Mexico Wellness Natural Products Market

Market Size in USD Billion

CAGR :

%

USD

8.08 Billion

USD

14.11 Billion

2024

2032

USD

8.08 Billion

USD

14.11 Billion

2024

2032

| 2025 –2032 | |

| USD 8.08 Billion | |

| USD 14.11 Billion | |

|

|

|

|

Wellness Natural Products Market Size

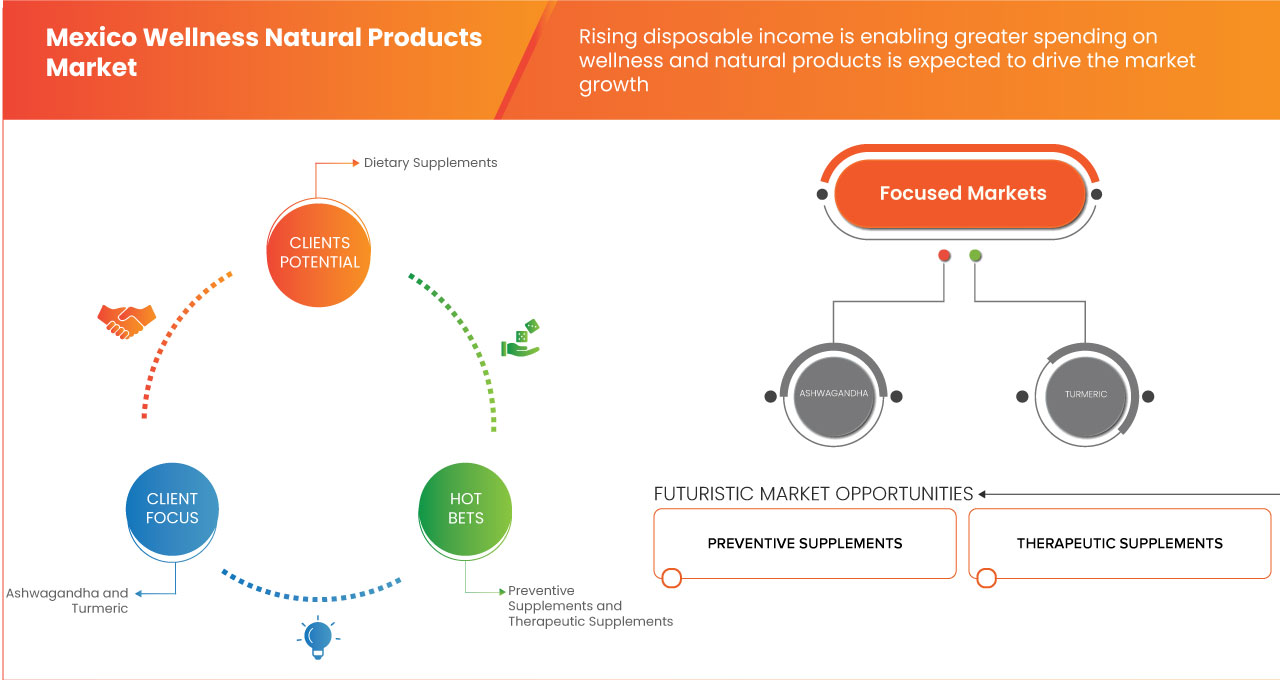

- The Mexico wellness natural products market was valued at USD 8.08 billion in 2024 and is expected to reach USD 14.11 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.3%, primarily driven by the rising awareness of the benefits of natural and organic products

- This growth is driven by factors such as the dietary supplements, fortified/functional food & beverages, dermo-cosmetic skin essentials, food intolerance products

Wellness Natural Products Market Analysis

- One of the primary drivers of growth in this market is the increasing demand for products made from organic and plant-based ingredients. Mexican consumers, particularly younger generations, are becoming more aware of the health benefits associated with natural ingredients, such as improved digestion, skin health, and overall wellness. This has led to the growing popularity of organic and plant-based food, herbal supplements, and natural skincare products

