North America Essential Oils Market Analysis and Insights

Essential oils can be defined as either products or mixtures of fragrant substances or as mixtures of fragrant and odorless substances. These fragrant substances are chemically pure compounds that provide respective distinguishability. They are extracted through various methods such as distillation, cold press extraction, solvent extraction, enzymatic extraction, and many others. The use of essential oils is rising due to the demand from the food & beverage industry for the preparation of various products such as soft drinks, bakery products, sports drinks, and many others. Furthermore, essential oils have gained demand due to the spa & relaxation centers across the nation. However, certain essential oils can cause allergenic effects, especially in people prone to skin rashes, and those who have pollen allergies may hamper the market growth.

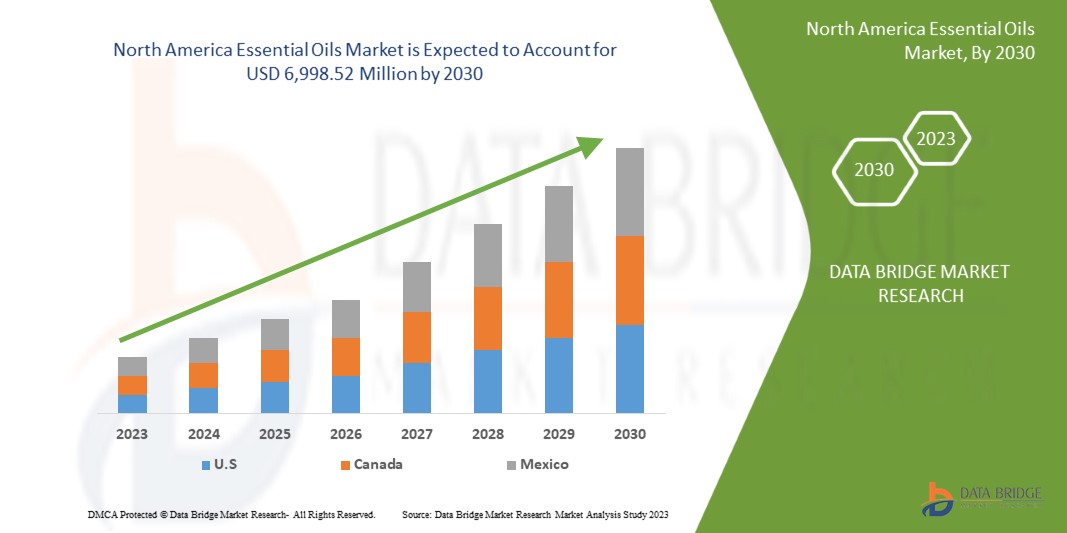

Data Bridge Market Research analyses that the North America essential oils market is expected to reach USD 6,998.52 million by 2030, at a CAGR of 9.7% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

