Middle East And Africa Dairy Protein Ingredients Market

Market Size in USD Million

CAGR :

%

USD

1.32 Million

USD

2.69 Million

2024

2032

USD

1.32 Million

USD

2.69 Million

2024

2032

| 2025 –2032 | |

| USD 1.32 Million | |

| USD 2.69 Million | |

|

|

|

|

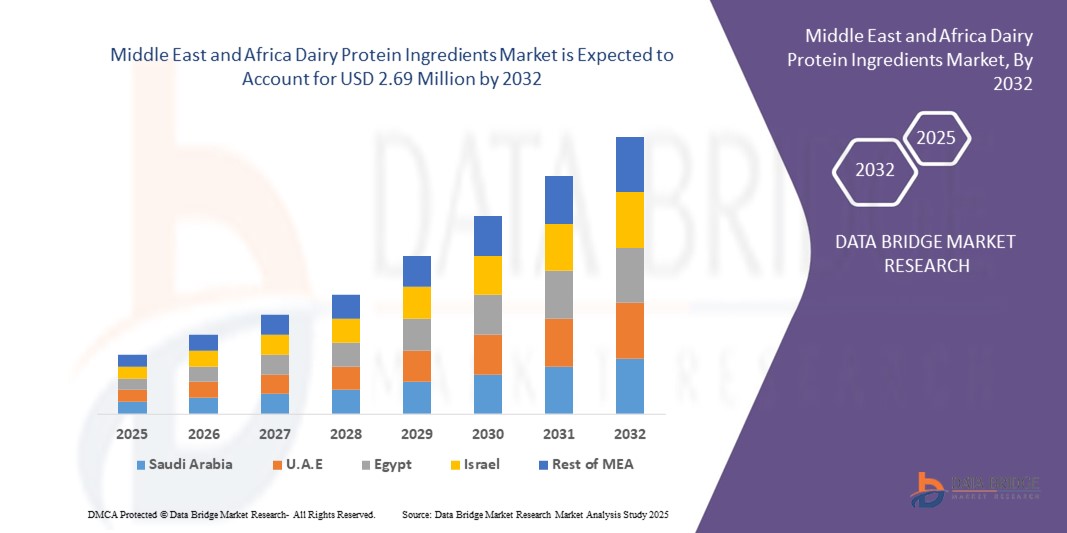

What is the Middle East and Africa Dairy Protein Ingredients Market Size and Growth Rate?

- The Middle East and Africa dairy protein ingredients market size was valued at USD 1.32 million in 2024 and is expected to reach USD 2.69 million by 2032, at a CAGR of 9.30% during the forecast period

- Dairy milk protein ingredients are the ingredients that can be used for giving proper texture to dairy products. It also has a binding quality that binds all the nutritional value of the food. These are very rich in protein which helps in providing a better quality diet to humans

- Dairy proteins are also used as an ingredient in infant formula to provide better nutrition to the newborn in their growth stage

- These proteins have a wide range of applications in bakery products, beverages, ice cream, and others. To fulfilling the demand, the manufacturers are focusing on providing dairy ingredients products in the market

What are the Major Takeaways of Dairy Protein Ingredients Market?

- Dairy protein ingredient is the concentrated liquid which is a by-product of the cheese making process. It has a high amount of protein content in it which helps in strengthening the digestive system of the human body

- As of now, dairy ingredients such as whey protein, milk protein, and casein protein are in high demand as these are mostly utilized in sports nutrition as well as in bakery products.

- U.A.E. is expected to dominate the dairy protein ingredients market with the largest revenue share of 54.36%, supported by a health-conscious population, high disposable incomes, and a strong presence of international food and beverage brands

- Saudi Arabia dairy protein ingredients market is expected to grow at the fastest rate, fueled by rapid urbanization, an expanding youth population, and rising awareness around fitness and nutrition

- The whey protein segment dominated the market with the largest revenue share of 46.7% in 2024, owing to its superior amino acid profile, fast digestibility, and high demand in sports nutrition and dietary supplements

Report Scope and Dairy Protein Ingredients Market Segmentation

|

Attributes |

Dairy Protein Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dairy Protein Ingredients Market?

