Middle East And Africa Gummies And Jellies Market

Market Size in USD Billion

CAGR :

%

USD

9.02 Billion

USD

16.95 Billion

2024

2032

USD

9.02 Billion

USD

16.95 Billion

2024

2032

| 2025 –2032 | |

| USD 9.02 Billion | |

| USD 16.95 Billion | |

|

|

|

|

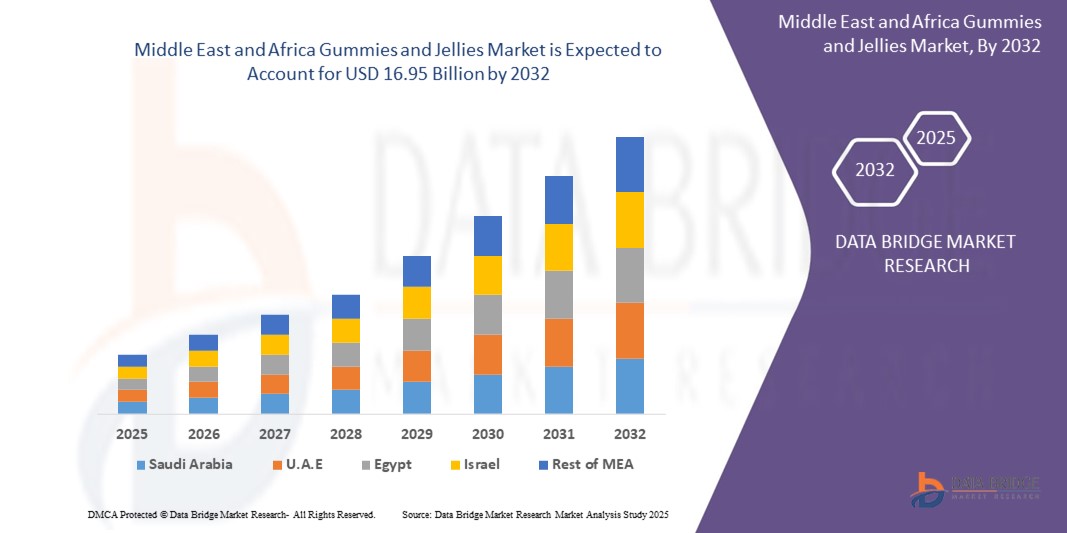

What is the Middle East and Africa Gummies and Jellies Market Size and Growth Rate?

- The Middle East and Africa gummies and jellies market size was valued at USD 9.02 billion in 2024 and is expected to reach USD 16.95 billion by 2032, at a CAGR of 8.20% during the forecast period

- Gummies and jellies are soft, chewy confectionery products made primarily from sugar, gelatin, fruit extracts, and flavoring agents, often enriched with vitamins or functional ingredients

- In this region, changing consumer lifestyles, rising disposable incomes, and increased demand for convenient, sweet snacks have significantly boosted the consumption of gummies and jellies

- Manufacturers are increasingly introducing halal-certified, sugar-free, and vitamin-enriched variants to cater to the diverse dietary preferences and health-conscious population across the Middle East and Africa

What are the Major Takeaways of Gummies and Jellies Market?

- Gummies and jellies are increasingly being used as nutraceutical carriers, offering added health benefits through the inclusion of vitamins, minerals, and herbal extracts

- In the Middle East and Africa, there is growing demand for clean-label and gelatin-free products made with natural ingredients, aligning with religious and cultural considerations

- The market is also witnessing a surge in children-focused gummies in fun shapes and flavors, as well as adult-targeted products for wellness, immunity, and sleep support

- U.A.E. is projected to dominate the Middle East and Africa gummies and jellies market with the largest revenue share of 54.36% in 2024, driven by high consumer spending power, a strong preference for premium confectionery, and the availability of a wide range of imported and locally produced gummy products

- Saudi Arabia gummies and jellies market is expected to grow at the fastest CAGR through 2032, supported by growing consumer interest in healthy snacking, rising disposable incomes, and modernization of retail channels

- The Traditional Gummies segment dominated the market with the largest revenue share of 57.6% in 2024, driven by their wide appeal as indulgent snacks across all age groups. Traditional gummies are available in a variety of flavors and textures, making them a preferred choice in daily snacking

Report Scope and Gummies and Jellies Market Segmentation

|

Attributes |

Gummies and Jellies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gummies and Jellies Market?

