The rising prevalence of obesity and sedentary lifestyles has led to increased usage of compression garments and stockings across various population groups. Prolonged sitting, lack of physical activity, and growing rates of metabolic disorders have contributed to a surge in vascular conditions such as varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency. In response, compression therapy is being adopted as a non-invasive, preventive, and therapeutic approach to support circulatory health and alleviate swelling and discomfort in the lower limbs.

Healthcare providers are recommending compression wear not only for at-risk individuals but also for the general population as part of preventive wellness routines. Urbanization, desk-bound work cultures, and aging demographics particularly in developed markets are further contributing to wider adoption. As awareness of circulatory health risks increases, compression wear continues to gain traction in both medical and lifestyle applications, supporting sustained market growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-compression-garments-stockings-market

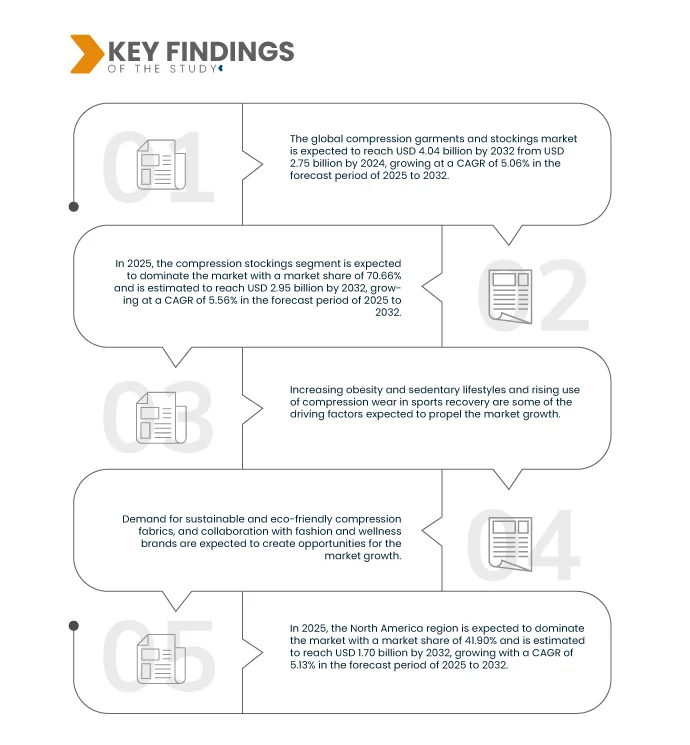

Data Bridge market research analyzes that Global Compression Garments and Stockings Market is expected to reach USD 4.04 billion by 2032 from USD 2.75 billion by 2024, growing at a CAGR of 5.06% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising Demand for Sustainable and Eco-Friendly Compression Fabrics

The growing consumer and regulatory focus on sustainability is fueling demand for eco-friendly materials in compression garments and stockings. As awareness of environmental impact increases, consumers are seeking products made from sustainable fibers such as recycled nylon, bamboo, organic cotton, and biodegradable elastane alternatives. These materials reduce dependence on petroleum-based synthetics, lower carbon emissions during production, and enhance recyclability features that resonate strongly in both medical and athleisure segments. Brands are increasingly incorporating these greener textiles to align with circular economy principles while maintaining the necessary compression, durability, and comfort.

This shift opens the door for textile innovators and compression wear manufacturers to differentiate themselves through sustainability-focused product lines. Beyond environmental benefits, eco-conscious compression garments also help meet ESG and green procurement standards, making them attractive to healthcare providers, retailers, and insurers. As regulations around textile waste and carbon footprints continue to tighten, early adoption of sustainable materials presents a strategic opportunity to lead in a market steadily evolving toward more responsible production and consumption practices.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Product Type (Compression Stockings, Compression Garments), Compression Level (Moderate Compression, Mild Compression, Firm Compression, Extra-Firm Compression), Application (Medical Use, Non-Medical Use), Material (Nylon & Spandex, Cotton, Microfiber, Bamboo Fiber, Breathable Mesh / Moisture-Wicking Fabrics, Wool Blends, Recycled/Organic Materials), Gender (Women, Unisex, Men), Distribution Channel (Offline, Online), End User (General Consumers, Healthcare Institutions, Sports Teams & Clubs, Corporate Wellness Programs)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Russia, Belgium, Netherlands, Turkey, Denmark, Norway, Finland, Sweden, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Singapore, Thailand, Malaysia, Philippines, New Zealand, Hong Kong, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Colombia, Chile, Peru, Ecuador, Uruguay, Paraguay, Bolivia, Venezuela, Rest of South America, South Africa, Saudi Arabia, Egypt, U.A.E., Israel, Kuwait, Qatar, Oman, Bahrain, Rest of Middle East and Africa

