Market Analysis and Size

Over the past few years, residential undercounter refrigerators have become popular amongst consumers as these products have evolved to serve increasing consumer needs. The demand for undercounter refrigerator is increasing in residential market due to change in lifestyle of consumers. In addition, pandemic and lockdown forced people to stay indoors that’s when the need for residential undercounter refrigerator was felt by people as they were stocking beverages to avoid stepping out. Moreover, a lot of people are likely to make a home bar which is fulfilled by using residential undercounter refrigerators.

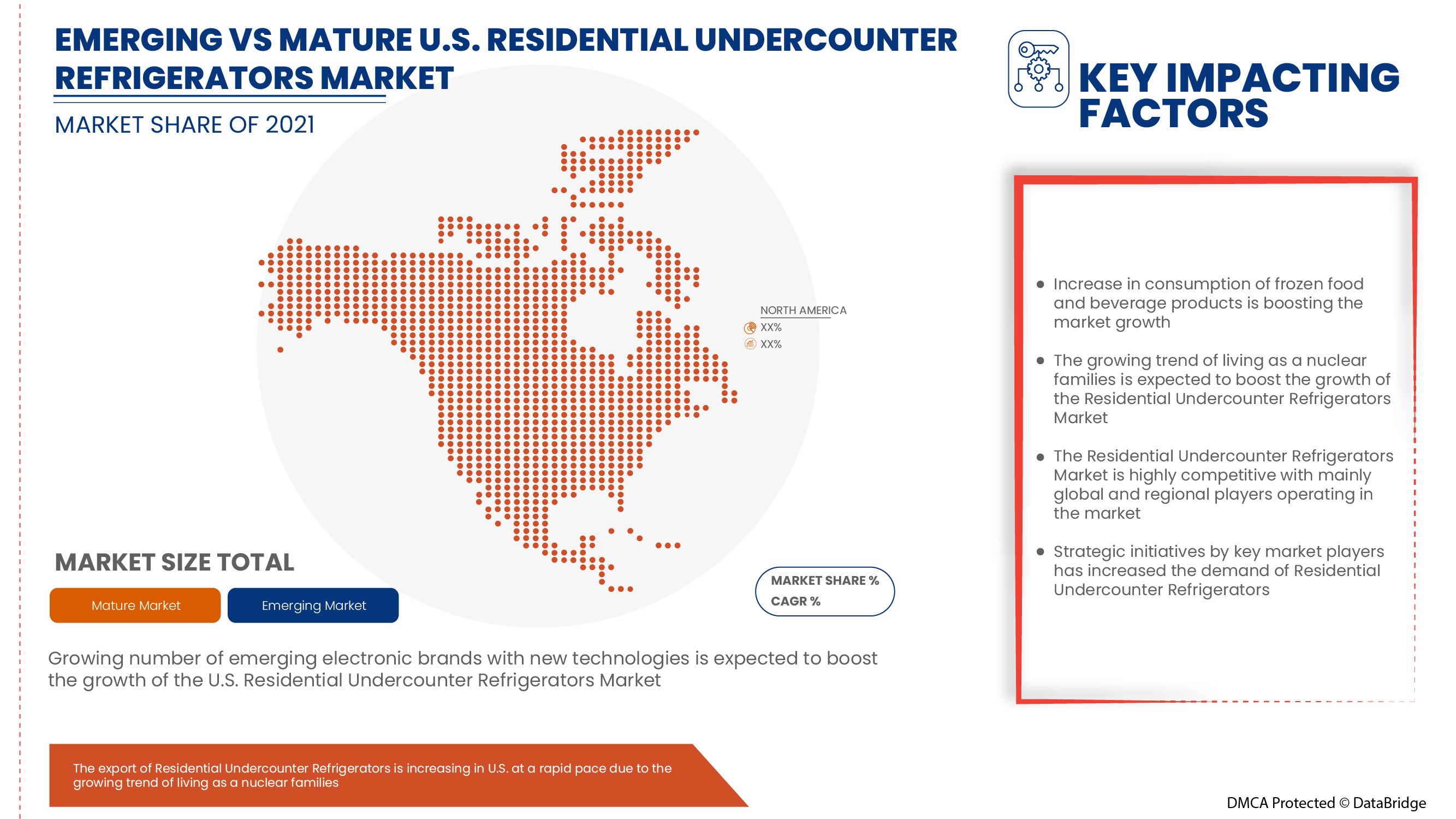

Increase in consumption of frozen foods and beverage products, rise in consumer disposable income, and growing trend of living as a nuclear family are some of the drivers boosting the residential undercounter refrigerators’ demand in the market. However, high maintenance and service cost of undercounter refrigerators is restraining its growth in the market.