- Moreover, social media and digital marketing have played a crucial role in spreading awareness of wellness trends. Influencers, bloggers, and wellness advocates frequently promote natural and organic products, which has amplified their appeal, especially among millennials and Gen Z consumers. The aesthetic appeal of many natural products, as well as the growing culture of wellness and self-care, has helped create a viral effect, encouraging more consumers to embrace these alternatives

- For instance, In April 2024, Organic Mexico published an article stating that rising consumer interest in natural health products has been fueled by the desire for healthier, more sustainable lifestyles, with increasing preference for clean-label, organic foods and eco-friendly skincare products

Report Scope and Wellness Natural Products Market Segmentation

|

Attributes |

Wellness Natural Products Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wellness Natural Products Market Trends

“Rising Disposable Income is Enabling Greater Spending on Wellness and Natural Products”

- Rising disposable income is enabling greater spending on wellness and natural products as consumers in Mexico have more financial flexibility to invest in healthier lifestyles. With economic growth and an increasing middle class, Mexican consumers are spending more on wellness-related products, including organic foods, plant-based supplements, natural skincare, and eco-friendly wellness items

- This increase in disposable income has also led to a growing awareness of personal well-being, driving demand for premium, high-quality wellness products. With higher purchasing power, more consumers are choosing products that align with their health goals and ethical values, such as natural ingredients, clean-label products, and sustainable packaging

- For instance, In March 2024, Mexico's Economic Growth Report noted a steady rise in disposable income, especially in urban areas, which has increased demand for high-end wellness products such as organic foods and natural supplements

- As disposable income rises, consumers are no longer as restricted by price, allowing them to prioritize health and sustainability over cost

- This trend is particularly evident in urban areas where higher-income groups are leading the shift toward healthier lifestyles

Wellness Natural Products Market Dynamics

Driver

“Government Policies Promoting the Growth of the Wellness Natural Products Market”

- Government policies promoting the growth of the wellness natural products market have played a key role in supporting the expansion of natural and organic products in Mexico

- The Mexican government has implemented several initiatives to encourage sustainable agriculture, organic farming, and the certification of natural products

- These policies provide incentives such as subsidies and tax breaks for businesses adopting eco-friendly and sustainable practices, making it easier for companies to enter the wellness products market. Additionally, the government’s promotion of clean-label and organic standards has helped build consumer trust in natural products

- Public awareness campaigns highlighting the health benefits of organic and plant-based foods, as well as eco-friendly skincare and supplements, are further fueling the market's growth

- The government's commitment to increasing the availability of organic products in retail and food service sectors has led to a more supportive environment for natural product producers

For instance,

- In March 2024, the Mexican Ministry of Agriculture and Rural Development published an article highlighting the expansion of the country's organic certification program, which aims to increase the availability of organic produce and products to consumers. This initiative is expected to further boost demand for natural wellness products in Mexico

- In July 2024, the Mexican Health Department launched a campaign to promote the benefits of natural supplements and wellness products, aimed at educating consumers about the importance of organic and plant-based ingredients for overall health

- As a result of the Mexico Wellness Natural Products Market is benefitting from a favorable policy environment that supports sustainable farming practices, organic certification, and consumer education. These government initiatives are helping drive the demand for natural and wellness products, positioning businesses for growth and success in a rapidly expanding market

Opportunity

“Rising Health and Sustainability Concerns Driving the Shift Towards Plant-Based and Vegan Products”

- The growing focus on health and sustainability is creating a significant opportunity for plant-based and vegan products in the market

- As consumers become more aware of the environmental impact of their choices and seek healthier, cruelty-free alternatives, plant-based options are gaining popularity across various sectors, from food and beverages to beauty and personal care

- The shift toward plant-based and vegan products is also being driven by the increasing availability of high-quality plant-based alternatives. Innovations in food technology have made plant-based proteins, dairy substitutes, and other vegan products more accessible and appealing to consumers, including those who are not fully vegan but are seeking to reduce their consumption of animal products

For instance,

- In March 2025, the Bullvine LLC highlighted that the Mexican startup "Moo" introduced a plant-based milk alternative, capitalizing on the rising demand for dairy substitutes, particularly among younger consumers. Moo’s success was largely attributed to its emphasis on product taste and educating consumers on the benefits of plant-based products

