Middle East And Africa Fitness Equipment Market

Market Size in USD Million

CAGR :

%

USD

375.81 Million

USD

538.55 Million

2024

2032

USD

375.81 Million

USD

538.55 Million

2024

2032

| 2025 –2032 | |

| USD 375.81 Million | |

| USD 538.55 Million | |

|

|

|

|

Middle East and Africa Fitness Equipment Market Size

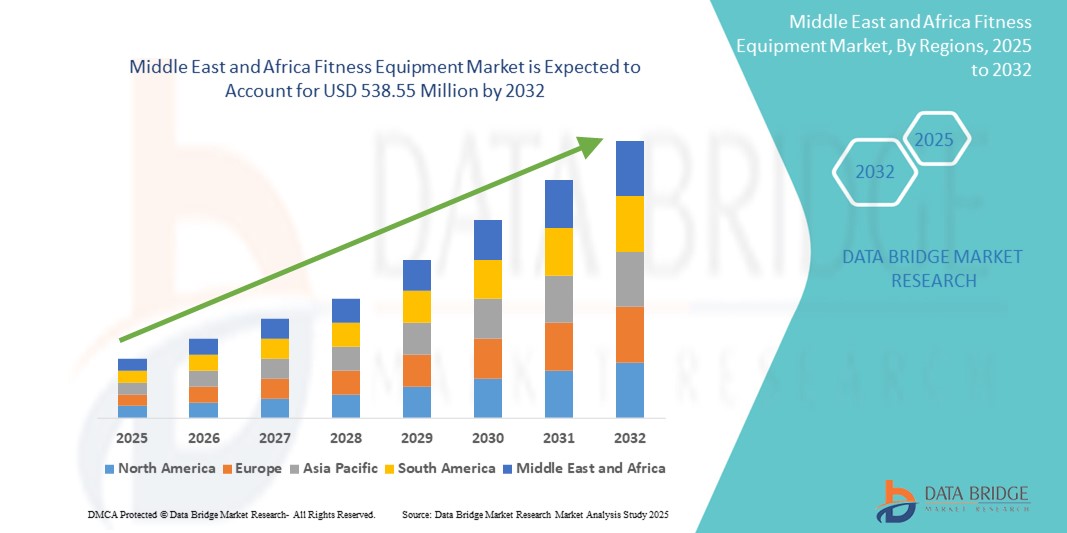

- The Middle East and Africa fitness equipment market size was valued at USD 375.81 million in 2024 and is expected to reach USD 538.55 million by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely driven by increasing health awareness, urbanization, and the expansion of fitness centers and gym chains across major cities in the region, fueling demand for both cardio and strength training equipment

- Moreover, government-led wellness initiatives, rising disposable incomes, and a growing youth population seeking active lifestyles are reinforcing fitness equipment adoption. These dynamics are accelerating market penetration and contributing significantly to the industry's sustained growth

Middle East and Africa Fitness Equipment Market Analysis

- Fitness equipment, encompassing machines and devices used for physical exercise such as treadmills, ellipticals, and strength-training systems, is becoming an essential part of personal and commercial wellness spaces across the Middle East and Africa due to increasing focus on health, wellness, and lifestyle transformation

- The rising demand for fitness equipment is primarily driven by growing health awareness, increasing prevalence of lifestyle-related diseases, and the surge in gym memberships and fitness club expansions across urban centers

- The United Arab Emirates dominated the Middle East and Africa fitness equipment market with the largest revenue share of 36.1% in 2024, supported by high disposable incomes, a well-established fitness culture, and government-backed wellness initiatives such as the Dubai Fitness Challenge that promote active living among residents

- Saudi Arabia is expected to be the fastest growing country in the Middle East and Africa fitness equipment market during the forecast period due to rapid infrastructure development, increasing female participation in fitness activities, and supportive public health campaigns

- Cardiovascular training equipment segment dominated the Middle East and Africa fitness equipment market with a market share of 48.4% in 2024, driven by its effectiveness in improving heart health and aiding weight management, making it a staple in both home and commercial gyms

Report Scope and Middle East and Africa Fitness Equipment Market Segmentation

|

Attributes |

Middle East and Africa Fitness Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Fitness Equipment Market Trends

