Global Gastrointestinal Otc Drugs Market

Размер рынка в млрд долларов США

CAGR :

%

USD

45.02 Billion

USD

78.52 Billion

2024

2032

USD

45.02 Billion

USD

78.52 Billion

2024

2032

| 2025 –2032 | |

| USD 45.02 Billion | |

| USD 78.52 Billion | |

|

|

|

|

Global Gastrointestinal OTC Drugs Market Segmentation, By Drug Class (Antacids, Laxatives, Anti-Diarrheal, Anti-Emetics, and Others), Indications (Heartburn, Diarrhoea, Constipation, Gastroesophageal Reflux Disease (GERD Nausea, Vomiting, Motion Sickness, and Others), End-Users (Hospitals, Clinics, Home Healthcare, and Others), Distribution Channel (Direct Tender, Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others) – Industry Trends and Forecast to 2032

Gastrointestinal OTC Drugs Market Analysis

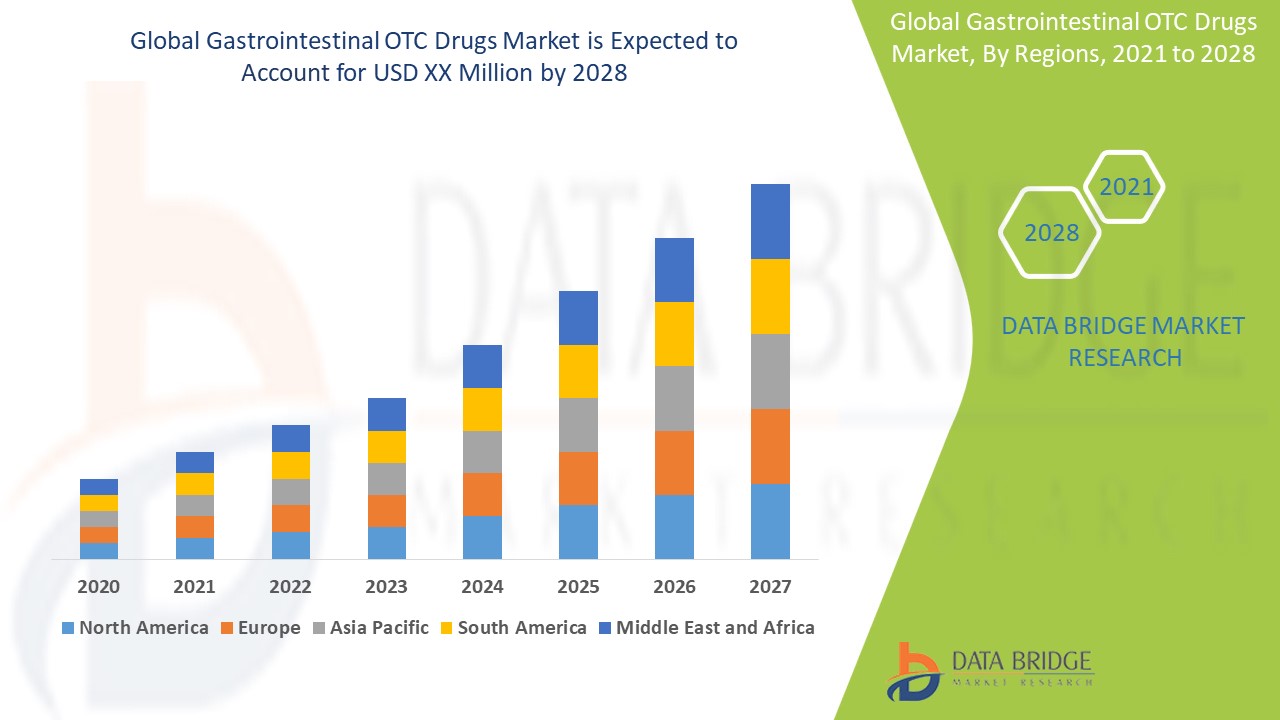

The gastrointestinal OTC drugs market includes over-the-counter medications designed to treat various digestive issues such as heartburn, indigestion, constipation, diarrhea, and nausea. This market is driven by increasing self-medication trends, rising prevalence of gastrointestinal disorders, and greater consumer awareness about the availability of OTC remedies. The convenience and accessibility of OTC drugs have boosted their popularity, as people seek quick relief without the need for a doctor’s prescription. Recent developments in the market include the introduction of new formulations, such as liquid and chewable tablets, and products targeting a broader range of digestive problems. The market has also seen innovations in natural and probiotic-based drugs, which appeal to health-conscious consumers. North America and Europe dominate the market, due to advanced healthcare infrastructure and high consumer awareness, while the Asia Pacific region shows significant growth potential due to rising healthcare access and changing lifestyles. The market is expected to expand further as demand for effective, accessible treatments increases.

