North America Digital Lending Platform Market Analysis and Size

Several firms are currently launching next-generation, end-to-end cloud-based lending platforms. Furthermore, advancements in payment trends are encouraging financial institutions to implement DLP to improve productivity, revenue, and service speed.

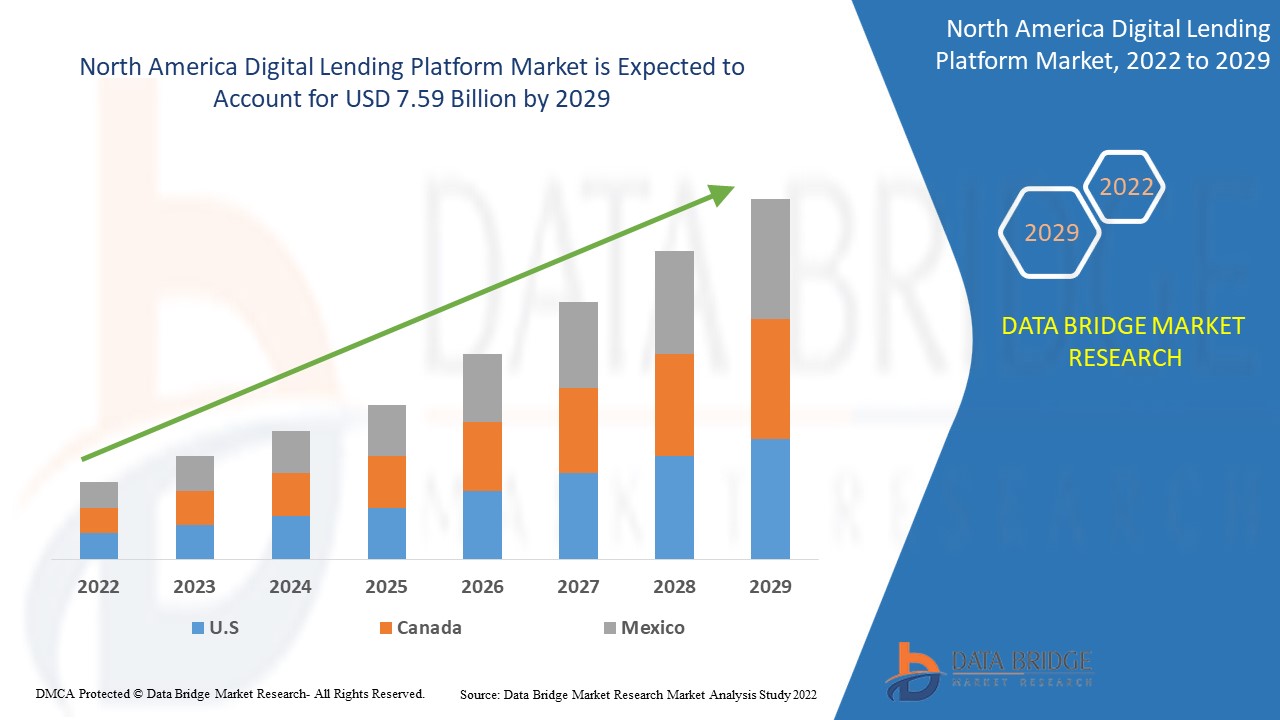

Data Bridge Market Research analyses that the digital lending platform market was valued at 1.73 billion in 2021 and is expected to reach the value of USD 7.59 billion by 2029, at a CAGR of 20.3% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

North America Digital Lending Platform Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

General Electric (U.S.), IBM Corporation (U.S.), PTC (U.S.), Microsoft (U.S.), Siemens AG (Germany), ANSYS, Inc. (U.S.), SAP SE (Germany), Oracle (U.S.), Robert Bosch GmbH (Germany), Swim.ai, Inc. (U.S.), Atos S.E. (France), ABB (Switzerland), KELLTON TECH (India), AVEVA Group plc (U.K.), DXC Technology Company (U.S.), Altair Engineering, Inc (U.S.), Hexaware Technologies Limited (India), Tata Consultancy Services Limited (India), Infosys Limited (Bengaluru), NTT DATA, Inc. (Japan), TIBCO Software Inc. (U.S.) |

|

Opportunities |

|

Market Definition

The digital lending platform allows lenders and borrowers to lend money in an electronic or digital format, resulting in greater ease of use, a better user experience, and lower overhead due to client verification time savings. The process begins with user registration and continues with online documentation collection, client authentication and verification, loan approval, loan distribution, and loan recovery.

Digital Lending Platform Market Dynamics

Drivers

- Growing popularity of online banking

With globalization and online banking services' growing popularity, lending processes are rapidly becoming digital. This is one of the most important factors influencing the use of DLP in the banking, financial services, and insurance (BFSI) industry for better decisions, better customer experiences, and significant cost savings. Furthermore, as a result of the coronavirus disease (COVID-19) outbreak, financial institutions all over the world are increasingly turning to digital channels for lending loans and dealing with pandemic challenges.