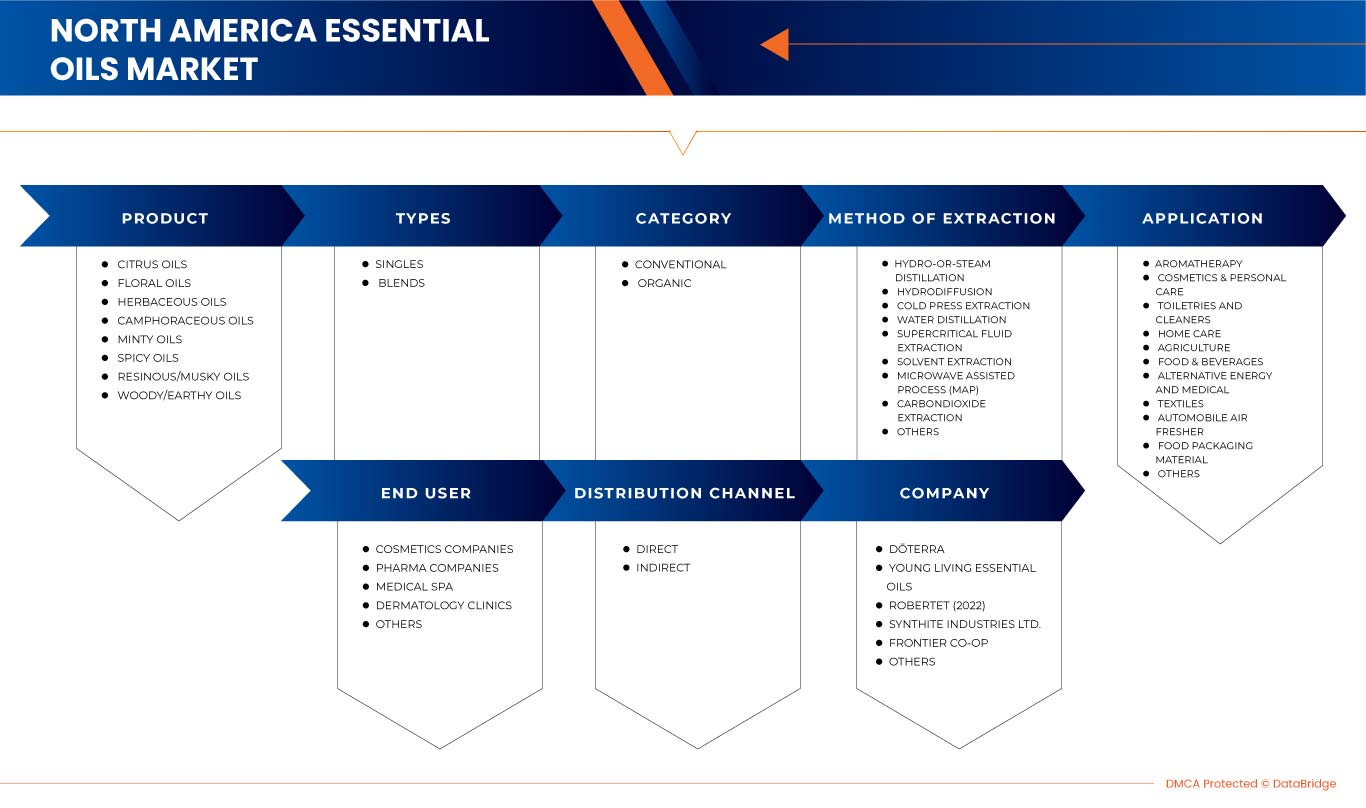

By Product (Citrus Oils, Floral Oils, Herbaceous Oils, Camphoraceous Oils, Minty Oils, Spicy Oils, Resinous/Musky Oils, and Woody/Earthy Oils), Types (Singles and Blends), Category (Conventional and Organic), Method of Extraction (Hydro-Or-steam-Distillation, Hydrodiffusion, Cold Press Extraction, Water Distillation, Supercritical Fluid Extraction, Solvent Extraction, Microwave Assisted Process, Carbondioxide Extraction, and Others), Application (Aromatherapy, Cosmetics & Personal Care, Toiletries and Cleaners, Home Care, Agriculture, Food & Beverages, Alternative Energy and Medical, Textiles, Automobile Air Fresher, Food Packaging Material, and Others), End User (Cosmetics Companies, Pharma Companies, Medical Spa, Dermatology Clinics, and Others), Distribution Channel (Direct and Indirect). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Lebermuth, Inc., Floral Essential Oil, Kelvin Natural Mint Pvt Ltd, SOiL Organic Aromatherapy and Skincare, dōTERRA, Clive Teubes Group, Young Living Essential Oils, LC., Floracopeia, Robertet, Rocky Mountain Oils, LLC, Vigon International, LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC among others. |

Market Definition

Essential oils are concentrated plant extracts that retain their source's natural smell, flavor, and essence. Unique aromatic compounds give each essential oil its characteristic essence. Essential oils are obtained through distillation (via steam and water) or mechanical methods, such as cold pressing. The oils capture the plant's scent and flavor, and essence. They are mostly named after the plant from which they are derived. The applications of essential oils are diverse. Widely used in cosmetics, perfumes, food & beverages, they also have medicinal applications due to their therapeutic properties and agro-alimentary uses because of their antimicrobial and antioxidant effects.