“Digitization of Fitness and Integration with Smart Technology”

- A significant and accelerating trend in the Middle East and Africa fitness equipment market is the digital transformation of fitness ecosystems, marked by the integration of connected devices, virtual training platforms, and smart tracking features. This shift is enhancing user engagement, training customization, and performance monitoring across home and commercial settings

- For instance, brands such as Technogym and Life Fitness offer internet-connected treadmills and bikes that sync with training apps and virtual coaching platforms, enabling users to follow instructor-led sessions or track progress through personalized dashboards

- The use of IoT-enabled equipment allows gyms and fitness centers to offer real-time performance data, automated workout adjustments, and remote diagnostics for equipment maintenance, optimizing both user experience and operational efficiency

- Wearable integration with cardio machines is also on the rise, as devices such as smartwatches and fitness trackers connect seamlessly with machines for synchronized heart rate monitoring and performance feedback

- This trend is reshaping fitness preferences, especially among tech-savvy users and younger demographics who seek interactive and data-driven workouts. As a result, companies operating in the region are increasingly offering connected equipment and AI-powered fitness platforms tailored for evolving user expectations

- The demand for digitally enabled fitness equipment is growing rapidly in urban areas of the Middle East and Africa, particularly within premium gyms, hospitality wellness centers, and home fitness setups, driven by a desire for more interactive, convenient, and results-oriented fitness experiences

Middle East and Africa Fitness Equipment Market Dynamics

Driver

“Rising Health Awareness and Government-Backed Wellness Initiatives”

- A key driver for the Middle East and Africa fitness equipment market is the growing public awareness of health and wellness, combined with national health strategies aimed at combating non-communicable diseases such as obesity, diabetes, and cardiovascular issue

- For instance, Saudi Arabia’s Vision 2030 and the UAE’s National Strategy for Wellbeing 2031 include dedicated initiatives to encourage physical activity, expand fitness infrastructure, and increase the share of the population engaging in regular exercise

- As urban populations grow and sedentary lifestyles become more prevalent, consumers are seeking fitness solutions both at home and in commercial gyms. The surge in boutique fitness studios, corporate wellness programs, and women-focused fitness centers is further driving equipment demand across segments

- In addition, the rise of social media fitness influencers and fitness challenges is boosting health consciousness among the youth, encouraging investment in personal fitness equipment and gym memberships across the region

Restraint/Challenge

“High Equipment Costs and Uneven Market Accessibility”

- A major challenge in the Middle East and Africa fitness equipment market is the high cost of quality equipment, which can limit adoption in low- and middle-income regions. Imported machines from global manufacturers often carry premium pricing due to duties, shipping, and maintenance expenses

- For instance, while markets such as the UAE and Saudi Arabia benefit from premium fitness infrastructure, many African nations face barriers related to affordability, limited gym penetration, and lack of reliable after-sales support

- In addition, the dominance of international brands with minimal local manufacturing presence contributes to limited availability and longer procurement cycles. For budget-conscious consumers or rural communities, access to durable, affordable fitness solutions remains limited

- Overcoming these challenges will require the introduction of cost-effective equipment lines, increased investment in regional distribution channels, and public-private partnerships to support fitness infrastructure development across underserved areas

Middle East and Africa Fitness Equipment Market Scope

The market is segmented on the basis of product type, application, gender, buyer type, usage, type, end user, and distribution channel.

- By Product Type

On the basis of product type, the Middle East and Africa fitness equipment market is segmented into strength training equipment, cardiovascular training equipment, body composition analyzers, fitness monitoring equipment, and others. The cardiovascular training equipment segment dominated the market with the largest market revenue share of 48.4% in 2024, driven by its effectiveness in improving heart health, aiding weight loss, and its universal applicability across all age groups. Treadmills, bikes, and elliptical machines remain preferred choices in both residential and commercial fitness environments.

The fitness monitoring equipment segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for smart fitness solutions that offer real-time performance tracking. The growing popularity of wearable fitness devices and smart gym ecosystems is propelling demand in this segment.

- By Application

On the basis of application, the Middle East and Africa fitness equipment market is segmented into weight loss, body building, physical fitness, mental fitness, and others. The physical fitness segment held the largest market revenue share in 2024, driven by increasing public health awareness, rising participation in daily workouts, and the growing number of fitness centers catering to general well-being.

