Middle East And Africa Medical Devices Market

Market Size in USD Million

CAGR :

%

USD

392.99 Million

USD

525.54 Million

2025

2033

USD

392.99 Million

USD

525.54 Million

2025

2033

| 2026 –2033 | |

| USD 392.99 Million | |

| USD 525.54 Million | |

|

|

|

|

East and Africa Medical Devices Market Size

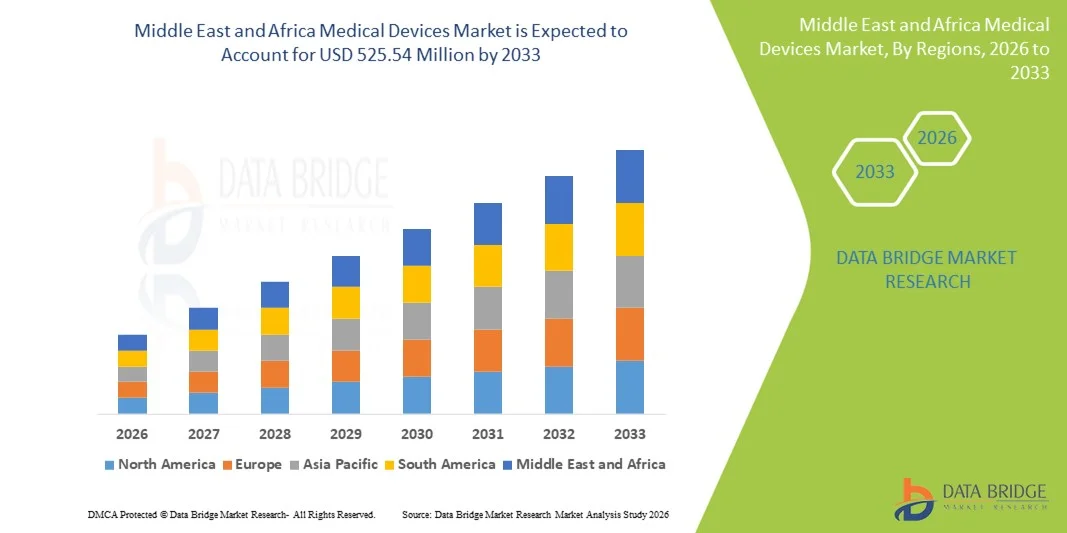

- The Middle East and Africa medical devices market size was valued at USD 392.99 million in 2025 and is expected to reach USD 525.54 million by 2033, at a CAGR of 3.7% during the forecast period

- The market growth is largely fueled by increasing healthcare expenditure, expansion of hospitals and clinics, technological advancements in diagnostic and therapeutic devices, and rising adoption of modern medical equipment to improve treatment outcomes across both developed and emerging healthcare systems in the region

- Furthermore, supportive government initiatives, growing prevalence of chronic diseases, and heightened demand for advanced, efficient, and patient‑centric medical technologies are driving the uptake of medical devices as essential healthcare infrastructure components. These converging factors are accelerating regional adoption rates and significantly boosting the industry’s long‑term growth prospects

Middle East and Africa Medical Devices Market Analysis

- Medical devices, including ventilators, spirometers, oxygen concentrators, anaesthesia machines, and CPAP/BIPAP devices, are increasingly vital components of healthcare infrastructure across the Middle East and Africa due to their role in improving patient outcomes, enhancing operational efficiency, and enabling advanced treatment options in both public and private healthcare settings

- The escalating demand for medical devices is primarily fueled by rising healthcare expenditure, growing prevalence of chronic and respiratory diseases, technological advancements in medical equipment, and increasing adoption of modern healthcare solutions in hospitals and clinics

- Saudi Arabia dominated the MEA medical devices market with the largest revenue share of 22.5% in 2025, characterized by high healthcare investment, advanced medical infrastructure, and strong government initiatives promoting digital healthcare and medical innovation

- Nigeria is expected to be the fastest-growing market in during the forecast period due to expanding healthcare access, increasing hospital and clinic networks, and rising awareness and adoption of advanced medical devices

- Ventilators segment dominated the MEA medical devices market with a market share of 28.8% in 2025, driven by increasing demand in hospitals and homecare settings, rising prevalence of respiratory diseases, and the need for critical care solutions across both public and private healthcare facilities

