and properties, making it ideal for manufacturing various medical devices, including catheters, implants, and wearable devices

What are the Major Takeaways of Thermoplastic Polyurethane Market for Medical Applications?

- The escalating need for advanced medical devices is propelled by several factors: an aging populace, surging chronic disease rates, and a heightened emphasis on patient-centric care. T. TPU's flexibility and durability render it ideal for crafting various medical devices such as catheters, implants, and wearable devices. Its biocompatibility ensures minimal adverse reactions, while its ability to withstand rigorous sterilization procedures maintains hygiene standards. Consequently, TPU is a pivotal material in meeting the burgeoning demand for innovative and effective medical solutions

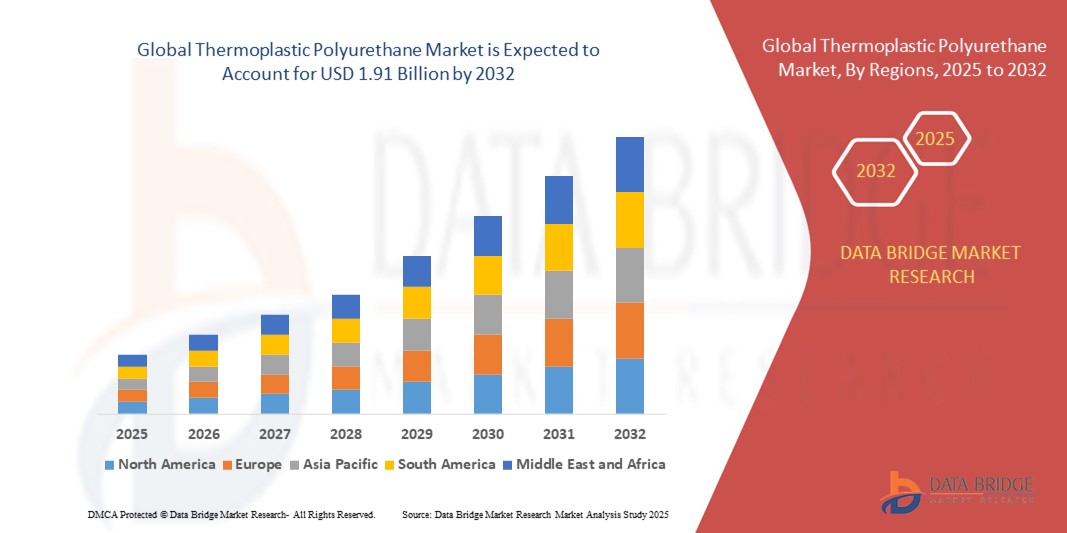

- North America dominated the thermoplastic polyurethane (TPU) market for medical applications with the largest revenue share of 32.12% in 2024, driven by the rising adoption of advanced medical devices, surgical equipment, and wearables requiring high-performance polymers

- Asia-Pacific is poised to grow at the fastest CAGR of 6.47% during 2025–2032, fueled by rising healthcare investments, expanding hospital infrastructure, and demand for cost-effective medical devices

- The polyester-based TPU segment dominated the market with the largest revenue share of 47.5% in 2024, driven by its excellent mechanical strength, abrasion resistance, and chemical resistance

Report Scope and Thermoplastic Polyurethane Market for Medical Applications Segmentation

|

Attributes |

Thermoplastic Polyurethane Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Thermoplastic Polyurethane Market for Medical Applications?

Growing Demand for Biocompatible and Sustainable TPU Solutions

- A significant trend shaping the global thermoplastic polyurethane market for medical applications is the increasing demand for biocompatible, recyclable, and eco-friendly TPU materials that meet stringent regulatory requirements for healthcare use. TPU’s unique combination of flexibility, durability, and chemical resistance makes it ideal for catheters, wound dressings, surgical tubing, and implantable devices

- For instance, Lubrizol has developed aliphatic TPUs that are biocompatible and free of plasticizers, catering to next-generation medical devices requiring long-term safety and patient comfort. Similarly, Covestro AG offers TPU grades designed for skin-contact applications, with high resistance to disinfectants and body fluids

- Medical-grade TPU innovations are increasingly aligned with sustainability goals, where manufacturers are focusing on recyclable and bio-based TPU formulations to reduce environmental impact without compromising performance. TPU’s adaptability to both extrusion and injection molding further broadens its applications in minimally invasive medical procedures

- The adoption of biocompatible TPU is also being accelerated by the rising demand for home healthcare devices and wearable medical equipment, where comfort, flexibility, and long-term skin tolerance are critical

- This shift towards sustainable, biocompatible TPU solutions is expected to redefine medical material standards, pushing companies to invest more in R&D for advanced formulations that balance performance with regulatory compliance

What are the Key Drivers of Smart Lock Maret?

