Global Transcatheter Embolization And Occlusion Market

Market Size in USD Billion

CAGR :

%

USD

5.93 Billion

USD

11.68 Billion

2025

2033

USD

5.93 Billion

USD

11.68 Billion

2025

2033

| 2026 –2033 | |

| USD 5.93 Billion | |

| USD 11.68 Billion | |

|

|

|

|

Transcatheter Embolization and Occlusion Market Size

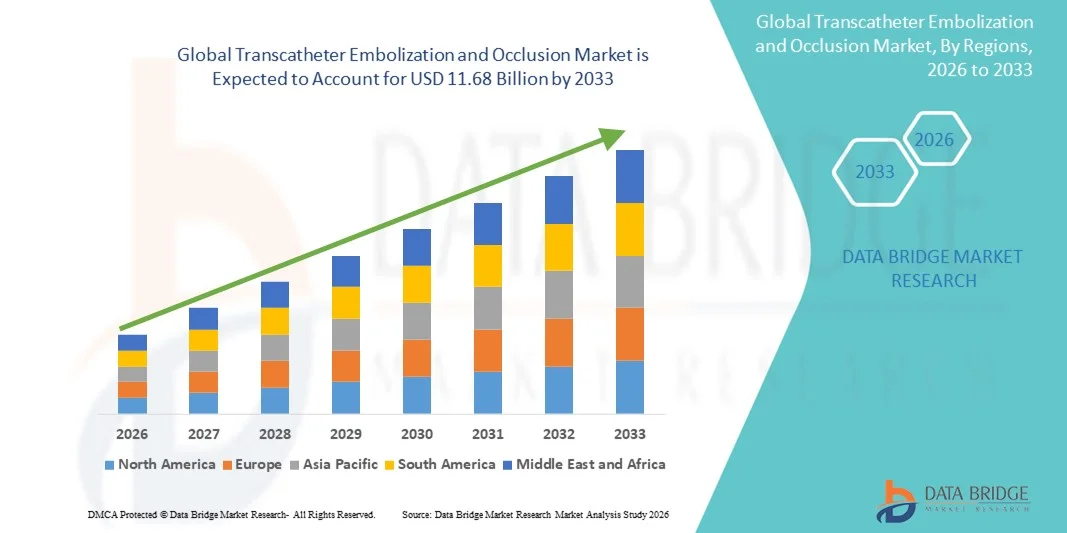

- The global transcatheter embolization and occlusion market size was valued at USD 5.93 billion in 2025 and is expected to reach USD 11.68 billion by 2033, at a CAGR of 8.85% during the forecast period

- The market growth is largely fueled by increasing adoption of minimally invasive vascular and interventional radiology procedures, rising prevalence of vascular diseases, and broader use in oncology and hemorrhage control

- Furthermore, technological advances in embolic agents and delivery systems, along with rising demand for less-invasive and effective solutions across both developed and emerging markets, are accelerating the uptake of transcatheter embolization and occlusion devices, thereby significantly boosting the industry's growth

Transcatheter Embolization and Occlusion Market Analysis

- Transcatheter embolization and occlusion devices, enabling minimally invasive blockage of blood vessels for therapeutic purposes, are increasingly critical in modern interventional radiology and vascular procedures due to their precision, reduced procedural risks, and faster patient recovery compared to traditional surgery

- The escalating demand for these devices is primarily fueled by the rising prevalence of vascular diseases, tumors requiring embolization, and other clinical conditions, coupled with growing adoption of minimally invasive procedures and technological advancements in device design and delivery systems

- North America dominated the transcatheter embolization and occlusion market with the largest revenue share of 38.2% in 2025, characterized by early adoption of advanced interventional procedures, high healthcare expenditure, and strong presence of key industry players, with the U.S. experiencing substantial growth in device usage driven by innovations in coil and non-coil occlusion technologies

- Asia-Pacific is expected to be the fastest growing region in the market during the forecast period due to increasing healthcare infrastructure investments, rising prevalence of vascular and oncological conditions, and growing awareness of minimally invasive treatment benefits

- Coil segment dominated the transcatheter embolization and occlusion market with a market share of 44.9% in 2025, driven by its established efficacy, precision, and compatibility across multiple clinical applications including peripheral vascular disease, oncology, neurology, and urology

Report Scope and Transcatheter Embolization and Occlusion Market Segmentation

|

Attributes |

Transcatheter Embolization and Occlusion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Transcatheter Embolization and Occlusion Market Trends

Advancements in Precision and Imaging-Guided Procedures

- A significant and accelerating trend in the global transcatheter embolization and occlusion market is the integration of advanced imaging technologies such as fluoroscopy, CT, and MRI-guided navigation, enhancing procedural precision and patient safety

