North America Exocrine Pancreatic Insufficiency Epi Therapeutics And Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

4.45 Billion

USD

7.82 Billion

2024

2032

USD

4.45 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.45 Billion | |

| USD 7.82 Billion | |

|

|

|

|

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Size

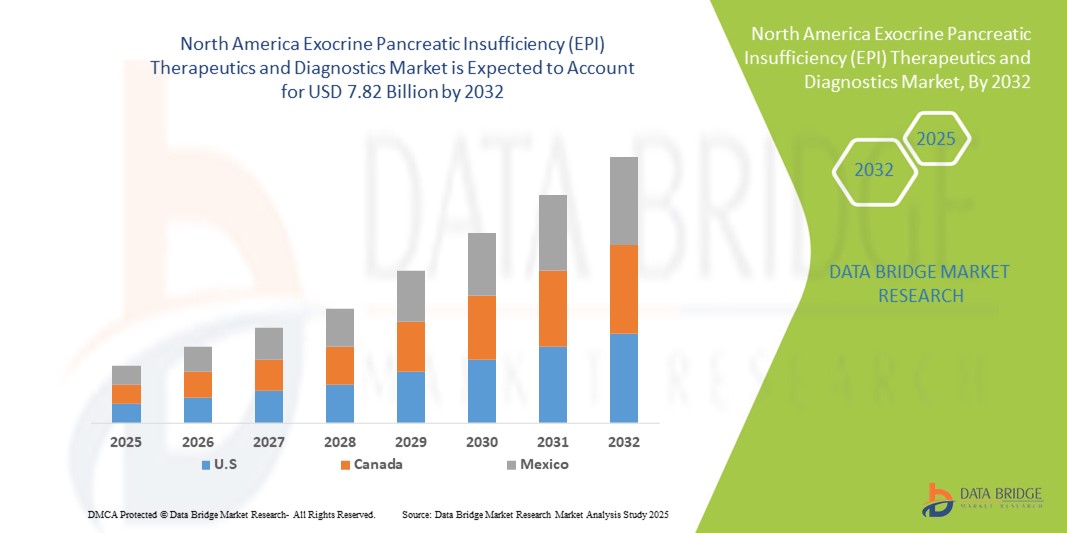

- The North America Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics market size was valued at USD 4.45 billion in 2024 and is expected to reach USD 7.82 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic pancreatitis and cystic fibrosis, which are major causes of EPI, along with technological advancements in diagnostic tools and novel therapeutics, leading to improved disease management

- Furthermore, rising patient awareness and demand for effective, easy-to-administer Pancreatic Enzyme Replacement Therapy (PERT) and related diagnostic solutions are establishing these treatments as the standard care for EPI. These converging factors are accelerating the adoption of EPI therapeutics and diagnostics, thereby significantly boosting the industry's growth

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Analysis

- Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics, including Pancreatic Enzyme Replacement Therapy (PERT) and diagnostic assays, are increasingly vital components of modern gastrointestinal healthcare in both clinical and home settings due to their effectiveness in managing malabsorption, improving patient quality of life, and integration with personalized treatment plans

- The escalating demand for EPI therapeutics and diagnostics is primarily fueled by the rising prevalence of chronic pancreatitis, cystic fibrosis, and other pancreatic disorders, growing patient awareness, and a preference for easy-to-administer, effective enzyme replacement therapies

- U.S. dominated the North America Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics market with the largest revenue share of 79.2% in 2024, characterized by early adoption of advanced diagnostic tools, high healthcare spending, and a strong presence of key pharmaceutical and biotech companies, with substantial growth in specialized clinics and hospitals driven by innovations in PERT formulations and diagnostic assays

- Canada is expected to be the fastest-growing country in the North America Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics market during the forecast period due to increasing awareness of pancreatic disorders, favorable healthcare policies, and rising investment in diagnostic infrastructure

- Pancreatic Enzyme Replacement Therapy (PERT) segment dominated the North America Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics market with a market share of 62.2% in 2024, driven by its established efficacy in managing EPI symptoms and widespread clinical adoption across hospitals and home care settings

Report Scope and North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Segmentation

|

Attributes |

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Trends

Enhanced Patient Care Through Advanced Diagnostics and Personalized Therapy

- A significant and accelerating trend in the North American EPI therapeutics and diagnostics market is the growing adoption of advanced diagnostic tools and personalized Pancreatic Enzyme Replacement Therapy (PERT) regimens, improving disease management and patient outcomes

