Global Urban Air Mobility Market

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

45.60 Billion

2024

2032

USD

4.80 Billion

USD

45.60 Billion

2024

2032

| 2025 –2032 | |

| USD 4.80 Billion | |

| USD 45.60 Billion | |

|

|

|

|

Urban Air Mobility Market Size

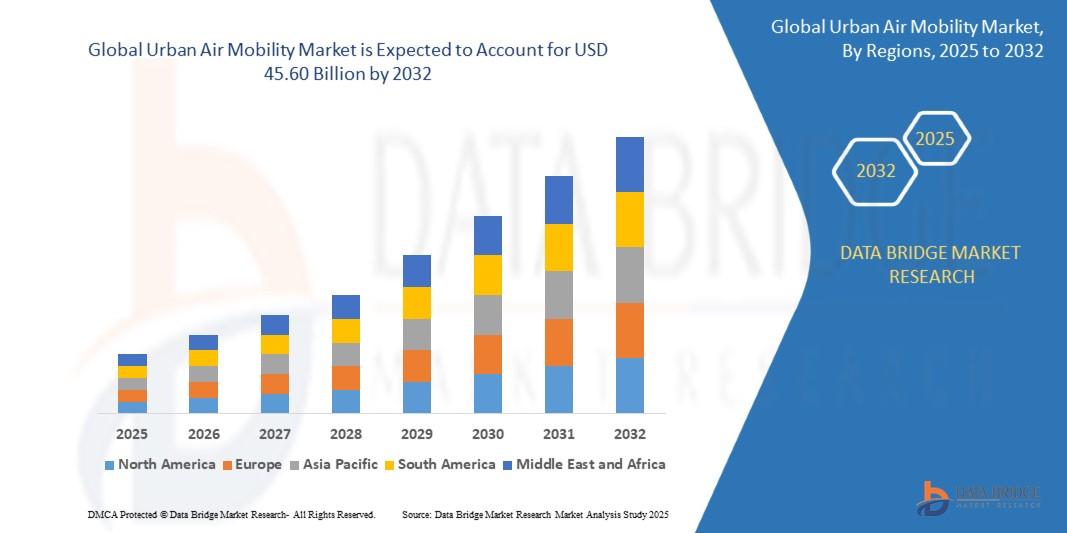

- The global urban air mobility market was valued at USD 4.80 billion in 2024 and is expected to reach USD 45.60 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 32.50%, primarily driven by advancements in electric vertical take-off and landing (eVTOL) technology

- This growth is driven by increasing demand for efficient urban transportation and the need to reduce traffic congestion in cities

Urban Air Mobility Market Analysis

- The urban air mobility (UAM) sector is rapidly growing as cities around the world look to integrate innovative aerial solutions into their transportation systems. This market is seeing a surge in investments, driven by technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, regulatory developments, and the push for sustainable and efficient urban mobility solutions

- The market's growth is fueled by a variety of factors, including the need for reduced traffic congestion, the demand for faster transportation in urban areas, and advancements in electric aviation technology

- For instance, NASA and FAA have been working on air traffic management systems for UAM operations. The FAA has been collaborating with Uber Elevate (now part of Joby Aviation) to create guidelines and establish testing protocols for urban air mobility solution

- The UAM market is still in its nascent stages, but its potential is substantial. While the eVTOL market is gaining attention in developed regions, emerging markets are also looking to adopt UAM solutions to address unique transportation challenges

Report Scope and Urban Air Mobility Market Segmentation

|

Attributes |

Urban Air Mobility Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Urban Air Mobility Market Trends

“Expansion of Electric Vertical Take-off and Landing (eVTOL) Aircraft”

- A significant trend in the urban air mobility market is the increasing integration of AI-driven automation and machine learning technologies, enhancing the speed, efficiency, and personalization of customer service interactions

- These technologies enable automated responses, predictive analytics, and real-time issue resolution, improving customer satisfaction while reducing operational costs for businesses

- For instance, companies such as Concentrix and Teleperformance are implementing AI-powered chatbots and virtual assistants to handle routine customer queries, enabling human agents to focus on more complex issues

- This trend is transforming the urban air mobility industry by enabling faster, more personalized customer service, optimizing agent productivity, and meeting the growing demand for 24/7, global customer support solutions

Urban Air Mobility Market Dynamics

Driver

“Rising Demand for Sustainable Urban Mobility Solutions”

- The increasing need for environmentally friendly transportation solutions is driving the growth of the urban air mobility (UAM) market. As cities face challenges related to air pollution, carbon emissions, and traffic congestion, the demand for cleaner, more sustainable modes of transport is intensifying

- Urban air mobility solutions, particularly eVTOL aircraft, are seen as key contributors to sustainable urban transportation by offering zero-emission, energy-efficient alternatives to traditional vehicles

- Governments and regulatory bodies are introducing stricter environmental regulations, further pushing the need for sustainable transportation options, creating a supportive ecosystem for UAM growth

For instance,

- In January 2024, Lilium received a major investment to accelerate the development of its electric air taxis, aimed at reducing urban congestion and minimizing emissions in European cities

- In December 2023, Vertical Aerospace announced a partnership with American Airlines to deploy electric aircraft that would reduce carbon footprints for short-distance urban travel

- In October 2023, Joby Aviation completed a successful test flight of its all-electric eVTOL aircraft, demonstrating its potential to offer a clean and sustainable transportation solution for urban areas

- The demand for sustainable mobility solutions is expected to continue growing, with urban air mobility playing a pivotal role in reducing emissions and improving transportation efficiency in cities globally

Opportunity

“Integration of Urban Air Mobility with Smart City Infrastructure”

