North America Wound Care Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

2.54 Billion

USD

3.81 Billion

2024

2032

USD

2.54 Billion

USD

3.81 Billion

2024

2032

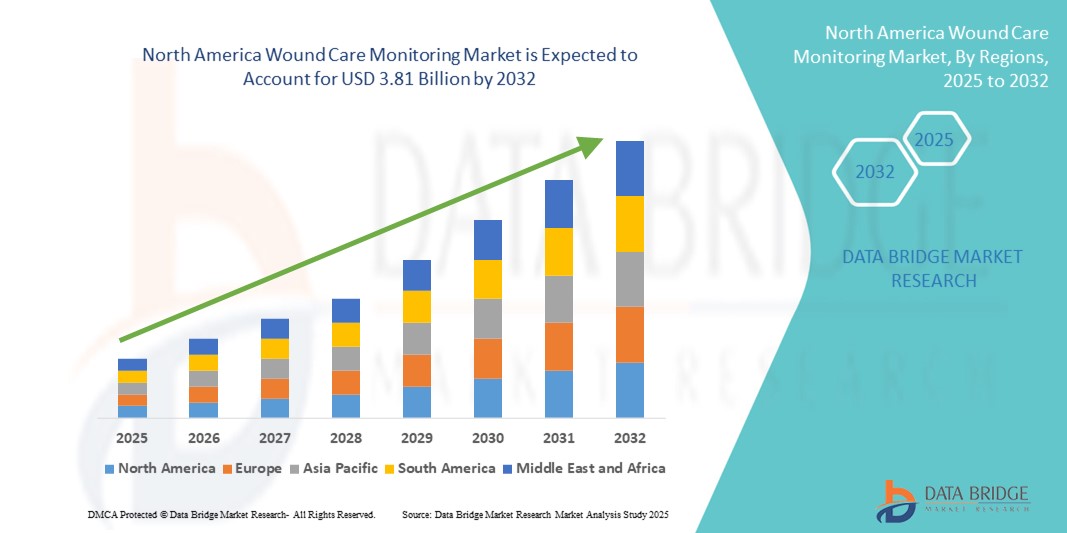

| 2025 –2032 | |

| USD 2.54 Billion | |

| USD 3.81 Billion | |

|

|

|

|

North America Wound Care Monitoring Market Size

- The North America wound care monitoring market size was valued at USD 2.54 billion in 2024 and is expected to reach USD 3.81 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely driven by increasing prevalence of chronic wounds, rising geriatric population, and the growing burden of diabetes and obesity across the region, especially in the U.S. and Canada

- Furthermore, advancements in sensor-based and AI-integrated wound monitoring technologies, along with a rising preference for home healthcare and remote monitoring solutions, are reinforcing the demand for wound care monitoring devices. These synergistic factors are accelerating the market expansion, thereby significantly boosting the industry's growth

North America Wound Care Monitoring Market Analysis

- Wound care monitoring solutions, offering real-time data on wound progression and healing status, are becoming crucial components of advanced wound management protocols in both clinical and home care settings across North America due to their ability to enhance treatment precision and reduce healing time

- The growing demand for wound care monitoring is primarily driven by the rising prevalence of chronic wounds, increasing geriatric and diabetic populations, and the shift toward value-based care emphasizing early diagnosis and remote monitoring

- U.S. dominated the North America wound care monitoring market with the largest revenue share of 42.3% in 2024, supported by advanced healthcare systems, high adoption of AI-powered diagnostic tools, and strong presence of medtech innovators focused on non-contact and image-based wound assessment technologies

- Canada is expected to be the fastest growing country in the North America wound care monitoring market during the forecast period, owing to the expansion of digital health infrastructure and growing emphasis on long-term and home-based wound care solutions

- Devices segment dominated the wound care monitoring market with a market share of 61.8% in 2024, driven by their technological advancement, integration with EHRs, and increasing use across hospitals and long-term care facilities

Report Scope and North America Wound Care Monitoring Market Segmentation

|

Attributes |

North America Wound Care Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Wound Care Monitoring Market Trends

