Global Whipping Cream Market

Market Size in USD Million

CAGR :

%

USD

965.09 Million

USD

1,494.64 Million

2024

2032

USD

965.09 Million

USD

1,494.64 Million

2024

2032

| 2025 –2032 | |

| USD 965.09 Million | |

| USD 1,494.64 Million | |

|

|

|

|

Whipping Cream Market Size

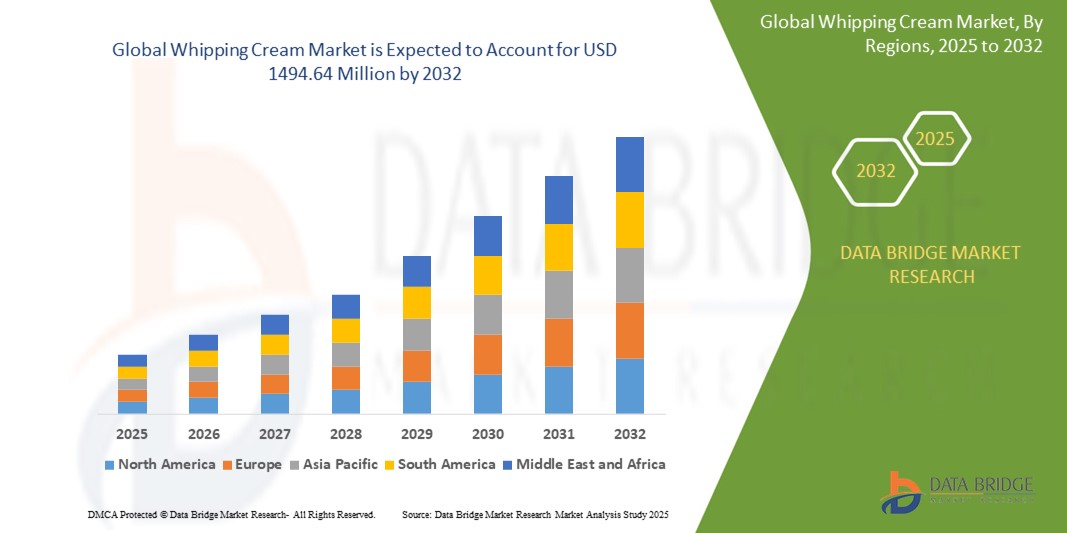

- The global whipping cream market was valued at USD 965.09 million in 2024 and is expected to reach USD 1494.64 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.62%, primarily driven by the increasing demand for premium bakery and confectionery products

- This growth is driven by factors such as the rising popularity of home baking, expanding foodservice industry, and growing consumer preference for dairy-based desserts

Whipping Cream Market Analysis

- Innovations in ultra-high temperature (UHT) processing have extended the shelf life of whipping cream without refrigeration until opened. Additionally, improvements in emulsification technology have enhanced product stability and performance in various culinary applications

- The market is divided into dairy and non-dairy segments. Dairy-based whipping cream holds a dominant share due to its traditional use and rich flavor. However, the non-dairy segment is experiencing rapid growth, driven by the increasing demand for plant-based and lactose-free alternatives

- Whipping cream is extensively used in both business-to-business (B2B) and business-to-consumer (B2C) applications. In the B2B sector, it is a staple in the foodservice industry, including restaurants and hotels. In the B2C sector, it is popular among consumers for home baking and cooking

- There is a growing consumer preference for premium and indulgent dairy products

- For instance, in January 2023, Alamance Foods introduced 'Whipt,' a plant-based whipped cream alternative available in oat, almond, and coconut varieties, catering to the increasing demand for vegan-friendly options

- These insights highlight the dynamic nature of the global whipping cream market, characterized by technological innovations, evolving consumer preferences, and expanding application areas

Report Scope and Whipping Cream Market Segmentation

|

Attributes |

Whipping Cream Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Whipping Cream Market Trends

“Rise in Plant-Based Whipping Cream”

- Increasing health consciousness and environmental awareness are driving demand for plant-based whipping creams made from ingredients such as coconut, almond, and soy

- For Instance, in January 2023, Alamance Foods introduced 'Whipt,' a plant-based whipped cream alternative available in oat, almond, and coconut varieties, catering to the growing vegan-friendly options

- Consumers are opting for plant-based alternatives due to concerns over health and environmental impacts associated with dairy production

- Manufacturers are responding by launching new plant-based products to meet the evolving consumer preferences

- The trend is contributing to the expansion of the plant-based segment in the global whipping cream market