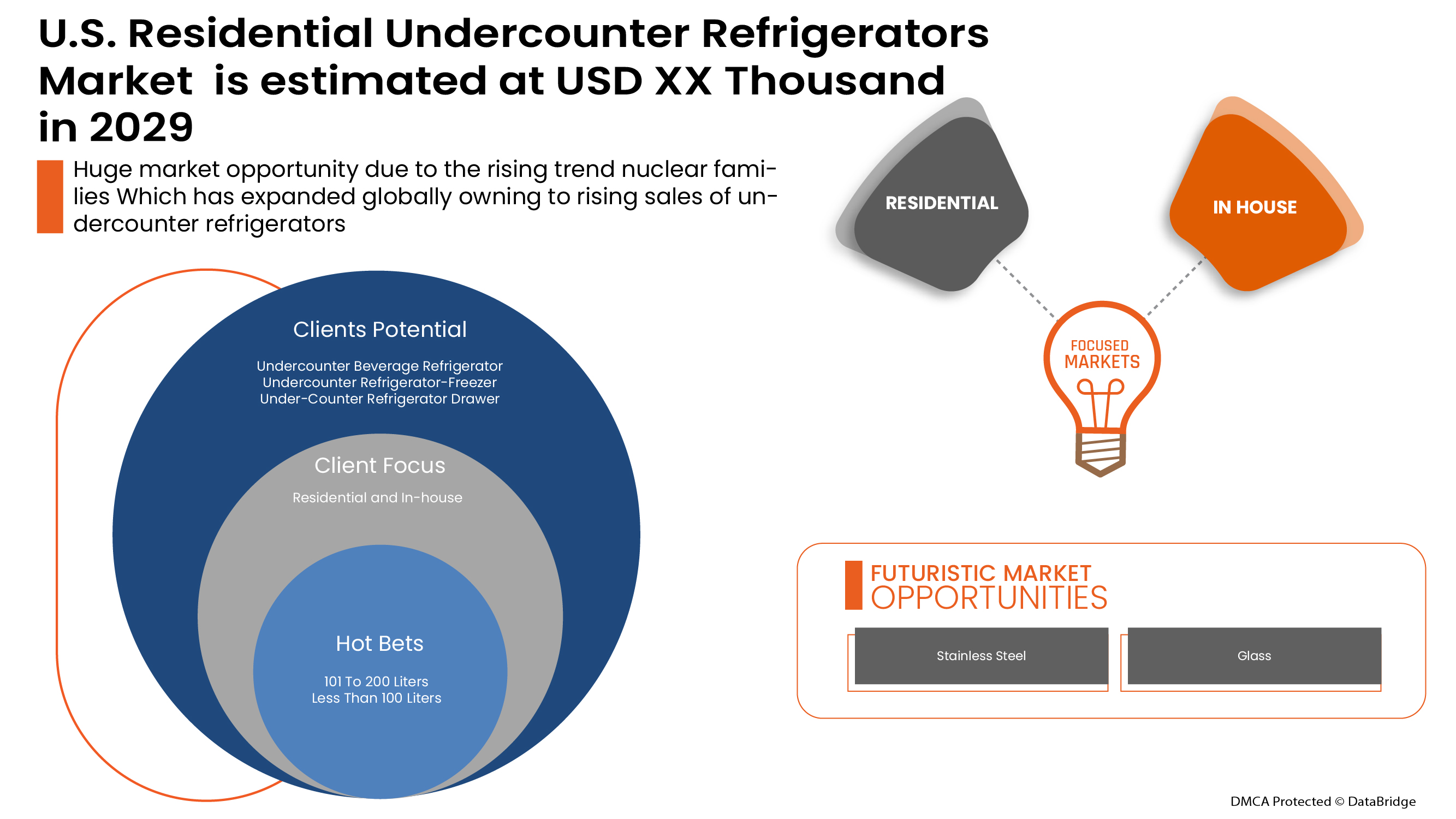

Data Bridge Market Research analyses that the residential undercounter refrigerator market is expected to grow at a CAGR of 2.8% during the forecast period. “Undercounter Beverage Refrigerator” accounts for the most prominent product segment in the respective market owing to rise in trend of home bar. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Undercounter Beverage Refrigerator, Undercounter Refrigerator Drawer, Undercounter Refrigerator Freezer), Hinge (Right Hinge, Left Hinge), Capacity (Less Than 100 Liters, 101 To 200 Liters, Others), Size (15 Inch, 24 Inch, 34 Inch), Door Material (Glass, Stainless Steel), Temperature Control (Automated, Manual), Distribution Channel (Supermarkets/Hypermarkets, Electronics And Appliance Store, E-Commerce, Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