- In March 2025, essfeed reported the rising demand for plant-based products in Mexico is seen in the growing popularity of vegan Mexican dishes. More consumers are turning to vegetarian and vegan options due to health, environmental, and ethical concerns. To meet this demand, restaurants like "Veggie Planet" in Mexico City have expanded their plant-based menus, offering vegan versions of traditional Mexican dishes. This shift has led to increased sales and customer satisfaction, reflecting the broader trend toward plant-based eating

- By capitalizing on this trend, brands can position themselves as leaders in sustainability and health-conscious living, which resonates strongly with younger generations who are highly engaged with environmental and ethical issues. This presents an opportunity for companies to not only expand their customer base but also enhance brand loyalty by aligning their products with the values of today’s mindful consumers. As the demand for plant-based and vegan options continues to rise, businesses have the chance to create a lasting impact in the wellness and natural products market

Restraint/Challenge

“Presence of Fake or Misrepresented Natural Products in the Market”

- The wellness and natural products industry face a significant challenge with the growing presence of fake or misrepresented natural products in the market. As demand for organic, plant-based, and sustainably sourced products continues to rise, the market has become a target for fraudulent practices

- Many products that claim to be "natural," "organic," or "sustainable" are often either diluted with synthetic ingredients, falsely labeled, or do not meet the required standards for certifications

- One of the primary reasons this challenge persists is the high consumer demand for natural and organic products, which has led to a flood of new brands and products entering the market

For instance,

- In 2020, an investigation by The Guardian exposed several popular natural skincare brands that falsely advertised their products as 100% natural, only to reveal that they contained synthetic additives, preservatives, or fragrances. Many consumers were misled into purchasing these products believing they were chemical-free when they were, in fact, laden with artificial ingredients. This created both safety concerns and a sense of betrayal among loyal customers

- The challenge of fake or misrepresented natural products in the wellness and natural products market highlights the need for greater transparency and regulation within the industry. While the demand for natural and organic products continues to rise, fraudulent practices undermine consumer trust and jeopardize the growth of the market

Wellness Natural Products Market Scope

The market is segmented on the basis product type, ingredients, usage, gender, age, type, packaging type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Ingredients |

|

|

By Usage |

|

|

By Gender

|

|

|

By Age |

|

|

By Type

|

|

|

By Packaging Type |

|

|

By End User |

|

|

By Distribution Channel |

|

Wellness Natural Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Mexico presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Juice Plus+ (U.S.)

- Nature's Sunshine Products, Inc. (U.S.)

- Organ (Mexico)

- Oriflame Cosmetics Global SA (Switzerland)

- Herbalife International Mexico, SA de CV (U.S.)

- Isagenix (U.S.)

- NIKKEN International Inc. (Mexico)

- Glanbia plc (Ireland)

- NU SKIN (U.S.)

- USANA Health Sciences, Inc. (U.S.)

- Amway (U.S.)

- Herbs of Mexico (U.S.)

Latest Developments in Mexico Wellness Natural Products Market

- In July 2023, Glanbia Nutritionals' heat-stable whey protein concentrate, OptiSol 1007, won the Product Innovation Award at the FFI 2023 Food Formulation Innovation show in Chengdu, China. Recognized for its outstanding functional properties, OptiSol 1007 stood out among over 120 entries evaluated by a panel of academics, industry experts, and R&D leaders

- In April 2024, Herbalife signed LA Galaxy midfielder Riqui Puig to a sports nutrition sponsorship through the 2025 MLS season. As an official sports performance nutrition partner, Herbalife will provide Puig with products from the Herbalife24 line and other health and wellness items to optimize his performance. The partnership will also include community initiatives, sports nutrition education, and global marketing efforts

