Global Wagyu Beef Market

Market Size in USD Billion

CAGR :

%

USD

2.66 Billion

USD

4.31 Billion

2024

2032

USD

2.66 Billion

USD

4.31 Billion

2024

2032

| 2025 –2032 | |

| USD 2.66 Billion | |

| USD 4.31 Billion | |

|

|

|

|

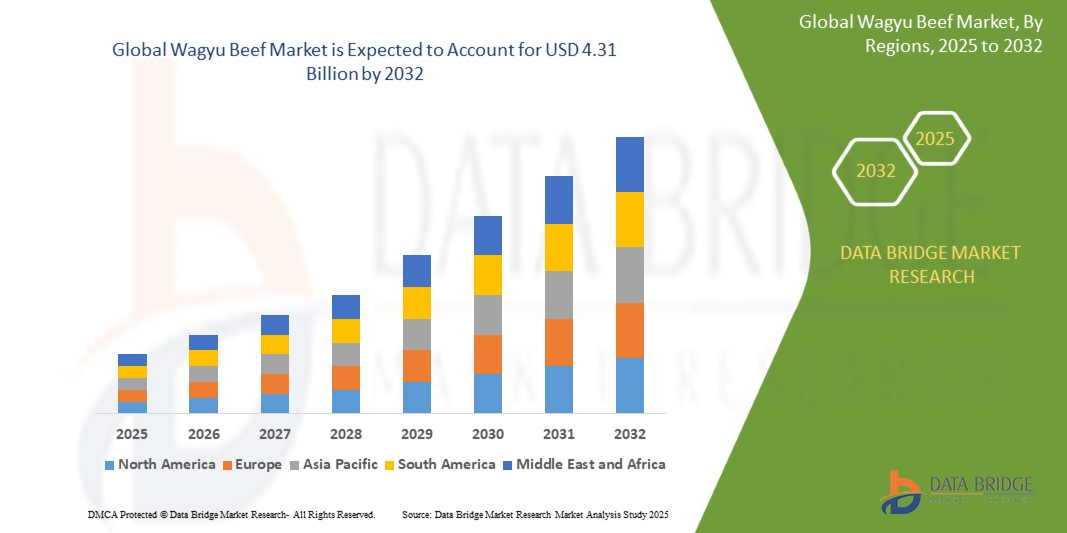

What is the Global Wagyu Beef Market Size and Growth Rate?

- The global wagyu beef market size was valued at USD 2.66 billion in 2024 and is expected to reach USD 4.31 billion by 2032, at a CAGR of 6.20% during the forecast period

- In the wagyu beef market, premium-grade cuts are favored for gourmet dining, enhancing culinary experiences in upscale restaurants worldwide. Beyond fine dining, Wagyu beef finds applications in high-end culinary events, exclusive catering, and luxury food products. Its unmatched marbling and tenderness redefine gastronomic standards, captivating discerning consumers globally

What are the Major Takeaways of Wagyu Beef Market?

- The wagyu beef market thrives on surging global demand for gourmet delicacies. Consumers eagerly pay a premium for Wagyu's unparalleled taste, tenderness, and exquisite marbling. This growing preference for high-quality, luxurious food experiences continues to propel the market forward, driving producers and distributors to meet the increasing appetite for Wagyu beef worldwide

- Asia-Pacific dominated the wagyu beef market with the largest revenue share of 42.3% in 2024, driven by the region’s deep-rooted Wagyu beef culture, expanding premium foodservice sector, and increasing consumer demand for high-quality protein

- North America wagyu beef market is poised to grow at the fastest CAGR of 11.9% from 2025 to 2032, driven by increased demand for gourmet and clean-label meat products across the U.S. and Canada

- The Japanese Breed segment dominated the market with the largest market revenue share of 47.6% in 2024, attributed to its unparalleled marbling, tenderness, and authenticity

Report Scope and Wagyu Beef Market Segmentation

|

Attributes |

Wagyu Beef Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wagyu Beef Market?