North America Essential Oils Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

RISING DEMAND FOR ESSENTIAL OILS IN THE PERSONAL CARE AND PHARMACEUTICAL INDUSTRY

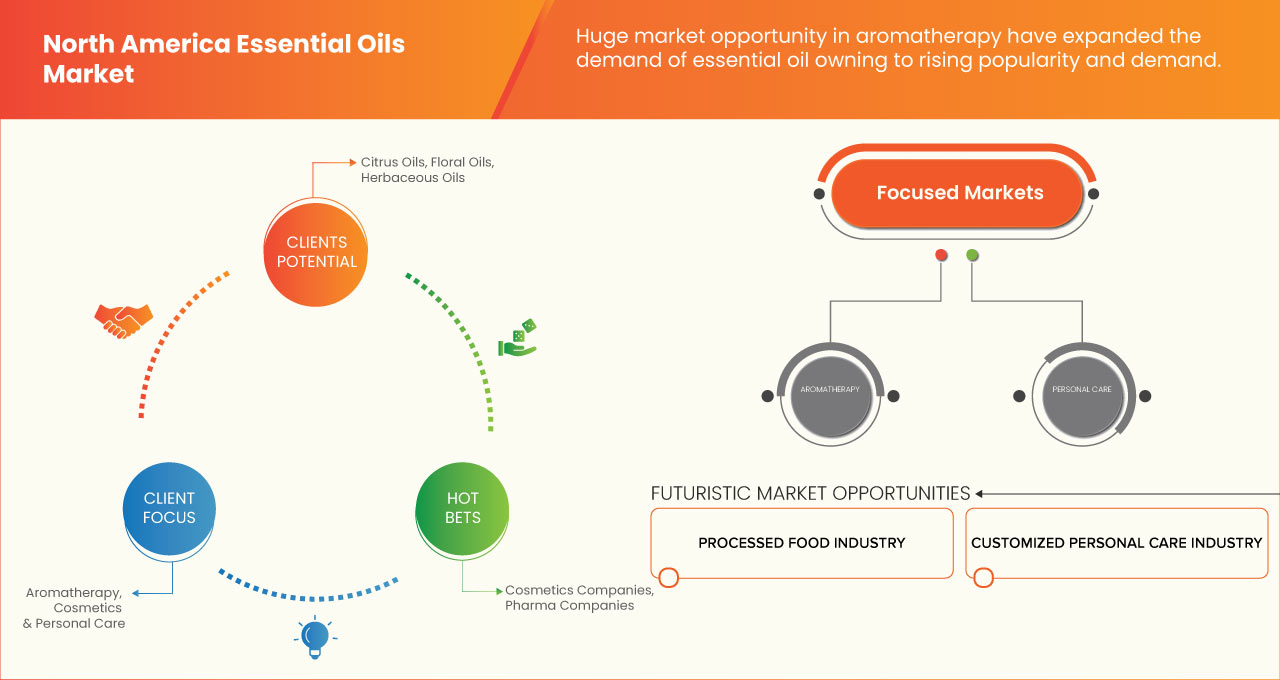

The cosmetics, personal care, and pharmaceutical industries widely utilize essential oils for formulating beauty products as they confer anti-aging, antioxidant, and anti-inflammatory properties, contributing to market growth.

Increasing demand for bio-based products in the personal care and cosmetic industries is expected to significantly increase the essential oils market growth over the forecast period. Essential oils have significant beneficial properties such as high nutritional value, temperature versatility, high squalene, and skin-identical properties. The use of essential oils in the personal care industry offers a variety of benefits. The main reason for their usage in cosmetics is their pleasant aroma. Applying various essential oils, such as lavender and tea tree oil, on the skin provides plenty of hydration. Essential oils can also be added to lotion, creams, shampoos, and many others.

Thus, the growth of the application segments and increasing demand for essential oils is anticipated to drive the growth of the North America essential oils market.

INCREASE IN CONSUMER ACCEPTANCE OF NATURAL PRODUCTS FOR HEALTHY LIVING

Consumers changing eating habits are more inclined towards conscious indulgence, which means that while they want to indulge in eating out and eating right, they want to be mindful of what they eat and will select their places after thorough consideration. For instance, around 78% of millennials prefer to purchase healthy foods, which is 8% more than the total market. Around 54% of millennials prefer vegetarian foods, which is 15% higher than the total market.