“Clean Label and Functional Innovation in Confectionery”

- A significant trend in the Middle East and Africa gummies and jellies market is the rising preference for clean-label, natural, and functional sweet products. Consumers are demanding transparency, with a shift toward non-GMO, artificial color-free, and gelatin-free offerings

- For instance, in 2023, Jelly Belly and Nature’s Truth introduced vitamin-enriched gummies with plant-based gelling agents tailored for health-conscious and vegan consumers in the region

- Functional confectionery is gaining momentum, with products fortified with vitamins, probiotics, and herbal extracts to support immunity, sleep, and energy

- This trend is further supported by increasing health awareness and dietary diversification, leading companies to reformulate recipes and explore innovative gelling agents such as pectin and agar

- Ultimately, the trend toward natural and functional gummies is transforming product development and driving investments in ingredient innovation and transparent branding strategies across the region

What are the Key Drivers of Gummies and Jellies Market?

- Rising demand for nutritionally enriched and low-sugar confectionery is a key growth driver, especially among parents and millennials seeking guilt-free indulgence for themselves and their children

- For instance, in January 2024, Nestlé launched a line of sugar-reduced fruit jellies enriched with vitamin C in the Gulf region, aligning with wellness trends

- Increased urbanization and changing snacking habits are boosting sales of convenient, portable, and portion-controlled gummies and jellies

- Expansion of organized retail and e-commerce platforms is enhancing product accessibility, especially in fast-growing markets such as the U.A.E., Saudi Arabia, and South Africa

- In addition, growing awareness of halal-certified and plant-based alternatives is broadening consumer interest across diverse demographic group

Which Factor is challenging the Growth of the Gummies and Jellies Market?

- A key challenge in the market is the health perception associated with sugary confectionery, particularly among diabetic and weight-conscious consumers

- For instance, concerns over high sugar content have prompted regulatory scrutiny, including sugar taxes in countries such as South Africa, impacting traditional product sales

- Availability and cost of natural gelling agents such as pectin and agar remain inconsistent in some parts of the region, limiting widespread reformulation efforts

- Rising raw material prices, coupled with import dependency for specialized ingredients, are affecting profit margins and product pricing

- Addressing these challenges through innovative sugar substitutes, local ingredient sourcing, and consumer education will be crucial to ensure sustained market growth in the Middle East and Africa

How is the Gummies and Jellies Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Product Type

On the basis of product type, the gummies and jellies market is segmented into Supplement Gummies and Traditional Gummies. The Traditional Gummies segment dominated the market with the largest revenue share of 57.6% in 2024, driven by their wide appeal as indulgent snacks across all age groups. Traditional gummies are available in a variety of flavors and textures, making them a preferred choice in daily snacking.

The Supplement Gummies segment is projected to witness the fastest CAGR during 2025 to 2032, supported by growing consumer demand for functional confectionery products enriched with vitamins, minerals, and herbal ingredients.

• By Type

On the basis of type, The Low Sugar Gummies segment accounted for the largest market share of 35.4% in 2024, as consumers become increasingly conscious of their sugar intake. These products balance taste with healthier profiles, making them suitable for adults and children asuch as.

The Sugar-Free Gummies segment is expected to grow at the fastest CAGR, driven by rising diabetic populations and dietary trends promoting low-carb and ketogenic lifestyles.

• By Jelly Ingredient

On the basis of jelly ingredient, the market is segmented into High Methoxyl Pectin (HMP) and Low Methoxyl Pectin (LMP). The High Methoxyl Pectin segment led the market with a revenue share of 61.2% in 2024, due to its wide usage in acidic and high-sugar environments such as fruit-based jellies and confections.

Meanwhile, the Low Methoxyl Pectin segment is gaining traction for its application in reduced-sugar and sugar-free formulations, and is projected to grow significantly through 2032.

• By Target Consumer

On the basis of target consumer, the market is segmented into Adults and Kids. The Adults segment dominated with a revenue share of 54.8% in 2024, driven by increasing adoption of supplement gummies for immunity, stress relief, and general wellness.

The Kids segment is expected to grow at a rapid pace, supported by the popularity of fruit-flavored and vitamin-enriched gummy supplements that are easy for children to consume.

• By Category

On the basis of category, the market is divided into GMO and Non-GMO. The Non-GMO segment held the largest market share of 59.5% in 2024, as clean-label preferences and natural ingredient demand continue to influence purchasing decisions.

Growing regulatory awareness and consumer trust in natural products are expected to further drive this segment throughout the forecast period.

• By Flavours

On the basis of Flavours, The market is segmented into a broad range of flavors including Strawberry, Orange, Lemon, Cherry, Grapes, Mango, Pomegranate, Apple, Peach, Honey & Ginger, Chocolate, Matcha, Coffee, Coconut, Watermelon, Pineapple, Raspberry, Lime, Combination, and Others. The Strawberry flavor segment led the market with a dominant revenue share of 12.3% in 2024, owing to its widespread acceptance among both children and adults.

Flavors such as Honey & Ginger and Matcha are gaining popularity for their perceived health benefits and are projected to register fast growth during the forecast period.

• By Ingredient

On the basis of ingredient, the market is segmented into Gelatin, Pectin, Starch, Sugar, Glucose Syrup, Citric Acid, and Others. The Gelatin segment held the highest market share of 41.8% in 2024, due to its excellent gelling properties and wide usage in traditional gummy production.

