Middle East And Africa Thermoplastic Polyurethane Tpu Market

Market Size in USD Million

CAGR :

%

USD

176.57 Million

USD

276.17 Million

2021

2029

USD

176.57 Million

USD

276.17 Million

2021

2029

| 2022 –2029 | |

| USD 176.57 Million | |

| USD 276.17 Million | |

|

|

|

Market Analysis and Size

The thermoplastic polyurethane market trends for the current forecast period show a progressive shift in attention toward creating bio-based goods, which offers the market tremendous features in terms of growth, expansion, and revenue expansion. In addition, the degree of research and development activity has increased; therefore, market is estimated to have lucrative growth over he forecasted period.

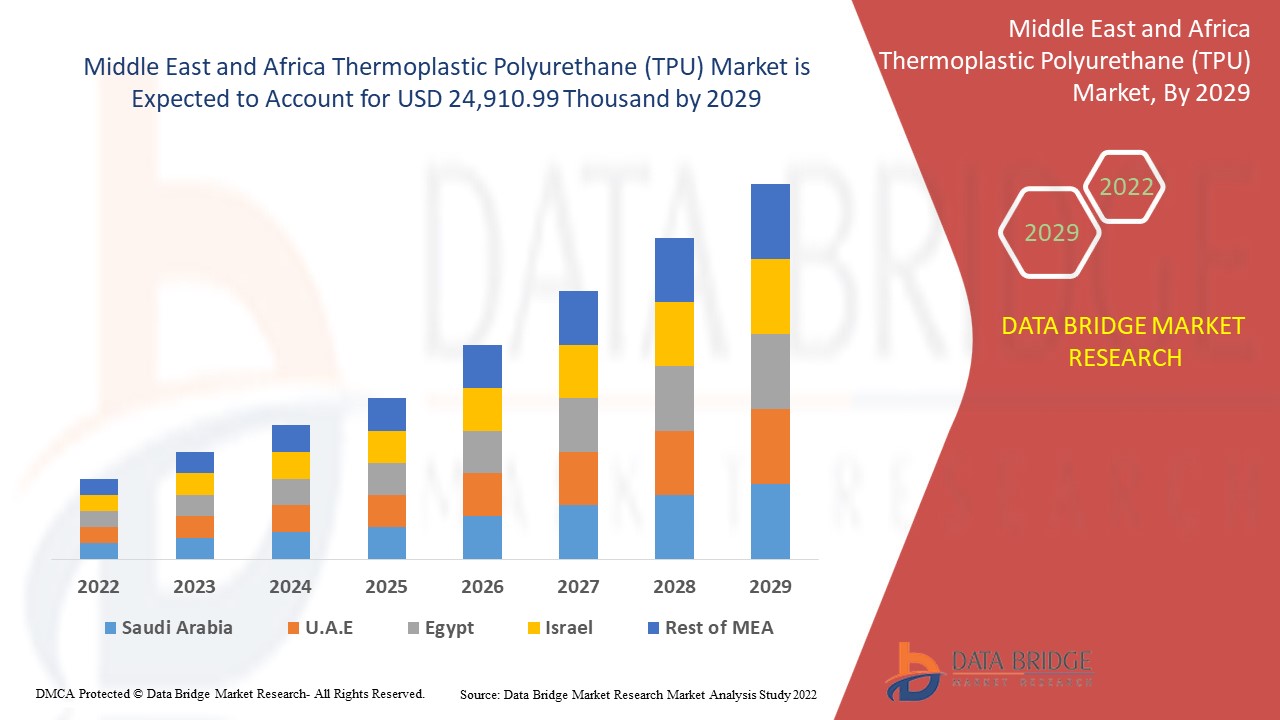

Middle East and Africa Thermoplastic Polyurethane (TPU) Market was valued at USD 176.57 million in 2021 and is expected to reach USD 276.17 million by 2029, registering a CAGR of 5.75% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Raw Material (Diisocyanate, Polyols, Diols, Others), Type (Polyester, Polyether, Polycaprolactone), Application (Extruded Products, Injection Molded Products, Adhesives, Other Applications), End-User (Footwear, Industrial Machinery, Automotive, Electronics, Medical, Consumer Goods, Sports and Leisure, Building and Construction, Textile, Heavy Engineering, Others) |