The result of this lifestyle shift has been more straightforward in high-growth natural consumers product categories such as baby care, personal care, household products, and cosmetics have also transitioned their offerings to cater to this new generation of consumers.

Restraint

LACK OF AVAILABILITY OF RAW MATERIALS

The lack of availability of raw materials can be caused due to climatic conditions. In unfavorable climatic conditions, it is difficult for farmers to cultivate and grow plants such as herbs, spices, mint, citrus fruits, and others, thus less available raw materials.

The fluctuating production of these plants has resulted in the volatile supply of these plants in the form of seeds, roots, leaves, and others. The volatile supply of raw materials also drives the prices of the end product, these essential oils. The limited raw material availability is expected to hamper the market's overall value chain, a key restraining factor of the North America essential oils market.

Opportunity

SHIFT TOWARDS AROMATHERAPY

Aromatherapy is increasingly considered a popular therapy, with more spas opening in various areas, increasing consumer awareness of well-being, higher demand for natural products, and its benefits in psychological and physiological health. Using essential oils in aromatherapy for personal and therapeutic purposes offers tremendous growth potential. This alternative therapy utilizes various combinations of essential oils to relieve ailments like depression, indigestion, headache, insomnia, muscular pain, respiratory problems, and others. For example, Thyme essential oil is widely used in aromatherapy to help reduce fatigue, nervousness, and stress. The availability of a wide range of aroma oils is expected to boost the North America essential oils market. Thus, the demand for essential oil enables manufacturers to launch new products to expand further, which may promote market growth in the forecast period.

Challenge

LOW PRODUCTION VOLUMES OF ESSENTIAL OILS AND INCREASING CONSUMER DEMAND

Low production volumes of essential oils and increasing consumer demand are expected to affect the market growth of North America essential oils market. High transportation rates, increased variability in rainfall, and intensive summer drought can be considered the main constraints to these crop productions. Under such conditions, adopting sustainable agricultural practices and introducing new/ underutilized crops, able to diversify cropping systems and mitigate climate changes, can represent promising strategies in addressing cropping system sustainability, crop improvement, and food security.

Thus, the increasing demand for essential oil cannot be fulfilled by the low production volumes and is expected to affect the market growth due to uncertainty in weather and the time-consuming extraction process, as well as the low content of oil after extraction. Moreover, it is expected to restrain the growth of North America's essential oils market.

Post-COVID-19 Impact on North America Essential Oils Market

Post the pandemic, the demand for essential oils has increased as there won't be more restrictions on movement, so the supply of products would be easy. In addition, the growing trend of using essential oils for their therapeutic properties and natural ingredients may propel the market's growth.

The increased demand for essential oils enables manufacturers to launch innovative and multifunctional essential oils, which ultimately increases the demand for essential oils and has helped the market grow.

Moreover, the high demand for essential oils for food and beverages and personal care products will drive the market's growth. Furthermore, the increased demand for products that boost the immune system after the COVID-19 pandemic resulted in market growth, as consumers were more concerned about their health and wellness. Additionally, consumers' interest in new flavors and enhanced fragrances is expected to fuel the growth of the North America essential oils market.

Recent Developments

- In August 2020, Young Living Essential Oils launched new products in the happy, healthy home category, including Cassia oil, Ecuadorian oregano oil, one heart essential oil.

- In October 2020, Neptune Wellness Solutions launched a brand called Forest Remedies with a collection of products developed in collaboration with IFF, which launched six essential oils lemon, sweet orange, bergamot, peppermint, eucalyptus, and tea tree oil.

North America Essential Oils Market Scope

The North America essential oils market is segmented into seven segments based on product, types, category, method of extraction, application, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Citrus Oils

- Minty Oils

- Floral Oils

- Herbaceous Oils

- Camphoraceous Oils

- Spicy Oils

- Resinous/Musky Oils

- Woody/Earthy Oils

On the basis of product, the North America essential oils market is segmented into citrus oils, herbaceous oils, floral oils, minty oils, spicy oils, camphoraceous oils, resinous/musky oils, and woody/earthy oils.