LIEBHERR (Baden-Württemberg, Germany), True Manufacturing Co., Inc. (Missouri, U.S.), Summit Appliance (Brand of FELIX STORCH, INC.) (New York, U.S.), The Middleby Corporation (Illinois, U.S.), Perlick Corporation (Wisconsin, U.S.) (), Whirlpool Corporation (Michigan, U.S.), Haier Group (Qingdao, China), Danby (Ontario, Canada), Smeg S.p.A. (Guastalla, Italy), Sub-Zero Group, Inc. (Wisconsin, U.S.), among others. |

Market Definition

Undercounter refrigerators are small enough to be placed under kitchen counter or under any other counter in residential places. The undercounter refrigerators are available in a wide range of temperature and size that can be used for small to medium applications. They are used to store and preserve beverages such as wine, juices, soft drinks, smoothies, and others. It can also be used as a mini refrigerator and food products can also be stored in it. The undercounter refrigerators are available in three types such as undercounter beverage refrigerator, undercounter refrigerator drawer, and undercounter refrigerator freezer.

Regulatory Framework

National Energy Conservation and Policy Act (NEPCA): The act states the policy of the United States that the Federal Government has the responsibility to promote the use of energy conservation and solar heating and cooling in Federal buildings. The purpose of this act is to provide for the regulation of interstate commerce, to reduce the growth in demand for energy in the United States, and to conserve nonrenewable energy resources produced both in commercial and residential sectors.

Market Dynamics of the U.S. Residential Undercounter Refrigerators Market Include:

Drivers/Opportunities in the U.S. Residential Undercounter Refrigerators Market

- Increase in consumption of frozen food and beverage products

Frozen food and beverage items include pre-washed, cooked, mostly packaged, ready-to-eat foods. Western culture strongly influences consumers due to tight schedules where everything is quick and easy. People have been looking for faster, easier-to-prepare, and healthier options than other foods and quick snacks on the market.

Also, frozen foods are among the fastest-growing categories in grocery, with clear indications that consumers' affinity for frozen food will continue to grow. Consumers across the globe want convenient, accessible, easily online options. This, in turn, increases the demand for small compatible refrigerators for storing and preserving food items.

- Growing trend of living as a nuclear family

Nuclear families have changed the way refrigerators are used. This has given the concept of mini refrigerators capable of storing drinks, water, milk, and other food snacks. A small fridge can store the stuff properly with an excellent cooling effect, and also it is capable of freezing with freezer compartments.

- Positive outlook toward the smart home concept

The smart home integrates technology and services through home networking for a better quality of living to facilitate the user's life in many different ways and make it more comfortable by using technology. The main objective of the smart home functions is to improve the quality of life and provide convenience in the home, along with ensuring greater security and efficiency with the use of remote-controllable devices. Smart kitchen appliances, such as mini compatible refrigerators, are among those kitchen appliances which can be self-controlled and easily handed.

- Government initiatives toward energy-efficient home appliances

Smart home appliances include advanced home and kitchen automation technology that improves the way governments monitor and control machinery, heating, cooling, and lighting systems in residential places across the countries, increasing the efficiency of these systems. In recent years, the U.S. government has made various research activities and investments to develop innovative and advanced home and kitchen appliances such as smart undercounter refrigerators, which would be more energy efficient in the long run.

Restraints/Challenges faced by the U.S. Residential Undercounter Refrigerator Market

- High maintenance and service cost of undercounter refrigerators

The cost of running an undercounter fridge depends on how much power it consumes daily. Factors such as size and refrigerator feature influence the power used, but a great portion of the cost also depends on the maintenance and service expenses that must be spent on the mini refrigerators. The mini refrigerators require cleaning once a week to take care of any odors or potential bacteria growth inside the fridge.