- The increasing development of smart cities presents significant opportunities for urban air mobility (UAM) providers, with the integration of aerial transportation solutions into urban infrastructure becoming a priority for many cities

- As cities embrace digitalization and automation, there is a growing need for innovative transportation solutions that can seamlessly connect with existing smart infrastructure, such as autonomous vehicles, intelligent traffic systems, and digital communication networks

- The rise of 5G technology, IoT, and advanced data analytics offers UAM companies the tools needed to optimize flight paths, ensure real-time monitoring, and provide efficient, safe, and coordinated urban air travel

For instance,

- In January 2024, Lilium announced a partnership with Munich Airport to integrate eVTOL aircraft into the city’s smart mobility ecosystem, connecting the airport with urban centers

- In October 2023, Volocopter collaborated with Singapore’s Land Transport Authority to explore the potential of UAM solutions as part of the city’s smart transportation framework

- In September 2023, Joby Aviation signed a deal with LA Metro to develop air mobility infrastructure that aligns with Los Angeles' smart city initiatives, ensuring UAM is integrated with other advanced transportation solutions

- As smart city initiatives expand, the integration of UAM services with existing urban mobility infrastructure presents significant opportunities for UAM providers to enhance connectivity and scalability, meeting the evolving needs of modern cities

Restraint/Challenge

“Regulatory Hurdles and Airspace Integration”

- The urban air mobility (UAM) industry faces significant challenges in navigating complex regulatory landscapes and integrating UAM operations into existing airspace systems, which were not designed to accommodate the large-scale deployment of aerial vehicles

- Governments and regulatory bodies around the world are working on establishing safety standards, flight regulations, and air traffic management systems for UAM, but the process is slow and complex, requiring collaboration between various stakeholders, including aviation authorities, cities, and private companies

- Delays in regulatory approval and airspace integration can hinder the speed of UAM deployment, creating uncertainty in market projections and affecting investor confidence

For instance,

- In November 2023, Joby Aviation faced delays in obtaining certification for its eVTOL aircraft from the FAA, slowing down its plans for urban air taxi services in the U.S.

- In September 2023, Volocopter encountered regulatory hurdles when trying to secure approval for test flights in Europe, requiring further modifications to its operational plans

- In August 2023, Lilium faced challenges in meeting European aviation regulations, delaying the launch of its eVTOL services in key markets such as Germany

- The challenge of overcoming regulatory hurdles and ensuring the safe integration of UAM into existing airspace systems remains a critical factor in the industry's long-term success. UAM companies must continue working with regulators to develop clear, scalable frameworks for air mobility

Urban Air Mobility Market Scope

The market is segmented on the basis of component, type, maximum take-off weight, propulsion, operation, range, application, product and end use.

|

Segmentation |

Sub-Segmentation |

|

By Component

|

|

|

By Type |

|

|

By Maximum Take-off Weight |

|

|

By Propulsion |

|

|

By Operation |

|

|

By Range |

|

|

By Application |

|

|

By Product |

|

|

By End Use |

|

Urban Air Mobility Market Regional Analysis

“North America is the Dominant Region in the Urban Air Mobility Market”

- North America leads the global urban air mobility (UAM) market, driven by robust investments, cutting-edge technology, and favorable regulations supporting UAM developments

- U.S. is at the forefront of UAM innovation, with companies focusing on advanced electric vertical takeoff and landing (eVTOL) aircraft, as well as public infrastructure adaptation

- The region's leadership is strengthened by government initiatives and a strong push toward sustainable air mobility solutions for both commercial and passenger transportation

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth in the urban air mobility (UAM) market due to increasing urbanization and a growing demand for efficient transportation solutions

- The region’s investments in smart city infrastructure and government incentives for eVTOL aircraft will drive market expansion

- Major players in Asia-Pacific are developing UAM solutions to address traffic congestion and sustainability, with rapid technological advancements and favorable regulations playing a critical role in the sector's growth

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Airbus (France)

- Lilium GmbH (Germany)

- EHang (China)

- Eve Holding, Inc. (U.S.)

- Vertical Aerospace (U.K.)

- Textron Inc. (U.S.)

- Joby Aviation (U.S.)

- Embraer Group (Brazil)

- Hyundai Motor Company (South Korea)

- Archer Aviation Inc. (U.S.)

- Airogroup B.V. (Netherlands)

- Wingcopter (Germany)

- BETA Technologies (U.S.)

- Volocopter GmbH (Germany)

- Uber Technologies, Inc. (U.S.)

- Safran Group (France)

- Carter Aviation Technologies (U.S.)

- Aurora Flight Sciences (U.S.)

- Terrafugia Inc. (U.S.)

- Workhorse (U.S.)

- Bartini (U.S.)

- Jaunt Air Mobility (U.S.)

Latest Developments in Global Urban Air Mobility Market

- In June 2024, Lilium GmbH formed a partnership with Bao’an District in China to leverage regional expertise and local infrastructure to support eVTOL operations in the Greater Bay Area, with plans for future expansion across the Asia-Pacific region

- In June 2024, Guangzhou EHang Intelligent Technology Co. Ltd. successfully completed the first autonomous flight of its pilotless eVTOL aircraft, EH216-S, in Mecca, Saudi Arabia, signaling a transformative shift for regional air transportation

- In April 2024, Joby Aero, Inc. signed a Memorandum of Understanding with the Abu Dhabi government to introduce air taxi services in the region

- In April 2024, Unifly, part of Terra Drone Corporation Group, completed the CORUS-XUAM project, a collaboration set to shape the future of urban air mobility

- In March 2024, Electron Aerospace revealed its designs for a five-seat electric utility aircraft, planning to begin production and testing, aiming for deployment by 2030

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.