TABLE 1 MIDDLE EAST & AFRICA NUMBER OF INCIDENT CASES, PREVALENT CASES OF FRACTURES BY ANATOMICAL SITE AND SEX IN 2019, AND PERCENTAGE CHANGE FROM 1990 TO 2019

TABLE 2 MIDDLE EAST & AFRICA TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INTERNAL FIXATION DEVICES IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA INTERNAL FIXATORS DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA INTERNAL FIXATORS DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 6 MIDDLE EAST & AFRICA EXTERNAL FIXATION DEVICES IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA EXTERNAL FIXATORS DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA EXTERNAL FIXATORS DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 9 MIDDLE EAST & AFRICA TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA METALLIC IMPLANT (STEEL, TITANIUM AND OTHER) IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA HYDBRID IMPLANT IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA BIO ABSORBABLE IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CARBON FIBER (THERMOPLASTIC) IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA GRAFTS AND ORTHOBIOLOGICS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA SHOULDER AND ELBOW IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HAND AND WRIST IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HIP AND FEMUR IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PELVIC IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CRANIOMAXILLOFACIAL IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA TIBIA IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA KNEE IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA FOOT AND ANKLE IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SPINAL IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HOSPITALS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA TRAUMA CENTERS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AMBULATORY CENTERS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA DIRECT TENDER IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA RETAIL SALES IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ONLINE SALES IN TRAUMA FIXATION MARKET, BY REGION, 2020-2029 (USD MILLION)

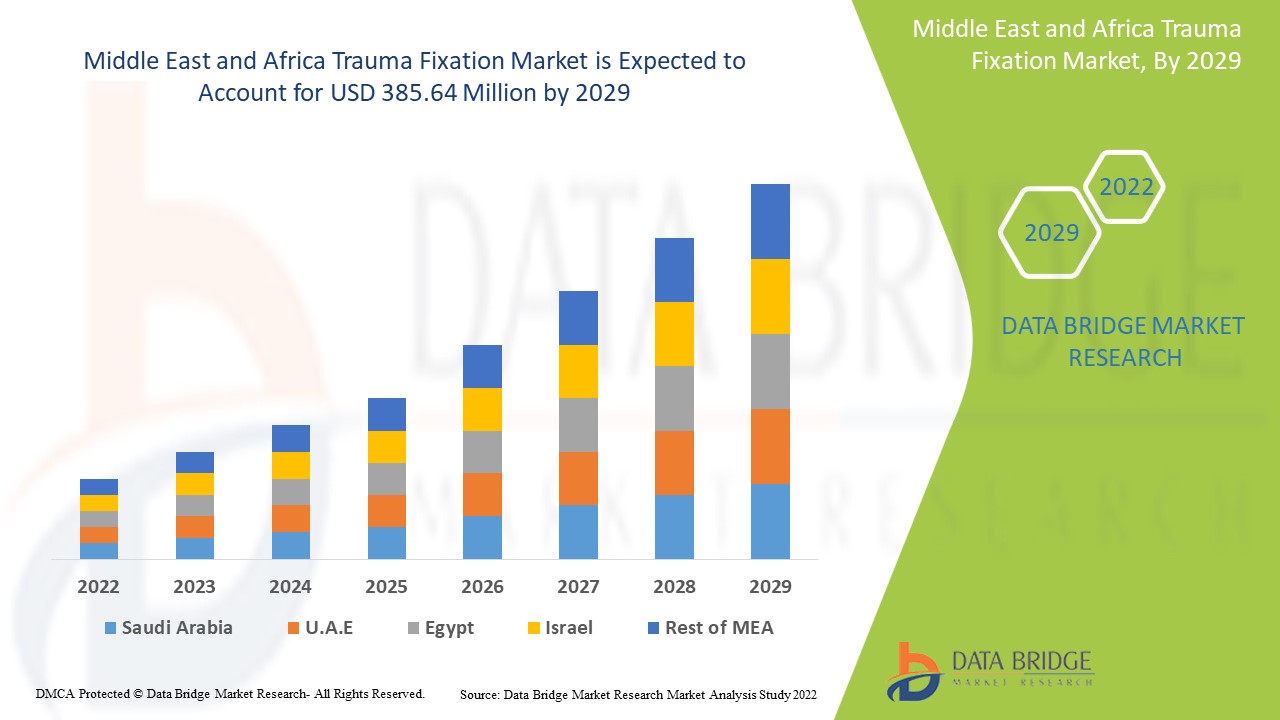

TABLE 35 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 39 MIDDLE EAST AND AFRICA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 41 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 48 SOUTH AFRICA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 50 SOUTH AFRICA TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 57 SAUDI ARABIA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 59 SAUDI ARABIA TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 UAE TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 UAE EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 UAE EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 66 UAE INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 UAE INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 68 UAE TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 UAE TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 UAE TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 UAE TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 EGYPT TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 EGYPT EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 EGYPT EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 75 EGYPT INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 77 EGYPT TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 78 EGYPT TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 EGYPT TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 UAE TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL EXTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 84 ISRAEL INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL INTERNAL FIXATOR DEVICES IN TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 86 ISRAEL TRAUMA FIXATION MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL TRAUMA FIXATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL TRAUMA FIXATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL TRAUMA FIXATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 REST OF THE MIDDLE EAST AND AFRICA TRAUMA FIXATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)