Us Horse Feed Market

Market Size in USD Billion

CAGR :

%

USD

3.72 Billion

USD

5.41 Billion

2024

2032

USD

3.72 Billion

USD

5.41 Billion

2024

2032

| 2025 –2032 | |

| USD 3.72 Billion | |

| USD 5.41 Billion | |

|

|

|

|

Horse Feed Market Size

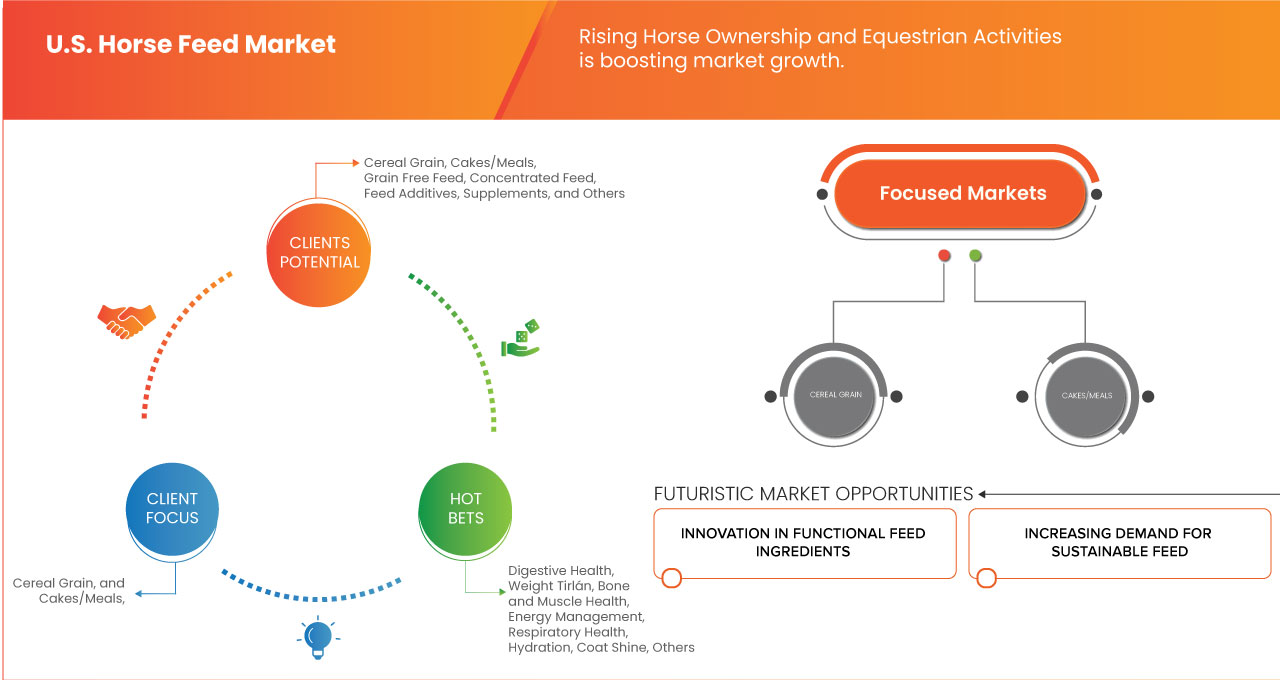

- The U.S. Horse Feed Market size was valued at USD 3.72 billion in 2024 and is expected to reach USD 5.41 billion by 2032, at a CAGR of 4.9% during the forecast period

- This growth is driven by factors such as rising horse ownership and equestrian activities and advancements in feed formulations

Horse Feed Market Analysis

- The rising global equine population, coupled with increasing participation in recreational riding, equestrian sports, and racing, is fuelling demand for specialized horse feed. Owners seek nutritional solutions that support performance, immunity, and overall health of their horses.