Method of Extraction

- Hydro- Or- Steam- Distillation

- Water Distillation

- Cold Press Extraction

- Carbondioxide Extraction

- Solvent Extraction

- Hydrodiffusion

- Supercritical Fluid Extraction

- Microwave Assisted Process (Map)

- Others

On the basis of method of extraction, the North America essential oils market is segmented into cold pressed, solvent extraction, supercritical extraction, carbondioxide extraction, hydro-or-steam distillation, water distillation, hydrodiffusion, microwave assisted process (MAP), and others.

Category

- Organic

- Conventional

On the basis of category, the North America essential oils market is segmented into organic and conventional.

Types

- Singles

- Blends

On the basis of types, the North America essential oils market is segmented into singles and blends.

Application

- Food & Beverages

- Aromatherapy

- Cosmetics & Personal Care

- Home Care

- Toiletries and Cleaners

- Alternative Energy and Medical

- Textiles

- Automobile Air Fresher

- Agriculture

- Food Packaging Material

- Others

On the basis of application, the North America essential oils market is segmented into food & beverages, aromatherapy, cosmetic & personal care, home care, toiletries & cleaners, alternative energy and medical, textiles, automobile air fresher, agriculture, food packaging material, and others.

End User

- Cosmetic Companies

- Pharma Companies

- Medical Spa

- Dermatology Clinics

- Others

On the basis of end user, the North America essential oils market is segmented into cosmetic companies, pharma companies, medical spa, dermatology clinics, and others.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the North America essential oils market is segmented into direct and indirect.

North America Essential Oils Market Regional Analysis/Insights

The North America essential oils market is analyzed, and market size insights and trends are provided based on product, types, category, method of extraction, application, end user, and distribution channel, as referenced above.

The countries covered in the North America essential oils markets report are U.S., Canada, and Mexico. The U.S. is expected to dominate the market due to rising awareness of the health benefits of essential oils. The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and North America Essential Oils Market Share Analysis

The North America essential oils market competitive landscape provides details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points only relate to the companies focus on the North America essential oils market.

Some of the major players operating in the North America essential oils market are Lebermuth, Inc., Floral Essential Oil, Kelvin Natural Mint Pvt Ltd, SOiL Organic Aromatherapy and Skincare, dōTERRA, Clive Teubes Group, Young Living Essential Oils, LC., Floracopeia, Robertet, Rocky Mountain Oils, LLC, Vigon International, LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ESSENTIAL OILS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE ANALYSIS

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 THE THREAT OF NEW ENTRANTS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 RIVALRY AMONG EXISTING COMPETITORS

4.3 KEY PRICING STRATEGIES

4.3.1 MINIMUM ADVERTISED PRICING "MAP" POLICY

4.3.2 PRIORITIZING PURITY AND POTENCY

4.4 MERGERS & ACQUISITION

4.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS

6.1.2 RISING DEMAND FOR ESSENTIAL OILS IN THE PERSONAL CARE AND PHARMACEUTICAL INDUSTRY

6.1.3 INCREASING DEMAND FOR ESSENTIAL OILS IN THE FOOD & BEVERAGE INDUSTRY

6.1.4 INCREASE IN CONSUMER ACCEPTANCE OF NATURAL PRODUCTS FOR HEALTHY LIVING

6.2 RESTRAINTS

6.2.1 LACK OF AVAILABILITY OF RAW MATERIALS

6.2.2 HIGH PRODUCTION COST FOR ESSENTIAL OILS

6.3 OPPORTUNITIES

6.3.1 SHIFT TOWARDS AROMATHERAPY

6.3.2 GROWING APPLICATION OF ESSENTIAL OIL IN-HOME CARE

6.3.3 INTRODUCTION OF NEW MANUFACTURING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 ALLERGIES FROM ESSENTIAL OILS DUE TO UNAWARENESS AMONG CONSUMERS