|

Countries Covered |

Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

BASF SE (Germany), The Lubrizol Corporation (U.S.), Covestro AG (Germany), HEXPOL AB (Japan), Huntsman Internaional LLC (U.S.), Wanhua (China), Sanyo Corporation of America ( U.S.), COIM Group (Italy), Mitsui Chemicals, Inc., (Japan), Tosoh India Pvt. Ltd. (Japan), American Polyfilm Inc., (U.S.), Kuraray Co., Ltd (Japan), HEXPOL AB (Sweden), AVERY DENNISON CORPORATION (U.S.), APi GROUP (U.S.), Kolon Industries (South Korea) and Avient (U.S.) |

|

Market Opportunities |

|

Market Definition

Thermoplastic polyurethane (TPU) is a special kind of material that bridges the gap between rubber and plastic. A polyaddition reaction creates a translucent, melt-processable, and extremely elastic thermoplastic elastomer. The characteristics of this material are transparency, high elasticity, resistance to high-energy radiation, abrasion, solvents, oil, and grease, string mechanical qualities, and can be as soft as rubber or as unyielding as rigid plastics. It is also environmentally friendly, biodegradable, and 100% recyclable as compared to polyvinyl chloride (PVC). It's largely utilized in specialty molded components, footwear, adhesives, hose, tubes, film, sheets, and wire and cable jacketing and other applications.

Thermoplastic Polyurethane (TPU) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increased Demand for Various Applications

The increasing textile demand, increasing usage of the product in automotive applications, rising presence of medium- and large-scale aerospace and component manufacturers, and emerging applications such as animal identification tags are the major factors driving market growth. Additionally, its extensive usage across construction, automotive, aerospace and medical industry for numerous applications and the growing replacement of traditional materials by thermoplastic polyurethane is estimated to carve a way for the market's growth.

The rising agriculture production in various economies will further propel the growth rate of thermoplastic polyurethane (TPU) market. Additionally, the product's durability, high strength, exceptional fungal and abrasion resistance will also drive market value growth.

Opportunities

- Emerging Market, Research and Developments

Furthermore, the growing replacement of polyvinyl chloride (PVC) in medical application by thermoplastic polyurethane (TPU) and rising emerging market for bio-based thermoplastic polyurethane extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the increase in the degree of research and development activities coupled with the development of market products through their manufacturing units will further expand the future growth of the thermoplastic polyurethane (TPU) market.

Restraints/Challenges

- High Costs

The higher cost of thermoplastic polyurethane, when compared to other conventional materials, is estimated to create hindrances for the growth of the thermoplastic polyurethane (TPU) market.

- Volatility in Raw Material Prices

Moreover, the fluctuations in the prices of raw materials will prove to be a demerit for the thermoplastic polyurethane (TPU) market. Therefore, this will challenge the thermoplastic polyurethane (TPU) market growth rate.

This thermoplastic polyurethane (TPU) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the thermoplastic polyurethane (TPU) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Thermoplastic Polyurethane (TPU) Market

The recent outbreak of coronavirus had a negative impact on the thermoplastic polyurethane (TPU) market. The pandemic's atrocities have largely affected the market as they have evolved and emerged. As global governments focus on implementing measures that will help and play a positive role in curbing the obnoxious spread of the novel coronavirus, market players have been facing a variety of market issues. However, these measures will have negative effects on demand and supply chain mechanisms, resulting in market losses, as predicted by trends. Furthermore, the market's ability to grow and expand is being hampered by the rising changes and preferences of the global target audience that is exposed to market operations. Over the forecast period, the aforementioned determinants will weigh the market's revenue trajectory over the forecast period.

On the brighter side, the governments throughout the world are lifting constraints that will aid in sustaining demand and supply and allow production units to operate in accordance with thermoplastic polyurethane market trends. Furthermore, rising market investments are anticipated to assist market firms in focusing on research and development departments, improving market portfolios and presenting target audiences with novel and imaginative options to pick from, which will aid the market to revive.