- Horse owners are increasingly prioritizing scientifically formulated, nutritionally balanced feed. This includes feeds enriched with vitamins, minerals, and digestive aids to prevent common ailments like colic and laminitis, ensuring optimal physical condition and longevity of horses across various use cases

- The Cereal grain segment is expected to dominate the market due to its high energy content, digestibility, and widespread availability. Grains like oats, barley, and corn provide essential nutrients that support performance and endurance in horses.

- The high fiber segment is expected to dominate the market due to its alignment with equine digestive physiology. Horses evolved to consume fiber-rich diets, relying on hindgut fermentation to derive up to 70% of their energy needs from volatile fatty acids produced during this process.

Report Scope and Horse Feed Market Segmentation

|

Attributes |

Horse Feed Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Horse feed market Trends

“Shift Toward Natural and Organic Feed”

- There is a growing preference for organic and chemical-free horse feed, driven by increased awareness of animal welfare, sustainability, and health-conscious consumer behavior among horse owners and breeders.

For instance,

- In October 2024, the BLM and Northern Nevada Correctional Center held a successful saddle-started wild horse adoption event, raising USD 74,550. With rising horse ownership and equestrian activities, demand for trained horses continues to grow, reflecting the increasing involvement in recreational and competitive horseback riding across the U.S.

- Manufacturers are developing breed-specific and performance-specific horse feeds. Customized formulations for senior horses, foals, and sport horses are gaining traction to meet unique nutritional needs and optimize health outcomes.

- Online platforms are becoming a major distribution channel for horse feed. E-commerce allows convenient access to premium products, subscription-based delivery services, and tailored nutrition advice, expanding market accessibility globally.

- Horse ownership is growing in emerging markets like India, China, and Brazil. Increasing income levels, equestrian tourism, and awareness of equine nutrition are driving new demand in these developing regions.

Horse feed market Dynamics

Driver

“RISING HORSE OWNERSHIP AND EQUESTRIAN ACTIVITIES”

- As more individuals and families engage in horseback riding, breeding, and competitive sports, the demand for specialized and nutritionally balanced horse feed continues to rise. This shift is not only driven by recreational interest but also by the expanding equine industry, including riding schools, stables, and training facilities. Horse owners are increasingly seeking high-quality feed that supports performance, immunity, and overall well-being. Moreover, the emotional bond between owners and their horses is pushing preferences toward premium, customized feeding solutions. The evolving needs of both leisure and professional riders are reshaping the feed market, encouraging innovation and tailored product offerings. This upward trend in equestrian culture directly supports long-term growth and diversification within the horse feed sector across the U.S.

For Instance,

- In 2023, the United States had an estimated 6.65 million horses, with approximately 1.5 million horse owners and 25 million individuals participating in horse-related activities. This substantial engagement underscores the nation's robust equestrian culture and its significant impact on the horse feed market.

- In May 2024, the Bureau of Land Management’s Wild Horse Adoption Incentive Program celebrated over 15,000 successful adoptions. Offering USD 1,000 incentives, the program helps manage wild horse populations but has faced criticism from advocacy groups regarding animal welfare concerns.

Opportunity

“INNOVATION IN FUNCTIONAL FEED INGREDIENTS”

- As equine nutrition shifts toward more holistic and preventive care, there is a rising opportunity to develop functional feed ingredients that address specific health challenges in horses. Modern horse owners and trainers are increasingly aware of how diet influences performance, recovery, and long-term well-being. As a result, they are actively seeking feeds enriched with targeted ingredients that provide measurable benefits—such as enhanced gut health, improved joint flexibility, reduced inflammation, and stronger immunity.

- Functional ingredients like probiotics and prebiotics are widely used to support digestive health and nutrient absorption, while omega-3 fatty acids (from flaxseed and fish oil) are being included to manage inflammation and promote healthy coats. Antioxidants such as vitamin E and selenium are also gaining ground for their role in reducing oxidative stress, particularly in performance horses.

- In addition, herbal additives like turmeric, devil’s claw, and yucca are being explored for their anti-inflammatory properties. These trends are not only reflective of growing veterinary recommendations but also mirror developments in the human health and wellness market, where clean-label and functional benefits are prioritized.