Report Scope and Middle East and Africa Medical Devices Market Segmentation

|

Attributes |

Middle East and Africa Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Medical Devices Market Trends

Expansion of Homecare and Remote Monitoring Solutions

- A significant and accelerating trend in the MEA medical devices market is the growing adoption of homecare medical devices such as portable ventilators, oxygen concentrators, and CPAP/BIPAP systems, enabling patients to receive critical care outside hospitals

- For instance, portable oxygen concentrators from Invacare and Philips Respironics allow patients with chronic respiratory conditions to manage therapy at home with mobility and ease, reducing dependency on hospital visits

- Remote monitoring features integrated into medical devices are enabling real-time tracking of patient health data, alerts for abnormal readings, and telemedicine connectivity, improving care quality and patient outcomes

- The integration of medical devices with mobile apps and cloud platforms facilitates seamless monitoring by healthcare providers, allowing timely interventions and treatment adjustments through a centralized interface

- This trend towards patient-centric, connected healthcare solutions is fundamentally reshaping expectations for medical service delivery, prompting companies such as ResMed to develop advanced homecare respiratory devices with smart monitoring and remote access capabilities

- The demand for homecare-enabled and digitally connected medical devices is growing rapidly across both urban and rural areas, as patients and caregivers increasingly prioritize convenience, continuous monitoring, and reduced hospital dependency

- Integration with AI-driven analytics for predictive healthcare is emerging, allowing devices to forecast patient health events and optimize treatment schedules automatically

- Partnerships between device manufacturers and telemedicine providers are increasing, creating end-to-end remote care solutions that combine diagnostics, monitoring, and therapeutic interventions

Middle East and Africa Medical Devices Market Dynamics

Driver

Rising Healthcare Expenditure and Chronic Disease Prevalence

- The increasing investment in healthcare infrastructure, combined with a rising prevalence of chronic respiratory, cardiac, and lifestyle-related diseases, is a significant driver for the heightened demand for medical devices

- For instance, in March 2025, Saudi Arabia announced expansion of its national homecare and telemedicine program, aiming to provide modern respiratory and monitoring devices to patients across urban and remote areas

- As patients and healthcare providers seek advanced solutions for improved diagnosis, treatment, and continuous care, devices such as ventilators, spirometers, and anaesthesia machines are gaining traction in hospitals, clinics, and homecare settings

- Furthermore, the increasing adoption of digital healthcare systems and connected medical devices is making advanced monitoring and therapeutic solutions integral to modern healthcare workflows

- Government initiatives, rising health awareness, and the desire for better treatment outcomes are key factors propelling medical device adoption, while the availability of user-friendly portable and table-top devices further contributes to market growth

- Increasing medical tourism in Gulf countries is driving demand for high-quality diagnostic and therapeutic devices in private hospitals and specialty clinics

- Expansion of insurance coverage for homecare and chronic disease management is encouraging wider adoption of portable and remote monitoring medical devices

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high initial cost of advanced medical devices and the complex regulatory environment pose significant challenges to broader market penetration in MEA

- For instance, devices such as AI-enabled ventilators and advanced CPAP/BIPAP systems often require significant capital investment, making them less accessible for smaller hospitals or budget-conscious healthcare providers

- Compliance with stringent medical device regulations and approvals in multiple countries adds to delays in product launch and increases operational costs for manufacturers

- While portable and affordable alternatives are emerging, premium devices with integrated monitoring, analytics, and telehealth features still carry higher price tags, limiting adoption among certain segments

- Overcoming these challenges through cost-effective device design, simplified regulatory pathways, and financing programs for hospitals and homecare providers will be crucial for sustained growth in the MEA medical devices market

- Limited technical expertise and training for healthcare personnel in using advanced medical devices can slow adoption in smaller clinics and rural areas

- Supply chain disruptions and dependency on imports for high-tech devices can cause delays and increase costs, particularly in countries with underdeveloped local manufacturing infrastructure

Middle East and Africa Medical Devices Market Scope

The market is segmented on the basis of product, mode, application, facility, end user, and distribution