AI-Driven Imaging and Remote Monitoring Integration

- A significant and accelerating trend in the North America wound care monitoring market is the integration of artificial intelligence (AI) with digital imaging and telehealth platforms, enhancing wound assessment accuracy, enabling predictive analytics, and supporting real-time remote care coordination

- For instance, Swift Medical’s wound imaging platform, widely used in U.S. hospitals, leverages AI and smartphone cameras to automatically measure wound dimensions, detect tissue types, and track healing progress, allowing clinicians to make data-driven decisions quickly. Similarly, MolecuLight’s fluorescence imaging devices help detect bacterial presence non-invasively, improving infection management

- AI integration enables more precise documentation and early detection of healing complications, allowing proactive intervention. These tools also support secure data sharing through cloud platforms and EHR integration, enabling efficient collaboration between providers across care settings

- The seamless adoption of these technologies is transforming wound management by minimizing subjectivity, optimizing treatment plans, and supporting continuity of care—especially in long-term care and remote patient monitoring scenarios

- This trend toward intelligent, image-based, and remotely accessible wound monitoring tools is reshaping clinical workflows. Consequently, companies such as Tissue Analytics and Spectral AI are developing advanced, AI-powered wound solutions adopted by leading healthcare networks across North America

- The demand for integrated, intelligent wound monitoring systems is rising rapidly across hospitals, long-term care facilities, and home care settings as providers seek better tools for outcome-based wound care management

North America Wound Care Monitoring Market Dynamics

Driver

Rising Chronic Wound Prevalence and Focus on Outcome-Based Care

- The increasing prevalence of chronic wounds including diabetic foot ulcers, pressure ulcers, and venous leg ulcers combined with an aging population and growing incidence of diabetes, is a key driver of the demand for advanced wound care monitoring in North America

- For instance, over 37 million Americans are living with diabetes, significantly raising the risk of slow-healing wounds that require continuous assessment and personalized care planning

- Advanced wound monitoring devices offer features such as real-time visualization, automated documentation, and remote tracking, supporting value-based care models that prioritize early intervention, reduced readmissions, and cost-effective treatment

- The growing emphasis on home healthcare, along with the expansion of telehealth services, has further increased the need for intelligent, portable wound monitoring tools capable of supporting clinicians and caregivers across a variety of care settings

Restraint/Challenge

High Device Costs and Interoperability Limitation

- The relatively high cost of advanced wound care monitoring technologies including AI-powered imaging devices and fluorescence diagnostics remains a significant restraint, especially for small healthcare providers and home care agencies operating under budget constraints

- For instance, the acquisition and implementation of image-based wound scanners may require specialized training, software licenses, and IT support, adding to the financial burden

- Furthermore, the lack of seamless interoperability with existing electronic health record (EHR) systems and inconsistent integration standards across healthcare networks creates operational inefficiencies and data silos

- Privacy concerns and regulatory compliance with standards such as HIPAA in the U.S. also pose challenges, particularly when data is transmitted over cloud-based platforms

- Addressing these issues through cost innovation, standardized integration protocols, and secure data management solutions is essential to drive wider adoption across the region

North America Wound Care Monitoring Market Scope

The market is segmented on the basis of product, modality, product type, wound type, application, end user, and distribution channel.

- By Product

On the basis of product, the North America wound care monitoring market is segmented into devices and wound assessment apps. The devices segment dominated the market with the largest revenue share of 61.8% in 2024, driven by widespread adoption in clinical settings due to their precision in wound measurement and integration with hospital information systems. These devices often include imaging systems and digital scanners, which allow healthcare providers to monitor healing progression with high accuracy. The growing demand for evidence-based wound care and the expansion of telehealth services are further fueling the uptake of these advanced monitoring tools.

The wound assessment apps segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing use of smartphones and digital health platforms. These apps allow caregivers and patients to document wound conditions remotely, enabling remote consultations and reducing in-person visits, especially in home healthcare and long-term care environments.

- By Modality

On the basis of modality, the North America wound care monitoring market is segmented into wearable and non-wearable devices. The non-wearable segment held the largest market share of 57.6% in 2024, primarily due to its extensive usage in hospitals and clinics, where high-resolution imaging and fixed assessment systems are preferred for consistent clinical evaluations. These systems are typically used during wound dressing changes and offer high reliability for chronic wound tracking.