For instance,

- In April 2023, Purina Animal Nutrition launched its "SuperSport Amino Acid Supplement" for horses, a scientifically formulated product designed to enhance muscle recovery, performance, and overall fitness in equine athletes. Developed by Purina's PhD equine nutritionists, this supplement features a proprietary blend of essential amino acids, high-quality proteins, vitamins, and minerals tailored to support muscle development and repair

- In January 2024, PMC published a study demonstrating the positive effects of adding yeast-derived beta-glucans to senior horse diets. The findings suggested improved immune response and reduced markers of inflammation in older horses—encouraging feed manufacturers to explore immune-supporting additives

Restraint/Challenge

“AGE-SPECIFIC NUTRITION FEED REQUIREMENT”

- Horses require different nutritional profiles at various stages of life—foals need feeds rich in protein and calcium for growth, adult horses require balanced energy sources for maintenance or performance, and senior horses often need easily digestible feed with added joint and digestive support. This variation creates challenges for feed manufacturers in terms of product diversification, inventory management, and marketing.

- Moreover, it complicates purchasing decisions for horse owners, especially those managing multi-age groups. Selecting the right formulation can be overwhelming without proper guidance, and incorrect choices may lead to nutritional imbalances or health issues. Smaller stables and casual horse owners may also find it financially burdensome to purchase separate feeds for each age group, leading to compromises in nutrition. Manufacturers must invest heavily in R&D to produce highly targeted feeds, which increases production costs.

- Additionally, retailers must allocate more shelf space and logistical planning to manage a wider range of SKUs. These factors can hinder scalability, limit product availability in smaller markets, and pose entry barriers for new players, ultimately restraining the overall growth of the horse feed market.

Horse Feed Market Scope

The U.S. horse feed market is segmented into seven segments based on product type, nutrition type, form, age, function, packaging size, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Nutrition Type |

|

|

By Form

|

|

|

By Age

|

|

|

By Function |

|

|

BY PACKAGING SIZE |

|

|

By END USER |

|

In 2025, the Cereal grain segment is projected to dominate the market with a largest share in product type segment

In 2025, the Cereal grain segment is expected to dominate the market due to its high energy content, digestibility, and widespread availability. Grains like oats, barley, and corn provide essential nutrients that support performance and endurance in horses.

In 2025, the high fiber segment is expected to account for the largest share during the forecast period in nutrition type segment

In 2025, the high fiber segment is expected to dominate the market due to its alignment with equine digestive physiology. Horses evolved to consume fiber-rich diets, relying on hindgut fermentation to derive up to 70% of their energy needs from volatile fatty acids produced during this process.

U.S. Horse Feed Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- ADM

- Compana Pet Brands

- Alltech

- Purina Animal Nutrition

- Kent Nutrition Group

- Triple Crown Feed

- Tribute Equine Nutrition

- Bluebonnet

- Hallway Feeds

- Medalist Feed

- Total Feeds, Inc.

- Blue Chip Feed

- Cavalor

- Modesto Milling Inc.

- HYGAIN

- Red Mills

- Mars, Incorporated and its Affiliates

- TIRLÁN

Latest Developments in U.S. Horse Feed Market

- In April 2025, Alltech has been awarded four new EcoVadis sustainability medals, including two Platinum honors, recognizing its commitment to implementing environmentally and economically sustainable solutions, fostering ethical business conduct, and prioritizing the efficient production of nutritious food.

- In October 2024, Mars, Incorporated and its Affiliates announced new partnerships across North America to promote regenerative agriculture within its pet food supply chain. Through collaborations with ADM, The Andersons, Inc., Riceland Foods, and others, Mars aims to transition 150,000 acres to regenerative practices in 2024, contributing to its goal of reaching over one million acres globally by 2030 as part of its Net Zero Roadmap.

- In July 2024, Mars, Incorporated and its Affiliates completed the acquisition of Cerba HealthCare’s stake in Cerba Vet and ANTAGENE, expanding their veterinary diagnostics capabilities in France. The move strengthens Mars Petcare’s Science & Diagnostics division, supporting its mission to enhance diagnostic access and better serve pets and veterinary professionals.