- For instance, advanced fecal elastase and breath tests allow clinicians to accurately monitor EPI progression and tailor enzyme dosing to individual patient needs

- Integration of digital health platforms and wearable monitoring devices enables real-time tracking of treatment effectiveness and symptom improvement, supporting more proactive and personalized care plans

- These technologies allow seamless coordination between gastroenterologists, primary care providers, and patients, facilitating remote monitoring and adjustment of enzyme therapy as needed

- This trend towards more precise, data-driven, and patient-centric management is fundamentally reshaping expectations for EPI care. Consequently, companies such as AbbVie and Nestlé Health Science are developing diagnostic kits and therapy solutions with enhanced monitoring capabilities and individualized dosing

- The demand for therapeutics and diagnostics that offer integrated monitoring, precision dosing, and ease of use is growing rapidly across both clinical and home care settings, as patients and providers increasingly prioritize efficacy and quality of life

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Dynamics

Driver

Rising Prevalence of Pancreatic Disorders and Growing Awareness

- The increasing prevalence of chronic pancreatitis, cystic fibrosis, and related pancreatic disorders, coupled with rising patient and physician awareness, is a significant driver for heightened demand for EPI therapeutics and diagnostics

- For instance, in March 2024, a clinical update highlighted improved outcomes in patients receiving optimized PERT dosing, reinforcing the importance of early diagnosis and therapy adjustment

- As patients and healthcare providers recognize the benefits of timely EPI diagnosis and effective enzyme replacement, demand for accurate diagnostics and individualized therapy increases substantially

- Furthermore, the expanding network of specialized gastroenterology clinics and patient support programs is driving adoption of PERT and diagnostic tools in both hospital and outpatient settings

- The ease of administering PERT alongside monitoring tools, combined with growing awareness campaigns and education programs, is further propelling the uptake of therapeutics and diagnostics across North America

Restraint/Challenge

High Treatment Costs and Limited Patient Compliance

- The relatively high cost of advanced enzyme formulations and diagnostic assays, particularly for long-term therapy, poses a significant challenge to broader market adoption

- For instance, some patients discontinue or underdose PERT due to out-of-pocket expenses, reducing treatment effectiveness and adherence

- Addressing affordability through insurance coverage, patient assistance programs, and lower-cost enzyme options is critical to improving access and compliance

- In addition, patient non-compliance and improper enzyme administration can limit therapy efficacy, emphasizing the need for educational support and monitoring tools to ensure correct usage

- While awareness and treatment options are increasing, perceived complexity and cost of therapy still hinder adoption for some patients, especially in regions with limited healthcare resources

- Overcoming these challenges through cost reduction strategies, patient education, and digital monitoring solutions will be vital for sustained market growth and improved patient outcomes

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Scope

The market is segmented on the basis of diagnosis, treatment, drug type, end user, and distribution channel.

- By Diagnosis

On the basis of diagnosis, the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into imaging tests and pancreatic function tests. The pancreatic function test segment dominated the market with the largest revenue share in 2024, driven by its essential role in accurately diagnosing enzyme insufficiency and guiding Pancreatic Enzyme Replacement Therapy (PERT). Clinicians often prefer fecal elastase and secretin stimulation tests for their high sensitivity and specificity. The segment benefits from growing awareness of EPI among patients and healthcare providers. Non-invasive and point-of-care testing further supports strong adoption in hospitals, specialty clinics, and diagnostic centers. Rising prevalence of chronic pancreatitis and cystic fibrosis is boosting the use of pancreatic function tests. Technological improvements in assay accuracy and rapid turnaround time also contribute to dominance.

The imaging tests segment is expected to witness the fastest growth during the forecast period, fueled by advancements in MRI, CT, and endoscopic ultrasonography. Imaging tests help detect structural pancreatic abnormalities and underlying causes such as chronic pancreatitis. Increasing integration with telemedicine platforms allows broader utilization in outpatient and homecare settings. Rising availability of imaging equipment and enhanced resolution accelerates adoption. Clinicians increasingly rely on imaging tests for monitoring disease progression and therapy effectiveness. Growth is further supported by hospitals and specialized clinics upgrading their diagnostic infrastructure.