The wearable segment is projected to grow at the fastest rate during the forecast period, driven by innovations in flexible biosensors and smart dressings. These devices enable continuous, real-time monitoring of wound temperature, moisture, and pH, promoting proactive intervention and improving wound healing outcomes in outpatient and home settings.

- By Product Type

On the basis of product type, the North America wound care monitoring market is segmented into contact wound measuring devices and non-contact wound measuring devices. The non-contact wound measuring devices segment dominated with a market share of 53.9% in 2024, owing to their reduced infection risk, ease of use, and faster data acquisition without disturbing the wound bed. These tools are particularly beneficial in managing chronic wounds in immunocompromised or elderly patients.

Contact wound measuring devices is expected to witness fastest growth during forecast period, due to relevance in resource-limited settings or for certain clinical procedures requiring direct physical measurements, but their usage is declining due to increased focus on hygiene and patient comfort.

- By Wound Type

On the basis of wound type, the North America wound care monitoring market is segmented into chronic wounds and acute wounds. The chronic wounds segment dominated the market with the largest share of 64.2% in 2024, driven by the growing incidence of diabetes, obesity, and an aging population. Chronic wounds such as diabetic foot ulcers and pressure ulcers require ongoing monitoring and documentation, making advanced wound monitoring systems essential.

Acute wounds such as surgical incisions and traumatic injuries are expected to see steady growth during forecast period, due to adoption of monitoring solutions, particularly in trauma centers and post-operative care.

- By Application

On the basis of application, the North America wound care monitoring market is segmented into wound healing monitoring, wound assessment, infection detection, and treatment monitoring. Wound healing monitoring led the segment with a market share of 38.5% in 2024, owing to the increasing emphasis on tracking healing rates for chronic wounds, enabling clinicians to adjust treatment regimens proactively and prevent complications.

Infection detection is expected to show robust growth during forecast period, fueled by innovations in fluorescence imaging and biomarker-based wound analysis that enable early identification of bacterial presence and infection risk.

- By End User

On the basis of end user, the North America wound care monitoring market is segmented into hospitals, clinics, home healthcare, long-term care facilities, trauma centers, and others. The hospitals segment held the largest revenue share of 41.1% in 2024, driven by the availability of specialized wound care teams, access to advanced imaging technologies, and the high patient volume for chronic and surgical wound treatment.

Home healthcare is expected to witness fastest growth during forecast period, particularly with the rise of aging populations and the shift toward decentralized care delivery supported by remote wound monitoring technologies.

- By Distribution Channel

On the basis of distribution channel, the North America wound care monitoring market is segmented into direct tenders and retail sales. The direct tenders segment dominated the market with the highest share of 63.4% in 2024, as hospitals and large healthcare institutions typically procure wound monitoring systems through negotiated tenders and institutional contracts for bulk purchasing.

The retail sales segment is anticipated to grow steadily during forecast period, particularly for consumer-grade wound assessment apps and portable digital tools intended for home care and outpatient settings.

North America Wound Care Monitoring Market Regional Analysis

- U.S. dominated the North America wound care monitoring market with the largest revenue share of 42.3% in 2024, supported by advanced healthcare systems, high adoption of AI-powered diagnostic tools, and strong presence of medtech innovators focused on non-contact and image-based wound assessment technologies

- U.S. healthcare providers are rapidly integrating AI-powered wound assessment tools, digital imaging systems, and remote monitoring platforms to improve clinical outcomes and reduce treatment costs, particularly in hospitals, long-term care, and home health environments

- This widespread adoption is further supported by strong healthcare infrastructure, significant R&D investments, and the presence of leading medtech companies, establishing the U.S. as the key hub for innovation and implementation of wound care monitoring solutions across both public and private care sectors

U.S. North America Wound Care Monitoring Market Insight

The U.S. wound care monitoring market captured the largest revenue share in 2024 within North America, fueled by the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure injuries, alongside increasing demand for digital health technologies. Healthcare providers are rapidly adopting AI-powered imaging systems, non-contact wound measurement tools, and remote monitoring platforms to improve care efficiency and patient outcomes. The strong presence of advanced healthcare infrastructure, coupled with favorable reimbursement frameworks and high adoption of telehealth services, continues to drive market expansion across hospitals, long-term care, and home healthcare environments.