- In February 2025, Dengie was awarded the Royal Warrant as a supplier of horse feed to His Majesty King Charles III, a prestigious recognition following the warrant granted by the late Queen Elizabeth II in 2007. The Royal Warrant is given to companies that have continuously supplied goods or services to the Royal Household, reflecting their high standards and commitment. Dengie’s focus on sustainability, local farming, and traceability in their feed production was central to the award.

- In September 2024, Allen & Page’s dedicated nutrition team was honoured with the prestigious BETA Award for Nutritional Helpline of the Year, sponsored by Stubbs England. This award recognises the team’s exceptional customer service, expertise, and commitment to providing tailored nutritional advice to equine owners across the country. The award highlights the team’s thorough knowledge and their dedication to helping horse owners make informed feeding decisions. Sarah Kearney, Head of Equine & Smallholder Nutrition, expressed that the recognition from BETA motivates the team to continue enhancing their services, ensuring they provide the highest standard of guidance to both novice and experienced horse owners.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF BUYERS

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING & FORMULATION

4.5.3 PACKAGING & STORAGE

4.5.4 DISTRIBUTION & LOGISTICS

4.5.5 RETAIL & SALES CHANNELS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO IN THE U.S. HORSE FEED MARKET

4.8 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS IN THE U.S. HORSE FEED MARKET

4.8.1 ANIMAL HEALTH AND PERFORMANCE NEEDS

4.8.2 INGREDIENT QUALITY AND NUTRITIONAL VALUE

4.8.3 VETERINARIAN AND PEER RECOMMENDATIONS

4.8.4 PRICE SENSITIVITY AND ECONOMIC FACTORS

4.8.5 BRAND TRUST AND PRODUCT AVAILABILITY

4.8.6 PACKAGING AND CONVENIENCE

4.8.7 SUSTAINABILITY AND ETHICAL CONCERNS

4.8.8 MARKETING AND CONSUMER EDUCATION

4.8.9 CONCLUSION

4.9 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.9.1 PRODUCT INNOVATION AND DIVERSIFICATION

4.9.2 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.9.3 GEOGRAPHIC AND CHANNEL EXPANSION

4.9.4 FOCUS ON SUSTAINABILITY AND BRAND ETHICS

4.1 IMPACT OF ECONOMIC SLOWDOWN ON THE U.S. HORSE FEED MARKET

4.10.1 IMPACT ON PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT AND DISTRIBUTION

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.11.1 RISING DEMAND FOR NATURAL AND ORGANIC HORSE FEED

4.11.2 INTEGRATION OF TECHNOLOGY AND DATA-DRIVEN FEEDING

4.11.3 SUSTAINABILITY AND ETHICAL SOURCING PRIORITIES

4.11.4 GROWTH IN SPECIALIZED AND THERAPEUTIC FEEDS

4.12 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.12.1 PRECISION NUTRITION AND CUSTOM FEED FORMULATIONS

4.12.2 SMART FEEDING SYSTEMS AND AUTOMATION

4.12.3 ENHANCED FEED PROCESSING AND PELLETIZATION TECHNOLOGIES

4.12.4 BLOCKCHAIN AND INGREDIENT TRACEABILITY SYSTEMS

4.13 RAW MATERIAL SOURCING ANALYSIS

4.13.1 GRAINS AND CEREALS (OATS, CORN, BARLEY)

4.13.2 FORAGES AND FIBERS (ALFALFA, TIMOTHY HAY, BEET PULP)

4.13.3 PROTEIN SOURCES (SOYBEAN MEAL, CANOLA MEAL, FLAXSEED)

4.13.4 ADDITIVES AND SUPPLEMENTS (VITAMINS, MINERALS, PROBIOTICS)

4.13.5 SPECIALTY AND FUNCTIONAL INGREDIENTS (HERBS, OILS, PREBIOTICS)

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 INPUT SUPPLY & SOURCING

4.14.2 FEED MANUFACTURING & FORMULATION

4.14.3 QUALITY ASSURANCE & COMPLIANCE

4.14.4 PACKAGING & WAREHOUSING

4.14.5 DISTRIBUTION & LOGISTICS

4.14.6 RETAIL & END-MARKET CHANNELS

4.14.7 AFTER-SALES SUPPORT & SERVICES

4.15 TARIFFS AND THEIR IMPACT ON THE MARKET

4.15.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.15.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.15.3 VENDOR SELECTION CRITERIA DYNAMICS