- By Product

On the basis of product, the MEA medical devices market is segmented into ventilators, spirometers, oxygen concentrators, anaesthesia machines, and CPAP/BIPAP devices. The ventilator segment dominated the market with the largest market revenue share of 28.8% in 2025, driven by the increasing prevalence of respiratory diseases, critical care needs in hospitals, and the rising demand for homecare solutions. Ventilators are crucial for both ICU and homecare applications, providing life-saving respiratory support. The segment’s growth is supported by government initiatives in GCC countries to expand critical care infrastructure and by technological advancements such as portable and AI-enabled ventilators. Hospitals prioritize ventilators for their reliability, scalability, and integration with monitoring systems. Furthermore, increasing awareness among patients and caregivers regarding chronic respiratory care is boosting demand in homecare settings.

The CPAP/BIPAP segment is anticipated to witness the fastest growth rate of 9.8% from 2026 to 2033, fueled by rising awareness of sleep apnea and other respiratory conditions in both urban and rural areas. These devices are increasingly adopted in homecare settings due to their portability and ease of use. Growing telemedicine adoption enables remote monitoring of CPAP/BIPAP usage, encouraging higher adoption rates. The segment also benefits from rising health awareness campaigns and support from insurance schemes that cover homecare respiratory therapies. Continuous technological innovation in design, noise reduction, and patient comfort is further driving market growth.

- By Mode

On the basis of mode, the market is segmented into portable, table-top, and standalone devices. The portable mode dominated the market with a market share of 31.2% in 2025, due to the rising adoption of homecare medical devices and the increasing need for patient mobility. Portable devices such as ventilators, oxygen concentrators, and CPAP machines allow patients to manage chronic conditions at home or during travel. Hospitals and rehabilitation centers also use portable devices for patient transfer and emergency care. The convenience, compact design, and ease of use of portable devices make them highly attractive in both developed and emerging MEA markets. Manufacturers are increasingly focusing on lightweight and battery-powered options to improve accessibility. Furthermore, portable devices integrate with remote monitoring systems, allowing healthcare providers to track patient health in real-time.

The table-top mode is expected to witness the fastest CAGR of 8.5% from 2026 to 2033, driven by its widespread use in hospitals, specialty clinics, and diagnostic centers. Table-top devices offer higher accuracy, durability, and functionality compared to portable devices, making them ideal for diagnostic and therapeutic applications. Rising investments in hospital infrastructure, particularly in UAE and Saudi Arabia, are driving demand for these reliable, high-performance devices. Table-top devices also serve as central units for multiple patients in critical care or homecare hubs, enhancing operational efficiency. Continuous product innovation and integration with hospital IT systems are further supporting the growth of this mode.

- By Application

On the basis of application, the market is segmented into diagnostic and therapeutic devices. The therapeutic application segment dominated the market with a revenue share of 55% in 2025, driven by the growing demand for respiratory support, critical care devices, and homecare therapies. Therapeutic devices such as ventilators, CPAP/BIPAP machines, and oxygen concentrators are essential for treating chronic and acute conditions. Hospitals, rehabilitation centers, and long-term care facilities are major end users of these devices. Increased prevalence of respiratory, cardiac, and sleep disorders is boosting demand in both urban and rural areas. Therapeutic devices are also benefiting from advancements in AI-enabled monitoring and portable designs, making them more effective and accessible. Governments in the Gulf region are investing in expanding critical care and homecare infrastructure, further supporting this segment.

The diagnostic application segment is expected to witness the fastest growth rate of 10.2% from 2026 to 2033, fueled by rising investments in early disease detection and preventive healthcare. Diagnostic devices such as spirometers and monitoring systems are increasingly adopted in hospitals, clinics, and homecare settings to detect respiratory and chronic conditions at early stages. Growing awareness of preventive care and increasing diagnostic capabilities in private hospitals are key growth drivers. Integration with telemedicine and digital health platforms allows remote data collection and physician monitoring, enhancing the appeal of diagnostic devices. Continuous technological innovation and government initiatives promoting preventive healthcare further accelerate adoption.