- By Treatment

On the basis of treatment, the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into nutritional management and Pancreatic Enzyme Replacement Therapy (PERT). The PERT segment dominated the market in 2024 with a market share of 62.2% due to its proven efficacy in managing EPI symptoms such as malabsorption and nutrient deficiencies. PERT is widely preferred for its standardized dosing, ease of administration, and positive clinical outcomes. Hospitals, specialty clinics, and homecare settings are major end users. Innovations such as delayed-release formulations, capsule size reduction, and combination therapies enhance patient compliance. Strong marketing and patient support programs by pharmaceutical companies further strengthen the segment. Growing awareness among patients and physicians about proper enzyme replacement also contributes to dominance.

The nutritional management segment is expected to register the fastest growth during the forecast period, driven by the rising role of dietary interventions in supporting EPI treatment. Nutritional supplements, high-calorie diets, and fat-soluble vitamins are increasingly used alongside PERT. Patient education and dietitian-led programs in hospitals and homecare settings boost adoption. Integration of nutrition with personalized therapy plans enhances treatment effectiveness. Rising awareness of the impact of diet on symptom management encourages growth. Homecare and outpatient adoption of nutritional management solutions is accelerating.

- By Drug Type

On the basis of drug type, the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into generic and branded. The branded segment dominated the market in 2024 due to strong clinical validation, regulatory approvals, and patient trust. Branded PERT products provide standardized enzyme activity and consistent packaging. Patient support programs and education campaigns enhance adherence. Branded drugs are widely used in hospitals, specialty clinics, and homecare. Pharmaceutical companies actively promote these products, strengthening market dominance. Clinical evidence and physician preference further sustain the segment.

The generic segment is expected to witness the fastest growth during the forecast period, driven by cost sensitivity and increasing insurance coverage. Generic PERT products offer similar efficacy to branded drugs at lower prices. Adoption is increasing in public hospitals, homecare, and outpatient clinics. Government initiatives promoting affordable treatment are supporting growth. Generic drugs are expanding access to underserved populations. Rising awareness of cost-effective options accelerates adoption in North America.

- By End User

On the basis of end user, the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into hospitals, specialty clinics, homecare, diagnostic centers, research and academic institutes, and others. The hospitals segment dominated the market in 2024 due to the concentration of advanced diagnostic facilities and PERT administration services. Hospitals provide inpatient and outpatient care for EPI patients. Strong collaborations with pharmaceutical companies enhance adoption. Hospitals also serve as primary centers for patient education and therapy monitoring. The segment benefits from the prevalence of chronic pancreatitis and cystic fibrosis. Expansion of gastroenterology departments and specialized clinics contributes to dominance.

The homecare segment is expected to witness the fastest growth during the forecast period, driven by patient-centric care and remote therapy management. Homecare adoption is facilitated by telemedicine platforms and digital monitoring tools. Patients can receive PERT and nutritional guidance in the comfort of their homes. Homecare supports adherence through remote clinician oversight. Increasing awareness about EPI management outside hospitals encourages growth. Convenience and reduced hospital visits are key factors driving segment adoption.

- By Distribution Channel

On the basis of distribution channel, the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into direct tender, retail pharmacy, third-party distributors, and others. The retail pharmacy segment dominated the market in 2024 due to convenience, accessibility, and strong presence of branded PERT products. Pharmacies provide counseling and support services to ensure adherence. Partnerships between pharmaceutical companies and retail chains enhance availability. Patients benefit from easy prescription fulfillment and timely access. Retail pharmacies are widely used across the U.S. and Canada. Continued expansion of pharmacy networks strengthens dominance.

The direct tender segment is expected to witness the fastest growth during the forecast period, driven by bulk procurement by hospitals, specialty clinics, and government programs. Direct tenders offer cost-effective solutions for PERT and diagnostics. Institutional buyers can manage large patient populations efficiently. Streamlined supply chains support adoption in hospitals and clinics. Rising demand from public healthcare initiatives accelerates growth. Growth is also fueled by long-term contracts ensuring consistent product availability.