- For instance, the use of Cone Beam CT with real-time imaging allows interventional radiologists to visualize complex vascular structures during embolization, improving targeting accuracy and reducing procedural complications

- These imaging enhancements enable more precise device placement, optimized embolic delivery, and reduced radiation exposure for patients and clinicians. For instance, modern microcatheter systems coupled with imaging guidance can navigate tortuous vessels to reach difficult-to-access lesions effectively

- The integration of imaging and navigation tools facilitates minimally invasive procedures, enabling faster recovery, shorter hospital stays, and reduced need for open surgery, while broadening clinical applications across oncology, neurology, and peripheral vascular interventions

- This trend towards more precise, image-guided, and technologically advanced embolization systems is reshaping clinician expectations and procedural standards. For instance, companies such as Terumo and Medtronic are developing next-generation embolic devices compatible with real-time imaging and robotic-assisted catheterization

- The demand for embolization devices that combine procedural precision with imaging-guided navigation is growing rapidly across both hospitals and outpatient intervention centers, as healthcare providers increasingly prioritize patient safety and clinical outcomes

- Growing interest in personalized embolic therapies, such as drug-eluting or biodegradable occlusion devices tailored to specific patient anatomy, is expanding the clinical scope and adoption of these devices. For instance, novel biodegradable coils are being studied for safer long-term outcomes

Transcatheter Embolization and Occlusion Market Dynamics

Driver

Increasing Prevalence of Vascular Diseases and Minimally Invasive Preference

- The rising prevalence of vascular disorders, tumors, aneurysms, and hemorrhages, combined with a growing preference for minimally invasive procedures, is a significant driver for transcatheter embolization and occlusion devices

- For instance, in March 2025, Medtronic announced the launch of a new detachable coil system for aneurysm embolization, targeting enhanced safety and treatment efficacy, which is expected to drive market adoption

- As physicians seek safer alternatives to open surgery, these devices offer precision, reduced procedural risks, shorter recovery periods, and lower overall treatment costs, making them highly attractive in clinical practice

- Furthermore, the increasing use of these devices in oncology, neurology, and peripheral vascular disease is reinforcing their position as essential tools in modern interventional procedures

- The ability to perform targeted vascular occlusion for multiple clinical applications, combined with continuous device innovation, is accelerating adoption across both developed and emerging healthcare markets

- Rising investments in healthcare infrastructure, particularly in Asia-Pacific and Latin America, are creating new opportunities for hospitals and outpatient centers to adopt minimally invasive embolization procedures. For instance, government-funded hospitals are increasingly procuring advanced embolic systems to improve patient care

- Continuous improvements in device design, such as smaller profile catheters and enhanced delivery systems, are making embolization procedures more accessible and safer, encouraging wider adoption

Restraint/Challenge

High Costs and Regulatory Hurdles

- The high device costs and stringent regulatory requirements for approval pose significant challenges to market expansion, particularly in price-sensitive or emerging regions

- For instance, complex approval processes by the FDA, EMA, and other regional authorities can delay the introduction of novel embolic devices, affecting market availability

- The need for specialized training and procedural expertise for safe and effective use also limits adoption in smaller hospitals or clinics. For instance, interventional radiologists require extensive training to handle advanced coil and non-coil systems safely

- In addition, potential procedural complications, including vessel perforation or non-target embolization, may make clinicians cautious, requiring robust post-market surveillance and clinical validation

- Overcoming these challenges through cost-effective device development, streamlined regulatory pathways, and enhanced clinician training will be critical for sustained market growth

- Reimbursement uncertainties and varied insurance coverage across regions may restrict adoption, particularly in emerging markets. For instance, delayed reimbursement approvals for embolization procedures can impact hospital procurement decisions

- Limited awareness among healthcare providers and patients regarding the full benefits of minimally invasive embolization procedures may slow market penetration. For instance, some hospitals still prefer conventional surgery due to familiarity despite embolization advantages

Transcatheter Embolization and Occlusion Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the transcatheter embolization and occlusion market is segmented into coil and non-coil devices. The coil segment dominated the market with the largest revenue share of 44.9% in 2025, driven by its proven efficacy, precision, and compatibility across multiple clinical applications. Coil devices are widely preferred by interventional radiologists for their established safety profile and ability to achieve controlled vascular occlusion. The segment also benefits from extensive clinical studies and long-term adoption in treating aneurysms, AVMs, and peripheral vascular lesions. Furthermore, coils are often used in combination with imaging-guided navigation systems, enhancing procedural accuracy and patient outcomes. The availability of detachable and microcoil options allows clinicians to customize treatment according to vessel size and lesion complexity. High reliability, predictable occlusion, and robust post-market support from key manufacturers reinforce coil devices’ dominance in the market.