The mental fitness segment is expected to witness the fastest CAGR from 2025 to 2032, supported by a surge in yoga, meditation, and mind-body workout offerings aimed at stress reduction and mental wellness. Public campaigns promoting holistic health further support the segment’s growth.

- By Gender

On the basis of gender, the Middle East and Africa fitness equipment market is segmented into male and female. The male segment dominated the market with the largest market revenue share in 2024, reflecting the traditionally higher gym participation and interest in strength training among male consumers.

The female segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by growing health consciousness, increasing gym membership among women, and the emergence of women-centric fitness centers and programs.

- By Buyer Type

On the basis of buyer type, the Middle East and Africa fitness equipment market is segmented into individual, institution, and others. The institution segment held the largest market revenue share in 2024, driven by purchases from health clubs, corporates, hotels, and public gyms investing in professional-grade equipment.

The individual segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising adoption of home workouts, increasing influence of fitness apps and social media trends, and greater availability of compact and affordable fitness solutions for personal use.

- By Usage

On the basis of usage, the Middle East and Africa fitness equipment market is segmented into residential and commercial. The commercial segment dominated the market with the largest revenue share in 2024, attributed to the proliferation of gym chains, rehabilitation centers, and hospitality fitness programs across urban hubs.

The residential segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of home gyms, hybrid work lifestyles, and the increased availability of foldable and multifunctional equipment for home use.

- By Type

On the basis of type, the Middle East and Africa fitness equipment market is segmented into outdoor and indoor. The indoor segment held the largest market revenue share in 2024, supported by strong demand from home users and commercial gyms prioritizing controlled environments and structured workouts.

The outdoor segment is projected to witness the fastest CAGR from 2025 to 2032, driven by public investment in outdoor gyms, wellness parks, and urban infrastructure encouraging open-air physical activity.

- By End User

On the basis of end user, the Middle East and Africa fitness equipment market is segmented into health clubs/gyms, home consumers, hotels, corporates, hospitals and medical centers, public institutions, and others. The health clubs/gyms segment dominated the market with the largest revenue share in 2024, driven by expanding fitness franchise models, urban fitness culture, and increased demand for group training sessions.

The corporates and hospital and medical centers segments are expected to grow rapidly through 2032, supported by wellness-focused workplace initiatives and rehabilitation-focused training programs in clinical settings.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa fitness equipment market is segmented into retail stores, specialty and sports shops, department and discount stores, online, and others. The specialty and sports shops segment held the largest market revenue share in 2024, driven by access to brand-specific products, knowledgeable sales staff, and the availability of product trials and consultations.

The online segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing e-commerce adoption, competitive pricing, growing digital fitness influence, and the convenience of home delivery across major urban centers.

Middle East and Africa Fitness Equipment Market Regional Analysis

- The Middle East and Africa fitness equipment market shared a revenue of 3.4% of the global market in 2024. Urbanization, sedentary lifestyles, and increasing obesity and diabetes rates are driving a growing focus on preventative health measures across the region. This awareness is translating into higher demand for fitness equipment for both commercial and home use

- Consumers in the UAE highly prioritize health and wellness, supported by initiatives such as the Dubai Fitness Challenge, which promotes active lifestyles and boosts demand for high-quality fitness equipment

- This strong market presence is further reinforced by high disposable incomes, a growing expatriate population, and ongoing investments in fitness infrastructure across health clubs, hotels, and corporate wellness programs, establishing the UAE as a leading hub for fitness innovation in the region

UAE Fitness Equipment Market Insight

The UAE fitness equipment market captured the largest revenue share of 36.1% in the Middle East and Africa region in 2024, driven by high disposable incomes, an established gym culture, and robust government wellness campaigns such as the Dubai Fitness Challenge. Consumers are increasingly investing in premium, connected equipment for both home and gym use. The expansion of hotel fitness centers, luxury gyms, and corporate wellness programs, combined with a tech-savvy population, continues to position the UAE as the regional hub for fitness innovation and smart wellness solutions.