4.16 IMPACT ON SUPPLY CHAIN

4.16.1 RAW MATERIAL PROCUREMENT

4.16.2 MANUFACTURING AND PRODUCTION

4.16.3 LOGISTICS AND DISTRIBUTION

4.16.4 PRICE PITCHING AND POSITION OF MARKET

4.17 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.17.1 SUPPLY CHAIN OPTIMIZATION

4.17.2 JOINT VENTURE ESTABLISHMENTS

4.18 IMPACT ON PRICES

4.19 REGULATORY INCLINATION

4.19.1 GEOPOLITICAL SITUATION

4.19.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.19.2.1 FREE TRADE AGREEMENTS (FTAS)

4.19.2.2 ALLIANCES ESTABLISHMENTS

4.19.3 STATUS ACCREDITATION (INCLUDING MFN)

4.19.4 DOMESTIC COURSE OF CORRECTION

4.19.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.19.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING HORSE OWNERSHIP AND EQUESTRIAN ACTIVITIES

6.1.2 ADVANCEMENTS IN FEED FORMULATIONS

6.1.3 EXPANSION OF PREMIUM AND ORGANIC FEED PRODUCTS

6.2 RESTRAINTS

6.2.1 AGE-SPECIFIC NUTRITION FEED REQUIREMENT

6.2.2 VULNERABILITY TO RAW MATERIAL PRICE VOLATILITY

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN FUNCTIONAL FEED INGREDIENTS

6.3.2 INCREASING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY FEED SOLUTIONS

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL REGULATIONS AND FEED SAFETY STANDARDS

6.4.2 RISKS OF CONTAMINATION IN ANIMAL FEED

7 U.S. HORSE FEED MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CEREAL CRAIN

7.3 CAKES/MEALS

7.4 GRAIN FREE FEED

7.5 CONCENTRATED FEED

7.6 FEED ADDITIVES

7.7 SUPPLEMENTS

7.8 OTHERS

8 U.S. HORSE FEED MARKET, BY NUTRITION TYPE

8.1 OVERVIEW

8.2 HIGH FIBER

8.3 STARCH CONTENT

8.4 HIGH-ENERGY FEEDS

8.5 PROTEIN-ENHANCED FEEDS

8.6 HIGH FATS AND OILS

8.7 VITAMIN & MINERAL FORTIFIED FEEDS

9 U.S. HORSE FEED MARKET, BY FORM

9.1 OVERVIEW

9.2 PELLET

9.3 CUBES

9.4 POWDER

9.5 FLAKES

9.6 OTHERS

10 U.S. HORSE FEED MARKET, BY AGE

10.1 OVERVIEW

10.2 MARE AND FOAL

10.3 SENIOR/OLD

10.4 YEARLING

10.5 STALLIONS

10.6 OTHERS

11 U.S. HORSE FEED MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 DIGESTIVE HEALTH

11.3 WEIGHT TIRLÁN

11.4 BONE AND MUSCLE HEALTH

11.5 ENERGY MANAGEMENT

11.6 RESPIRATORY HEALTH

11.7 HYDRATION

11.8 COAT SHINE

11.9 OTHERS

12 U.S. HORSE FEED MARKET, BY PACKAGING SIZE

12.1 OVERVIEW

12.2 MORE THAN 25KG

12.3 10-25KG

12.4 5-10KG

12.5 LESS THAN 5KG

13 U.S. HORSE FEED MARKET, BY END USER

13.1 OVERVIEW

13.2 INDIVIDUAL HOBBYIST

13.3 SPORTS CLUBS

13.4 FARMERS

13.5 OTHERS

14 U.S. HORSE FEED MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: U.S.

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KENT NUTRITION GROUP

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 HALLWAY FEEDS

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 BLUEBONNET

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 CAVALOR

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 ALLTECH

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT/NEWS

16.6 ADM

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 BLUE CHIP FEED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CARGILL, INCORPORATED. (NUTRENA)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 COMPANA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HYGAIN

