North America Food Pathogen Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

3.21 Billion

2024

2032

USD

1.70 Billion

USD

3.21 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 3.21 Billion | |

|

|

|

|

North America Food Pathogen Testing Market Size

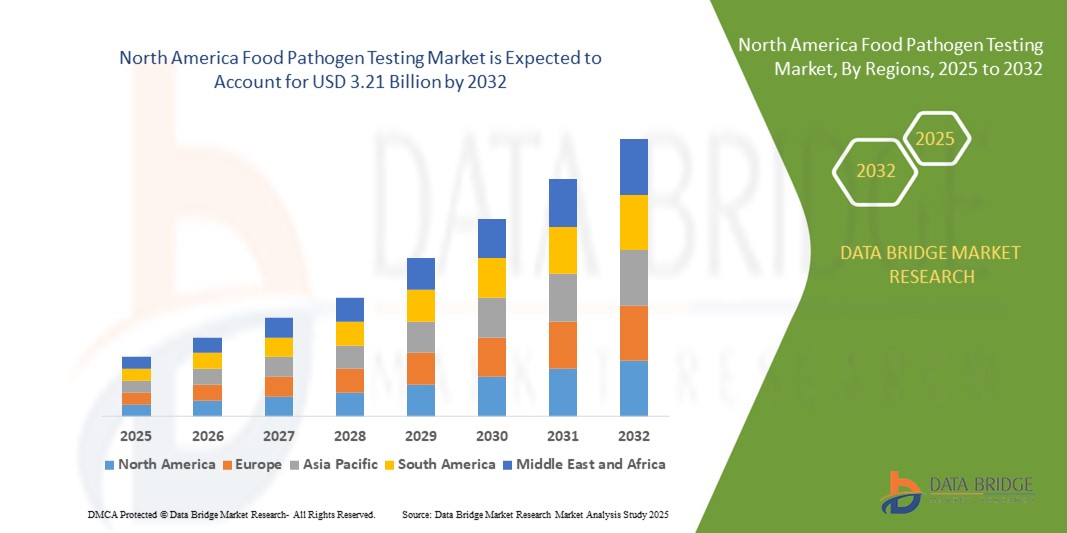

- The North America food pathogen testing market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 3.21 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth in North America Food Pathogen Testing Market is largely fueled by the expanding healthcare infrastructure and increased demand for efficient medical supply chain systems across the region, driven by rising chronic disease prevalence, healthcare digitization, and the growing need for timely detection and management of foodborne pathogens.

- Furthermore, rising consumer and institutional demand for accurate, rapid, and technologically advanced food pathogen testing solutions is establishing specialized testing services as a cornerstone of food safety and public health in North America. These converging factors are accelerating the adoption of advanced food pathogen testing technologies, thereby significantly boosting the industry’s growth across both public health agencies and private food manufacturing sectors in the region.

North America Food Pathogen Testing Market Analysis

- The North America food pathogen testing market is increasingly critical in ensuring the timely, secure, and compliant delivery of healthcare products across the region. These systems support temperature-sensitive storage, real-time tracking, and efficient distribution, which are essential for life-saving medical devices and equipment

- The growing demand is driven by rising healthcare infrastructure development, increasing import and export of medical technologies, and stringent regulatory requirements for supply chain traceability and cold chain management in North America

- U.S. dominated the North America food pathogen testing market with the largest revenue share of 78.5% in 2024, supported by a robust healthcare ecosystem, high consumption of medical devices, and widespread adoption of advanced warehouse automation and IoT-enabled logistics

- Canada is expected to be the fastest-growing country in the North America food pathogen testing market, registering a CAGR of 10.2% between 2025 and 2032. Growth drivers include increasing reliance on imported medical devices, expanding biopharmaceutical activities, and improved healthcare access in remote regions

- The system segment dominated the North America food pathogen testing market with the largest revenue share of 38.5% in 2024, driven by the demand for integrated, high-throughput systems capable of detecting multiple pathogens simultaneously with greater accuracy and speed. These systems are preferred by large food processing companies and third-party testing labs for their automation, scalability, and compliance with regulatory standards