Whipping Cream Market Dynamics

Driver

“Increasing Consumer Preference for Organic Products”

- Consumers are increasingly seeking natural and organic options to reduce intake of chemically treated food

- The demand for organic whipping cream is rising, particularly in developed countries such as the U.S., Italy, France, and Germany

- The number of private-label brands offering organic whipping cream is increasing, contributing to market growth

- Manufacturers are focusing on producing organic whipping cream using organic fertilizers and pesticides to meet consumer demand

- The shift towards organic products is influencing market dynamics and driving growth in the organic segment of the whipping cream market

Opportunity

“Expansion in Emerging Markets”

- Emerging markets present significant growth opportunities for the global whipping cream market due to increasing urbanization and changing dietary habits

- Expanding product availability in these regions can cater to the growing demand for whipping cream in various applications

- Increasing consumer awareness about the versatility and convenience of whipping cream can drive market growth in emerging economies

- Forming partnerships with local distributors and retailers can enhance market penetration and brand presence in emerging markets

- Strategic market penetration in emerging regions can lead to increased sales and market share for whipping cream products

Restraint/Challenge

“Limited Demand for Lactose-Free Options”

- The demand for lactose-free whipping cream is limited, primarily catering to consumers with lactose intolerance

- The niche market for lactose-free whipping cream restricts its growth potential compared to traditional dairy-based products

- Limited consumer awareness about the availability and benefits of lactose-free options hinder market expansion

- The availability of lactose-free whipping cream is constrained by limited production and distribution channels

- Intense competition from traditional dairy-based whipping creams poses challenges for the growth of lactose-free alternatives

Whipping Cream Market Scope

The market is segmented on the basis product, application, distribution channel, container, and fat content.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Distribution Channel |

|

|

By Container |

|

|

By Fat Content |

|

Whipping Cream Market Regional Analysis

“North America is the Dominant Region in the Whipping Cream Market”

- The region's strong demand for desserts, specialty beverages, and baked goods has been a key driver

- The availability of both traditional and plant-based whipping cream options caters to diverse consumer needs

- The prevalent coffee culture and increasing use of whipping cream in coffee shops have contributed to market growth

- North America is expected to maintain its dominant position in the coming years due to consistent consumer demand and product innovation

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to expand at the fastest compound annual growth rate (CAGR)

- Rapid urbanization in countries such as China and India has led to increased consumption of Western-style desserts and beverages

- A growing health-conscious population is driving demand for low-fat and sugar-free whipping cream options

- The introduction of innovative products tailored to local tastes is fueling market growth in the region

- Asia-Pacific is projected to continue its rapid growth trajectory, offering significant opportunities for market players

Whipping Cream Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Arla Foods amba (Denmark)

- GCMMF (India)

- Land O'Lakes, Inc. (U.S.)

- Royal FRIESLANDCAMPINA NV (Netherlands)

- Groupe Lactalis (France)

- Agropur (Canada)

- Dairy Farmers of America, Inc. (U.S.)

- Saputo Inc. (Canada)

- Organic Valley (U.S.)

- Fonterra Co-operative Group Limited (New Zealand)

Latest Developments in Global Whipping Cream Market

- In October 2023, Hanan Products announced the launch of its novel ‘Top 'n Fil Deluxe’ ready-to-whip icing and filling. The topping can be used to fill doughnuts and decorate cakes and pies, offering a consistent texture and stability that makes it suitable for commercial usage

- In July 2023, Lactalis American Group announced the launch of the Président Whipped Crème gourmet-style line of whipped crème for outdoor occasions such as parties and gatherings

- In May 2023, Whipt, a dairy-free, vegan whipped topping brand, launched a vegan whipped cream. The new product is made with organic, gluten-free oats and cane sugar

- In February 2023, Alamance Foods launched Whipt, a vegan-friendly whipped cream in oat, almond, and coconut flavours. The oat version, a unique offering, targeted post-pandemic health-conscious consumers seeking dairy-free and lower-fat options.

- In July 2022, Country Crock, a food brand owned by Upfield, added a new cream to their plant-based line of dairy-free and vegan products. The new product is a cooking and baking alternative to dairy-heavy whipping cream.

- In July 2021, General Mills announced the launch of our layered dessert strawberry cheesecake with chocolate crust. The product is a spin on creme fraiche — a cultured French cream — combined with a chocolate crust and strawberry fruit for an indulgent dessert experience.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Whipping Cream Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Whipping Cream Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Whipping Cream Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.