- In March 2025, Nature's Sunshine has launched its first integrated brand platform, "Be More Earth," developed in collaboration with the media and creative agency Crispin. This initiative emphasizes the company's 50-year legacy of harnessing nature's healing powers and sourcing premium ingredients. The platform's visual design draws inspiration from Earth's natural beauty and restorative power, aiming to differentiate Nature's Sunshine from synthetic products prevalent in the market. The campaign is set to roll out across various channels, including the company's website, email, storefronts, and paid media platforms such as Meta, Pinterest, Reddit, Vox, YouTube, Connected TV, and through influencer partnerships

- In October 2024, Nu Skin introduced MYND360, a line of clinically proven supplements and topicals designed to support mental well-being. The collection includes six products targeting sleep quality, stress management, focus enhancement, and memory support, reflecting five years of dedicated research and clinical studies

- In October 2024, updated formulas for XM+ and SuperMix will be introduced, with SmartMix following in 2025. Based on customer feedback, the bitterness has been reduced, and the moringa powder content optimized for improved digestive comfort. The new formulas feature a more vibrant green pigment due to increased moringa content, while maintaining the use of high-quality, shade-dried moringa oleifera leaves, seeds, and fruit. Enhanced wellness offerings are set to launch soon

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 OVERVIEW

4.1.2 LOGISTIC COST SCENARIO

4.1.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.2 TRENDS IN THE MARKET (GROW, STOCK, DOWN)

4.2.1 METABOLISM-FOCUSED WELLNESS

4.2.2 ORAL MICROBIOME HEALTH

4.2.3 STOCK MARKET PERFORMANCE

4.2.4 INDUSTRY DEVELOPMENT

4.3 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

4.3.1 HEALTH AND WELLNESS AWARENESS

4.3.2 INGREDIENT TRANSPARENCY AND CLEAN LABELS

4.3.3 INFLUENCE OF TRADITIONAL AND HERBAL MEDICINE

4.3.4 PRICING AND AFFORDABILITY

4.3.5 SUSTAINABILITY AND ETHICAL SOURCING

4.3.6 RETAIL AVAILABILITY AND ONLINE ACCESSIBILITY

4.3.7 BRAND TRUST AND REPUTATION

4.3.8 INFLUENCE OF SOCIAL MEDIA AND DIGITAL MARKETING

4.3.9 REGULATORY COMPLIANCE AND CERTIFICATIONS

4.3.10 PERSONALIZATION AND CONVENIENCE

4.3.11 CONCLUSION

4.4 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4.1 DIGITAL AND SOCIAL MEDIA MARKETING

4.4.2 E-COMMERCE AND DIRECT-TO-CONSUMER (DTC) MODELS

4.4.3 MULTI-LEVEL MARKETING (MLM) AND DIRECT SELLING

4.4.4 SUSTAINABILITY AND ETHICAL BRANDING

4.4.5 IN-STORE PROMOTIONS AND RETAIL EXPANSION

4.4.6 SUBSCRIPTION-BASED WELLNESS PROGRAMS

4.4.7 CONCLUSION

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 CONSUMER TRUST AND PRODUCT AUTHENTICITY