The non-coil segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing demand for alternative embolic agents such as liquid embolics, particles, and plugs. Non-coil devices offer advantages in complex anatomical regions where coils may be difficult to deploy, such as tortuous vessels or small diameter arteries. They are also gaining traction in oncology for targeted tumor embolization and in urology procedures requiring precise occlusion of pathological vessels. The growing development of biodegradable and drug-eluting non-coil embolic materials is further accelerating adoption. Non-coil devices allow rapid procedure times and improved versatility across multiple clinical applications. Their expanding use in emerging markets with growing interventional radiology infrastructure contributes to higher growth potential. Continuous innovation and integration with minimally invasive imaging platforms enhance the clinical appeal of non-coil devices.

- By Application

On the basis of application, the market is segmented into peripheral vascular disease, oncology, neurology, and urology. The oncology segment dominated the market with the largest revenue share of 40% in 2025, driven by the increasing use of transcatheter embolization for tumor management. Embolization is widely used to restrict blood supply to liver, kidney, and other solid tumors, improving patient outcomes and complementing chemotherapy or radiotherapy. The segment benefits from rising cancer prevalence globally and growing adoption of minimally invasive procedures as alternatives to surgical resection. Imaging-guided embolization techniques allow precise delivery of embolic agents directly to the tumor site, minimizing damage to surrounding healthy tissues. Oncology applications often involve repeated interventions, creating consistent demand for embolic devices. The availability of specialized embolic materials such as drug-eluting beads enhances efficacy and reinforces oncology’s leading market position.

The peripheral vascular disease segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing prevalence of aneurysms, AVMs, and other vascular disorders. Embolization is increasingly preferred over open surgery for peripheral interventions due to lower procedural risks, shorter hospital stays, and faster recovery. Growing awareness among physicians and patients of minimally invasive treatment benefits is driving adoption in both developed and emerging markets. The segment is supported by continuous innovation in catheter and delivery technologies that allow access to small and tortuous vessels. Expanding healthcare infrastructure and rising investment in interventional radiology facilities further contribute to growth. Non-coil and hybrid embolic systems tailored for peripheral applications are also gaining traction, reinforcing the segment’s rapid expansion.

Transcatheter Embolization and Occlusion Market Regional Analysis

- North America dominated the transcatheter embolization and occlusion market with the largest revenue share of 38.2% in 2025, characterized by early adoption of advanced interventional procedures, high healthcare expenditure, and strong presence of key industry players, with the U.S. experiencing substantial growth in device usage driven by innovations in coil and non-coil occlusion technologies

- Physicians and hospitals in the region highly value the precision, safety, and efficacy offered by embolization devices, along with seamless integration with advanced imaging and navigation systems such as fluoroscopy and CT-guided platforms

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players, establishing embolization devices as the preferred solution for treating peripheral vascular, oncological, neurological, and urological conditions

U.S. Transcatheter Embolization and Occlusion Market Insight

The U.S. transcatheter embolization and occlusion market captured the largest revenue share of 81% in North America in 2025, fueled by the rapid adoption of minimally invasive procedures and advanced interventional radiology technologies. Hospitals and outpatient centers are increasingly prioritizing safer, precise, and image-guided embolization techniques for treating vascular diseases, tumors, and aneurysms. The growing preference for less-invasive alternatives to open surgery, combined with strong physician awareness and advanced training, further propels the market. Moreover, continuous integration of coil and non-coil embolic devices with imaging and navigation systems is significantly contributing to market expansion. High healthcare expenditure and the presence of leading global manufacturers also support sustained growth.

Europe Transcatheter Embolization and Occlusion Market Insight

The Europe transcatheter embolization and occlusion market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare standards and increasing demand for minimally invasive treatment options. Rising prevalence of vascular diseases and cancers, coupled with strong healthcare infrastructure, is fostering adoption. European hospitals are incorporating embolization procedures into both tertiary care and specialized oncology centers. Furthermore, growing awareness among physicians of improved patient outcomes and reduced hospital stays reinforces the use of these devices. The market is also witnessing advancements in biodegradable and drug-eluting embolic materials, further boosting adoption.

U.K. Transcatheter Embolization and Occlusion Market Insight

The U.K. transcatheter embolization and occlusion market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of minimally invasive procedures and advanced interventional radiology systems. Rising concerns about patient safety, procedural risks, and recovery times are encouraging hospitals to prefer embolization techniques over traditional surgery. In addition, the U.K.’s robust healthcare system, emphasis on innovative medical technologies, and availability of skilled interventional radiologists are expected to continue driving market growth. Increased awareness of coil and non-coil device efficacy across oncology, neurology, and peripheral vascular interventions also supports expansion.