- Difficulties in recycling of waste materials and gas

Waste generated during the manufacturing of electronic goods and from the used electronic products of metal harms the environment to a larger extent. Large amounts of metals are used in industrial processes every day, widely used in producing different appliances ranging from undercounter refrigerators to various electronic materials. In recent times, metal has become an indispensable and versatile product with a wide range of properties, chemical composition, and applications, which as a result, creates a problem at the time of disposal.

COVID-19 had a Minimal Impact on U.S. Residential Undercounter Refrigerator Market

COVID-19 impacted various manufacturing and service providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to the outbreak of COVID-19 throughout the globe, the demand for residential undercounter refrigerator was decreased. Thus, electrical appliances industry suffered a lot during the pandemic, the residential undercounter refrigerator industry will hopefully grow with the removed restrictions in France.

Recent Developments

- In May 2021, Whirlpool Corporation announced that it is investing $15 million into its factory in Tulsa, Oklahoma as part of the company’s ongoing efforts to further strengthen its U.S. manufacturing capabilities and bring even more innovation, top ranking consumer products and high-quality jobs to the region. In conjunction with its investment, Whirlpool Corporation will receive an additional $1 million from the state of Oklahoma through its Business Expansion Investment Program (BEIP).

- In March 2021, Liebherr launched a new range of fully integrated appliances focusing more strongly on technical innovations, energy efficiency and intelligent features in its new generation of refrigerating appliances by using the new HydroBreeze function.