4.5.2 PRODUCT DIFFERENTIATION AND UNIQUE SELLING PROPOSITION (USP)

4.5.3 MARKET DEMAND AND CONSUMER AWARENESS

4.5.4 BRAND REPUTATION AND POSITIONING

4.5.5 SALES PERFORMANCE AND MARKET PENETRATION

4.5.6 CONCLUSION

4.6 PROMOTIONAL ACTIVITIES

4.6.1 CULTURAL RELEVANCE AND CONSUMER ALIGNMENT

4.6.2 INFLUENCE OF SOCIAL MEDIA AND INFLUENCERS

4.6.3 LOCALIZED MESSAGING AND EMOTIONAL APPEAL

4.6.4 CONSUMER LIFESTYLE DATA AND BEHAVIORAL SHIFTS

4.6.5 EFFECTIVENESS OF IN-STORE PROMOTIONS VS. ONLINE CAMPAIGNS

4.6.6 PRICE SENSITIVITY AND PERCEIVED VALUE

4.6.7 CONCLUSION

4.7 SHOPPING BEHAVIOUR AND DYNAMICS

4.7.1 CONSUMER AWARENESS AND PREFERENCES

4.7.2 PRICE SENSITIVITY AND BRAND LOYALTY

4.7.3 SHOPPING CHANNELS AND PRODUCT SOURCING PREFERENCES

4.7.4 CONSUMER DEMOGRAPHICS AND TRUST IN GLOBAL VS. LOCAL BRANDS

4.7.5 CONCLUSION

4.8 PRICING ANALYSIS

4.8.1 COST OF RAW MATERIALS AND PRODUCTION

4.8.2 IMPORT TARIFFS AND REGULATORY COMPLIANCE COSTS

4.8.3 BRAND POSITIONING AND MARKET SEGMENTATION

4.8.4 DISTRIBUTION CHANNEL IMPACT ON PRICING

4.8.5 COMPETITIVE PRICING STRATEGIES

4.8.6 CONSUMER PERCEPTION OF PRICE VS. VALUE

4.8.7 INFLATION AND ECONOMIC IMPACT ON PRICING

4.9 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.1 BRAND OUTLOOK

4.10.1 BRAND COMPARATIVE ANALYSIS OF MEXICO WELLNESS NATURAL PRODUCTS MARKET

4.10.2 PRODUCT VS BRAND OVERVIEW

4.10.2.1 PRODUCT OVERVIEW

4.10.2.2 BRAND OVERVIEW

4.11 IMPACT OF ECONOMIC SLOWDOWN

4.11.1 IMPACT OF PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 NEW PRODUCT LAUNCHES

4.13 PRIVATE LABEL VS. BRAND ANALYSIS

4.13.1 PRIVATE LABEL

4.13.2 BRAND

4.13.3 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING AWARENESS OF THE BENEFITS OF NATURAL AND ORGANIC PRODUCTS

6.1.2 GOVERNMENT POLICIES PROMOTING THE GROWTH OF THE WELLNESS NATURAL PRODUCTS MARKET

6.1.3 RISING DISPOSABLE INCOME IS ENABLING GREATER SPENDING ON WELLNESS AND NATURAL PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF NATURAL INGREDIENTS

6.2.2 STRINGENT CERTIFICATION PROCESSES AND COMPLIANCE REQUIREMENTS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTH AND SUSTAINABILITY CONCERNS DRIVING THE SHIFT TOWARDS PLANT-BASED AND VEGAN PRODUCTS