Middle East and Africa Thermoplastic Polyurethane (TPU) Market Scope

The thermoplastic polyurethane (TPU) market is segmented on the basis of raw material, type, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw Material

- Diisocyanate

- Polyols

- Diols

- Others

Type

- Polyester

- Polyether

- Polycaprolactone

Application

- Extruded Products

- Injection Molded Products

- Adhesives

- Other Applications

End-User

- Footwear

- Industrial Machinery

- Automotive

- Electronics

- Medical

- Consumer Goods

- Sports and Leisure

- Building and Construction

- Textile

- Heavy Engineering

- Others

Thermoplastic Polyurethane (TPU) Market Regional Analysis/Insights

The thermoplastic polyurethane (TPU) market is analyzed and market size insights and trends are provided by country, raw material, type, application and end-user as referenced above.

The countries covered in the thermoplastic polyurethane (TPU) market report are Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Thermoplastic Polyurethane (TPU) Market Share Analysis

The thermoplastic polyurethane (TPU) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to thermoplastic polyurethane (TPU) market.

Some of the major players operating in the thermoplastic polyurethane (TPU) market are

- BASF SE (Germany)

- The Lubrizol Corporation (U.S.)

- Covestro AG (Germany)

- HEXPOL AB (Japan)

- Huntsman Internaional LLC (U.S.)

- Wanhua (China)

- Sanyo Corporation of America (U.S.)

- COIM Group (Italy)

- Mitsui Chemicals, Inc., (Japan)

- Tosoh India Pvt. Ltd. (Japan)

- American Polyfilm Inc., (U.S.)

- Kuraray Co., Ltd (Japan)

- HEXPOL AB (Sweden)

- AVERY DENNISON CORPORATION (U.S.)

- API GROUP (U.S.)

- Kolon Industries (South Korea)

- Avient (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING CONSUMPTION OF TPU IN AUTOMOTIVE