6.4.2 LOW PRODUCTION VOLUMES OF ESSENTIAL OILS AND INCREASING CONSUMER DEMAND

7 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CITRUS OILS

7.2.1 CITRUS OILS, BY CATEGORY

7.2.1.1 CONVENTIONAL

7.2.1.2 ORGANIC

7.2.2 CITRUS OILS, BY TYPE

7.2.2.1 ORANGE OIL

7.2.2.2 LEMON OIL

7.2.2.3 LIME OIL

7.2.2.4 BERGAMOT OIL

7.2.2.5 GRAPEFRUIT OIL

7.2.2.6 LEMONGRASS OIL

7.2.2.7 MANDARIN OIL

7.2.2.8 TANGERINE OIL

7.2.2.9 CITROELLA OIL

7.2.2.10 LITSEA CUBEBA OIL

7.2.2.11 TAGETES OIL

7.3 MINTY OILS

7.3.1 MINTY OILS, BY CATEGORY

7.3.1.1 CONVENTIONAL

7.3.1.2 ORGANIC

7.3.2 MINTY OILS, BY TYPE

7.3.2.1 PEPPERMINT OIL

7.3.2.2 SPEARMINT OIL

7.3.2.3 WINTERGREEN OIL

7.3.2.4 OTHERS

7.4 FLORAL OILS

7.4.1 FLORAL OILS, BY CATEGORY

7.4.1.1 CONVENTIONAL

7.4.1.2 ORGANIC

7.4.2 FLORAL OILS, BY TYPE

7.4.2.1 LAVENDER OIL

7.4.2.2 ROSE OIL

7.4.2.3 JASMINE OIL

7.4.2.4 CHAMOMILE OIL

7.4.2.5 GERANIUM OIL

7.4.2.6 NEROLI OIL

7.4.2.7 ROSEWOOD OIL

7.4.2.8 YLANG-YLANG OIL

7.4.2.9 PETITGRAIN OIL

7.5 SPICY OILS

7.5.1 SPICY OILS, BY CATEGORY

7.5.1.1 CONVENTIONAL

7.5.1.2 ORGANIC

7.5.2 SPICY OILS, BY TYPE

7.5.2.1 CLOVE BUD OIL

7.5.2.2 BASIL OIL

7.5.2.3 CORIANDER OIL

7.5.2.4 GINGER OIL

7.5.2.5 CUMIN OIL

7.5.2.6 CINNAMON OIL

7.5.2.7 CARDAMOM OIL

7.5.2.8 BLACK PEPPER OIL

7.5.2.9 ALLSPICE OIL

7.5.2.10 NUTMEG OIL

7.5.2.11 ANISEED OIL

7.5.2.12 CASSIA OIL

7.5.2.13 OTHERS

7.6 CAMPHORACEOUS OILS

7.6.1 CAMPHORACEOUS OILS, BY CATEGORY

7.6.1.1 CONVENTIONAL

7.6.1.2 ORGANIC

7.6.2 CAMPHORACEOUS OILS, BY TYPE

7.6.2.1 CAMPHOR OIL

7.6.2.2 EUCALYPTUS OIL

7.6.2.3 LAVANDIN OIL

7.6.2.4 LAUREL LEAF OIL

7.6.2.5 PANNYROYAL OIL

7.6.2.6 CAJEPUT OIL

7.6.2.7 OTHERS

7.7 HERBACEOUS OILS

7.7.1 HERBACEOUS OILS, BY CATEGORY

7.7.1.1 CONVENTIONAL

7.7.1.2 ORGANIC

7.7.2 HERBACEOUS OILS, BY TYPE

7.7.2.1 OREGANO OIL

7.7.2.2 ROSEMARY OIL

7.7.2.3 THYME OIL

7.7.2.4 CHAMOMILE OIL

7.7.2.5 TEA TREE OIL

7.7.2.6 CLARY SAGE OIL

7.7.2.7 EUCALYTUS OIL

7.7.2.8 FENNEL OIL

7.7.2.9 SAGE DALMATIAN OIL

7.7.2.10 PARSLEY OIL

7.7.2.11 ANGELICA ROOT OIL

7.7.2.12 BAY LAUREL OIL

7.7.2.13 CATNIP OIL

7.7.2.14 HYSSOP OIL

7.7.2.15 MARJORAM OIL

7.7.2.16 MELISSA OIL

7.7.2.17 YARROW OIL

7.7.2.18 OTHERS

7.8 RESINOUS/MUSKY OILS

7.8.1 RESINOUS/MUSKY OILS, BY CATEGORY

7.8.1.1 CONVENTIONAL

7.8.1.2 ORGANIC

7.8.2 RESINOUS/MUSKY OILS, BY TYPE

7.8.2.1 BENZOIN OIL

7.8.2.2 ELEMI OIL

7.8.2.3 FRANKINCENSE OIL

7.8.2.4 MYRRH OIL

7.8.2.5 PERU BALSAM OIL

7.8.2.6 OTHERS

7.9 WOODY/EARTHY OILS

7.9.1 WOODY/EARTHY OILS, BY CATEGORY

7.9.1.1 CONVENTIONAL

7.9.1.2 ORGANIC

7.9.2 WOODY/EARTHY OILS, BY TYPE

7.9.2.1 ROSEWOOD OIL

7.9.2.2 SANDALWOOD OIL

7.9.2.3 VETIVER OIL

7.9.2.4 PINE OIL

7.9.2.5 CARROT SEED OIL

7.9.2.6 CEDARWOOD OIL

7.9.2.7 JUNIPER BERRY OIL

7.9.2.8 FIR OIL

7.9.2.9 VALERIAN OIL

7.9.2.10 CYPRESS OIL

7.9.2.11 PALO SANTO OIL

7.9.2.12 OTHERS

8 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES

8.1 OVERVIEW

8.2 SINGLES

8.3 BLENDS

9 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION

10.1 OVERVIEW

10.2 HYDRO- OR- STEAM- DISTILLATION

10.3 WATER DISTILLATION

10.4 COLD PRESS EXTRACTION

10.5 CARBONDIOXIDE EXTRACTION

10.6 SOLVENT EXTRACTION

10.7 HYDRODIFFUSION

10.8 SUPERCRITICAL FLUID EXTRACTION

10.9 MICROWAVE ASSISTED PROCESS (MAP)

10.1 OTHERS

11 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 CONFECTIONERY

11.2.2 BEVERAGES

11.2.2.1 CARBONATED DRINKS

11.2.2.2 ALMOND MILK

11.2.2.3 ICED TEA

11.2.2.4 OTHERS

11.2.3 BAKERY

11.2.3.1 BREAD & BUNS

11.2.3.2 PASTRY

11.2.3.3 MUFFIN & CUPCAKES

11.2.3.4 OTHERS

11.2.4 DAIRY PRODUCTS

11.2.5 RTE MEALS

11.2.6 SNACKS & NUTRITIONAL BARS

11.2.7 MEAT, POULTRY & SEAFOOD

11.2.8 OTHERS

11.3 AROMATHERAPY

11.3.1 SPA & RELAXATION THERAPY

11.3.2 INSOMNIA THERAPY

11.3.3 PAIN MANAGEMENT

11.3.4 SKIN & HAIR CARE THERAPY

11.3.5 SCAR MANAGEMENT

11.3.6 COUGH & COLD THERAPY

11.4 COSMETICS & PERSONAL CARE

11.4.1 PERFUMES & BODY SPRAYS/MISTS

11.4.2 SKIN CARE

11.4.3 HAIR CARE

11.4.4 MAKEUP AND COLOR COSMETICS

11.4.5 SOAPS

11.5 HOME CARE

11.5.1 AIR FRESHER

11.5.2 SCENTED CANDLES

11.5.3 OTHERS

11.6 TOILETRIES AND CLEANERS

11.6.1 FABRIC CARE

11.6.2 DETERGENTS

11.6.3 HANDWASH

11.6.4 KITCHEN CLEANERS

11.6.5 BATHROOM CLEANER

11.6.6 FLOOR CLEANER

11.6.7 OTHERS

11.7 ALTERNATIVE ENERGY AND MEDICAL

11.7.1 INFLAMMATORY DISEASE

11.7.2 NERVOUS SYSTEM

11.7.3 MICROBIAL INFECTIONS

11.7.4 ALLERGIES

11.8 TEXTILES

11.9 AUTOMOBILE AIR FRESHER

11.1 AGRICULTURE

11.11 FOOD PACKAGING MATERIAL

11.12 OTHERS

12 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER

12.1 OVERVIEW

12.2 COSMETIC COMPANIES

12.3 PHARMA COMPANIES

12.4 MEDICAL SPA

12.5 DERMATOLOGY CLINICS

12.6 OTHERS

13 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

13.3.1 STORE-BASED RETAILING

13.3.1.1 WHOLESALERS

13.3.1.2 CONVENIENCE STORES

13.3.1.3 SPECIALTY STORES

13.3.1.4 SUPERMARKETS/HYPERMARKETS

13.3.1.5 GROCERY STORES

13.3.1.6 OTHERS

13.3.2 NON-STORE RETAILING

13.3.2.1 ONLINE

13.3.2.2 VENDING

14 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY

14.1 U.S.

14.2 CANADA

14.3 MEXICO