6.3.2 GROWING TRACTION FOR PERSONALIZED WELLNESS PRODUCTS AND CUSTOM FORMULATIONS

6.3.3 THRIVING WELLNESS TOURISM INDUSTRY IN MEXICO

6.4 CHALLENGES

6.4.1 PRESENCE OF FAKE OR MISREPRESENTED NATURAL PRODUCTS IN THE MARKET

6.4.2 STRONG COMPETITION FROM WELL-ESTABLISHED GLOBAL BRANDS IMPACTING LOCAL PLAYERS' MARKET

7 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DIETARY SUPPLEMENTS

7.3 FORTIFIED/FUNCTIONAL FOOD & BEVERAGES

7.4 DERMO-COSMETIC SKIN ESSENTIALS

7.5 FOOD INTOLERANCE PRODUCTS

7.6 OTHERS

8 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY INGREDIENTS

8.1 OVERVIEW

8.2 ASHWAGANDHA

8.3 TURMERIC

8.4 SPIRULINA

8.5 GREEN TEA

8.6 MORINGA

8.7 APPLE CIDER VINEGAR

8.8 MACA ROOT

8.9 AMLA

8.1 HONEY

8.11 ALOE VERA

8.12 PEPPERMINT

8.13 HIBISCUS

8.14 MILK

8.15 OTHERS

9 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY USAGE

9.1 OVERVIEW

9.2 GENERAL HEALTH AND WELLNESS

9.3 DIGESTIVE HEALTH

9.4 IMMUNE SUPPORT

9.5 STRESS MANAGEMENT

9.6 HEART HEALTH

9.7 GLUCOSE MANAGEMENT/BLOOD SUGAR

9.8 BONE HEALTH

9.9 ANTI-AGING & LONGEVITY

9.1 BRAIN HEALTH

9.11 LIVER HEALTH/DETOXIFICATION

9.12 HORMONAL BALANCE

9.13 SEXUAL HEALTH

9.14 NERVE HEALTH & COMFORT SUPPORT

10 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY GENDER

10.1 OVERVIEW

10.2 FEMALE

10.3 MALE

11 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY AGE

11.1 OVERVIEW

11.2 ADULTS

11.3 GERIATRIC

11.4 CHILDREN

12 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY TYPE

12.1 OVERVIEW

12.2 PREVENTIVE SUPPLEMENTS

12.3 THERAPEUTIC SUPPLEMENTS

13 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PACKAGING TYPE

13.1 OVERVIEW

13.2 POUCHES

13.3 BOTTLES

13.4 TETRA PACKS

13.5 JARS

13.6 CANS

13.7 BOXES

13.8 OTHERS

14 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOME CARE

14.3 HEALTH & WELLNESS CENTERS

14.4 GYMNASIUM

14.5 SPORTS ACADEMY

14.6 OTHERS

15 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE BASED RETAILERS

15.3 NON-STORE RETAILERS

16 MEXICO WELLNESS NATURAL PRODUCTS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MEXICO

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GLANBIA PLC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT/ NEWS TYPE

18.2 HERBALIFE LTD

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 JUICE PLUS+

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENTS

18.4 NATURE'S SUNSHINE PRODUCTS, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 NU SKIN

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 AMWAY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 HERBS OF MEXICO

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 ISAGENIX

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT NEWS

18.9 NIKKEN INTERNATIONAL INC

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 ORGAN

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 ORIFLAME COSMETICS GLOBAL SA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT/BRAND PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 USANA HEALTH SCIENCES, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MEXICO DIETARY SUPPLEMENTS IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MEXICO FORTIFIED/FUNCTIONAL FOOD & BEVERAGES IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MEXICO DERMO-COSMETIC SKIN ESSENTIALS IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MEXICO FOOD INTOLERANCE PRODUCTS IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY INGREDIENTS, 2018-2032 (USD THOUSAND)

TABLE 9 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 10 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 11 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 12 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MEXICO POUCHES IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 16 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 17 MEXICO STORE BASED RETAILERS IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MEXICO NON-STORE RETAILERS IN WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO WELLNESS NATURAL PRODUCTS MARKET

FIGURE 2 MEXICO WELLNESS NATURAL PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO WELLNESS NATURAL PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO WELLNESS NATURAL PRODUCTS MARKET: MEXICO VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO WELLNESS NATURAL PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO WELLNESS NATURAL PRODUCTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MEXICO WELLNESS NATURAL PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MEXICO WELLNESS NATURAL PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET END USER COVERAGE GRID

FIGURE 10 MEXICO WELLNESS NATURAL PRODUCTS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FIVE SEGMENTS COMPRISE THE MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PRODUCT TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RAISING AWARENESS OF THE BENEFITS OF NATURAL AND ORGANIC PRODUCTS IS EXPECTED TO DRIVE THE MEXICO WELLNESS NATURAL PRODUCTS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO WELLNESS NATURAL PRODUCTS MARKET IN 2025 AND 2032

FIGURE 16 MEXICO WELLNESS NATURAL PRODUCTS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MEXICO WELLNESS NATURAL PRODUCTS MARKET

FIGURE 18 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PRODUCT TYPE, 2024

FIGURE 19 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY INGREDIENTS, 2024

FIGURE 20 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY USAGE, 2024

FIGURE 21 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY GENDER, 2024

FIGURE 22 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY AGE, 2024

FIGURE 23 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY TYPE, 2024

FIGURE 24 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY PACKAGING TYPE, 2024

FIGURE 25 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY END USER, 2024

FIGURE 26 MEXICO WELLNESS NATURAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 27 MEXICO WELLNESS NATURAL PRODUCTS MARKET: COMPANY SHARE 2024 (%)

Mexico Wellness Natural Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Wellness Natural Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Wellness Natural Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.