“Rising Consumer Preference for Premiumization and Authenticity”

- A major emerging trend in the global wagyu beef market is the growing consumer preference for premiumized, traceable, and authentic meat products. Increasing disposable incomes, especially in urban regions, are fueling demand for high-quality, gourmet meat such as Wagyu, known for its intense marbling, rich taste, and tenderness

- Producers are now leveraging DNA traceability and QR code labelling to guarantee authenticity and ensure transparency about cattle origin, feeding methods, and breed genetics. For instance, Mishima Reserve and Snake River Farms offer detailed lineage and farm-to-table tracking to build consumer trust and differentiate their premium offerings

- Technological integration is also rising with smart livestock monitoring systems enabling precision feeding, health tracking, and stress-free environments to maximize meat quality. AI-driven tools help monitor Wagyu cattle conditions, contributing to ethical production and consistency in quality

- As consumers increasingly seek unique, high-value culinary experiences, luxury restaurants and online meat platforms are curating exclusive Wagyu selections, further expanding its global appeal. Premium cuts such as A5 Wagyu are becoming mainstream in foodservice, particularly in North America, Japan, and the U.A.E

- This trend of premiumization and authenticity is reshaping market dynamics, encouraging innovation in product labeling, quality assurance, and branding strategies, while reinforcing consumer trust and enabling price premiums

What are the Key Drivers of Wagyu Beef Market?

- The rising global demand for high-protein and gourmet meat options is a major factor driving growth in the wagyu beef market. Consumers are becoming more health-conscious and seeking meat that offers superior taste, nutrition, and traceability

- For instance, in March 2024, Starzen Co., Ltd. (Japan) expanded its Wagyu beef exports to the U.S. and Europe, leveraging its controlled breeding and feeding protocols to meet the surging demand for authentic, certified Wagyu products

- Another growth catalyst is the increasing popularity of e-commerce meat delivery services, offering consumers direct access to premium cuts. Companies such as Holy Grail Steak Co. and Black Hawk Farms offer curated boxes and subscription-based Wagyu meat services, simplifying premium meat purchases for end-users

- The hospitality sector, including luxury hotels and high-end restaurants, is heavily investing in exclusive Wagyu offerings to elevate dining experiences, which boosts institutional demand. Culinary tourism is also playing a role, with consumers seeking authentic Wagyu at its place of origin especially in Japan

- In addition, strategic cross-border collaborations and breed improvement programs are expanding the availability of Wagyu across Australia, the U.S., and South America, promoting consistency in supply and quality. These developments are expected to support long-term market growth globally

Which Factor is challenging the Growth of the Wagyu Beef Market?

- One of the main challenges for the wagyu beef market is the high production cost and premium pricing, which can limit consumer accessibility in price-sensitive regions. Wagyu cattle require longer feeding periods, specialized diets, and intensive care, resulting in higher operational costs

- For instance, Blackmore Wagyu (U.S.) reports significantly higher input costs for raising full-blood Wagyu cattle compared to conventional beef. These costs are passed onto consumers, making Wagyu unaffordable for some markets, especially in developing economies

- Another constraint is the limited availability of authentic Wagyu genetics and the risk of counterfeit labeling. Not all beef labeled as “Wagyu” meets the strict standards of full-blood or purebred lineage, which can erode consumer trust and market credibility

- Regulatory barriers and export restrictions in countries such as Japan also pose challenges to consistent global supply. Fluctuations in cattle feed prices and disease outbreaks (e.g., Bovine spongiform encephalopathy) may further affect production stability

- Overcoming these issues will require investment in breed certification, transparency systems, and scalable production methods, as well as broader consumer education to justify premium pricing through demonstrated quality and traceability

How is the Wagyu Beef Market Segmented?

The market is segmented on the basis of product type, applications, grade, nature, distribution channels, and end use.

• By Product Type

On the basis of product type, the wagyu beef market is segmented into Japanese Breed, Australian Breed, Cross Breed, and Others. The Japanese Breed segment dominated the market with the largest market revenue share of 47.6% in 2024, attributed to its unparalleled marbling, tenderness, and authenticity. Japanese breeds such as Kobe and Matsusaka Wagyu are globally recognized for their premium quality and are preferred in gourmet dining settings.