|

|

Market Players Covered

|

Bauerfeind (Germany), 3M (U.S.), Cardinal Health (U.S.), Thusane (France), Lohmann & Rauscher GmbH & Co. KG (Germany), Sockwell (U.S.), Tynor Orthotics Pvt. Ltd. (India), Gibaud (France), Scholl’s Wellness Co. (U.S.), SIGVARIS Group (Switzerland), JUZO (Germany), SWISSLASTIC AG ST. GALLEN (Switzerland), G. Surgiwear Limited (India), Medi GmbH & Co. KG (Germany), ThermoTek (U.S.), Ames Walker (U.S.), Vissco Next (India), Calzificio Zeta S.r.l. (Italy), VIM & VIGR (U.S.), CEP (Germany), Sanyleg S.r.l. (Italy), Maxwell India (India), Heinz Schiebler GmbH & Co. KG (Germany), Gloria Med S.p.A. (Italy), NovaMed Europe Ltd (U.K.), Rejuva Health (U.S.), and Zensah (U.S.) and among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global compression garments and stockings market is categorized into seven notable segments which are on the basis of product type, compression level, application, material, gender, distribution channel, and end user.

- On the basis of product type the market is segmented into compression stockings, compression garments.

In 2025, the compression stockings segment is expected to dominate the market

In 2025, the compression stockings segment is expected to dominate the market with a market share of 70.66%. due to its widespread clinical use in managing venous disorders such as varicose veins and Deep Vein Thrombosis (DVT), along with strong adoption in post-surgical care and preventive applications.

- On the basis of compression level, the market is segmented into moderate compression, mild compression, firm compression, extra-firm compression.

In 2025, the moderate compression segment is expected to dominate the market

In 2025, the moderate compression segment is expected to dominate the market with a market share of 36.05%. due to its wide applicability in treating common conditions such as mild varicose veins, leg fatigue, and swelling, while ensuring user comfort for both medical and preventive daily use.

- On the basis of application, the market is segmented into medical use, non-medical use. In 2025, the medical use segment is expected to dominate the market with a market share of 62.00%. due to the rising prevalence of chronic venous disorders, lymphedema, and post-surgical complications, along with increased physician recommendations and reimbursement support for compression therapy

- On the basis of material, the market is segmented into nylon & spandex, cotton, microfiber, bamboo fiber, breathable mesh / moisture-wicking fabrics, wool blends, recycled/organic materials. In 2025, the nylon & spandex segment is expected to dominate the market with a market share of 32.65%. due to their superior elasticity, durability, and moisture-wicking properties, which ensure optimal compression, comfort, and long-term wearability in medical and athletic applications

- On the basis of gender, the market is segmented into women, unisex, men. In 2025, the women segment is expected to dominate the market with a market share of 42.96%. due to the higher prevalence of varicose veins and pregnancy-related venous disorders among women, along with increasing adoption of compression wear for aesthetics, fitness, and post-surgical recovery

- On the basis of distribution channel, the market is segmented into offline, online. In 2025, the offline segment is expected to dominate the market with a market share of 60.38%. due to greater consumer trust in physical assessment, fitting support, and personalized guidance offered by pharmacies, specialty medical stores, and hospitals for selecting appropriate compression levels and sizes

- On the basis of end user the market is segmented into general consumers, healthcare institutions, sports teams & clubs, corporate wellness programs. In 2025, the general consumers segment is expected to dominate the market with a market share of 41.95%. due to increasing use of compression garments for preventive health, fitness recovery, travel-related circulation support, and everyday comfort among aging and active populations

Major Players

Bauerfeind (Germany), 3M (U.S.), Cardinal Health (U.S.), Thusane (France), Lohmann & Rauscher GmbH & Co. KG (Germany) and among others.