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Regional Analysis

- U.S. dominated the North America exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with the largest revenue share of 79.2% in 2024, characterized by early adoption of advanced diagnostic tools, high healthcare spending, and a strong presence of key pharmaceutical and biotech companies, with substantial growth in specialized clinics and hospitals driven by innovations in PERT formulations and diagnostic assays

- Patients and healthcare providers in the region highly value the accessibility of Pancreatic Enzyme Replacement Therapy (PERT), advanced diagnostic tests such as fecal elastase and imaging tests, and integrated treatment plans that improve patient outcomes and quality of life

- This widespread adoption is further supported by well-established healthcare infrastructure, high healthcare spending, a technologically advanced population, and growing preference for patient-centric care models, establishing EPI therapeutics and diagnostics as essential solutions in both hospital and homecare settings

U.S. Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The U.S. exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market captured the largest revenue share in 2024 within North America, fueled by the high prevalence of chronic pancreatitis, cystic fibrosis, and other pancreatic disorders. Patients and healthcare providers are increasingly prioritizing early diagnosis and effective Pancreatic Enzyme Replacement Therapy (PERT) to improve outcomes and quality of life. The growing preference for integrated diagnostic tools, patient monitoring systems, and homecare therapies further propels the market. Moreover, advanced clinical infrastructure, widespread insurance coverage, and the presence of leading pharmaceutical and biotech companies significantly contribute to the market’s expansion. The adoption of telemedicine and digital health platforms for remote therapy management is also enhancing accessibility and adherence.

Canada Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Canada exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of pancreatic disorders and rising investment in healthcare infrastructure. Government healthcare programs and favorable reimbursement policies are fostering adoption of both diagnostics and therapeutics. Canadian patients and clinicians are drawn to the benefits of PERT, advanced pancreatic function tests, and nutritional management solutions. The market is witnessing growth across hospitals, specialty clinics, and homecare settings, with early diagnosis and personalized therapy being key focus areas. Rising educational initiatives and patient support programs are further encouraging market uptake.

Mexico Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Mexico exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing healthcare expenditure and rising patient awareness of EPI. Efforts to expand access to diagnostic tests and affordable PERT formulations are supporting market growth. Hospitals and specialty clinics are increasingly adopting advanced diagnostic and treatment options, while homecare therapy is emerging as a convenient solution for patients in remote areas. Collaboration with pharmaceutical companies and educational campaigns are promoting early diagnosis and adherence. In addition, government initiatives to strengthen healthcare infrastructure are expected to continue stimulating market growth.

North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Share

The North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Entero Therapeutics, Inc. (U.S.)

- Axovant Gene Therapies Ltd. (U.S.)

- Cumberland Pharmaceuticals Inc. (U.S.)

- Protalix BioTherapeutics, Inc. (U.S.)

- Prometic Life Sciences Inc. (Canada)

- Aptalis Pharma Inc. (Canada)

- Enzo Biochem, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (U.S.)

- Siemens Healthineers AG (Germany)

- Bio-Techne Corporation (U.S.)

- PerkinElmer (U.S.)

- llumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

What are the Recent Developments in North America Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market?

- In May 2024, a new symptom scoring tool, the EPI/PEI-SS, was developed by a patient-led initiative to assist in screening for Exocrine Pancreatic Insufficiency. This tool, created through a review of existing literature and patient-generated symptom lists, aims to provide a more comprehensive method for evaluating the frequency and severity of common EPI symptoms

- In December 2023, Codexis and Nestlé Health Science entered into a purchase agreement for CDX-7108, a novel oral enzyme therapy for EPI. Under the terms of the agreement, Nestlé Health Science will be responsible for the continued development and commercialization of CDX-7108, including all associated costs

- In May 2023, First Wave BioPharma completed patient screening for its Phase 2 SPAN clinical trial of adrulipase for the treatment of EPI in cystic fibrosis patients. This milestone marks a significant step in evaluating the potential of adrulipase as a treatment option for EPI, with results anticipated to inform future therapeutic strategies

- In February 2023, Codexis and Nestlé Health Science announced interim results from a Phase 1 clinical trial of CDX-7108, a novel oral enzyme therapy for the treatment of EPI. The trial aimed to evaluate the safety, tolerability, and pharmacokinetics of CDX-7108 in healthy subjects. This collaboration marks a significant step in developing non-porcine-based enzyme therapies for EPI patients

- In August 2021, AzurRx Biopharma, Inc. (now First Wave BioPharma, Inc.) announced the completion of enrollment for its Phase 2 clinical trial of MS1819 in combination with pancreatic enzyme replacement therapy (PERT) to treat severe exocrine pancreatic insufficiency (EPI) in cystic fibrosis patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.