The Australian Breed segment is expected to witness the fastest CAGR from 2025 to 2032, driven by large-scale exports, advanced breeding techniques, and competitive pricing that makes it attractive to a wider consumer base across Asia-Pacific and Europe.

• By Applications

On the basis of applications, the wagyu beef market is segmented into Direct To Human Use and Industrial Use. The Direct To Human Use segment held the largest revenue share of 69.2% in 2024, driven by rising consumer demand for premium meat in restaurants, hotels, and households.

The Industrial Use segment is projected to grow steadily, supported by rising demand in value-added products such as processed meats, pre-packaged meals, and ready-to-cook gourmet kits featuring Wagyu as a key ingredient.

• By Grade

On the basis of grade, the wagyu beef market is segmented into Grade A, Grade B, and Grade C. The Grade A segment dominated the market with a market share of 58.9% in 2024, as it represents the highest quality standard of Wagyu with exceptional marbling, color, and fat distribution.

Grade B is expected to register a notable growth rate, driven by its availability at relatively lower price points while still offering superior quality compared to conventional beef.

• By Nature

On the basis of nature, the market is segmented into Organic and Conventional. The Conventional segment accounted for the largest market share of 76.4% in 2024, due to its greater availability and lower production costs.

The Organic segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising health consciousness, demand for clean-label products, and ethical consumption trends.

• By Distribution Channels

On the basis of distribution channels, the market is segmented into Online and Retail. The Retail segment led with the largest revenue share of 61.8% in 2024, driven by the strong presence of specialty meat stores, supermarkets, and butcher shops offering premium Wagyu products.

The Online segment is expected to experience robust growth, supported by the surge in e-commerce, direct-to-consumer platforms, and the convenience of doorstep delivery of vacuum-sealed and flash-frozen Wagyu cuts.

• By End Use

On the basis of end use, the market is segmented into Foodservice Channels and Retail Channel. The Foodservice Channels segment held the largest revenue share of 66.3% in 2024, owing to high-volume demand from luxury hotels, fine dining restaurants, and premium steak houses.

The Retail Channel is projected to grow rapidly during the forecast period, bolstered by consumers increasingly purchasing gourmet meat for at-home dining experiences and celebrations.

Which Region Holds the Largest Share of the Wagyu Beef Market?

- Asia-Pacific dominated the wagyu beef market with the largest revenue share of 42.3% in 2024, driven by the region’s deep-rooted Wagyu beef culture, expanding premium foodservice sector, and increasing consumer demand for high-quality protein

- Consumers across countries such as Japan, Australia, and China prefer Wagyu for its exceptional marbling, tenderness, and premium appeal in fine dining and gourmet home cooking

- The region benefits from being home to original Japanese Wagyu breeds and large-scale commercial producers in Australia, supporting both domestic consumption and export growth. In addition, rising disposable incomes and an expanding middle class are further boosting demand for luxury food products, solidifying Asia-Pacific’s leadership in the global wagyu beef market

Japan Wagyu Beef Market Insight

The Japan wagyu beef market held a dominant position within Asia-Pacific in 2024, fueled by its heritage status and global branding of Wagyu as a luxury meat product. Japan’s strict grading system and breed authenticity—especially in Kobe, Matsusaka, and Ohmi beef—contribute to strong domestic and export demand. The government’s ongoing promotion of agricultural exports and culinary tourism continues to support market growth, making Japan a cornerstone of the global Wagyu Beef industry.

Australia Wagyu Beef Market Insight

The Australia wagyu beef market is expected to grow significantly over the forecast period, supported by its reputation as the largest Wagyu exporter outside Japan. Australia's pasture-fed Wagyu, advanced breeding practices, and access to international markets such as the U.S., China, and the Middle East make it a key player. Rising global demand for hormone-free and traceable beef products further positions Australia as a critical supplier in the premium meat segment.

China Wagyu Beef Market Insight

The China wagyu beef market is experiencing rapid expansion, driven by rising disposable incomes, growing consumer interest in premium proteins, and increasing availability through e-commerce and retail channels. Chinese foodservice operators are incorporating Wagyu into upscale menus, and domestic breeding programs are emerging. Strategic partnerships with Australian and Japanese suppliers are also facilitating supply chain growth and knowledge transfer.

