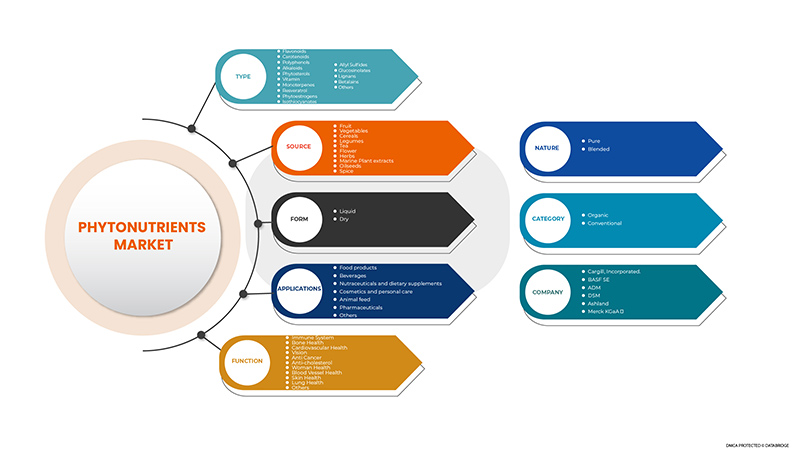

Asia-Pacific Phytonutrients Market, By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Function (Immune System, Vision, Skin Health, Bone Health, Cardiovascular Health, Anti-Cancer, Lung Health, Blood Vessel Health, Woman Health, Anti-Cholesterol, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, Marine Plant Extracts), Form (Liquid, Dry), Category (Organic, Conventional), Nature (Blended, Pure), Application (Food Products, Beverages, Nutraceuticals, and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, Others) Industry Trends and Forecast to 2029.