5.1.2 SHIFT TOWARDS TPU FROM CONVENTIONAL MATERIALS

5.1.3 INCREASED INFRASTRUCTURE SPENDING IN ASIA-PACIFIC

5.1.4 SHIFT FROM PVC IN MEDICAL INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGHER COST OF TPU

5.2.2 HYDROSCOPIC NATURE OF THERMOPLASTIC POLYURETHANE

5.3 OPPORTUNITIES

5.3.1 EMERGING MARKET FOR BIO-BASED TPU

5.3.2 SHIFT FROM CONVENTIONAL MANUFACTURING PROCESSES TO 3D PRINTING

5.3.3 INCREASING APPLICATIONS OF MELT-PROCESS ABLE POLYURETHANES IN MANUFACTURING CATHETERS

5.4 CHALLENGE

5.4.1 LACK OF COST-EFFECTIVENESS WITH RESPECT TO EMERGING CHEAPER SOLUTIONS

6 COVID-19 IMPACT ON THERMOPLASTIC POLYURETHANE (TPU) IN CHEMICAL AND MATERIALS INDUSTRY

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 DIISOCYANATE

7.3 POLYOLS

7.4 DIOLS

7.5 OTHERS

8 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYESTER

8.3 POLYETHER

8.4 POLYCAPROLACTONE

9 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER

9.1 OVERVIEW

9.2 FOOTWEAR

9.2.1 POLYESTER

9.2.2 POLYETHER

9.2.3 POLYCAPROLACTONE

9.2.4 SOLE

9.2.5 SLIPPER

9.2.6 SHOE

9.2.7 OTHERS

9.3 INDUSTRIAL MACHINERY

9.3.1 POLYESTER

9.3.2 POLYETHER

9.3.3 POLYCAPROLACTONE

9.3.4 HOSES AND TUBING

9.3.5 SEALS AND GASKETS

9.3.6 BELTS AND PROFILES

9.3.7 WHEELS AND ROLLERS

9.3.8 OTHERS

9.4 AUTOMOTIVE

9.4.1 POLYESTER

9.4.2 POLYETHER

9.4.3 POLYCAPROLACTONE

9.4.4 INTERIOR PARTS

9.4.5 EXTERIOR PARTS

9.5 ELECTRONICS

9.5.1 POLYESTER

9.5.2 POLYETHER

9.5.3 POLYCAPROLACTONE

9.5.4 WIRES AND CABLES

9.5.5 ELECTRONIC DEVICES

9.5.6 OTHERS

9.6 MEDICAL

9.6.1 POLYESTER

9.6.2 POLYETHER

9.6.3 POLYCAPROLACTONE

9.6.4 CATHETERS

9.6.5 MEDICAL DEVICE HOUSING

9.6.6 WOUND CARE PRODUCTS

9.6.7 OTHERS

9.7 CONSUMER GOODS

9.7.1 POLYESTER

9.7.2 POLYETHER

9.7.3 POLYCAPROLACTONE

9.8 SPORTS AND LEISURE

9.8.1 POLYESTER

9.8.2 POLYETHER

9.8.3 POLYCAPROLACTONE

9.8.4 IN-LINE SKATES

9.8.5 SKI BOOTS

9.8.6 OTHERS

9.9 BUILDING AND CONSTRUCTION

9.9.1 POLYESTER

9.9.2 POLYETHER

9.9.3 POLYCAPROLACTONE

9.1 TEXTILE

9.10.1 POLYESTER

9.10.2 POLYETHER

9.10.3 POLYCAPROLACTONE

9.11 HEAVY ENGINEERING

9.11.1 POLYESTER

9.11.2 POLYETHER

9.11.3 POLYCAPROLACTONE

9.12 OTHERS

9.12.1 POLYESTER

9.12.2 POLYETHER

9.12.3 POLYCAPROLACTONE

10 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY GEOGRAPHY

10.1 MIDDLE EAST AND AFRICA

10.1.1 UAE

10.1.2 ISRAEL

10.1.3 SAUDI ARABIA

10.1.4 EGYPT

10.1.5 SOUTH AFRICA

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT

13 COMPANY PROFILES

13.1 HEXPOL AB

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 AVERY DENNISON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 HUNTSMAN INTERNATIONAL LLC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATES

13.4 AVIENT CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 TOSOH CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATE

13.6 AMERICAN POLYFILM, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 API

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 BASF SE

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 COIM GROUP

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 COVESTRO AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATE

13.11 KOLON INDUSTRIES, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 KURARAY CO., LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATE

13.13 MITSUI CHEMICALS, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATE

13.14 NOVOTEX ITALIANA S.P.A.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 SANYO CORPORATION OF AMERICA (A SUBSIDIARY OF THE SANYO TRADING CO., LTD.)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATE

13.16 SONGWON

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATES

13.17 STATEX

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 TAIWAN PU CORPORATION

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATE

13.19 THE LUBRIZOL CORPORATION (A SUBSIDIARY OF BERKSHIRE HATHAWAY INC.)

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT UPDATE

13.2 WANHUA CHEMICAL GROUP CO., LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 IMPORT DATA OF AMINO-RESINS, PHENOLIC RESINS AND POLYURETHANES, IN PRIMARY FORMS HS CODE - 3909 USD (THOUSAND)

TABLE 2 EXPORT DATA OF AMINO-RESINS, PHENOLIC RESINS AND POLYURETHANES, IN PRIMARY FORMS HS CODE - 3909 USD (THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL,2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 5 MIDDLE EAST AND AFRICA DIISOCYANATE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DIISOCYANATE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (MILLION TONS)

TABLE 7 MIDDLE EAST AND AFRICA POLYOLS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA POLYOLS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (MILLION TONS)

TABLE 9 MIDDLE EAST AND AFRICA DIOLS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA DIOLS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (MILLION TONS)

TABLE 11 MIDDLE EAST AND AFRICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (MILLION TONS)

TABLE 13 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE,2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA POLYESTER IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA POLYETHER IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA POLYCAPROLACTONE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER,2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA AUTOMOTIVEIN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY COUNTRY, 2018-2027 (MILLION TONS)