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DOTERRA

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 YOUNG LIVING ESSENTIAL OILS.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 ROBERTET

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 SYNTHITE INDUSTRIES LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FRONTIER CO-OP.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ARBRESSENCE

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 FLORACOPEIA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 FLORAL ESSENTIAL OIL

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 KELVIN NATURAL MINT PVT. LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LEBERMUTH, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 PHOENIX AROMAS & ESSENTIAL OILS, LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 ROCKY MOUNTAIN OILS, LLC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SILVERLINE CHEMICALS.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SOIL ORGANIC AROMATHERAPY AND SKINCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 VIGON INTERNATION LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MERGERS & ACQUISITION

TABLE 2 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 4 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 5 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 8 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 9 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 12 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 13 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 16 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 17 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 20 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 21 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 24 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 25 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 28 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 29 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 32 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 33 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 36 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 37 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 56 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (ASP/TONS)

TABLE 57 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 59 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 60 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 61 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 63 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 64 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 68 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 69 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 71 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 72 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 73 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 75 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 76 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 79 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 80 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 81 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 83 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 84 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 85 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 87 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 88 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 89 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 91 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 92 U.S. ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 93 U.S. ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 U.S. ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 95 U.S. ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 U.S. FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 U.S. BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.S. BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.S. HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.S. ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.S. ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 105 U.S. ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 106 U.S. INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 110 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 111 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 112 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 113 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 115 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 116 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 117 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 119 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 120 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 123 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 124 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 125 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 127 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 128 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 