North America Laxative Market

Market Size in USD Billion

CAGR :

%

USD

4.31 Billion

USD

6.47 Billion

2024

2032

USD

4.31 Billion

USD

6.47 Billion

2024

2032

| 2025 –2032 | |

| USD 4.31 Billion | |

| USD 6.47 Billion | |

|

|

|

|

North America Laxative Market Size

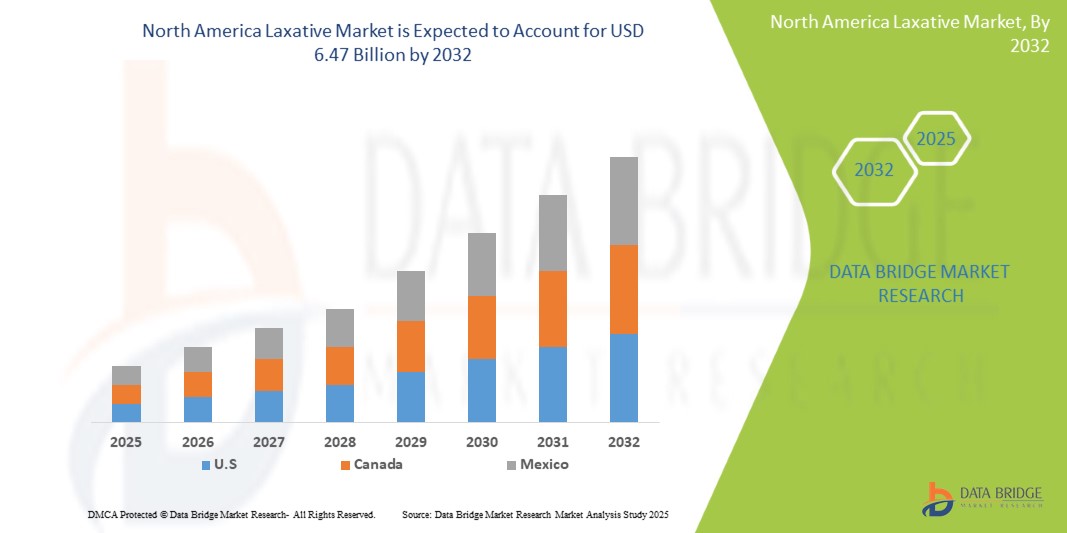

- The North America laxative market size was valued at USD 4.31 billion in 2024 and is expected to reach USD 6.47 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of gastrointestinal disorders, a growing aging population, and rising awareness about digestive health

- Rising demand for natural and plant-based laxatives is further contributing to market expansion, as consumers increasingly prefer gentle, herbal alternatives over synthetic formulations

North America Laxative Market Analysis

- An expanding elderly population across North America, especially in the U.S. and Canada, is contributing to higher incidences of chronic constipation, thereby driving the demand for laxatives

- Consumers are increasingly turning to over-the-counter laxatives and dietary supplements as first-line remedies for irregular bowel movements, influenced by the convenience and accessibility of such products

- U.S. laxative market accounted for the largest revenue share within North America in 2024, supported by a high incidence of lifestyle-induced constipation and irritable bowel syndrome

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America laxative market due to increasing focus on preventive healthcare and growing demand for natural and organic laxatives.

- The osmotic laxatives segment held the largest revenue share in 2024, primarily driven by their widespread use and consistent efficacy in treating occasional constipation. These laxatives work by drawing water into the intestines, softening stools, and facilitating bowel movements. The segment benefits from strong physician recommendation and over-the-counter accessibility, making them a reliable option for both short-term and ongoing use

Report Scope and North America Laxative Market Segmentation

|

Attributes |

North America Laxative Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Laxative Market Trends

“Increasing Shift Toward Natural And Herbal-Based Laxatives”

• Growing consumer preference for plant-based and herbal alternatives such as senna, aloe vera, and psyllium husk is reshaping the product landscape. These ingredients are perceived as safer, milder, and aligned with wellness-focused lifestyles

• Aging populations are increasingly adopting herbal options to avoid the side effects associated with long-term chemical laxative use, including dehydration or dependency

• Clean-label trends are driving demand for organic-certified and non-GMO herbal formulations in both over-the-counter and e-commerce retail sectors