TABLE 48 MIDDLE EAST AND AFERICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFERICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 50 MIDDLE EAST AND AFERICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFERICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFERICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFERICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFERICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFERICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFERICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFERICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFERICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFERICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFERICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFERICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFERICA CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFERICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFERICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFERICA BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFERICA TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFERICA HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFERICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 69 UAE THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 70 UAE THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 71 UAE THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 UAE THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 73 UAE FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 UAE FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 75 UAE INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 UAE INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 77 UAE AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 UAE AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 79 UAE ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 80 UAE ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 81 UAE MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 UAE MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 83 UAE CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 UAE SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 85 UAE SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 86 UAE BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 87 UAE TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 88 UAE HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 89 UAE OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 90 ISRAEL THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 91 ISRAEL THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 92 ISRAEL THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 93 ISRAEL THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 94 ISRAEL FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 95 ISRAEL FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 96 ISRAEL INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 97 ISRAEL INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 98 ISRAEL AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 99 ISRAEL AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 100 ISRAEL ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 ISRAEL ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 102 ISRAEL MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 103 ISRAEL MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 104 ISRAEL CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 ISRAEL SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 106 ISRAEL SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 107 ISRAEL BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 108 ISRAEL TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 109 ISRAEL HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 110 ISRAEL OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 111 SAUDI ARABIA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 112 SAUDI ARABIA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 113 SAUDI ARABIA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 114 SAUDI ARABIA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 115 SAUDI ARABIA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 116 SAUDI ARABIA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 117 SAUDI ARABIA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 118 SAUDI ARABIA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 119 SAUDI ARABIA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 120 SAUDI ARABIA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 121 SAUDI ARABIA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 SAUDI ARABIA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 123 SAUDI ARABIA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 124 SAUDI ARABIA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 125 SAUDI ARABIA CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 126 SAUDI ARABIA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 127 SAUDI ARABIA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 128 SAUDI ARABIA BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 SAUDI ARABIA TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 130 SAUDI ARABIA HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 131 SAUDI ARABIA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 132 EGYPT THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 133 EGYPT THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 134 EGYPT THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 135 EGYPT THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 136 EGYPT FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 137 EGYPT FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 138 EGYPT INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 139 EGYPT INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 140 EGYPT AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 141 EGYPT AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 142 EGYPT ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 143 EGYPT ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 144 EGYPT MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 145 EGYPT MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 146 EGYPT CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 147 EGYPT SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 148 EGYPT SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 149 EGYPT BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 150 EGYPT TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 151 EGYPT HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 152 EGYPT OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 153 SOUTH AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 154 SOUTH AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (MILLION TONS)

TABLE 155 SOUTH AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 156 SOUTH AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 157 SOUTH AFRICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 158 SOUTH AFRICA FOOTWEAR IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 159 SOUTH AFRICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 160 SOUTH AFRICA INDUSTRIAL MACHINERY IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 161 SOUTH AFRICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 162 SOUTH AFRICA AUTOMOTIVE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 163 SOUTH AFRICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 164 SOUTH AFRICA ELECTRONICS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 165 SOUTH AFRICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 166 SOUTH AFRICA MEDICAL IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 167 SOUTH AFRICA CONSUMER GOODS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 168 SOUTH AFRICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 169 SOUTH AFRICA SPORTS AND LEISURE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 170 SOUTH AFRICA BUILDING AND CONSTRUCTION IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 171 SOUTH AFRICA TEXTILE IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 172 SOUTH AFRICA HEAVY ENGINEERING IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 173 SOUTH AFRICA OTHERS IN THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET, BY TYPE, 2018-2027 (MILLION TONS)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET : MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: SEGMENTATION

FIGURE 13 SHIFT FROM PVC IN MEDICAL INDUSTRY IS DRIVING THE MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 14 DIISOCYANATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET

FIGURE 16 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY RAW MATERIAL, 2019

FIGURE 17 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY TYPE, 2019

FIGURE 18 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY END-USER, 2019

FIGURE 19 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: SNAPSHOT (2019)

FIGURE 20 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY COUNTRY (2019)

FIGURE 21 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY COUNTRY (2020 & 2027)

FIGURE 22 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY COUNTRY (2019 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: BY TYPE (2020-2027)

FIGURE 24 MIDDLE EAST AND AFRICA THERMOPLASTIC POLYURETHANE (TPU) MARKET: COMPANY SHARE 2019 (%)

Middle East And Africa Thermoplastic Polyurethane Tpu Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Thermoplastic Polyurethane Tpu Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Thermoplastic Polyurethane Tpu Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.