Asia-Pacific Phytonutrients Market Analysis and Insights

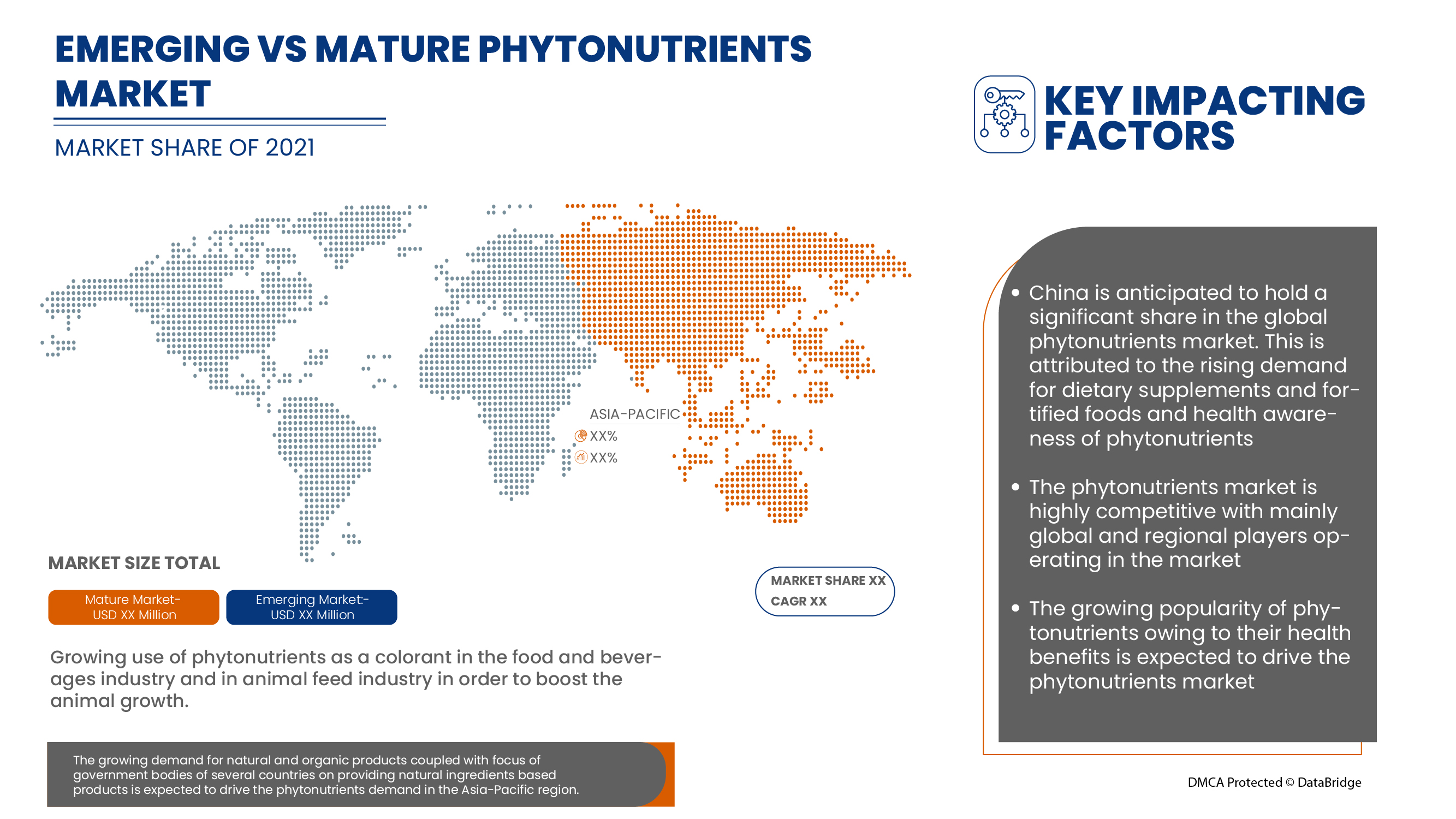

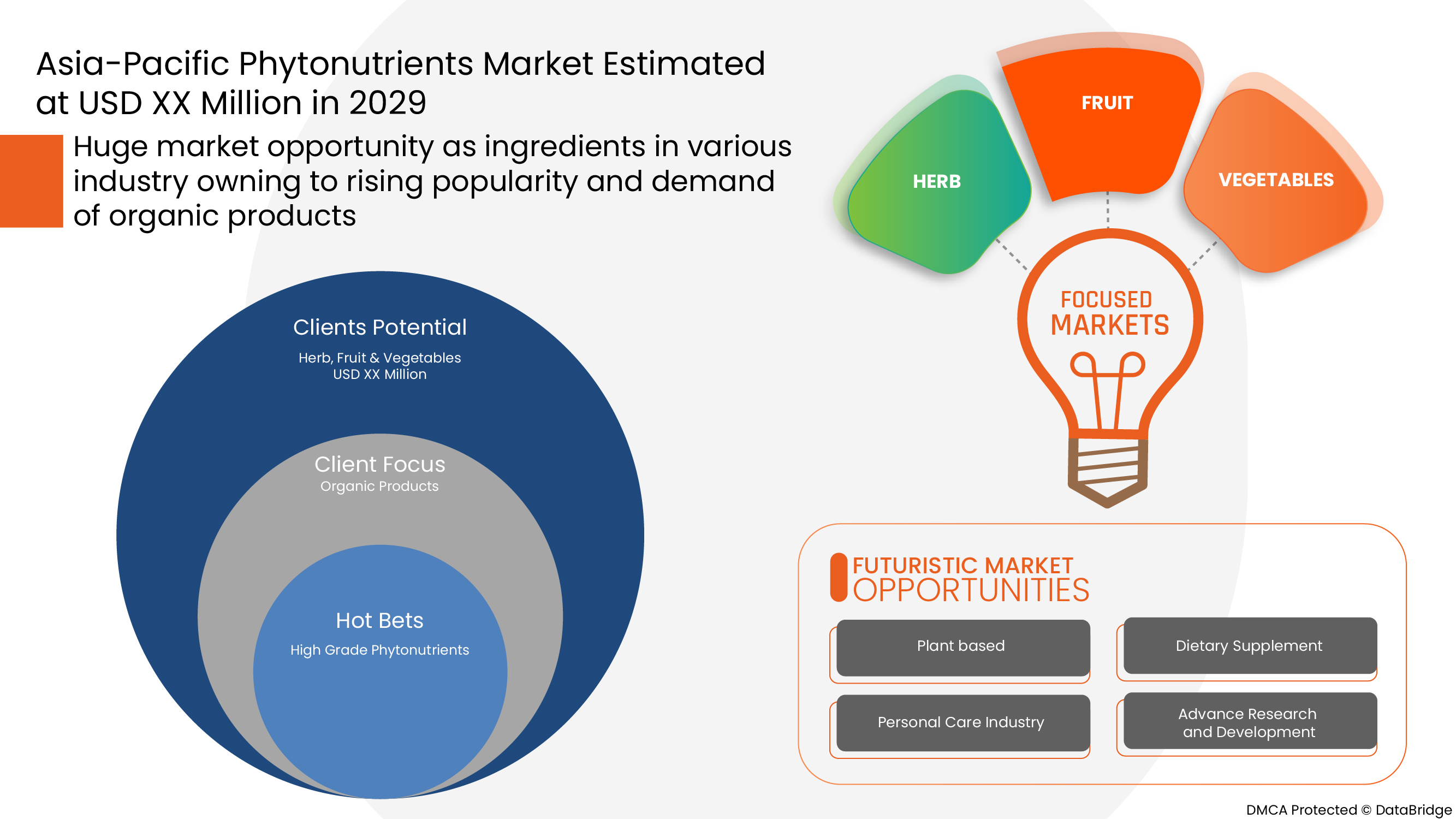

Increasing demand for phytonutrients in the food and beverage industries will accelerate the market demand. The rising focus on pharmaceutical industries to reduce cancer, diabetes, and heart disease will also enhance the Asia-Pacific phytonutrients market. Additionally, the need for phytonutrients in the feed and cosmetics industries is also expected to drive the market. The increase in demand for ayurvedic products is expected to act as an opportunity for the market.

The standard quality determination technique of phytonutrients and their products is inadequate, which is expected to restrain the growth of the Asia-Pacific phytonutrients market. Additionally, the phytonutrient supplements are insufficient in regulating products that involve marketing and promotion, which is anticipated to inhibit the development of the Asia-Pacific phytonutrients market through the forecast term. The manufacturers of the phytonutrients focus on the R&D work on the extraction process of phytonutrients that may challenge competitors in the market.