Saudi Arabia Fitness Equipment Market Insight

The Saudi Arabia fitness equipment market is projected to grow at a strong CAGR during the forecast period, supported by the country’s Vision 2030 strategy aimed at improving public health and promoting physical activity. The opening of women-only gyms, government grants for fitness facilities, and the proliferation of modern gyms in Riyadh, Jeddah, and Dammam are key contributors to this growth. The market also benefits from growing awareness about obesity and chronic diseases, encouraging consumers to adopt cardio and strength-training equipment in both commercial and residential settings.

South Africa Fitness Equipment Market Insight

The South Africa fitness equipment market is expanding steadily, fueled by increased focus on physical fitness, rising incidences of lifestyle-related conditions, and the growth of affordable gym chains across major urban areas. Cities such as Johannesburg and Cape Town are seeing the emergence of mid-tier and budget-friendly fitness centers, increasing accessibility for a broader consumer base. In addition, government-supported health awareness campaigns and the development of outdoor community fitness spaces are stimulating demand for both indoor and outdoor fitness equipment.

Egypt Fitness Equipment Market Insight

The Egypt fitness equipment market is witnessing growing momentum, driven by a rising middle-class population, increased health consciousness, and rapid urbanization. The expanding presence of gyms in cities such as Cairo and Alexandria, along with youth-driven interest in bodybuilding and general fitness, is contributing to higher demand for both cardio and strength-training equipment. In addition, public-private partnerships focused on upgrading sports and wellness infrastructure, including university and corporate gyms, are expected to further accelerate market growth in the coming years.

Middle East and Africa Fitness Equipment Market Share

The Middle East and Africa fitness equipment industry is primarily led by well-established companies, including:

- Technogym S.p.A. (Italy)

- Life Fitness (U.S.)

- Johnson Health Tech Co., Ltd. (Taiwan)

- Precor Incorporated (U.S.)

- Matrix Fitness (Taiwan)

- Cybex International, Inc. (U.S.)

- TRUE Fitness Technology, Inc. (U.S.)

- Nautilus, Inc. (U.S.)

- Star Trac Health & Fitness, Inc. (U.S.)

- Body Solid, Inc. (U.S.)

- Icon Health & Fitness, Inc. (U.S.)

- Panatta S.r.l. (Italy)

- Core Health & Fitness, LLC (U.S.)

- Bodytone International Sport S.L. (Spain)

- SportsArt Fitness, Inc. (Taiwan)

- Shua Fitness Co., Ltd. (China)

- Gym80 International GmbH (Germany)

- Keiser Corporation (U.S.)

- JORDAN Fitness Ltd. (U.K.)

What are the Recent Developments in Middle East and Africa Fitness Equipment Market?

- In April 2024, Technogym, a global leader in fitness and wellness solutions, partnered with the Dubai Sports Council to supply state-of-the-art equipment for newly launched community fitness centers across Dubai. This initiative aims to promote active living and increase public access to quality fitness facilities, reinforcing Technogym’s presence in the region and aligning with UAE’s national health and wellness objectives. The partnership reflects a growing trend toward integrating premium fitness technology into public health infrastructure across the Middle East

- In March 2024, Johnson Health Tech announced the opening of a new regional service center in Riyadh, Saudi Arabia, aimed at improving customer support and strengthening after-sales services for its commercial and home fitness equipment. The move enhances Johnson’s operational efficiency in the GCC region and responds to increasing demand for reliable service solutions from health clubs, hotels, and institutional buyers. This expansion reflects the growing sophistication of the Saudi fitness market

- In February 2024, Impulse Health Tech, a prominent Chinese fitness equipment manufacturer, entered a distribution agreement with South Africa’s Planet Fitness Group to supply advanced strength and cardio machines to new club locations. This collaboration supports Planet Fitness’s aggressive expansion plan across major South African cities and marks Impulse’s strategic effort to deepen its footprint in Sub-Saharan Africa. The development showcases the region’s rising appetite for modern, tech-enabled gym solutions

- In January 2024, Life Fitness collaborated with Egypt’s Ministry of Youth and Sports to modernize gym facilities across national youth centers. The initiative is part of Egypt’s broader plan to encourage physical activity among its young population, especially in underserved regions. By equipping public centers with professional-grade equipment, Life Fitness is reinforcing its commitment to accessible wellness and contributing to the country's public health agenda

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.