Gastrointestinal OTC Drugs Market Size

The global gastrointestinal OTC drugs market size was valued at USD 45.02 billion in 2024 and is projected to reach USD 78.52 billion by 2032, with a CAGR of 7.20% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Gastrointestinal OTC Drugs Market Trends

“Rising Prevalence of Digestive Disorders”

The gastrointestinal OTC drugs market is witnessing significant growth, driven by the increasing demand for self-medication and the rising prevalence of digestive disorders. Consumers are increasingly seeking over-the-counter solutions for issues such as heartburn, constipation, and diarrhea due to their convenience and accessibility. One major innovation in this market is the development of probiotic-based treatments, which support digestive health and appeal to health-conscious consumers. A key trend is the rising shift towards natural and herbal remedies, as many consumers opt for products with fewer chemicals. The market is also evolving with the introduction of more advanced formulations, such as chewable tablets and liquid versions, providing easier consumption. With increasing awareness and evolving consumer preferences, the gastrointestinal OTC drugs market is poised for steady growth.

Report Scope and Gastrointestinal OTC Drugs Market Segmentation

|

Attributes |

Gastrointestinal OTC Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

Viatris Inc. (U.S.), Sandoz AG (Switzerland), Johnson & Johnson Services, Inc. (U.S.), Sun Pharmaceuticals Industries Limited (India), Teva Pharmaceuticals Industries Ltd. (Israel), Zydus Cadila (India), Sanofi (France), Bayer AG (Germany), Pfizer Inc. (U.S.), Abbott (U.S.), Lupin (India), GSK Plc. (U.K.), Prestige Consumer Healthcare Inc. (U.S.), Procter & Gamble (U.S.), Amneal Pharmaceuticals LLC (U.S.), Hikma Pharmaceutical PLC (U.K.), Perrigo Company plc. (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Gastrointestinal OTC Drugs Market Definition

Gastrointestinal OTC (over-the-counter) drugs are medications available without a prescription to treat various digestive issues, including heartburn, constipation, diarrhea, and nausea. These drugs, such as antacids, laxatives, and anti-diarrheals, provide accessible relief for mild to moderate gastrointestinal discomfort. They are commonly available in forms such as tablets, liquids, or chewables, and are designed for self-medication and ease of use.

Gastrointestinal OTC Drugs Market Dynamics

Drivers

- Increasing Prevalence of Digestive Disorders

The rising cases of gastrointestinal conditions such as acid reflux, constipation, and irritable bowel syndrome (IBS) are significantly driving the demand for over-the-counter (OTC) treatments. As these conditions become more prevalent globally, especially due to lifestyle changes, poor diets, and increased stress, consumers are seeking convenient and accessible solutions for relief. OTC medications such as antacids, laxatives, and anti-diarrheals offer an easy and cost-effective way to manage these symptoms without requiring a doctor’s prescription. This growing demand for self-medication contributes directly to the expansion of the gastrointestinal OTC drugs market, making it a key market driver.

- Growing Preference for Self-Medication

Consumers are increasingly choosing over-the-counter (OTC) products for gastrointestinal issues because of their convenience, accessibility, and cost-effectiveness. OTC medications eliminate the need for a doctor’s visit or prescription, providing quick relief for common conditions such as heartburn, constipation, and indigestion. The ease of purchasing these products from pharmacies or online retailers further appeals to consumers, especially those with busy lifestyles. In addition, OTC products are often more affordable than prescription medications, making them an attractive option for individuals seeking cost-effective solutions. This growing preference for self-medication and accessible treatments is driving the expansion of the gastrointestinal OTC drugs market.

Opportunities

- Expansion of Natural and Probiotic-Based Products

As consumers become more health-conscious, there is a rising demand for natural and probiotic-based treatments to address gastrointestinal issues. This trend reflects a shift towards products that align with a preference for holistic and sustainable health solutions. Probiotics, known for their benefits in supporting gut health, and herbal remedies that promote digestion, are gaining popularity due to their perceived safety and minimal side effects. This growing demand presents significant opportunities for companies to innovate and develop new formulations that cater to these consumer preferences. The shift toward natural products is opening new avenues for market growth and product differentiation in the gastrointestinal OTC drugs sector.