“Clean Label and Functional Nutrition Drive Innovation”

- A major trend in the Middle East and Africa dairy protein ingredients market is the rising demand for clean-label, functional, and sustainably sourced protein products. Consumers are increasingly prioritizing transparency in ingredient sourcing and product formulation, leading to a shift toward natural, non-GMO, and minimally processed dairy protein ingredients

- For instance, companies such as Arla Foods Ingredients and Fonterra have launched clean-label whey and casein ingredients aimed at sports nutrition and healthy aging

- Functional health benefits, such as muscle recovery, immunity boost, and weight management, are also influencing new product development. Innovative formats, including ready-to-mix powders and fortified dairy beverages, are being introduced to meet this demand

- The trend is supported by a growing number of health-conscious consumers and the Middle East and Africa shift toward preventive health and wellness. This is prompting companies to reformulate existing products and invest in R&D for value-added dairy proteins

- Ultimately, the demand for clean, functional, and sustainable protein solutions is reshaping the market, influencing product innovation, marketing strategies, and ingredient sourcing practices Middle East and Africaly

What are the Key Drivers of Dairy Protein Ingredients Market?

- Increasing consumer awareness of health, wellness, and nutritional needs is a primary driver, pushing demand for high-protein functional foods across demographics, including athletes, aging populations, and weight-conscious individuals

- For instance, in February 2024, Glanbia Nutritionals expanded its dairy protein product line to cater to rising demand in sports nutrition and medical foods sectors

- The widespread growth of the sports nutrition, infant formula, and clinical nutrition industries is contributing significantly to market expansion, as dairy proteins such as whey, casein, and milk protein isolates offer essential amino acids and digestibility

- Growing interest in fortified and functional foods, especially in emerging economies, is pushing manufacturers to incorporate dairy proteins into RTD beverages, snacks, and meal replacements

- In addition, rising income levels, urbanization, and busy lifestyles are supporting demand for convenient, protein-rich food formats, further propelling market growth across both developed and developing regions

Which Factor is challenging the Growth of the Dairy Protein Ingredients Market?

- A key challenge for the dairy protein ingredients market is the rising incidence of lactose intolerance and dairy allergies, particularly in Asia-Pacific and parts of Africa, where large segments of the population are lactose sensitive

- For instance, as awareness of lactose-free diets grows, plant-based alternatives such as soy, pea, and rice proteins are capturing market share, especially among vegan and health-conscious consumers

- Environmental concerns around dairy farming’s carbon footprint and animal welfare are also prompting a shift away from traditional dairy proteins toward sustainable alternatives, which may limit growth potential in certain consumer segments

- Volatility in milk prices, supply chain disruptions, and regulatory pressure regarding clean-label and allergen disclosures present further obstacles for manufacturers

- Addressing these issues through lactose-free formulations, improved sustainability practices, and consumer education will be essential to maintaining competitiveness and driving adoption in Middle East and Africa markets

How is the Dairy Protein Ingredients Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Type

On the basis of type, the dairy protein ingredients market is segmented into milk protein, whey protein, and casein protein. The whey protein segment dominated the market with the largest revenue share of 46.7% in 2024, owing to its superior amino acid profile, fast digestibility, and high demand in sports nutrition and dietary supplements. Whey proteins are widely used in functional foods due to their role in muscle synthesis and weight management.

The milk protein segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing use in infant formulas, clinical nutrition, and dairy-based beverages. Milk protein blends offer a balanced nutritional profile, appealing to health-conscious consumers and manufacturers seeking natural protein enrichment.

• By Content

On the basis of content, the dairy protein ingredients market is segmented into 30%-85%, 85%-95%, and 95% & above protein concentration. The 85%-95% content segment held the highest revenue share of 39.4% in 2024, driven by its balance of cost-efficiency and functionality in a wide range of applications such as bakery, dairy, and RTD beverages.

The 95% & above segment is expected to register the fastest growth rate from 2025 to 2032, due to its rising use in premium sports nutrition and medical foods, where high purity and performance are critical.

• By Form

On the basis of form, the dairy protein ingredients market is segmented into dry and liquid. The dry form segment dominated the market with the largest revenue share of 72.1% in 2024, attributed to its long shelf life, ease of storage and transport, and suitability in powdered applications such as nutritional supplements, baking mixes, and meal replacements.

The liquid segment is projected to witness the fastest CAGR during 2025 to 2032, driven by its integration in RTD beverages, yogurt drinks, and dairy emulsions. Its ready-to-use nature makes it convenient for manufacturers focused on functional and fortified product lines.

• By Application

On the basis of application, the dairy protein ingredients market is segmented into bakery product, dairy products, sports nutrition, confectionery, beverages, dietary supplements, infant formula, nutritional bars, breakfast cereals, sauces, dressings & seasonings, RTE meals, and meat & poultry products. The sports nutrition segment led the market with a revenue share of 25.3% in 2024, driven by the rising consumer focus on fitness, muscle building, and active lifestyles.