Canada Wound Care Monitoring Market Insight

The Canada wound care monitoring market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by increased government investment in digital healthcare and the expanding burden of chronic wounds. The country is witnessing a surge in the deployment of non-invasive monitoring tools and mobile wound assessment apps, particularly in remote and aging populations. Rising awareness among healthcare professionals about the benefits of continuous wound tracking and data-driven treatment planning is also contributing to market growth, with adoption expanding across clinics, community health centers, and long-term care facilities.

Mexico Wound Care Monitoring Market Insight

The Mexico wound care monitoring market is expected to expand steadily during the forecast period, supported by the growing prevalence of diabetes-related complications and the increasing need for improved wound care in underserved regions. The government’s initiatives to strengthen primary care and chronic disease management are creating opportunities for the adoption of affordable and portable wound monitoring solutions. In addition, rising healthcare investments and partnerships with global medtech companies are encouraging the integration of digital wound assessment tools in public hospitals and outpatient settings, promoting broader access to advanced wound care technologies.

North America Wound Care Monitoring Market Share

The North America wound care monitoring industry is primarily led by well-established companies, including:

- Smith+Nephew (U.K.)

- Mölnlycke Health Care AB (Sweden)

- B. Braun SE (Germany)

- Coloplast A/S (Denmark)

- ConvaTec Group PLC (U.K.)

- Integra LifeSciences Holdings Corporation (U.S.)

- Derma Sciences, Inc. (U.S.)

- Organogenesis Inc. (U.S.)

- MiMedx Group, Inc. (U.S.)

- Hollister Incorporated (U.S.)

- Systagenix Wound Management Ltd. (U.K.)

- Kerecis Limited (Iceland)

- Essity AB (Sweden)

- Medline Industries, LP (U.S.)

- Advancis Medical (U.K.)

- Acelity L.P. Inc. (U.S.)

- Urgo Medical (France)

- Swift Medical Inc. (Canada)

What are the Recent Developments in North America Wound Care Monitoring Market?

- In April 2024, Swift Medical, a U.S.-based leader in AI-powered wound care solutions, announced the expansion of its digital wound platform across multiple long-term care facilities in the U.S. This move aims to standardize wound documentation and enable real-time monitoring using smartphone-based imaging, thereby improving clinical outcomes and reducing hospital readmissions. The development underscores Swift Medical’s commitment to transforming chronic wound care through scalable, data-driven technologies

- In March 2024, Tissue Analytics, a digital wound imaging company acquired by Net Health, partnered with a major U.S. hospital network to integrate its wound monitoring system with electronic health records (EHRs). This integration enables seamless tracking of wound progression and supports clinicians with AI-generated insights, reinforcing the shift toward intelligent and efficient wound management workflows in clinical settings

- In February 2024, MolecuLight Inc., a Canadian medical imaging firm, received expanded FDA clearance for its i:X fluorescence imaging device. The approval allows broader clinical applications for detecting bacterial presence in chronic wounds. This milestone further validates MolecuLight’s role in advancing wound diagnostics, facilitating timely and targeted interventions across U.S. wound care centers

- In January 2024, WoundVision, a U.S.-based wound care technology company, introduced an upgraded version of its Scout device, integrating thermographic imaging and analytics for enhanced early detection of pressure injuries. The updated solution is being piloted across several U.S. hospitals to support preventive wound care practices, aligning with national efforts to reduce hospital-acquired conditions and improve patient safety

- In January 2023, Spectral AI, a Dallas-based predictive diagnostics firm, secured a contract with the U.S. Biomedical Advanced Research and Development Authority (BARDA) to further develop its AI-powered DeepView system for assessing burn and wound healing. This initiative reflects the U.S. government’s investment in cutting-edge wound assessment tools that can deliver faster, more accurate evaluations in both civilian and military care environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.