• Manufacturers are reformulating traditional products to include natural fibers and botanical extracts to meet consumer expectations for transparency and holistic health benefits

• Trusted brands such as Traditional Medicinals and Nature’s Way have reported a surge in demand for herbal laxative teas and fiber supplements, particularly among U.S. wellness-focused consumers

North America Laxative Market Dynamics

Driver

“Growing Prevalence of Constipation and Digestive Disorders”

• A high number of individuals in North America suffer from chronic constipation due to lifestyle-related factors, including sedentary routines and inadequate hydration. This is especially true for aging populations, who are at higher risk of digestive issues

• Dietary patterns low in fiber and rich in processed foods contribute significantly to sluggish bowel movements, prompting consumers to seek OTC laxatives for relief

• The rising awareness of gut health and digestive wellness has led to increased self-medication using both stimulant and bulk-forming laxatives

• Medical professionals frequently recommend laxatives for patients under opioid medication, as these drugs are known to cause constipation as a side effect

• For instance, the American Gastroenterological Association estimates that around 16% of U.S. adults and over 33% of adults over 60 suffer from chronic constipation, directly driving up demand for laxative products

Restraint/Challenge

“Health Risks Associated with Long-Term Laxative Use”

• Continuous or unsupervised usage of stimulant laxatives can lead to dependency, where the bowel becomes reliant on external stimulation to function properly. This poses a long-term risk to digestive health

• Products containing harsh stimulants such as bisacodyl or senna, if overused, can cause complications such as electrolyte imbalance, dehydration, and abdominal cramping

• Regulatory authorities have become more cautious, enforcing labeling requirements and issuing warnings on over-the-counter stimulant-based laxatives to protect consumers from adverse effects

• Consumers are becoming increasingly educated about these risks through online health platforms, leading to a shift toward lifestyle changes and consultation before using such products regularly

• For instance, in 2023, the U.S. Food and Drug Administration released a public safety update concerning the risks of chronic use of stimulant laxatives, encouraging healthcare providers to offer safer alternatives and usage guidelines

North America Laxative Market Scope

The market is segmented on the basis of type, flavors, source, indication, mode of purchase, dosage form, route of administration, population type, sales channel, and distribution channel.

• By Type

On the basis of type, the North America laxative market is segmented into osmotic laxatives, stimulant laxatives, bulk laxatives, and lubricant and emollient laxatives. The osmotic laxatives segment held the largest revenue share in 2024, primarily driven by their widespread use and consistent efficacy in treating occasional constipation. These laxatives work by drawing water into the intestines, softening stools, and facilitating bowel movements. The segment benefits from strong physician recommendation and over-the-counter accessibility, making them a reliable option for both short-term and ongoing use.

The stimulant laxatives segment is expected to witness the fastest growth from 2025 to 2032, fueled by their quick action and effectiveness in managing severe or opioid-induced constipation. These products stimulate bowel muscles to contract, making them suitable for individuals with chronic bowel movement issues. Increased use in hospital and elderly care settings is also driving segment growth.

• By Flavors

On the basis of flavors, the market is segmented into with flavor and without flavor. The with flavor segment dominated the market in 2024 due to rising consumer preference for palatable dosage forms. Flavored laxatives, particularly in liquid and powder forms, are more appealing to children and elderly individuals who may find unflavored alternatives unpleasant.

The without flavor segment is expected to witness the fastest growth from 2025 to 2032, as it remains a preferred choice for those with dietary restrictions or sensitivity to additives.

• By Source

On the basis of source, the market is segmented into natural, synthetic, and others. The synthetic segment accounted for the largest market share in 2024, driven by consistent supply, stable formulations, and cost-effectiveness. These laxatives often provide faster relief and are widely available across both prescription and over-the-counter categories.

The natural segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing consumer interest in plant-based, clean-label health products such as senna, aloe vera, and psyllium husk-based laxatives.

• By Indication

On the basis of indication, the market is segmented into chronic constipation, irritable bowel syndrome with constipation, opioid-induced constipation, acute constipation, and others. The chronic constipation segment led the market in 2024 due to the high prevalence of sedentary lifestyles and dietary imbalances across North America.

The opioid-induced constipation segment is expected to witness the fastest growth from 2025 to 2032, driven by the ongoing opioid crisis and the associated need for adjunct laxative therapy among long-term opioid users.