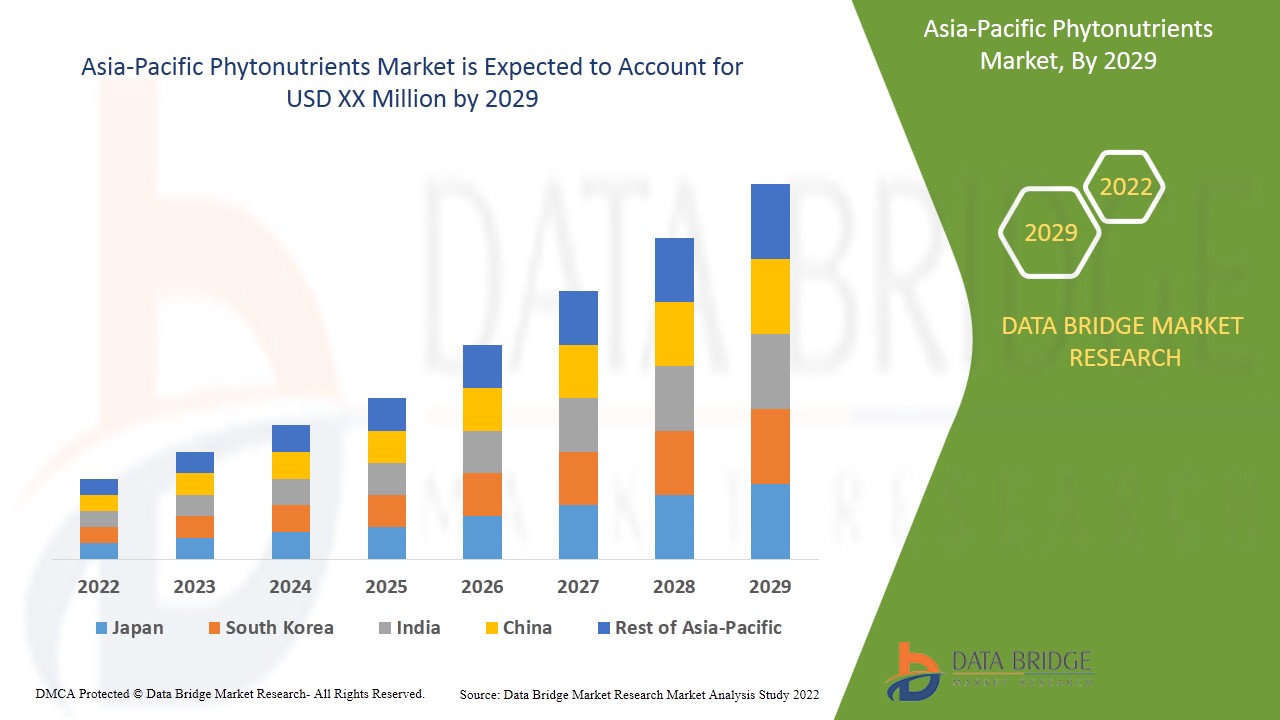

Data Bridge Market Research analyses that the Asia-Pacific phytonutrients market will grow at a CAGR of 8.7% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million, Volume in Units, Pricing in USD |

|

Segments Covered |

按类型(黄酮类化合物、胡萝卜素、多酚、生物碱、植物固醇、维生素、单萜、白藜芦醇、植物雌激素、异硫氰酸酯、烯丙基硫化物、硫代葡萄糖苷、木脂素、甜菜碱等)、功能(免疫系统、视力、皮肤健康、骨骼健康、心血管健康、抗癌、肺部健康、血管健康、妇女健康、抗胆固醇等)、来源(香料、草本植物、花卉、茶、水果、蔬菜、谷物、豆类、油籽、海洋植物提取物)、形式(液体、干燥)、类别(有机、常规)、性质(混合、纯净)、应用(食品、饮料、营养保健品和膳食补充剂、化妆品和个人护理、动物饲料、药品等) |

|

覆盖国家 |

中国、印度、日本、澳大利亚、韩国、马来西亚、新加坡、泰国、新西兰、印度尼西亚、菲律宾、越南、亚太地区其他地区 |

|

涵盖的市场参与者 |

DSM、ADM、BASF SE、Cargill, Incorporated.、Merck KGaA、Ashland、IFF Nutrition & Biosciences、ConnOils LLC、PhytoSource, Inc.、NutriScience Innovations, LLC、Matrix Fine Sciences Pvt. Ltd、西安健康生物技术有限公司、Vitae Caps SA、DÖHLER GMBH、HERBAL CREATIONS、ExcelVite、Bio-India Biologicals (BIB) Corporation、Cyanotech Corporation、Kothari Phytochemicals International、Aayuritz Phytobiotics Pvt.Ltd.、Lycored、BTSA、MANUS AKTTEVA BIOPHARMA LLP、Hindustan Herbals、Brlb International、Sabinsa 等 |

亚太植物营养素市场动态

驱动程序

- 食品和饮料产品需求不断增长

由于亚太地区人口不断增长,食品和饮料需求不断增长,预计将推动该行业对植物营养素的需求。此外,由于人们对食品和饮料产品的质量和营养价值的关注度不断提高,对天然成分食品和饮料产品的需求不断增长,预计将推动食品和饮料行业对植物营养素的需求。

- 动物饲料需求不断增长

在动物饲料行业,植物营养素被用作动物饲料中的抗氧化剂,以促进动物生长并保护动物免受自由基引起的氧化损伤。植物营养素有助于增强动物(尤其是家禽)的先天免疫力。动物饲料中植物营养素的增长归因于一些因素,例如全球对肉类的需求不断增长、家禽肉类消费量不断增长,其他因素预计将推动对动物饲料的需求,反过来,预测期内动物饲料行业对植物营养素的需求可能会增加

机会

- 天然护肤品和化妆品需求不断增长

消费者对天然或有机产品益处的认识不断提高,预计会增加对天然护肤品和化妆品的需求。此外,日益增长的环境问题也可能在未来几年增加产品需求。此外,护肤品和化妆品中对植物化学物质的需求也在增加,例如姜黄素、白藜芦醇、表儿茶素、鞣花酸和芹菜素,它们用于化妆品配方中以对抗皮肤衰老。因此,对天然护肤品和化妆品的需求增加预计将为亚太植物营养素市场带来机遇。

限制/挑战

- 过量摄入植物营养素的副作用

植物营养素对人体有益。但是,过量摄入某些植物营养素可能会产生副作用。对人体有毒的植物化学物质被称为植物毒素。一些植物化学物质具有抗营养特性,会干扰营养素的吸收。而一些植物营养素,如多酚和类黄酮,在摄入量较高时会成为促氧化剂。