The infant formula segment is expected to record the highest growth rate from 2025 to 2032, supported by increasing birth rates in developing nations, premiumization trends, and demand for high-quality, digestible protein sources for early nutrition.

Which Region Holds the Largest Share of the Dairy Protein Ingredients Market?

- U.A.E. is expected to dominate the dairy protein ingredients market with the largest revenue share of 54.36%, supported by a health-conscious population, high disposable incomes, and a strong presence of international food and beverage brands

- Growing consumer interest in fitness and wellness has driven demand for whey and casein protein-enriched products

- Moreover, the country's developed infrastructure and robust e-commerce sector facilitate easy access to premium dairy protein supplements and functional food items

Saudi Arabia Dairy Protein Ingredients Market Insight

The Saudi Arabia dairy protein ingredients market is expected to grow at the fastest rate, fueled by rapid urbanization, an expanding youth population, and rising awareness around fitness and nutrition. The government’s Vision 2030 initiative to improve public health has encouraged healthier eating habits, boosting the demand for high-protein foods. Local manufacturers are increasingly collaborating with global players to introduce innovative dairy protein products tailored to regional dietary preferences.

South Africa Dairy Protein Ingredients Market Insight

South Africa dairy protein ingredients market is expected to grow at a notable pace, driven by increasing health consciousness, a growing middle class, and greater availability of fortified dairy products. Consumers are showing growing interest in protein-rich snacks, RTD beverages, and infant formulas. The expansion of fitness centers and wellness trends, coupled with support from local health agencies, is also contributing to the growing demand for dairy protein solutions.

Which are the Top Companies in Dairy Protein Ingredients Market?

The dairy protein ingredients industry is primarily led by well-established companies, including:

- Westland Milk Products (New Zealand)

- LACTALIS Ingredients (France)

- Cniel (France)

- Nutrinnovate Australia (Australia)

- Glanbia plc (Ireland)

- Kerry Inc. (Ireland)

- Lacto Japan Co., Ltd. (Japan)

- Darigold (U.S.)

- AMCO Proteins (U.S.)

- Hoogwegt (Netherlands)

- Unternehmensgruppe Theo Müller (Luxembourg)

- Tatura Milk Industries Pty. Ltd. (Australia)

- Idaho Milk Products (U.S.)

- Milk Specialties (U.S.)

- Arla Foods Ingredients Group P/S (Denmark)

- ALPAVIT (Germany)

- Agropur US (Canada)

- wheyco GmbH (Germany)

- FrieslandCampina Ingredients (Netherlands)

- Fonterra Co-operative Group (Australia)

What are the Recent Developments in Middle East and Africa Dairy Protein Ingredients Market?

- In May 2025, Danone’s Oikos brand introduced a new protein shake specifically designed for consumers using GLP-1 medications such as Ozempic and Wegovy, which suppress appetite. The shake includes five grams of fiber and is now available in major U.S. retail outlets. This launch reflects a strategic alignment with emerging health trends and growing interest in portion-controlled, high-protein dairy products

- In February 2025, Arla Foods, a major Middle East and Africa dairy cooperative, announced a modest revenue increase from USD 13.7 million in 2023 to USD 13.8 million in 2024. The company anticipates continued revenue growth in 2025, supported by rising dairy prices and steady consumer demand. This outlook underscores Arla’s resilience and adaptability in a fluctuating economic environment

- In October 2024, Israeli-based company DairyX unveiled innovative yeast strains capable of producing casein proteins without the use of cows. These proteins are essential for delivering the stretch and creaminess in cheese, enhancing the quality of plant-based alternatives. Regulatory approval is expected by 2027. This development marks a breakthrough in sustainable dairy innovation and the future of alternative cheese products

- In May 2024, Saputo’s Frigo Cheese Heads brand expanded its product range by launching a whole milk string cheese to cater to consumer demand for creamier, higher-fat dairy snacks. This addition enhances their existing string cheese lineup with a richer taste experience. The launch highlights Saputo’s commitment to product diversity and evolving dietary preferences

- In May 2024, Epi Ingredients introduced a new butter powder free from additives, targeting the increasing market demand for clean-label, natural food components. The product is designed for use across a variety of food applications as a convenient and versatile alternative to traditional butter. This move supports the industry shift toward minimally processed, functional dairy ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.