Germany Transcatheter Embolization and Occlusion Market Insight

The Germany transcatheter embolization and occlusion market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure and emphasis on technological innovation. Growing awareness of minimally invasive treatments, combined with increasing prevalence of vascular and oncological diseases, promotes adoption of embolization devices in hospitals and specialized centers. Integration with imaging-guided systems ensures procedural precision and enhances safety, making these devices preferred for complex interventions. Government support for advanced healthcare technologies and reimbursement policies further accelerate the market. In addition, Germany’s focus on research and clinical validation fosters the development and acceptance of next-generation embolic devices.

Asia-Pacific Transcatheter Embolization and Occlusion Market Insight

The Asia-Pacific transcatheter embolization and occlusion market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing prevalence of vascular diseases, cancer, and aneurysms in countries such as China, Japan, and India. Expanding healthcare infrastructure, growing awareness of minimally invasive procedures, and investments in interventional radiology facilities are fueling adoption. The region’s rising patient population, coupled with government initiatives promoting advanced healthcare and medical device accessibility, supports market growth. In addition, the emergence of local device manufacturers and partnerships with global players is improving affordability and availability, further propelling adoption across hospitals and clinics.

Japan Transcatheter Embolization and Occlusion Market Insight

The Japan transcatheter embolization and occlusion market is gaining momentum due to the country’s technologically advanced healthcare system and growing focus on minimally invasive interventions. High awareness of procedural safety, precision, and faster patient recovery is driving the adoption of embolic devices in oncology, neurology, and peripheral vascular applications. Integration with imaging-guided systems and next-generation coil and non-coil devices is further accelerating uptake. Japan’s aging population and rising demand for outpatient-based interventions also spur market growth. Hospitals are increasingly investing in advanced catheters, microcoils, and liquid embolics to improve treatment outcomes.

India Transcatheter Embolization and Occlusion Market Insight

The India transcatheter embolization and occlusion market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, increasing prevalence of vascular diseases, and growing adoption of minimally invasive procedures. India is emerging as a key hub for interventional radiology, with hospitals and specialty centers investing in coil and non-coil embolic systems. Government initiatives promoting advanced healthcare services and medical device accessibility support growth. The availability of cost-effective devices and collaborations with global manufacturers further enhance adoption. Rising awareness among physicians and patients regarding the benefits of embolization over open surgery is driving market expansion across both urban and semi-urban regions.

Transcatheter Embolization and Occlusion Market Share

The Transcatheter Embolization and Occlusion industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Terumo Corporation (Japan)

- Cook (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Penumbra, Inc. (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- BD (U.S.)

- AngioDynamics, Inc. (U.S.)

- Balt Extrusion SAS (France)

- MicroPort Scientific Corporation (China)

- Shape Memory Medical, Inc. (U.S.)

- Acandis GmbH (Germany)

- phenox GmbH (Germany)

- Lepu Medical Technology Co., Ltd. (China)

- Sirtex Medical Limited (Australia)

- INVAMED (Turkey)

What are the Recent Developments in Global Transcatheter Embolization and Occlusion Market?

- In November 2025, Embolization, Inc. announced the first clinical procedure using the polymer‑based NED coil system. The procedure treated a patient with pelvic venous congestion marking the first real-world use of a non-metal embolic coil in peripheral embolization

- In June 2025, Embolization, Inc. received 510(k) clearance from U.S. Food and Drug Administration (FDA) for its novel non‑metal vascular coil Nitinol Enhanced Device (NED) designed for arterial and venous embolization in peripheral vasculature, offering improved occlusion and reduced imaging artifacts compared to traditional metal coils

- In November 2024, Arsenal Medical launched the FIH clinical trial EMBO‑02 to study NeoCast for the treatment of chronic subdural hematoma (cSDH) via middle meningeal artery embolization (MMAe) signalling expansion of liquid‑embolization applications beyond oncology into neurological conditions

- In July 2024, Arsenal Medical reported that its next‑generation liquid embolic agent NeoCast met both primary safety and feasibility endpoints in the first‑in‑human (FIH) EMBO-01 trial. The agent achieved deep distal penetration and predictable, controlled vascular occlusion for hypervascular brain tumors

- In July 2023, the first patient was successfully treated using NeoCast in a clinical setting, marking the first human use of this solvent‑free, non‑adhesive embolic biomaterial for neurovascular conditions and demonstrating feasibility of next‑gen liquid embolics for tumor embolization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.