- The rising prevalence of chronic diseases and the demand for advanced medical devices such as catheters, infusion sets, and wound care products are driving TPU adoption due to its biocompatibility and high performance

- For instance, in 2024, BASF SE expanded its Elastollan TPU portfolio for medical use, focusing on long-term implantable devices with superior chemical resistance. Such product innovations by leading players are expected to drive growth in the coming years

- The shift towards minimally invasive surgeries and home-based care has accelerated the use of TPU in wearable medical devices, owing to its flexibility, lightweight properties, and skin comfort

- Growing regulatory support for medical-grade polymers and the replacement of PVC and silicone with safer TPU alternatives are also fueling adoption in the healthcare sector

- In addition, the rise of 3D printing technologies in medical device manufacturing is boosting TPU demand, as the material enables high-precision customization for patient-specific needs

Which Factor is Challenging the Growth of the Thermoplastic Polyurethane Market for Medical Applications?

- One of the major challenges is the high cost of medical-grade TPU compared to traditional polymers such as PVC or silicone. The specialized formulations and compliance with strict medical regulations increase production costs, limiting adoption in cost-sensitive markets

- For instance, smaller medical device manufacturers in Asia-Pacific often prefer PVC over TPU due to lower costs, despite TPU’s superior performance and safety profile

- Another challenge lies in regulatory hurdles and the long approval cycles required for medical-grade polymers in critical applications, which can delay product commercialization and increase R&D expenditures

- The limited recyclability of certain TPU grades and the need for specialized disposal methods also pose sustainability challenges for hospitals and healthcare systems

- Overcoming these hurdles will require manufacturers to focus on cost optimization, compliance support, and development of recyclable TPU solutions to ensure wider adoption in global healthcare applications

How is the Thermoplastic Polyurethane Market for Medical Applications Segmented?

The market is segmented on the basis of type, application, and end user.

- By Type

The thermoplastic polyurethane (TPU) market for medical applications is segmented into polyester-based, polyether-based, and polycaprolactone-based. The polyester-based TPU segment dominated the market with the largest revenue share of 47.5% in 2024, driven by its excellent mechanical strength, abrasion resistance, and chemical resistance, making it highly suitable for catheters, tubing, and surgical instrument components. Its durability and stability under sterilization methods such as gamma radiation and ethylene oxide further strengthen its adoption in critical care devices.

The polycaprolactone-based TPU segment is projected to register the fastest growth from 2025 to 2032, fueled by its superior biocompatibility, biodegradability, and growing use in tissue engineering and drug delivery systems. With rising demand for sustainable and patient-friendly materials, polycaprolactone-based TPU is increasingly preferred for next-generation medical applications. This trend signals a strong shift toward bioresorbable and regenerative solutions in medical device manufacturing.

- By Application

The market is segmented into medical tubing, wound care, medical devices and components, and orthopedic devices. The medical tubing segment held the dominant market revenue share of 41.3% in 2024, owing to its widespread use in catheters, infusion sets, and respiratory circuits. The superior flexibility, kink resistance, and biocompatibility of TPU make it an excellent alternative to PVC, which faces regulatory scrutiny over DEHP plasticizers. Furthermore, the demand for TPU tubing has been bolstered by the rising prevalence of chronic diseases, home-based care, and minimally invasive surgeries.

The wound care segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the growing use of TPU films and foams in advanced dressings. Their high moisture vapor transmission rate, elasticity, and comfort make them ideal for managing chronic wounds, burns, and surgical incisions. This reflects a broader trend toward advanced wound healing materials that improve patient recovery outcomes.

- By End User

The thermoplastic polyurethane market for medical applications is categorized into hospitals and clinics, medical device manufacturers, and home healthcare. The medical device manufacturers segment dominated with the largest market share of 52.8% in 2024, primarily due to the high demand for TPU in the production of catheters, implants, tubing, and specialized device components. TPU’s adaptability for custom formulations, combined with its compliance with medical-grade standards such as ISO 10993 and USP Class VI, positions it as a preferred material in manufacturing.

The home healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032. This growth is fueled by the rapid shift toward patient-centric care, increasing use of portable medical devices, and the rising incidence of chronic diseases requiring long-term monitoring. The adoption of TPU in lightweight, flexible, and user-friendly devices is expected to accelerate with the global expansion of home healthcare solutions.

Which Region Holds the Largest Share of the Smart Lock Maret?

- North America dominated the thermoplastic polyurethane (TPU) market for medical applications with the largest revenue share of 32.12% in 2024, driven by the rising adoption of advanced medical devices, surgical equipment, and wearables requiring high-performance polymers

- The region’s strong healthcare infrastructure, coupled with a growing focus on patient comfort and safety, accelerates the demand for TPU in catheters, wound care, and medical tubing

- Increasing investments in R&D by global players, alongside strict regulatory standards for biocompatibility and durability, further strengthen North America’s leading position in this market

U.S. Thermoplastic Polyurethane Market for Medical Applications Insight

The U.S. captured the largest revenue share of 81% in 2024 within North America, fueled by rapid adoption of minimally invasive surgical devices, advanced wound care, and biomedical implants. A strong presence of leading TPU manufacturers and medical OEMs, combined with rising expenditure on healthcare innovation, drives steady market growth. Growing demand for lightweight, flexible, and durable medical polymers supports the widespread integration of TPU across a range of medical applications.