因此,过量摄入植物营养素所引起的副作用预计将对亚太地区植物营养素市场的需求构成挑战。

本亚太植物营养素市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关亚太植物营养素市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报;我们的团队将帮助您做出明智的市场决策,以实现市场增长。

新冠肺炎疫情对亚太植物营养素市场的影响

受新冠疫情影响,大多数国家都采取了封锁措施以限制病毒传播,这对各行各业都产生了重大影响。新冠疫情的爆发给全球植物营养素市场的增长带来了极大的不确定性。维持食品链中的食品流通对食品和饮料行业至关重要。大多数公司在政府指导方针出台后恢复了运营,这对未来几年亚太地区植物营养素市场的增长产生了积极影响。

近期发展

- 2020 年 12 月,默克集团扩建了其在美国的生命科学业务生产设施。这些扩建将分别在 2021 年和 2022 年底显著提高这些设施的产能和产量,并创造近 700 个新的制造岗位。此次扩张帮助该公司扩大了其地理分布

亚太植物营养素市场范围

亚太植物营养素市场细分为类型、来源、性质、类别、形式、功能和应用。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 黄酮类化合物

- 类胡萝卜素

- 多酚

- 生物碱

- 植物固醇

- 维生素

- 单萜

- 白藜芦醇

- 植物雌激素

- 异硫氰酸酯

- 烯丙基硫醚

- 硫代葡萄糖苷

- 木脂素

- 甜菜红素

- 其他的

根据类型,亚太植物营养素市场分为黄酮类化合物、胡萝卜素、多酚、生物碱、植物固醇、维生素、单萜、白藜芦醇、植物雌激素、异硫氰酸酯、烯丙基硫化物、硫代葡萄糖苷、木脂素、甜菜碱等。

形式

- 干燥

- 液体

根据形态,亚太植物营养素市场分为干植物营养素和液体植物营养素。

类别

- 有机的

- 传统的

根据类别,亚太植物营养素市场分为有机植物营养素和传统植物营养素市场。

自然

- 混合

- 纯的

根据性质,亚太植物营养素市场分为混合型和纯净型。

功能

- 免疫系统

- 想象

- 皮肤健康

- 骨骼健康

- 心血管健康

- 抗癌

- 肺部健康

- 血管健康

- 女性健康

- 抗胆固醇

- 其他的

根据功能,亚太植物营养素市场分为免疫系统、视力、皮肤健康、骨骼健康、心血管健康、抗癌、肺部健康、血管健康、女性健康、抗胆固醇等。

来源

- 香料

- 草本植物

- 花

- 茶

- 水果

- 蔬菜

- 谷物

- 豆类

- 油籽

- 海洋植物萃取

根据性质,亚太植物营养素市场细分为香料、草本植物、花卉、茶、水果、蔬菜、谷物、豆类、油籽、海洋植物提取物。

应用

- 食品

- 饮料

- 营养保健品

- 膳食补充剂

- 化妆品和个人护理

- 动物饲料

- 药品

- 其他的

根据应用,亚太植物营养素市场分为食品、饮料、营养保健品和膳食补充剂、化妆品和个人护理、动物饲料、药品等。

亚太植物营养素市场区域分析/见解

对亚太植物营养素市场进行了分析,并根据上述国家、类型、来源、性质、类别、形式、功能和应用提供了市场规模洞察和趋势。

亚太植物营养素市场报告涉及的国家包括中国、印度、日本、澳大利亚、韩国、马来西亚、新加坡、泰国、新西兰、印度尼西亚、菲律宾、越南和亚太其他地区。

India is expected to dominate the Asia-Pacific phytonutrients market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. The growth in the region is attributed to an increase in the use of phytonutrients in cosmetic products and dietary supplements.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Phytonutrients Market Share Analysis

The Asia-Pacific phytonutrients market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Asia-Pacific phytonutrients market.

Some of the key market players in the Asia-Pacific phytonutrients market are DSM, ADM, BASF SE, Cargill, Incorporated., Merck KGaA, Ashland, IFF Nutrition & Biosciences, ConnOils LLC, PhytoSource, Inc., NutriScience Innovations, LLC, Matrix Fine Sciences Pvt. Ltd, Xi'an Healthful Biotechnology Co., Ltd, Vitae Caps S.A., DÖHLER GMBH, HERBAL CREATIONS, ExcelVite, Bio-India Biologicals (BIB) Corporation, Cyanotech Corporation, Kothari Phytochemicals International, Aayuritz Phytonutrients Pvt.Ltd., Lycored, BTSA, MANUS AKTTEVA BIOPHARMA LLP, Hindustan Herbals, Brlb International, Sabinsa, among others.