Market Developments

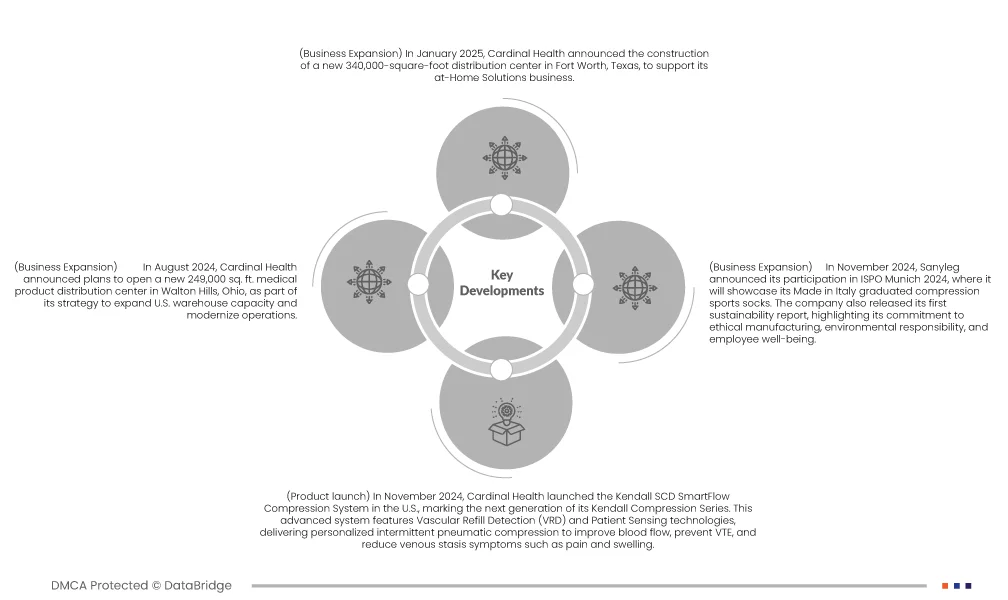

- In January Cardinal Health announced the construction of a new 340,000-square-foot distribution center in Fort Worth, Texas, to support its at-Home Solutions business. The facility will integrate advanced robotics and AI-powered warehouse systems to boost order fulfillment efficiency and safety. It will replace two existing warehouses, expand inventory capacity, and process around 10,000 packages daily. The center is expected to be fully operational by Summer 2025.

- In August Cardinal Health announced plans to open a new 249,000 sq. ft. medical product distribution center in Walton Hills, Ohio, as part of its strategy to expand U.S. warehouse capacity and modernize operations. The facility, set to be operational by spring 2025, will replace the smaller Solon location and incorporate advanced automation and technology to enhance supply chain efficiency and employee safety.

- In November Cardinal Health launched the Kendall SCD SmartFlow Compression System in the U.S., marking the next generation of its Kendall Compression Series. This advanced system features Vascular Refill Detection (VRD) and Patient Sensing technologies, delivering personalized intermittent pneumatic compression to improve blood flow, prevent VTE, and reduce venous stasis symptoms such as pain and swelling. The system aims to enhance both clinical outcomes and caregiver efficiency. An international launch is expected in early 2025.

- In November, Sanyleg announced its participation in ISPO Munich 2024, where it will showcase its Made in Italy graduated compression sports socks. The company also released its first sustainability report, highlighting its commitment to ethical manufacturing, environmental responsibility, and employee well-being.

As per Data Bridge Market Research analysis:

For more detailed information about the Global compression garments and stockings market report, click here – https://www.databridgemarketresearch.com/reports/global-compression-garments-stockings-market