- Growing emphasis on digital automation

DLP provides the benefits of e-signing and easy accessibility, while the increasing reliance on smartphones and the rate of internet penetration are also driving market growth. Furthermore, the growing emphasis on digital automation is contributing to North America market growth because DLP requires minimal paperwork, reducing the likelihood of human errors. Several companies are also integrating advanced technologies to mitigate fraud, such as block chain, artificial intelligence (AI), machine learning, and analytics, which is fuelling market growth. Furthermore, the increasing prevalence of cyber threats is hastening its North America adoption.

Opportunities

- High prevalence of advanced and innovative technologies

Artificial intelligence, machine learning, and block chain are among the emerging technologies that are expected to enhance the capabilities of digital lending platforms and open up new growth opportunities. Integrating these technologies allows for a simple, quick, and transparent loan-raising process. AI and machine learning-based algorithms can process loan applications in seconds, making the approval process truly scalable. Furthermore, by eliminating intermediaries or middlemen from the lending process, the block chain-based lending platform establishes a direct relationship between lenders and borrowers.

Restraints

- Data security and privacy concerns

However, challenges such as concerns about data security and privacy protection are expected to limit market growth. Several governments around the world have already begun efforts to address concerns about data security and privacy protection associated with digital lending platforms. Furthermore, because all digital platforms rely heavily on backend infrastructure and internet access, any system glitches, power outages, or connectivity issues may render digital platforms inaccessible to end users. Other challenges, such as a preference for traditional lending methods and lower levels of digital literacy in developing countries, are expected to limit market growth to some extent.

This digital lending platform market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital lending platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Digital Lending Platform Market

The COVID-19 pandemic has benefited the market for digital lending platforms. Following the pandemic, credit unions and banks are expanding their digital banking offerings to better meet the needs of their customers. Furthermore, in COVID-19, banks have begun to use digital channels for lending loans under the Pay check Protection Program in greater numbers. The Pay Check Protection Program in the United States provides funds to small businesses for up to 8 weeks. During COVID-19, 82 percent of businesses in the United States choose to apply for PPP loans online rather than through traditional channels, according to Numerated, a digital lending platform provider.

Recent Development

- In July 2021 Newgen Software will launch its new digital transformation platform, NewgenONE. The platform aids in the management of unstructured data and the enhancement of customer engagement.

- In June 2021, TPBank of Vietnam will collaborate with Nucleus Software to enhance its digital commerce. FinnOne Neo assisted TPBank in providing instant digital loans, increasing process efficiency, and improving credit assessments.

- In January 2021 Fiserv acquired Ondot Systems Inc., a provider of digital experience platforms. This would enable Fiserv to expand its digital solutions portfolio.

- In September 2020 ICE Mortgage Technology will acquire Ellie Mae, a leading digital lending platform provider. The acquisition aided ICE in speeding up the automation of mortgage processes.

North America Digital Lending Platform Market Scope

The digital lending platform market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Software

- Services

Loan amount size

- Less than US$ 7,000

- US$ 7,001 to US$ 20,000

- More than US$ 20,001

Organization size

- Large Organization

- Small & Medium Organization

Deployment

- On-premise

- Cloud

Subscription type

- Free

- Paid

Loan type

- Automotive Loan

- SME Finance Loan

- Personal Loan

- Home Loan

- Consumer Durable

- Others

Vertical

- Banking

- Financial Services

- Insurance Companies

- P2P (Peer-to-Peer) Lenders

- Credit Unions

- Saving

- Loan Associations

Digital Lending Platform Market Regional Analysis/Insights

The digital lending platform market is analyzed and market size insights and trends are provided by country, component, deployment model, loan amount size, subscription type, loan type and vertical as referenced above.

The countries covered in the digital lending platform market report are U.S., Canada and Mexico.

North America dominates the digital lending platform market because major players in the region, such as FIS and Fiserv, Inc., offer a variety of lending solutions on a single platform. The United States and Canada were early adopters of this technology, allowing them to dominate the lending platform market in North America.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Lending Platform Market Share Analysis

The digital lending platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital lending platform market.

Some of the major players operating in the digital lending platform market are:

- General Electric (U.S.)

- IBM Corporation (U.S.)

- PTC (U.S.)

- Microsoft (U.S.)

- Siemens AG (Germany)

- ANSYS, Inc. (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Swim.ai, Inc. (U.S.)

- Atos S.E. (France)

- ABB (Switzerland)

- KELLTON TECH (India)

- AVEVA Group plc (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc. (U.S.)

- Hexaware Technologies Limited (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (Bengaluru)

- NTT DATA, Inc. (Japan)

- TIBCO Software Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.