Research Methodology

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、亚太地区与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PHYTONUTRIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGIES

4.1.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.1.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.1.3 A VAST NETWORK OF DISTRIBUTION

4.1.4 STRATEGIC DECISIONS BY KEY PLAYERS

4.2 PATENT ANALYSIS OF ASIA PACIFIC PHYTONUTRIENTS MARKET

4.2.1 DBMR ANALYSIS

4.2.2 COUNTRY LEVEL ANALYSIS

4.2.3 YEARWISE ANALYSIS

4.3 EXTRACTION PROCESS

4.4 CERTIFICATION

4.5 TECHNOLOGICAL CHALLENGES

4.6 LIST OF SUBSTITUTES

4.7 HEALTH CLAIMS OF PHYTONUTRIENTS

4.8 NUTRITIONAL FACTS OF PHYTONUTRIENTS

4.8.1 RECOMMENDED INTAKE OF PHYTONUTRIENTS

4.9 RAW MATERIAL PRICING ANALYSIS

4.9.1 GEOGRAPHICAL PRICING

4.9.2 DEMAND FACTOR IN PRICING

4.9.3 GEOGRAPHICAL PRICING

4.9.4 DEMAND FACTOR IN PRICING

4.1 CONSUMPTION ANALYSIS FOR PHYTONUTRIENT INTAKES IN EUROPEAN COUNTRIES

4.11 IMPORT-EXPORT ANALYSIS

4.12 ASIA PACIFIC PHYTONUTRIENTS MARKET: SUPPLY CHAIN ANALYSIS

4.13 VALUE CHAIN ANALYSIS: ASIA PACIFIC PHYTONUTRIENTS MARKET

4.14 IMPORT-EXPORT ANALYSIS

5 ASIA PACIFIC PHYTONUTRIENTS MARKET: REGULATIONS

5.1 FDA REGULATIONS

5.2 EU REGULATIONS

5.3 USDA REGULATIONS

5.4 FAO REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FOOD & BEVERAGE PRODUCTS

6.1.2 INCREASING DEMAND FOR ANIMAL FEED

6.1.3 INCREASING DEMAND FOR NUTRACEUTICAL PRODUCTS

6.1.4 NUMEROUS HEALTH BENEFITS ASSOCIATED WITH PHYTONUTRIENTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES

6.2.2 QUALITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR NATURAL FOOD PRODUCTS

6.3.2 INCREASING DEMAND FOR CAROTENOIDS IN VARIOUS END-USE INDUSTRIES

6.3.3 GROWING DEMAND FOR NATURAL SKINCARE AND COSMETIC PRODUCTS

6.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF PHYTONUTRIENTS

7 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLAVONOIDS

7.3 CAROTENOIDS

7.4 POLYPHENOLS

7.5 ALKALOIDS

7.6 PHYTOSTEROLS

7.7 VITAMIN

7.8 MONOTERPENES

7.9 RESVERATROL

7.1 PHYTOESTROGENS

7.11 ISOTHIOCYANATES

7.12 ALLYL SULFIDES

7.13 GLUCOSINOLATES

7.14 LIGNANS

7.15 BETALAINS

7.16 OTHERS

8 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 FRUIT

8.3 VEGETABLES

8.4 CEREALS

8.5 LEGUMES

8.6 TEA

8.7 FLOWER

8.8 HERBS

8.9 MARINE PLANT EXTRACTS

8.1 OILSEEDS

8.11 SPICE

9 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 BLENDED

11.3 PURE

12 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 IMMUNE SYSTEM

12.3 BONE HEALTH

12.4 CARDIOVASCULAR HEALTH

12.5 VISION

12.6 ANTI-CANCER

12.7 ANTI-CHOLESTEROL

12.8 WOMEN HEALTH

12.9 BLOOD VESSEL HEALTH

12.1 SKIN HEALTH

12.11 LUNG HEALTH

12.12 OTHERS

13 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD PRODUCTS

13.3 BEVERAGES

13.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

13.5 COSMETICS AND PERSONAL CARE

13.6 PHARMACEUTICALS

13.7 ANIMAL FEED

13.8 OTHERS

14 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 JAPAN

14.1.4 AUSTRALIA

14.1.5 SOUTH KOREA

14.1.6 NEW ZEALAND

14.1.7 SINGAPORE

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 MALAYSIA

14.1.11 PHILIPPINES

14.1.12 VIETNAM

14.1.13 REST OF ASIA-PACIFIC

15 ASIA PACIFIC PHYTONUTRIENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MERCK KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 BASF SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 IFF NUTRITION & BIOSCIENCES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KOTHARI PHYTOCHEMICALS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 ASHLAND

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 AAYURITZ PHYTONUTRIENTS PVT.LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 AOM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARBORIS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIO-INDIA BIOLOGICALS (BIB) CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 BRLB INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BTSA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CONNOILS LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 CYANOTECH CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUS ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 DÖHLER GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 DYNADIS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ELEMENTA