- By Facility

On the basis of facility, the market is segmented into large, medium, and small healthcare facilities. The large facility segment dominated the market with a revenue share of 45% in 2025, due to high adoption of advanced medical devices in large hospitals, specialty clinics, and rehabilitation centers. These facilities have better budgets and infrastructure to incorporate critical care, diagnostic, and therapeutic equipment. They also prioritize device integration with hospital IT and monitoring systems to improve operational efficiency. Large facilities in Saudi Arabia and UAE are increasingly investing in ICU expansion, telemedicine-enabled wards, and homecare device programs. The scale of operations and patient load in large hospitals also drives demand for multi-functional devices. Furthermore, these facilities often adopt devices that comply with international standards, further boosting high-end device adoption.

The small facility segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by rising investments in local clinics, ambulatory surgical centers, and homecare hubs. Small facilities are adopting portable and table-top devices due to cost-efficiency, ease of use, and flexibility. Growing healthcare access in rural areas and smaller cities across Africa is boosting demand for these facilities. Affordable, easy-to-maintain devices that support telemedicine and remote monitoring are highly preferred. Manufacturers are introducing compact, multi-purpose devices suitable for small clinics, further accelerating market growth.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, long-term care centers, rehabilitation centers, and homecare settings. The hospital segment dominated the market with a share of 50% in 2025, driven by high patient volume and the need for critical care, diagnostic, and therapeutic devices. Hospitals in GCC countries are expanding ICU capacity and investing in advanced respiratory and anaesthesia devices. Integration with digital healthcare systems, telemedicine, and hospital IT infrastructure further boosts demand. Hospitals also focus on multi-functional devices that serve diverse applications and patient types. Government healthcare programs and medical tourism initiatives increase adoption in high-end hospitals. The continuous upgrade of medical infrastructure ensures sustained demand.

The homecare settings segment is expected to witness the fastest growth rate of 12% from 2026 to 2033, fueled by rising prevalence of chronic respiratory and cardiac conditions, increased patient awareness, and adoption of portable devices. Homecare solutions such as CPAP/BIPAP devices, portable ventilators, and oxygen concentrators enable patients to manage therapy at home with mobility and ease. Telehealth platforms and remote monitoring enhance adoption, allowing healthcare providers to track patient progress. Insurance coverage for homecare devices is expanding, and government programs supporting chronic disease management further accelerate growth. The convenience, patient comfort, and cost-effectiveness of homecare settings make it an attractive growth segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and third-party distributors. The direct sales segment dominated the market with a share of 60% in 2025, driven by strong relationships between manufacturers and large hospitals, specialty clinics, and homecare service providers. Direct sales allow customized solutions, technical support, and device training for healthcare staff. Companies in GCC countries and South Africa leverage direct sales to penetrate high-end hospitals and large healthcare facilities. Direct sales also ensure quicker adoption of new technologies and provide opportunities for after-sales service contracts. Manufacturers prefer this channel for high-value devices such as ventilators, anaesthesia machines, and CPAP/BIPAP devices. The direct relationship also helps in regulatory compliance and faster installation.

The third-party distributor segment is expected to witness the fastest CAGR of 11% from 2026 to 2033, fueled by rising adoption of devices in smaller clinics, homecare settings, and rural regions. Distributors provide wider reach, cost-effective solutions, and supply chain support, making devices accessible in remote or underserved areas. Third-party distribution enables manufacturers to focus on product development while leveraging distributor networks for sales and service. Growth in Africa and emerging MEA markets is driven by distributor-led penetration strategies. Increasing demand for portable and table-top devices in small facilities also supports this segment’s rapid growth.

Middle East and Africa Medical Devices Market Regional Analysis

- Saudi Arabia dominated the MEA medical devices market with the largest revenue share of 22.5% in 2025, characterized by high healthcare investment, advanced medical infrastructure, and strong government initiatives promoting digital healthcare and medical innovation

- Healthcare providers and patients in the region increasingly value high-quality diagnostic and therapeutic devices, advanced homecare solutions, and integration with telemedicine platforms, which enhance patient outcomes and operational efficiency across hospitals, rehabilitation centers, and homecare settings

- This widespread adoption is further supported by growing healthcare expenditure, a tech-savvy population in urban centers, rising prevalence of chronic and respiratory diseases, and increasing medical tourism in the Gulf countries, establishing medical devices as essential solutions for modern healthcare delivery in both public and private facilities

The Saudi Arabia Medical Devices Market Insight

The Saudi Arabia medical devices market captured the largest revenue share of 22.5% in 2025, fueled by substantial government investments in healthcare infrastructure, hospital expansions, and homecare programs. Healthcare providers are increasingly prioritizing advanced diagnostic and therapeutic devices to improve patient outcomes and operational efficiency. The growing adoption of telemedicine, portable ventilators, and oxygen concentrators is driving demand. Moreover, initiatives to promote medical tourism and specialized healthcare services are further accelerating market growth, while technological advancements in AI-enabled monitoring systems and critical care devices strengthen the country’s leadership in MEA.