Report Scope and North America Food Pathogen Testing Market Segmentation

|

Attributes |

North America Food Pathogen Testing Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Food Pathogen Testing Market Trends

Advancements in Rapid and On-Site Testing Technologies Driving the North America Food Pathogen Testing Market

- A significant trend in the North America food pathogen testing market is the growing adoption of rapid testing technologies such as PCR assays and immunoassays, which enable faster, more accurate detection of foodborne pathogens

- The increasing demand for portable, on-site testing kits is reshaping the market by allowing real-time monitoring of food safety directly at manufacturing and distribution sites, reducing reliance on centralized laboratories

- Regulatory pressure from agencies such as the U.S. FDA and Canadian Food Inspection Agency is encouraging food producers to invest heavily in advanced testing solutions to comply with strict safety standards

- Collaborations between technology providers and food manufacturers are facilitating tailored testing protocols to improve quality control and consumer trust

- Automation and data analytics integration in testing processes are enhancing throughput, traceability, and supply chain transparency, supporting food safety management efforts

- These technological and regulatory advancements are expected to sustain market growth through 2032 in North America’s expanding food production and processing industries

- Food producers are increasingly adopting internal, in-house labs to facilitate continuous monitoring and rapid corrective actions without relying on outsourced testing—driven by the need for speed, traceability, and confidentiality

- Cloud-connected diagnostic tools are enabling centralized tracking of testing data, which supports trend analysis, predictive risk assessment, and regulatory reporting

- There is a surge in strategic partnerships between food manufacturers and diagnostic companies to co-develop tailored solutions for specific food matrices, helping to address complex contamination challenges

- The focus on shelf-life extension and reduction of recalls is also boosting the integration of preventive testing strategies throughout the supply chain

- Together, these advancements are expected to improve food safety outcomes, reduce economic losses due to contamination, and significantly bolster consumer confidence—contributing to sustained growth of the Food Pathogen Testing Market in North America through 2032

North America Food Pathogen Testing Market Dynamics

Driver

Rising Demand for Food Safety and Regulatory Compliance

- The North America food pathogen testing market is witnessing significant growth due to increasing regulatory pressure from agencies such as the U.S. Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA), which enforce stringent safety standards under the Food Safety Modernization Act (FSMA). These regulations require routine monitoring and testing to ensure pathogen-free food products

- The rising incidence of foodborne illnesses across the U.S. and Canada is a key growth driver. According to the CDC, around 48 million people get sick annually from foodborne pathogens, prompting food manufacturers to invest heavily in preventive testing strategies

- Growing consumer awareness regarding food safety, transparency, and traceability is influencing food producers and retailers to adopt rigorous testing practices, especially for ready-to-eat products, meats, dairy, and fresh produce

- The increasing complexity of the food supply chain—particularly due to imported raw materials and globalized sourcing—necessitates robust testing frameworks to detect pathogens such as Salmonella, Listeria, and E. coli at multiple stages of production and distribution

- Technological advancements such as polymerase chain reaction (PCR), immunoassays (ELISA), biosensors, and next-generation sequencing are making food testing faster, more accurate, and scalable, enhancing adoption across mid- to large-sized enterprises

- Investments in laboratory automation, real-time detection systems, and on-site testing capabilities by major food producers and third-party laboratories are further accelerating the uptake of pathogen testing solutions across North America

- The rising number of food recalls in the U.S. is prompting food companies to proactively adopt rigorous testing protocols to prevent contamination and mitigate reputational risk

- Export-driven food producers and private-label manufacturers are also increasing testing compliance to meet international food safety standards and maintain competitiveness in the global market

Restraint/Challenge

High Testing Costs and Infrastructure Gaps Among Small and Medium Enterprises (SMEs)

- Despite growing demand, the North America food pathogen testing market faces challenges due to the high cost of diagnostic equipment and technologies such as real-time PCR, NGS, and MALDI-TOF. These systems require substantial upfront capital investment and specialized maintenance

- Many small and mid-sized food producers lack in-house testing capabilities and rely on third-party labs, leading to increased operational expenses, longer turnaround times, and limited real-time response during safety crises