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MARS, INCORPORATED AND ITS AFFILIATES

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 MEDALIST FEED

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MODESTO MILLING INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 PURINA ANIMAL NUTRITION LLC

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 RED MILLS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 TRIBUTE EQUINE NUTRITION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 TRIPLE CROWN FEED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 TOTAL FEEDS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 TIRLÁN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 U.S. HORSE FEED MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. HORSE FEED MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 6 U.S. CEREAL CRAIN IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. CAKES/MEALS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. CONCENTRATED FEED IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. FEED ADDITIVES IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. VITAMINS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. MINERALS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. MACRO MINERALS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. ORGANIC TRACE MINERALS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. YEAST IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. OMEGA-3/OMEGA-6 FATTY ACIDS IN HORSE FEED MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. PROBIOTICS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. PREBIOTICS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. AMINO ACIDS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. DIGESTIVE ENZYMES IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. PHYTOGENIC IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. MYCOTOXIN BINDERS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. ORGANIC IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. INORGANIC IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. FEED ACIDIFIERS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. SUPPLEMENTS IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. HORSE FEED MARKET, BY NUTRITION TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. SERVICES IN HORSE FEED MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. HORSE FEED MARKET, BY FORM,2018-2032 (USD THOUSAND)

TABLE 29 U.S. HORSE FEED MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. HORSE FEED MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. HORSE FEED MARKET, BY ENERGY MANAGEMENT, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. HORSE FEED MARKET, BY PACKAGING SIZE 2018-2032 (USD THOUSAND)

TABLE 33 U.S. HORSE FEED MARKET, BY END USER 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. HORSE FEED MARKET

FIGURE 2 U.S. HORSE FEED MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HORSE FEED MARKET: DROC ANALYSIS

FIGURE 4 U.S. HORSE FEED MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. HORSE FEED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HORSE FEED MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. HORSE FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. HORSE FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. HORSE FEED MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. HORSE FEED MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 U.S. HORSE FEED MARKET: SEGMENTATION

FIGURE 12 U.S. HORSE FEED MARKET: EXECUTIVE SUMMARY

FIGURE 13 SEVEN SEGMENTS COMPRISE THE U.S. HORSE FEED MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING HORSE OWNERSHIP AND EQUESTRIAN ACTIVITIES IS EXPECTED TO DRIVE THE U.S. HORSE FEED MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE CEREAL GRAIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE U.S. HORSE FEED MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 U.S. HORSE FEED MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/ KG)

FIGURE 20 VALUE CHAIN OF U.S. HORSE FEED MARKET

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL ALPHA-METHYLSTYRENE MARKET

FIGURE 22 U.S. HORSE FEED MARKET, BY PRODUCT TYPE, 2018-2032

FIGURE 23 U.S. HORSE FEED MARKET, BY NUTRITION TYPE, 2018-2032

FIGURE 24 U.S. HORSE FEED MARKET: BY FORM, 2018-2032

FIGURE 25 U.S. HORSE FEED MARKET, BY AGE, 2018-2032

FIGURE 26 U.S. HORSE FEED MARKET, BY FUNCTION, 2018-2032

FIGURE 27 U.S. HORSE FEED MARKET, BY PACKAGING SIZE, 2018-2032

FIGURE 28 U.S. HORSE FEED MARKET, BY END USER, 2018-2032

FIGURE 29 U.S. HORSE FEED MARKET: COMPANY SHARE 2024 (%)

Us Horse Feed Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Horse Feed Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Horse Feed Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.