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 EXCELVITE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 GUSTAV PARMENTIER GMBH

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 HERBAL CREATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 HINDUSTAN HERBALS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 LYCORED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MATRIX LIFE SCIENCE PVT. LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 MANUS AKTTEVA BIOPHARMA LLP

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 NUTRISCIENCE INNOVATIONS, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PHYTOSOURCE, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 PRINOVA GROUP LLC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 SABINSA

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

17.31 VITAE CAPS S.A.

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 XI'AN HEALTHFUL BIOTECHNOLOGY CO., LTD

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 LIST OF SUBSTITUTE

TABLE 2 POTENTIAL BENEFITS OF PHYTONUTRIENT COMPOUNDS.

TABLE 3 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED FRUITS, YEAR (2019-2021)

TABLE 4 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED VEGETABLES, YEAR (2019-2021)

TABLE 5 EUROPEAN UNION FRUITS PRICES: (2021)

TABLE 6 EUROPEAN UNION VEGETABLES PRICES: (2021)

TABLE 7 WORLD FRUITS AND VEGETABLE PRODUCTION, (MILLION TONS), 2018

TABLE 8 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 9 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 10 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 11 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 12 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 13 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 14 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 15 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 16 LIST OF SOME PHYTONUTRIENTS USED IN NUTRACEUTICAL PRODUCTS

TABLE 17 FLAVONOIDS AND SOURCES

图片列表

FIGURE 1 ASIA PACIFIC PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHYTONUTRIENTS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHYTONUTRIENTS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHYTONUTRIENTS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHYTONUTRIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHYTONUTRIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PHYTONUTRIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC PHYTONUTRIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC PHYTONUTRIENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE ASIA PACIFIC PHYTONUTRIENTS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING USE OF PHYTONUTRIENTS IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS LEAD TO THE GROWTH OF THE ASIA PACIFIC PHYTONUTRIENTS MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHYTONUTRIENTS MARKET IN 2022 & 2029

FIGURE 14 PATENT REGISTERED FOR PHYTONUTRIENTS, BY COUNTRY

FIGURE 15 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 16 VALUE CHAIN OF PHYTONUTRIENTS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHYTONUTRIENTS MARKET

FIGURE 18 POULTRY MEAT CONSUMPTION KILOGRAMS PER CAPITA GROWTH FROM 2019-2021

FIGURE 19 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY SOURCE, 2021

FIGURE 21 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY FORM, 2021

FIGURE 22 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY CATEGORY, 2021

FIGURE 23 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY NATURE, 2021

FIGURE 24 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY FUNCTION, 2021

FIGURE 25 ASIA PACIFIC PHYTONUTRIENTS MARKET, BY APPLICATION, 2021

FIGURE 26 ASIA-PACIFIC PHYTONUTRIENTS MARKET: SNAPSHOT (2021)

FIGURE 27 ASIA-PACIFIC PHYTONUTRIENTS MARKET: BY COUNTRY (2021)

FIGURE 28 ASIA-PACIFIC PHYTONUTRIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 ASIA-PACIFIC PHYTONUTRIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 ASIA-PACIFIC PHYTONUTRIENTS MARKET: BY TYPE (2022 & 2029)

FIGURE 31 ASIA PACIFIC PHYTONUTRIENTS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。