However, Pectin is anticipated to grow at the fastest rate due to increasing demand for plant-based and vegan-friendly alternatives.

• By Packaging Type

On the basis of Packaging types the market is segmented into Bottles and Jars, Stand Up Pouches, Sachet Packs, Club Store Trays, and Others. The Bottles and Jars segment dominated with the largest share of 38.6% in 2024, thanks to their convenience, resealability, and popularity in vitamin gummies.

Stand Up Pouches are emerging as the fastest-growing segment due to their lightweight, flexible design and visual appeal on retail shelves.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Store-Based Retailing and Non-Store Retailing. Store-Based Retailing held the dominant share of 66.9% in 2024, with supermarkets, hypermarkets, and pharmacies being the key points of sale.

The Non-Store Retailing segment, which includes e-commerce and direct-to-consumer platforms, is projected to grow rapidly, driven by digital convenience and rising online supplement purchases.

Which Region Holds the Largest Share of the Gummies and Jellies Market?

- U.A.E. is projected to dominate the Middle East and Africa gummies and jellies market with the largest revenue share of 54.36% in 2024, driven by high consumer spending power, a strong preference for premium confectionery, and the availability of a wide range of imported and locally produced gummy products

- The country’s advanced retail infrastructure, health-conscious population, and demand for clean-label and low-sugar options have spurred the popularity of both traditional and supplement gummies

- In addition, the booming tourism and hospitality sector continues to support the demand for impulse-buy items such as gummies and jellies in airports, hotels, and convenience stores

Saudi Arabia Gummies and Jellies Market Insight

The Saudi Arabia gummies and jellies market is expected to grow at the fastest CAGR through 2032, supported by growing consumer interest in healthy snacking, rising disposable incomes, and modernization of retail channels. As part of Vision 2030, initiatives aimed at promoting healthier diets are boosting the demand for low-sugar and functional gummies. Local food manufacturers are increasingly innovating with natural ingredients and fortified products to appeal to the country’s young and urban population.

South Africa Gummies and Jellies Market Insight

The South Africa gummies and jellies market is projected to expand at a notable pace, fueled by a growing middle class, increasing awareness of sugar intake, and demand for plant-based and vegan-friendly options. The rise of specialty stores and e-commerce platforms has improved access to a variety of global gummy brands. Health-driven innovations, including supplement gummies with vitamins and minerals, are resonating well with consumers, especially in urban centers such as Johannesburg and Cape Town.

Which are the Top Companies in Gummies and Jellies Market?

The gummies and jellies industry is primarily led by well-established companies, including:

- Shenzhen Rungu Food Co., Ltd. (China)

- Dori Alimentos S.A. (Brazil)

- Guandy (El Salvador)

- Hatops Food (China) Co., Ltd. (China)

- North West Sweets Ltd (U.K.)

- Nutris (Mexico)

- TOROS (Turkey)

- Perfetti Van Melle (Netherlands)

- Just Born, Inc. (U.S.)

- Pharmavite LLC (U.S.)

- JELLY BELLY CANDY COMPANY (U.S.)

- Franssons Konfektyrer AB (Sweden)

- Cloetta AB (Sweden)

- Candy People (Sweden)

- SIRIO PHARMA CO., LTD. (China)

What are the Recent Developments in Middle East and Africa Gummies and Jellies Market?

- In September 2024, The Hershey Company launched its newest oversized gummy product line, Shaq-A-Licious XL Gummies, featuring Shaq-A-Licious Original and Shaq-A-Licious Sour in three playful shapes and flavors. This launch highlights Hershey’s strategic move into novelty and celebrity-branded gummies to attract a younger audience

- In August 2024, HARIBO unveiled its first-ever football-themed gummy offering, the HARIBO Football Mix, which includes six unique gummy shapes and fruity flavors such as strawberry, raspberry, pineapple, lemon, apple, and orange in a dual-layered texture. This limited-edition mix is a targeted play toward sports fans and seasonal demand spikes

- In October 2023, Ferrara reached an agreement to acquire Jelly Belly, aiming to combine Jelly Belly’s wide range of gourmet jelly beans with Ferrara’s broad sugar candy portfolio. This acquisition strengthens Ferrara’s position in the premium confections segment and expands its product diversity

- In May 2022, Jelly Drops entered the U.S. market with its hydrating candy innovation, made of 95% water, added electrolytes, and no sugar. This product is particularly gaining traction among elderly consumers, especially those with Alzheimer’s, addressing hydration challenges in a flavorful format

- In February 2022, Amway Corp. India introduced nutrition supplements in candy and jelly strip forms under the Nutrilite brand, focusing on convenience and taste. This initiative reflects the company’s push to appeal to modern consumers seeking easy-to-consume health products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.