• By Mode of Purchase

On the basis of mode of purchase, the market is segmented into prescription and over-the-counter. The over-the-counter segment held the dominant share in 2024 owing to easy availability, self-medication trends, and the wide range of OTC laxative options in pharmacy chains.

The prescription segment is expected to witness the fastest growth from 2025 to 2032, particularly for treating complex gastrointestinal conditions or when tailored treatment regimens are required.

• By Dosage Form

On the basis of dosage form, the market is segmented into tablets, capsules, powder, liquid and gels, suppositories, and others. The tablets segment led the market in 2024 due to ease of administration, portability, and extended shelf life.

The liquid and gels segment is expected to witness the fastest growth from 2025 to 2032, especially among pediatric and geriatric populations who prefer easier-to-swallow formats.

• By Route of Administration

On the basis of route of administration, the market is segmented into oral and rectal. The oral segment dominated the market with the largest share in 2024, as most laxatives are formulated for easy consumption and fast absorption through the digestive tract.

The rectal segment is expected to witness the fastest growth from 2025 to 2032, due to its effectiveness in providing immediate relief and use in clinical settings.

• By Population Type

On the basis of population type, the market is segmented into children and adults. The adults segment accounted for the largest share in 2024 due to higher incidences of lifestyle-related and medication-induced constipation among the adult population.

The children segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing cases of functional constipation and dietary-related issues in younger demographics.

• By Sales Channel

On the basis of sales channel, the market is segmented into hospitals, elderly care centers, home healthcare, pharmacy stores, grocery/health and beauty stores, and others. Pharmacy stores dominated the segment in 2024 due to widespread availability of laxative products and ease of accessibility for consumers.

The elderly care centers and home healthcare segments is expected to witness the fastest growth from 2025 to 2032, supported by aging populations and growing preference for at-home treatment solutions.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, wholesalers, and others. The wholesalers segment held the largest share in 2024 due to bulk purchasing trends among pharmacies, clinics, and retail chains.

Direct sales is expected to witness the fastest growth from 2025 to 2032, particularly among healthcare providers and institutional buyers looking for custom supply agreements and product consistency.

North America Laxative Market Regional Analysis

- U.S. laxative market accounted for the largest revenue share within North America in 2024, supported by a high incidence of lifestyle-induced constipation and irritable bowel syndrome

- The population’s preference for fast-acting, effective laxative solutions and growing consumer awareness campaigns from healthcare bodies are influencing purchase behaviors

- The popularity of fiber-based and flavored products is increasing, especially among older adults

- The expansion of online pharmacies and consumer demand for convenient formats such as gummies and powders are expected to enhance growth further

Canada Laxative Market Insight

The Canada laxative market is expected to witness the fastest growth from 2025 to 2032, supported by rising healthcare awareness and an increasing geriatric population. Canadians are becoming more proactive in managing digestive health, leading to a higher demand for over-the-counter and natural laxative products. A shift toward preventive healthcare and wellness is boosting sales of fiber-based, herbal, and flavored laxatives. Moreover, the widespread presence of pharmacies, along with the convenience of online health retail platforms, is improving consumer access to a variety of laxative formats such as tablets, powders, and liquid formulations. Government efforts to promote gut health through dietary recommendations and public health programs further complement market growth.

North America Laxative Market Share

The North America Laxative industry is primarily led by well-established companies, including:

- Prestige Consumer Healthcare Inc. (U.S.)

- Procter & Gamble (U.S.)

- Sanofi Aventis LLC U.S (U.S.)

- Mallinckrodt (U.S.)

- Abbott (U.S.)

- Avrio Health L.P (U.S.)

- LNK INTERNATIONAL INC. (U.S.)

- Salix PHARMACEUTICAL (U.S.)

Latest Developments in North America Laxative Market

- In January 2020, Fresenius Kabi Austria GmbH launched a new website providing detailed information on the use of laxatives, including lactulose. This initiative aimed to increase awareness about lactulose among consumers, boost purchase power, enhance the product portfolio, and ultimately drive net sales. The website focused on the benefits and proper use of lactulose, a synthetic laxative used to treat constipation. This move was expected to positively impact the company's sales and customer engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.