- Development of New Product

Advancements in pharmaceutical formulations, such as the development of targeted therapies and combination treatments, present significant growth opportunities in the gastrointestinal OTC drugs market. Targeted therapies that focus on specific gastrointestinal issues, such as acid reflux or IBS, offer more precise and effective treatment options. In addition, combination treatments that address multiple symptoms simultaneously are becoming increasingly popular, offering convenience for consumers seeking all-in-one solutions. These innovations improve patient outcomes and create differentiation in a competitive market. As a result, pharmaceutical companies have the opportunity to expand their product offerings and tap into a broader consumer base, driving market growth.

Restraints/Challenges

- Side Effects and Safety Concerns

Some OTC medications, particularly laxatives and antacids, can cause side effects when used excessively, such as dehydration, dependency, or digestive imbalances. For instance, prolonged use of laxatives can lead to bowel dependency, while overuse of antacids may disrupt the body's natural acid-base balance, causing long-term digestive issues. These adverse effects can deter consumers from continuing their use, limiting the market's potential growth. As consumers become more aware of the risks associated with overuse, they may opt for alternative treatments or seek professional medical advice, presenting a significant challenge for the gastrointestinal OTC drugs market.

- High Intense Competition

The gastrointestinal OTC drugs market is highly competitive, with numerous established players offering a wide range of similar products. This intense competition makes it difficult for new entrants to differentiate themselves and gain significant market share. Large, well-established companies benefit from brand recognition, strong distribution networks, and extensive marketing resources, which can create barriers for smaller players trying to penetrate the market. New entrants may also struggle to meet regulatory standards and compete on price, further limiting their ability to capture consumer attention. This competition presents a key restraint to growth in the gastrointestinal OTC drugs market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Gastrointestinal OTC Drugs Market Scope

The market is segmented on the basis of drug class, indications, end-users, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Drug Class

Indications

- Heartburn

- Diarrhoea

- Constipation

- Gastroesophageal Reflux Disease (GERD)

- Nausea

- Vomiting

- Motion Sickness

- Others

End-Users

- Hospitals

- Clinics

- Home Healthcare

- Others

Distribution Channel

- Direct Tender

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Gastrointestinal OTC Drugs Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, drug class, indications, end-users, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America holds the largest market share in the gastrointestinal OTC drugs market, driven by substantial healthcare expenditure and supportive reimbursement policies. The region's advanced healthcare infrastructure ensures greater accessibility to treatments, further contributing to its dominance. In addition, favorable insurance coverage and reimbursement options enhance the affordability and adoption of OTC products, fueling market growth in the region.

Asia-Pacific is anticipated to hold the largest market share in the gastrointestinal OTC drugs market in the coming years, driven by the rising incidence of gastrointestinal disorders, including cancer. This growing prevalence, combined with a heightened demand for affordable therapeutic solutions, is propelling market growth. In addition, expanding healthcare access and increasing consumer awareness in the region are expected to further boost the adoption of OTC treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Gastrointestinal OTC Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Gastrointestinal OTC Drugs Market Leaders Operating in the Market Are:

- Viatris Inc. (U.S.)

- Sandoz AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Sun Pharmaceuticals Industries Limited (India)

- Teva Pharmaceuticals Industries Ltd. (Israel)

- Zydus Cadila (India)

- Sanofi (France)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Lupin (India)

- GSK Plc. (U.K.)

- Prestige Consumer Healthcare Inc. (U.S.)

- Procter & Gamble (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Hikma Pharmaceutical PLC (U.K.)

- Perrigo Company plc. (Ireland)

Latest Developments in Gastrointestinal OTC Drugs Market

- In August 2021, Arena Pharmaceuticals formed a partnership with Second Genome, a biotechnology company, to identify gastrointestinal biomarkers. Second Genome will utilize its sg-4-sight research engine alongside Arena's Cultivate clinical trial to discover microbiome biomarkers. This collaboration aims to improve patient stratification and optimize potential treatments for gastrointestinal conditions, enhancing therapeutic precision

- In March 2021, Janssen Research and Development, LLC initiated a Phase III clinical trial to evaluate the safety of ustekinumab. The study is focused on assessing the treatment's effectiveness for pediatric patients suffering from moderate to severe Crohn's disease. This trial aims to provide valuable data to support ustekinumab's use in younger populations with this challenging condition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.