- Regulatory compliance remains complex and resource-intensive for SMEs. Variations in local, state, and federal food safety requirements create confusion and increase the administrative burden for smaller players with limited compliance staff

- There is a notable shortage of skilled microbiologists and technicians, especially in remote and underserved regions, which hampers the ability of smaller processors to implement and maintain reliable testing procedures

- Traditional food manufacturers are often slow to adopt emerging technologies due to lack of awareness or resistance to change, leading to inefficiencies and missed opportunities for early pathogen detection

- Operational challenges, such as the need for specialized storage, frequent equipment calibration, and compliance with ISO and HACCP standards, further deter small players from fully participating in the pathogen testing landscape

- Many SMEs face digitalization barriers and lack integrated traceability and reporting systems required for audits and recalls, reducing transparency and delaying response during outbreaks

- In addition, limited access to public funding or targeted subsidies for food safety infrastructure discourages small food enterprises from scaling their testing capabilities, widening the compliance gap between large corporations and SMEs

North America Food Pathogen Testing Market Scope

The market is segmented on the basis of testing type, type of pathogen testing, site, and application.

- By Testing Type

On the basis of testing type, the North America food pathogen testing market is segmented into system, test kits, consumables, and others. The system segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the demand for integrated, high-throughput systems capable of detecting multiple pathogens simultaneously with greater accuracy and speed. These systems are preferred by large food processing companies and third-party testing labs for their automation, scalability, and compliance with regulatory standards.

The test kits segment is projected to witness the fastest CAGR of 11.6% from 2025 to 2032, as food manufacturers increasingly adopt rapid, cost-effective, and easy-to-use kits for on-site screening of contamination, especially in SMEs and decentralized facilities.

- By Type of Pathogen Testing

On the basis of type of pathogen testing, the North America food pathogen testing market is segmented into Salmonella SPP, E. Coli, Listeria SPP, Listeria, Vibrio SPP, Campylobacter, and others. The Salmonella SPP segment captured the largest market share of 29.1% in 2024, owing to the high prevalence of salmonella contamination in meat, poultry, and dairy products, and regulatory mandates requiring routine monitoring.

The Listeria segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, due to its high-risk association with processed and ready-to-eat foods, particularly affecting vulnerable populations such as pregnant women and the elderly.

- By Site

On the basis of site, the North America food pathogen testing market is segmented into in-house/internal lab and outsourcing facility. The in-house/internal lab segment held the largest market revenue share of 54.3% in 2024, as major food processing companies and multinationals maintain dedicated internal labs for stringent quality control, faster turnaround, and better traceability.

The outsourcing facility segment is projected to grow at the highest CAGR of 12.2% from 2025 to 2032, fueled by growing demand from SMEs and startups that prefer external labs for specialized testing, regulatory reporting, and cost-efficiency without investing in infrastructure.

- By Application

On the basis of application, the North America food pathogen testing market is segmented into meat and poultry products, dairy products, processed food, plant-based meat and meat alternatives, confectionary, baby food, herbal extracts and herbs, edible oils, CBD products, honey, and spices. The meat and poultry products segment dominated the market with the highest revenue share of 34.7% in 2024, due to stringent USDA safety regulations, frequent contamination incidents, and the need for continuous microbiological monitoring throughout the supply chain.

The plant-based meat and meat alternatives segment is expected to record the fastest CAGR of 13.1% from 2025 to 2032, reflecting growing consumer demand for vegan and sustainable protein sources. This segment requires rigorous pathogen screening, particularly due to the use of novel ingredients and production processes.