U.S. Residential Undercounter Refrigerators Market Scope

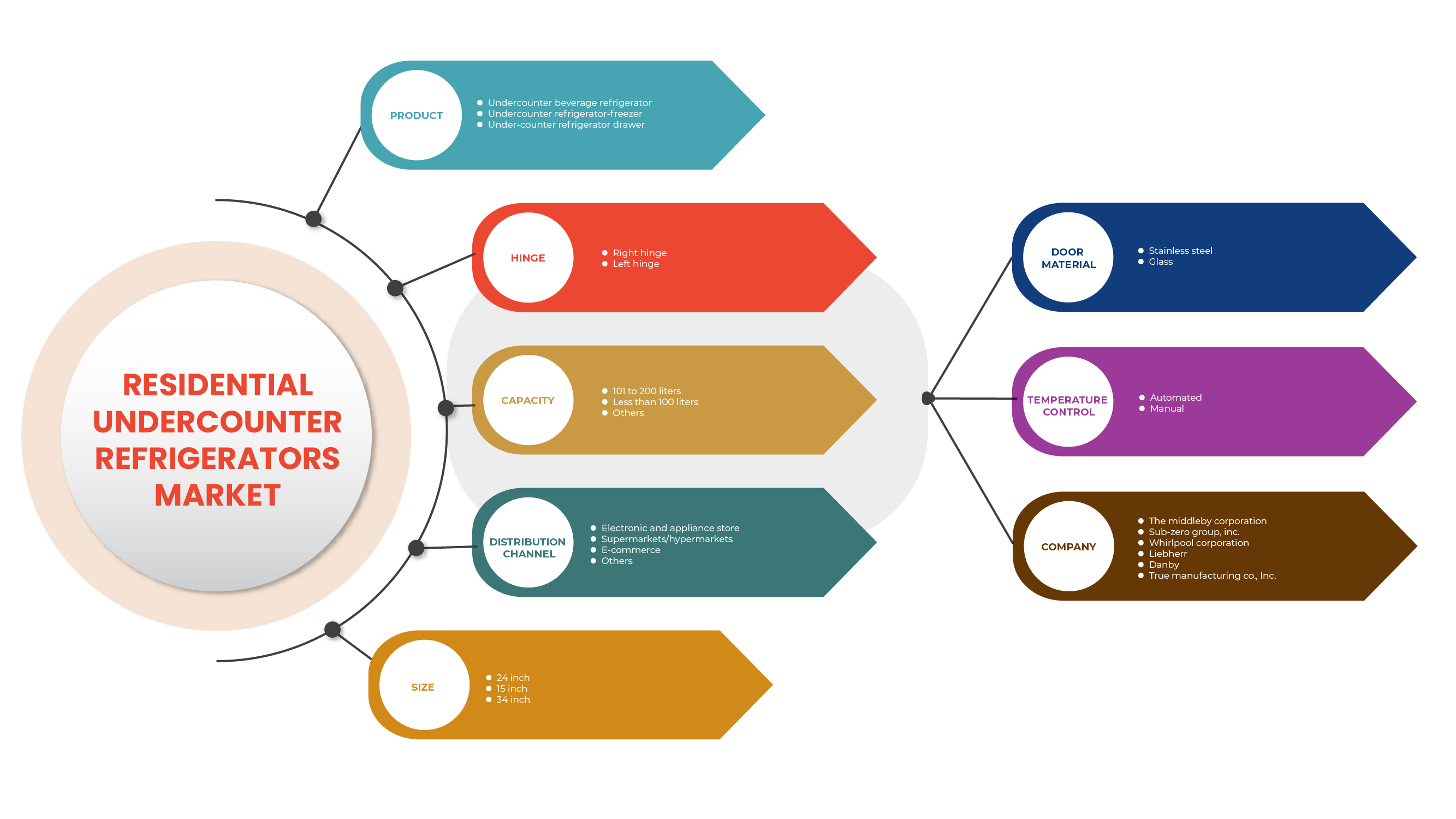

The residential undercounter refrigerator market is segmented on the basis of product, hinge, capacity, size, door material, temperature control and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Undercounter Beverage Refrigerator

- Undercounter Refrigerator Drawer

- Undercounter Refrigerator Freezer

On the basis of product, the U.S. residential undercounter refrigerators market is segmented into undercounter beverage refrigerator, undercounter refrigerator drawer, and undercounter refrigerator freezer.

Hinge

- Right Hinge

- Left Hinge

On the basis of hinge, the U.S. residential undercounter refrigerators market is segmented into right hinge and left hinge.

Capacity

- Less Than 100 Liters

- 101 To 200 Liters

- Others

On the basis of capacity, the U.S. residential undercounter refrigerators market is segmented into less than 100 liters, 101 to 200 liters and others.

Size

- 15 Inch

- 24 Inch

- 34 Inch

On the basis of size, the U.S. residential undercounter refrigerators market is segmented into 15 inch, 24 inch and 34 inch.

Door Material

- Glass

- Stainless Steel

On the basis of door material, the U.S. residential undercounter refrigerators market is segmented into glass and stainless steel.

Temperature Control

- Automated

- Manual

On the basis of temperature control, the U.S. residential undercounter refrigerators market is segmented into automated and manual.

Distribution Channel

- Supermarkets/Hypermarkets

- Electronics And Appliance Store

- E-Commerce

- Others

On the basis of distribution channel, the U.S. residential undercounter refrigerators market is segmented into supermarkets/hypermarkets, electronics and appliance store, e-commerce and others.

Competitive Landscape and Residential Undercounter Refrigerator Market Share Analysis

The U.S. residential undercounter refrigerator market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.S. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to residential undercounter refrigerator market.

Some of the major market players engaged in the U.S. residential undercounter refrigerators market are LIEBHERR, True Manufacturing Co., Inc., Summit Appliance (Brand of FELIX STORCH, INC.), The Middleby Corporation, Perlick Corporation, Whirlpool Corporation, Haier Group, Danby, Smeg S.p.A, Sub-Zero Group, Inc., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT CATEGORY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 IMPORT-EXPORT DATA

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VENDOR SELECTION CRITERIA

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRICING ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 REGULATION COVERAGE

4.6 PESTEL ANALYSIS

4.6.1 OVERVIEW

4.6.2 POLITICAL FACTORS

4.6.3 ENVIRONMENTAL FACTORS

4.6.4 SOCIAL FACTORS

4.6.5 TECHNOLOGICAL FACTORS

4.6.6 ECONOMICAL FACTORS

4.6.7 LEGAL FACTORS

4.6.8 CONCLUSION

4.7 CONSUMER BEHAVIOR ANALYSIS

4.7.1 OVERVIEW

4.7.2 CONSUMER TRENDS AND PREFERENCES

4.7.3 FACTORS AFFECTING BUYING DECISION

4.7.3.1 PURCHASING POWER

4.7.3.2 MARKETING

4.7.3.3 SOCIAL FACTORS

4.7.3.4 PSYCHOLOGICAL FACTORS

4.7.3.5 ECONOMIC CONDITIONS

4.7.3.6 CONSUMER'S EXPERIENCE

4.7.3.7 PURCHASE DECISION AND WILLINGNESS TO PAY

4.7.4 CONSUMER PRODUCT ADOPTION

4.7.4.1 PERSONAL INFLUENCE

4.7.4.2 PRODUCT INNOVATION CHARACTERISTICS

4.7.4.3 WILLINGNESS TO EMBRACE NEW PRODUCTS

4.7.4.4 CONCLUSION

4.8 COUNTRY ANALYSIS (2021-22)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN CONSUMPTION OF FROZEN FOOD AND BEVERAGE PRODUCTS