Europe Thermoplastic Polyurethane Market for Medical Applications Insight

Europe is projected to expand at a substantial CAGR, driven by stringent medical safety regulations and increasing demand for eco-friendly, biocompatible polymers. Rising adoption of medical devices in home healthcare and hospitals, coupled with growth in an aging population, fuels market expansion. TPU is gaining traction across wound dressings, prosthetics, and hospital equipment, with innovation in recyclable and sustainable TPU formulations supporting future growth.

U.K. Thermoplastic Polyurethane Market for Medical Applications Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, supported by growing healthcare modernization initiatives and increased investment in advanced medical materials. Rising awareness of infection control and patient-centric healthcare solutions is boosting demand for TPU in catheters, gloves, and wearable monitoring devices. Strong distribution networks and medical research collaborations further stimulate TPU adoption in the country.

Germany Thermoplastic Polyurethane Market for Medical Applications Insight

The German market is expected to expand at a considerable CAGR, supported by the country’s innovation-driven medical technology ecosystem and demand for sustainable, high-performance polymers. TPU is increasingly being integrated into advanced prosthetics, hospital equipment, and implantable devices, aligning with Germany’s emphasis on precision engineering. Government focus on medical technology exports and biocompatibility regulations continues to strengthen the country’s position in the European TPU market.

Which Region is the Fastest Growing Region in the Thermoplastic Polyurethane Market for Medical Applications?

Asia-Pacific is poised to grow at the fastest CAGR of 6.47% during 2025–2032, fueled by rising healthcare investments, expanding hospital infrastructure, and demand for cost-effective medical devices. Countries such as China, Japan, and India are leading the adoption of TPU due to rapid urbanization, increasing chronic disease prevalence, and government-led healthcare reforms. As APAC emerges as a medical manufacturing hub, the availability of affordable TPU-based solutions drives mass adoption across wound care, drug delivery devices, and protective medical equipment.

Japan Thermoplastic Polyurethane Market for Medical Applications Insight

Japan’s TPU market is witnessing strong momentum due to its tech-driven healthcare system, rapid medical innovation, and increasing aging population. High demand for TPU in wearable devices, surgical equipment, and diagnostic consumables is boosting market growth. Integration of TPU with next-gen IoT-enabled medical devices is a key driver in the Japanese market.

China Thermoplastic Polyurethane Market for Medical Applications Insight

China accounted for the largest market revenue share in APAC in 2024, driven by its expanding middle class and strong domestic manufacturing base. Rising demand for affordable medical consumables, coupled with government emphasis on healthcare expansion and smart hospitals, supports market growth. TPU adoption is widespread in catheters, films, and medical tubing, establishing China as a dominant market player in the region.

Which are the Top Companies in Thermoplastic Polyurethane Market for Medical Applications?

The thermoplastic polyurethane market for medical applications is primarily led by well-established companies, including:

- Lubrizol Corporation (U.S.)

- Covestro AG (Germany)

- Huntsman Corporation (U.S.)

- BASF SE (Germany)

- Wanhua Chemical Group Co., Ltd. (China)

- DSM Engineering Plastics (Netherlands)

- American Polyfilm, Inc. (U.S.)

- PolyOne Corporation (U.S.)

- Kuraray Co., Ltd. (Japan)

- Tosoh Corporation (Japan)

What are the Recent Developments in Global Thermoplastic Polyurethane Market for Medical Applications?

- In March 2024, ICP DAS-BMP secured major TPU contracts with leading medical materials companies in the U.S. and Japan, aimed at enhancing product reliability. This move is expected to strengthen the company’s competitive position and open new growth opportunities

- In February 2023, Covestro AG announced plans to establish its largest thermoplastic polyurethane manufacturing plant in Zhuhai, South China, with construction divided into three phases and final completion targeted by late 2025. Once fully operational, the plant will provide an annual production capacity of 20,000 tons of TPU, solidifying Covestro’s manufacturing presence in Asia

- In August 2022, The Lubrizol Corporation introduced a new TPU production line at its Shanghai Songjiang Site to expand capacity and reinforce its footprint in the Asia Pacific market. This expansion is projected to improve supply capabilities and cater to rising regional demand

- In September 2021, Huntsman’s Polyurethanes and Performance Products divisions took part in the 63rd Center for the Polyurethanes Industry’s (CPI) Technical Conference, presenting advancements in low-aldehyde catalysts, automotive seating, and sustainable raw materials. The participation highlighted the company’s innovation-driven approach and commitment to sustainability

- In September 2021, BASF partnered with Hotter, a leading footwear manufacturer, to deliver its first expanded thermoplastic polyurethane (E-TPU) product called Infinergy for shoe production. This collaboration emphasized BASF’s entry into performance footwear applications and showcased its ability to withstand market fluctuations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermoplastic Polyurethane Market For Medical Applications, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoplastic Polyurethane Market For Medical Applications research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoplastic Polyurethane Market For Medical Applications consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.