North America Food Pathogen Testing Market Regional Analysis

- North America accounted for 20% of the global food pathogen testing market revenue in 2024, driven by stringent food safety regulations, advanced laboratory infrastructure, and growing consumer awareness regarding foodborne illnesses. Both the U.S. and Canada are witnessing increased adoption of rapid testing methods in meat, dairy, and processed food segments to ensure regulatory compliance and public health safety

- The market is further supported by strong investment in public health monitoring systems, a robust food export sector, and collaborations between food manufacturers and diagnostic companies for customized pathogen detection solutions

- The region’s leadership in adopting molecular diagnostic techniques (such as PCR and next-generation sequencing) and in-house quality control labs has reinforced the region’s competitive edge in pathogen testing accuracy and speed

U.S. Food Pathogen Testing Market Insight

The U.S. food pathogen testing market dominated the North American market with the largest revenue share of 78.5% in 2024, supported by a highly developed food safety infrastructure, widespread deployment of rapid testing kits, and strong oversight from agencies such as the FDA and USDA. Significant investments in laboratory automation and real-time pathogen detection technologies are driving improvements in testing turnaround times. The presence of key players such as 3M, BIOMÉRIEUX, and Neogen ensures continuous innovation and supply chain efficiency in diagnostic tools. Moreover, increasing recalls and foodborne illness outbreaks have compelled both small and large food processors to adopt in-house and external pathogen testing on a routine basis, further expanding the market.

Canada Food Pathogen Testing Market Insight

The Canada food pathogen testing market is projected to be the fastest-growing country in the region, registering a CAGR of 10.2% between 2025 and 2032. Growth is fueled by increased government funding for food surveillance programs, rising dependence on imported food products, and greater alignment with international safety standards such as HACCP and ISO 17025. The Canadian Food Inspection Agency (CFIA) has accelerated the use of molecular diagnostic tools for identifying Listeria, E. coli, and Salmonella in retail and wholesale food items, enhancing market demand. In addition, partnerships between food manufacturers and third-party testing labs are gaining momentum, particularly in provinces such as Ontario and British Columbia, which have robust agri-food sectors.

Mexico Food Pathogen Testing Market Insight

The Mexico food pathogen testing market is emerging as a significant market in North America, benefiting from its growing food exports to the U.S. and rising domestic food safety regulations. The country is increasingly adopting pathogen detection systems to ensure compliance with international standards, particularly for meat, produce, and seafood exports. Mexico is expected to witness a steady CAGR of 7.1% from 2025 to 2032, supported by growing public-private partnerships, increased emphasis on HACCP implementation, and the expansion of certified food testing labs across the nation.In addition, government-backed modernization programs in food safety and quality assurance are expected to elevate testing capabilities in both public and private sectors.

North America Food Pathogen Testing Market Share

The food pathogen testing market industry is primarily led by well-established companies, including:

- 3M (U.S.)

- PerkinElmer (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

- Agilent Technologies, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Neogen Corporation (U.S.)

- Randox Food Diagnostics (U.K.)

- FOSS (Denmark)

- Ring Biotechnology Co Ltd. (China)

- Omega Diagnostics Group PLC (U.K.)

- Romer Labs Division Holding GmbH (Austria)

Latest Developments in North America Food Pathogen Testing Market

- In July 2022, SGS inaugurated a state-of-the-art food analysis laboratory in Mexico City. This facility aids food organizations by ensuring rigorous quality checks and regulatory compliance

- In May 2022, Bureau Veritas unveil its advanced microbiology laboratory in the United States. Specializing in pathogen testing, it serves the agri-food sector with comprehensive microbiological analyses

- In April 2022, Mérieux NutriSciences' acquired the Laboratorios Bromatológicos Araba, bolstering its presence in South Africa's pesticide market. This strategic move enhances the company's capabilities in food quality, sustainability, and safety provision

- In March 2024, UPS Healthcare rolled out its Supply Chain Symphony for Healthcare, a cloud-based platform integrating transportation and warehouse data into a unified system. This solution enhances visibility, traceability, and operational efficiency—key capabilities for managing pathogen testing workflows and ensuring temperature-sensitive sample integrity

- In October 2024, SGS North America expanded its food safety and nutraceutical testing operations by opening a new, state-of-the-art testing facility in Fairfield, New Jersey. This expansion addresses rising demand for rapid turnaround food pathogen testing across meat, dairy, and produce sectors

- In May 2025, a serious E. coli outbreak traced to contaminated romaine lettuce infected nearly 90 people and drew criticism over transparency, emphasizing the need for rapid detection and information sharing across supply chains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Food Pathogen Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Food Pathogen Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Food Pathogen Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.