129 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 131 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 132 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 133 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 135 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 136 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 137 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 139 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 140 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 143 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 144 CANADA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 145 CANADA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 146 CANADA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 147 CANADA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 CANADA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 CANADA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 CANADA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 CANADA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 CANADA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 CANADA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 CANADA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 157 CANADA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 158 CANADA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 163 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 164 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 167 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 168 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 169 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 171 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 172 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 175 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 176 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 177 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 179 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 180 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 181 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 183 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 184 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 185 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 187 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 188 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 189 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 191 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 192 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 193 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 195 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 196 MEXICO ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 197 MEXICO ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 198 MEXICO ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 199 MEXICO ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 MEXICO FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 MEXICO BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 MEXICO BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 MEXICO AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 MEXICO HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 MEXICO ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 MEXICO ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 209 MEXICO ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 210 MEXICO INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ESSENTIAL OILS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ESSENTIAL OILS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ESSENTIAL OILS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ESSENTIAL OILS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ESSENTIAL OILS MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ESSENTIAL OILS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 10 INCREASE IN AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS IS EXPECTED TO DRIVE THE NORTH AMERICA ESSENTIAL OILS MARKET IN THE FORECAST PERIOD

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ESSENTIAL OILS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ESSENTIAL OILS MARKET

FIGURE 13 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT, 2022

FIGURE 14 NORTH AMERICA ESSENTIAL OILS MARKET: BY TYPES, 2022

FIGURE 15 NORTH AMERICA ESSENTIAL OILS MARKET: BY CATEGORY, 2022

FIGURE 16 NORTH AMERICA ESSENTIAL OILS MARKET: BY METHOD OF EXTRACTION, 2022

FIGURE 17 NORTH AMERICA ESSENTIAL OILS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA ESSENTIAL OILS MARKET: BY END USER, 2022

FIGURE 19 NORTH AMERICA ESSENTIAL OILS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA ESSENTIAL OILS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT (2023-2030)

FIGURE 25 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY SHARE 2022 (%)

North America Essential Oils Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Essential Oils Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Essential Oils Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.