5.1.2 THE GROWING TREND OF LIVING AS A NUCLEAR FAMILY

5.1.3 POSITIVE OUTLOOK TOWARD THE SMART HOME CONCEPT

5.2 RESTRAINT

5.2.1 HIGH MAINTENANCE AND SERVICE COST OF UNDERCOUNTER REFRIGERATORS

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES TOWARD ENERGY-EFFICIENT HOME APPLIANCES

5.3.2 GROWING NUMBER OF EMERGING ELECTRONIC BRANDS WITH NEW TECHNOLOGIES

5.4 CHALLENGE

5.4.1 DIFFICULTIES IN RECYCLING OF WASTE MATERIALS AND GAS

6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 UNDERCOUNTER BEVERAGE REFRIGERATOR

6.3 UNDERCOUNTER REFRIGERATOR-FREEZER

6.4 UNDER-COUNTER REFRIGERATOR DRAWER

7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY HINGE

7.1 OVERVIEW

7.2 RIGHT HINGE

7.3 LEFT HINGE

8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY CAPACITY

8.1 OVERVIEW

8.2 101 TO 200 LITERS

8.3 LESS THAN 100 LITERS

8.4 OTHERS

9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY SIZE

9.1 OVERVIEW

9.2 24 INCH

9.3 15 INCH

9.4 34 INCH

10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DOOR MATERIAL

10.1 OVERVIEW

10.2 STAINLESS STEEL

10.3 GLASS

11 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY TEMPERATURE CONTROL

11.1 OVERVIEW

11.2 AUTOMATED

11.3 MANUAL

12 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 ELECTRONIC AND APPLIANCE STORE

12.3 SUPERMARKETS/HYPERMARKETS

12.4 E-COMMERCE

12.5 OTHERS

13 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.1.1 MERGER & ACQUISITION

13.1.2 EXPANSIONS AND PARTNERSHIP

13.1.3 NEW PRODUCT DEVELOPMENT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THE MIDDLEBY CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 SUB-ZERO GROUP, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT UPDATES

15.3 WHIRLPOOL CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 DANBY

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT UPDATES

15.5 HAIER GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 LIEBHERR

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 PERLICK CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 SMEG S.P.A

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 SUMMIT APPLIANCE (BRAND OF FELIX STORCH, INC.)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 TRUE MANUFACTURING CO., INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF HOUSEHOLD REFRIGERATORS, COMPRESSION-TYPE; HS CODE - 841821 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HOUSEHOLD REFRIGERATORS, COMPRESSION-TYPE; HS CODE - 841821 (USD THOUSAND)

TABLE 3 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 5 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY HINGE, 2020-2029 (USD THOUSAND)

TABLE 6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DOOR MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY TEMPERATURE CONTROL, 2020-2029 (USD THOUSAND)

TABLE 10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: SEGMENTATION

FIGURE 2 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DROC ANALYSIS

FIGURE 4 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: HINGE LIFE LINE CURVE

FIGURE 7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: CHALLENGE MATRIX

FIGURE 11 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: SEGMENTATION

FIGURE 13 INCREASE IN CONSUMPTION OF FROZEN FOOD AND BEVERAGE PRODUCTS IS EXPECTED TO DRIVE THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 UNDERCOUNTER BEVERAGE REFRIGERATOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET IN 2022 & 2029

FIGURE 15 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: PESTEL ANALYSIS

FIGURE 16 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: FACTORS AFFECTING BUYING DYNAMICS OF THE CONSUMERS

FIGURE 17 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 18 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET

FIGURE 19 SMART HOMES CONNECTIONS IN U.S. (MILLIONS)

FIGURE 20 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY PRODUCT, 2021

FIGURE 21 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY HINGE, 2021

FIGURE 22 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY CAPACITY, 2021

FIGURE 23 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY SIZE, 2021

FIGURE 24 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY DOOR MATERIAL, 2021

FIGURE 25 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY TEMPERATURE CONTROL, 2021

FIGURE 26 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.