Which Region is the Fastest Growing in the Wagyu Beef Market?

North America wagyu beef market is poised to grow at the fastest CAGR of 11.9% from 2025 to 2032, driven by increased demand for gourmet and clean-label meat products across the U.S. and Canada. Rising awareness of Wagyu’s nutritional benefits, including higher levels of monounsaturated fats and omega-3s, is reshaping consumer preferences in the premium beef category. The foodservice sector, particularly high-end restaurants and steakhouses, is leading demand with curated Wagyu offerings, while direct-to-consumer channels are expanding through online meat delivery services. Consumer willingness to experiment with luxury proteins at home and the growing availability of American-style Wagyu crossbreeds are expected to significantly drive market penetration.

U.S. Wagyu Beef Market Insight

The U.S. wagyu beef market held the largest share in North America in 2024, with companies such as Snake River Farms, Lone Mountain Cattle Company, and Imperial Wagyu Beef at the forefront. These producers are investing in sustainable breeding, marbling consistency, and e-commerce distribution, catering to a discerning consumer base. In addition, collaborations with restaurants and celebrity chefs are elevating Wagyu’s appeal and accessibility in both retail and foodservice channels.

Which are the Top Companies in Wagyu Beef Market?

The wagyu beef industry is primarily led by well-established companies, including:

- Black Hawk Farms (U.S.)

- AUSTRALIAN AGRICULTURAL COMPANY LIMITED (Australia)

- Starzen Co., Ltd. (Japan)

- Imperial Wagyu Beef, LLC (U.S.)

- Toriyama Umami Wagyu (Japan)

- Mishima Reserve (U.S.)

- Snake River Farms (U.S.)

- Blackmore Wagyu (U.S.)

- Lone Mountain Cattle Company (U.S.)

- K.C. Cattle Company (U.S.)

- Nebraska Star Beef (U.S.)

- Middle East Fuji L.L.C. (U.A.E.)

- Tajimaya UK Ltd. (U.K.)

- Holy Grail Steak Co. (U.S.)

- DEBRAGGA INC. (U.S.)

- Chicago Steak Company (U.S.)

- Creek Bed Farmacy (U.S.)

- The Butcher's Market (U.S.)

- West Coast Prime Meat (U.S.)

What are the Recent Developments in Global Wagyu Beef Market?

- In June 2022, Matilda 159 Domain, a U.S.-based restaurant, introduced a limited-time menu offering called the Blackmore Wagyu tomahawk steak. This special launch successfully generated buzz, word-of-mouth publicity, and encouraged customer interest in premium beef experiences. The initiative helped boost the restaurant’s visibility and positioned Wagyu as an elite dining option

- In May 2022, Arby’s unveiled its Wagyu Steakhouse Burger, featuring a patty composed of 48% Wagyu ground beef blended with American Wagyu beef. The launch targeted fast-food lovers seeking gourmet flavors at accessible prices. This innovation strengthened Arby’s brand differentiation and appeal among quality-focused consumers

- In September 2021, Blackmore Wagyu, a prominent Australian Wagyu beef supplier, expanded its portfolio by launching a new grass-fed breed tailored for fine dining restaurants. This product diversification responded to growing demand for natural and high-end beef. The move enabled Blackmore Wagyu to increase its market penetration and boost sales revenue

- In June 2021, Mishima Reserve partnered with Cuker, a digital marketing firm, to build brand recognition and attract American Wagyu beef enthusiasts through targeted online campaigns. Their collaboration delivered disruptive digital strategies that enhanced customer engagement. This partnership significantly elevated Mishima Reserve’s brand visibility across digital platforms

- In August 2020, Agri Beef Co. collaborated with local beef producers in Jerome, Idaho, to develop a new processing facility named True West Beef. This facility aimed to support beef supply chain resilience amid COVID-19-related disruptions. The project enhanced Agri Beef’s operational capabilities and ensured consistent product availability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wagyu Beef Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wagyu Beef Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wagyu Beef Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.