UAE Medical Devices Market Insight

The UAE medical devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high healthcare expenditure, growing private hospital networks, and increasing adoption of smart homecare solutions. Urbanization, coupled with rising chronic and lifestyle-related diseases, is fostering the use of advanced medical devices. Consumers and healthcare providers value convenience, quality, and reliability, particularly in portable ventilators, CPAP/BIPAP devices, and monitoring systems. Government initiatives supporting digital healthcare, telemedicine, and medical tourism are further stimulating adoption in both residential and commercial healthcare settings.

Nigeria Medical Devices Market Insight

The Nigeria medical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding healthcare access, increasing hospital and clinic networks, and rising prevalence of respiratory and chronic diseases. Portable and table-top devices are increasingly adopted in urban and semi-urban areas for diagnostic and therapeutic applications. Moreover, awareness campaigns on preventive and homecare solutions are encouraging patients to invest in monitoring and respiratory devices. Nigeria’s improving healthcare infrastructure, coupled with donor-funded programs and partnerships with international manufacturers, is expected to continue supporting market growth.

South Africa Medical Devices Market Insight

The South Africa medical devices market is expected to expand at a considerable CAGR during the forecast period, fueled by well-established private healthcare systems, growing investment in hospitals and specialty clinics, and increasing demand for advanced medical equipment. Hospitals and rehabilitation centers are adopting high-end diagnostic and therapeutic devices, while homecare adoption is rising for chronic disease management. Integration with telemedicine platforms and electronic health record systems is becoming prevalent, promoting operational efficiency and patient monitoring. In addition, increasing awareness of respiratory, cardiac, and sleep disorders is driving the uptake of devices such as ventilators, CPAP/BIPAP machines, and oxygen concentrators.

Middle East and Africa Medical Devices Market Share

The Middle East and Africa Medical Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Abbott (U.S.)

- Stryker (U.S.)

- B. Braun SE (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Getinge AB (Sweden)

- Drägerwerk AG & Co. KGaA (Germany)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Zimmer Biomet. (U.S.)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- PureHealth (UAE)

- East African Medical Vitals Limited (Uganda)

- Cordis (U.S.)

- Al Faisaliah Medical Systems (Saudi Arabia)

What are the Recent Developments in Middle East and Africa Medical Devices Market?

- In March 2025, Medtronic announced a strategic partnership with Methinks AI to integrate AI‑driven radiological triage for stroke care across the Middle East, Africa, Türkiye, and Central/Eastern Europe, aiming to enhance early stroke assessment and treatment pathways in hospitals

- In January 2025, Royal Philips unveiled AI‑driven innovations in diagnostics, patient monitoring, and treatment at Arab Health 2025, including partnerships and advanced tele‑ultrasound solutions to extend healthcare access and improve clinical decision support across MEA

- In October 2024, Philips introduced cutting‑edge health tech innovations at Global Health Exhibition 2024 in Riyadh, including advanced eICU connectivity, AI‑enhanced imaging and ultrasound systems, and next‑generation clinical solutions aligned with Saudi Arabia’s Vision 2030 healthcare transformation goals

- In February 2024, Philips and Malaffi (Abu Dhabi Health Data Services) expanded their partnership at Arab Health 2024 to set global standards for seamless medical image exchange using Philips’ Image Exchange Solution, significantly improving radiology interoperability and data sharing across healthcare facilities in the UAE

- In January 2023, United Imaging announced multiple partnerships and the deployment of cutting-edge medical imaging systems in the Middle East and Africa at Arab Health 2023, including high-resolution PET/MR scanners, advanced CT and MRI systems, and mobile DR units, while signing strategic agreements to install these technologies in hospitals and research facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.